Hi there and welcome to the fifth installment of the Crypto Digest where I share a weekly list of my favorite articles and videos on technology, blockchain, futurism and beyond.

Today' s selection revolves around the "fat protocol" thesis, this idea that the protocol layer of any bockchain network is where value will accrue the most.

Articulated in 2016 by Joel Monegro, the thesis helped fuel the investing frenzy around the ICO boom of 2017 when it became a part of the sales pitch of many start-ups looking to sell worthless tokens to unsuspecting retail investors.

In the aftermath of that craze, we take a look at the thesis and hear from Joel Monegro himself reflect on how it's been holding up. Finally, we'll listen to Chris Burniske, co-founder of Placeholder Capital with Joel Monegro on his methodology to value crypto assets.

Enjoy your weekend!

1. Fat Protocols.

by Joel Monegro

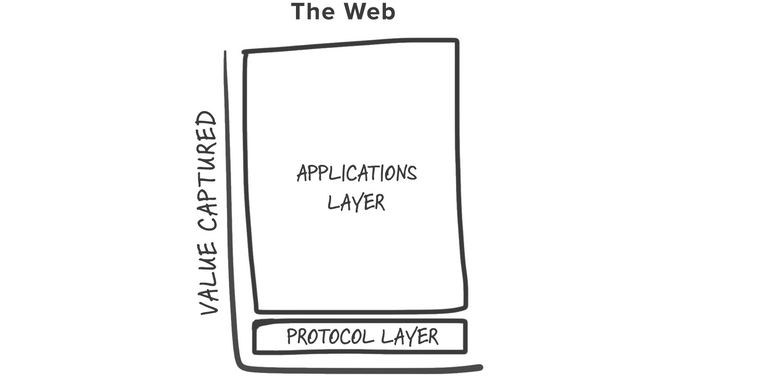

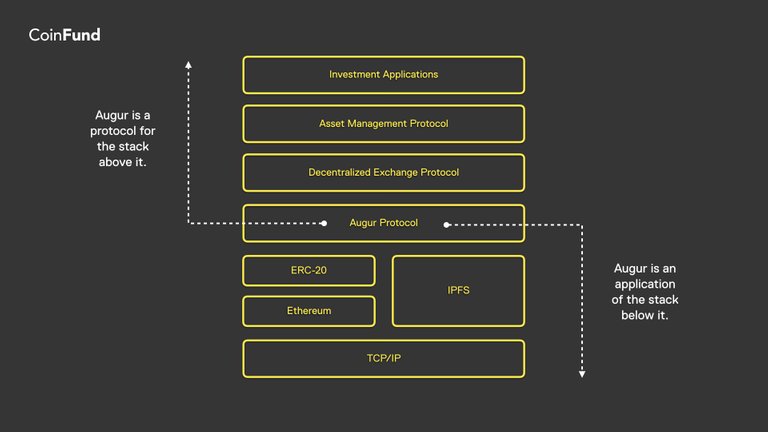

The Internet stack, in terms of how value is distributed, is composed of "thin" protocols and "fat" applications. This relationship between protocols and applications is reversed in the blockchain application stack. Value concentrates at the shared protocol layer and only a fraction of that value is distributed along at the applications layer. It's a stack with "fat" protocols and "thin" applications.

2. Placeholder's Joel Monegro on the Fat Protocols Thesis Today.

a podcast by Laura Shin

Joel Monegro, partner at crypto VC firm Placeholder Ventures, describes how well his seminal blog post, "Fat Protocols," is holding up, why he and his partner Chris Burniske opted to found a crypto VC firm as opposed to a hedge fund, and what main factors they think will determine the success of a blockchain. He also describes how crypto and blockchains fit into the evolution of technology, how the business models in the crypto space will be built, and why their first publicly known investment was in Decred. Plus, he reveals why their firm is called Placeholder.

3. Fat Protocols are Not an Investment Thesis.

a blogpost by Jake Brukhman

The characterization of value networks as fat protocols has helped to underscore the need for [new investing methodologies] and to outline a solution: investment for exposure to the network’s cryptoeconomics. However, the issue is that it’s easy to misconstrue the idea of fat protocols as an investment criteria. We now find investors deploying hard filters on “protocol tokens” when evaluating opportunities. I suppose we all wish that TCP/IP was “fat” and we had invested in it in 1992. In my opinion, though, this kind of investment strategy espoused by cryptoinvestors is a misapplication of Joel’s characterization of value networks.

4. How Do You Value a Cryptocurrency?

a podcast hosted by Demetri Kofinas

How do you value a cryptocurrency? What are cryptoassets? Can economic and financial models help us build a framework for appraising them? In Episode 31 of Hidden Forces, host Demetri Kofinas speaks with Chris Burniske, a co-founder of Placeholder, a New York venture firm that specializes in cryptoassets.

Hope you'll enjoy this selection!

Until next weekend,

FØx.

This content is for informational purposes only and does not constitute financial advice.

If you liked this article, make sure to show some love by up-voting or following the blog. You can also follow us on Twitter at F0xSociety.

Buy Digital Assets: Coinbase

Buy Digital Assets: Coinbase

Keep your Crypto Safe in a Hardware Wallet: LEDGER NANO S

Keep your Crypto Safe in a Hardware Wallet: LEDGER NANO S

Published on

by FØx