Disclaimer: I am a COSS token holder & believer in this project. This should not be taken as investment advice.

This article was originally posted on Medium Dec 27, 2017

The rise in public awareness and interest in the cryptocurrency space in 2017 has been explosive. With that came the rapid influx of new users. The number of blockchain applications have also increased dramatically and a number of platforms have emerged, each offering their own limited services and products. Since the use of the platforms are tied to their applications, this results in a less than enjoyable crypto-experience for users.

More often than not, users have to sign up for a variety of platforms to use cryptocurrencies e.g: to buy, to sell, to exchange, to spend, to trade, to fundraise, to donate or to invest. Users have switch between applications and complete multiple registration and KYC processes just to perform several functions. The complexity and hassle can turn some users off and result in poor adoption of cryptocurrencies beyond us enthusiasts.

This is where COSS comes in.

What is COSS?

COSS is actually C.O.S.S which stands for Crypto One Stop Service. As its name suggests, COSS wants to create an crypto currency ecosystem that is user-friendly and useful for both veterans and newcomers alike. This ecosystem consists of the entire community of crypto users; companies, startups, traders, customers and merchants.

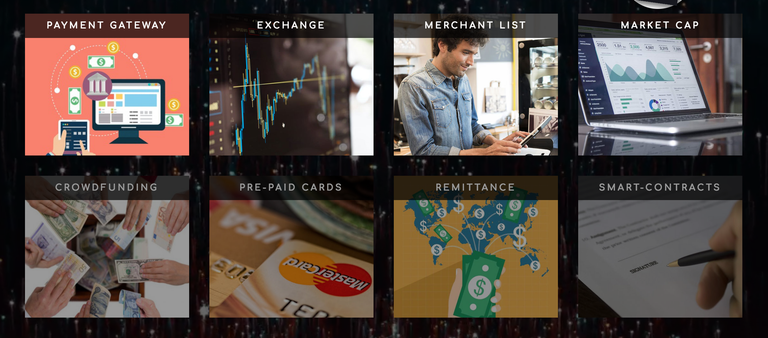

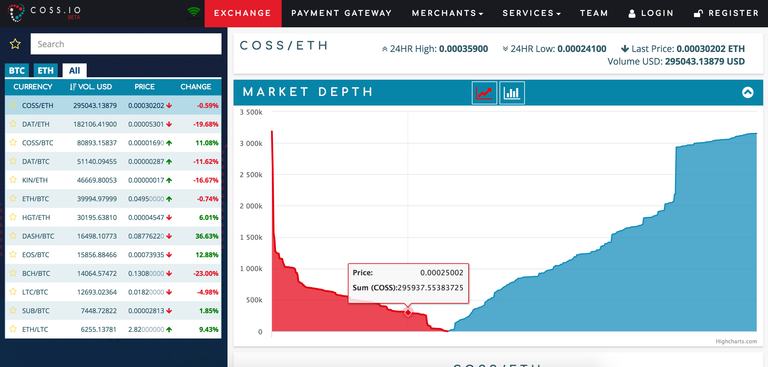

Today, the COSS systems consists of a payment gateway, an exchange, a merchant list, market cap rankings and an e-wallet. These are just the initial features which are still being improved and iterated upon. But there are many more features in the pipeline like a mobile platform, marketplace and fiat trading (more on that later).

In the COSS whitepaper these are the initial features that the developers would like to implement:

Wallet; providing COSS users with a secure medium to store cryptocurrencies.

Market cap listing; an archive list featuring the market prices, the trading volume and the whitepapers of the most popular cryptocurrencies.

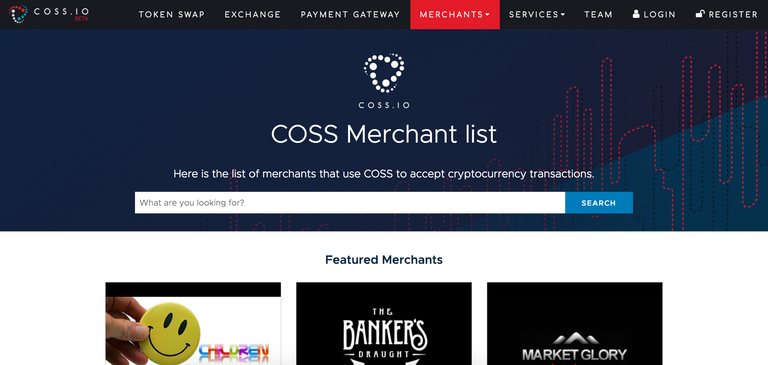

Merchant list; an early version of the COSS marketplace, on which customers can find merchants accepting cryptocurrency payments for their services directly via COSS.

Merchant Platform; a virtual marketplace, on which customers can search for merchants, services and products that are cryptocurrency-friendly.

Cryptocurrency listing; a feature that allows coin developers and owners to add their tokens to the Exchange and to become part of the COSS ecosystem.

Proof-of-development; a mechanism that analyzes and lists blockchain, cryptocurrency, DApps, smart contracts and DLT developers, helping individuals and businesses to hire the approved devs.

News feed; that displays articles published by CoinTelegraph, the updates from COSS and the twitter posts.

Screenshot of coss.io mainpage (not all the features are available yet)

The COSS Token

The token is probably the most exciting part and key differentiator between COSS and any similar platforms in the space.

The COSS token is a revenue generating token. The owners of COSS tokens will receive revenue in the form of transaction fees charged by the COSS system for cryptocurrency transactions.

How does the payout work?

50% or the transaction revenue will be distributed to token holders on a weekly basis. This revenue will be distributed according to the number of COSS tokens you own. The more tokens you hold the more profits you receive.

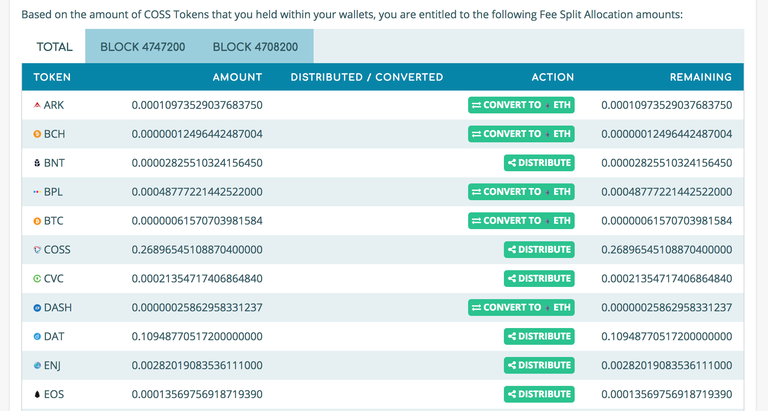

Simply hold your tokens in your COSS wallet on the platform and every week (usually on Tuesdays), you will receive your payout. If you hold your tokens in other wallets such as MyEtherWallet, you have the activate the fee collection manually by following these instructions. The payout will also come in the form of whatever tokens were being traded. For example, if there was a trade between OMG and REQ, the user will receive a percentage of these 2 coins. Currently, the DAO will only be able to pay users in Ether or ERC-20 tokens. You will end up with small amounts of a variety of ERC-20 tokens and ether.

For the non ERC-20 tokens, they will have to be converted to ETH and transferred to the holder’s wallet. This can be done easily with the simple press of the “convert to ETH” button in the fee split page.

Example of Fee Split Allocation Page

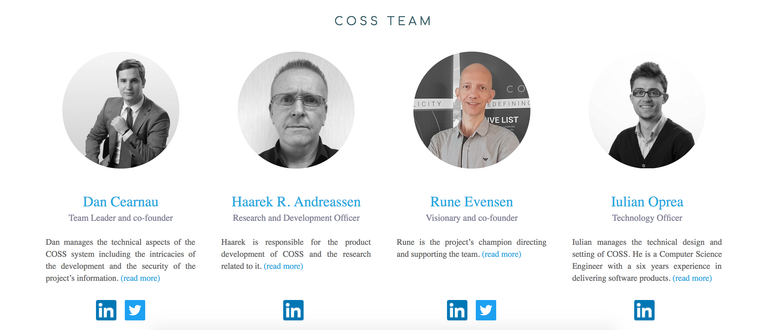

The COSS Team

The team is not the most experienced one but still good enough. The initial team has 12 members, compared to the other teams valued at over 100million but only have 3–4 team members. They are also constantly hiring and expanding the team. This is a good sign of a growing business.

Some of the initial COSS team members (team has grown from here)The team keeps the community updated regularly. You can follow them on reddit, slack, telegram or medium. Rune, their co-founder, updates the blog every couple of weeks and it is pretty comprehensive, informing the community about the teams progress. You can see his regular medium updates here.Their COSS announcement chat on telegram is also well updated.

The team is also really responsive to community feedback and takes them seriously. This is quite a rarity in the space. This means that the platform is always growing and developing to suit the needs of users. An example is how the team decided to focus to building up the exchange instead of working on everything at once after receiving responses from the community. They also started running trading promotions based on user feedback.

Platform Development

Currently the COSS platform is still in BETA.

Exchange

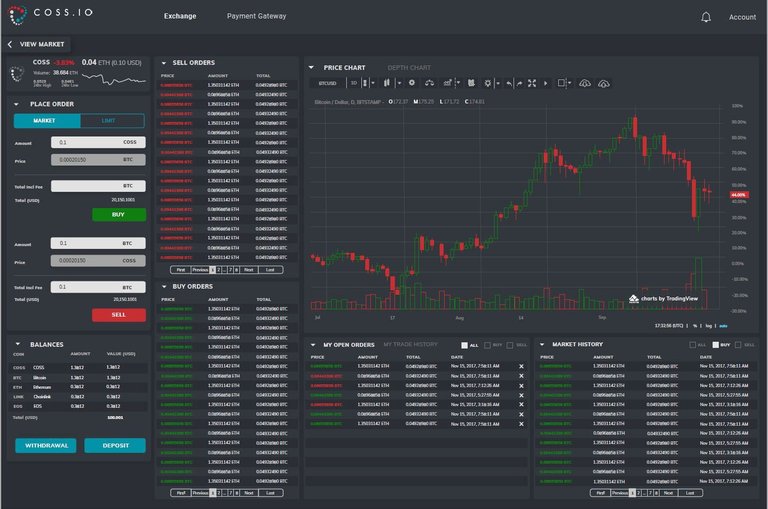

The exchange seems to me to be the most “developed” part of the platform. But let me warn you, it is ugly. Please don’t let that turn you off. According to Rune, they already have a new UI ready that is being tested by a select number of users. The team is hoping to have it up and running before the end of the year, hopefully.

Current View of Exchange (Soon to be radically updated ETA : Christmas Day 2017)

Sample images shared by the COSS team of initial designs of the new COSS UI (subject to changes)

As shown above, the new UI will be much more professional and competitive with exchanges already in the market. Personally, I really like the colour scheme and layout. Very promising. This will probably be the most significant customer-facing update that they will have done and I expect a significant spike in interest in COSS and the exchange.

ICOs

Coin developers can list their coins on the exchange. The team has been adding new ICOs to their platform at a pretty rapid clip. This helps to onboard new users to the exchange as well since these ICOs are usually not listed on the main big exchanges at their launch. Upcoming ICOs include https://www.aditus.net/ and https://lalaworld.io/ .

Merchants

COSS already has about 600 merchants in their merchant listing. These are merchants that use the COSS token to accept cryptocurrency transactions. While this part of the platform has not grown much in the last couple of months (as of my knowledge), I believe once the new exchange is more or less up and running and there is more awareness about COSS, the team will be working hard to increase merchant adoption.

Current coss.io merchant list page

The Community

The COSS telegram group has 1157 members at the time of writing. An alright size but significantly smaller than some of the overhyped ICOs. The COSS Telegram group is probably the most civil and enjoyable one out of the many that I have been part of. The community is also quite supportive towards new members and the team. There are always people willing and available to answer queries (in addition to Rune himself). When the team encounters technical difficulties, the members do not just start aggressively complaining or reprimanding the team unreasonably. Usually they are more patient and understanding compared to some of the other groups I have been in.

After the recent Etherdelta fiasco, one of the COSS Telegram group members informed the group that he lost about 2000 COSS tokens on that platform. He didn't ask for anything, only saying that he was sorry that he won’t be able to join us on our COSS journey. Almost immediately, some good Samaritans asked him for his public COSS address so that they could send him some COSS to make up for what he had lost. I’m sure he has more COSS tokens now then when he started. One of the best acts of community that I have seen in this space.

Market Capitalisation

At the time of writing, the market cap of COSS has been hovering at about 14–16 million USD. In comparison to the other tokens that also offer a form of fee split/indirect dividend functionality, this is extremely small.

By comparison:

Binance Coin : 539 million USD

- Use of Quarterly profits to buy back own tokens and burn them

Iconomi: 246 million USD

- Use of Quarterly profits to buy back own tokens and burn them

KuCoin: 91.5 million USD

- Awards token holders with a percentage of trading fees

TenX: 425 million USD

- Use of Quarterly profits to buy back own tokens and burn them

COSS: 16 million USD

- Awards token holders with a percentage of trading fees

From the comparison we can see that KuCoin has the greatest similarity of token structure and fee split when compared with COSS. With KuCoin, the cut of the transaction fee that is returned to the token-holders is 50%. After 6 months, the fee split percentage will be reduced over time before bottoming out at 15%. With COSS however, the fee split is planned to be fixed at 50%. The revenue split from the trading fees is controlled by a DAO, meaning the COSS team cannot change the split percentage according to their own whims in the future. This is one of the key attractions for me. When the transaction volume reaches the hundreds of millions, maybe billions one day, that 35% will make quite a big difference in the token holder’s weekly ‘dividend’.

Even with this fee-split advantage, we can see from the list above that the market cap of COSS is significantly smaller than any of its competitors that provide a similar offering. This leaves the investors with a lot of room for a healthy return on their investment.

Regulation

COSS is a Singapore based company. This is a good thing. The Singapore government has always been an advocate of Blockchain technology and cryptocurrencies. The Monetary Authority Of Singapore (MAS) does not see the need to regulate cryptocurrencies at the moment. The approach taken is more about regulating the activities around cryptocurrency instead of the cryptocurrency itself.

The COSS team itself is big on compliance as well. They are always working hard to be on the right side of the law so that in the event that regulation is eventually implemented, COSS and COSS token holder’s risk is minimal and the project can still move forward.

What’s Coming Up

UI Revamp

- The soonest and most significant update will be the new UI update expected before the end of 2017. A heavy hitting marketing campaign has also been hinted at once the UI is launched to attract new users and to increase trading volume.

Fiat Gateway

- As mentioned in the whitepaper as well as in the latest update by Rune on medium, a Fiat gateway will be implemented in the future. There is no timeline yet but the team is figuring out the nitty gritty regarding the mechanics of it as well as ensuring compliance. It is a priority for the team and they have promised more clarity in Q1 2018.

Additional Fee Generating Products

- Today, COSS is just an exchange. However COSS promises to be more than that and aims to handle remittances, merchant payment gateway, direct fiat/crypto Credit/debit card etc. All the transaction fees through these other fee generating products will also be subject to the revenue split model and we, as token holders, are entitled to 50% of that fee. If you believe that cryptocurrencies will become more mainstream in the future and accepted by many merchants, this is the coin you should be invested in. Imagine a time when merchants all around the world are using COSS to accept crypto payments. You will be entitled to a cut of all these transaction fees generated by the thousands(if not more) merchants around the world.

Moving out of Beta

- If you didn’t know it yet, the entire COSS platform is still in BETA. They will be out of BETA soon with the new UI, better engine and most of the kinks straightened out. We will soon have a much more professional, user-friendly and stable platform to trade.

Potential Risk

I would not have made an investment in COSS without first understanding the potential challenges and risks involved. I’d advise you to do the same.

COSS is a centralised exchange. This in itself isn’t an inherent risk or negative thing. However, in 2018, we will probably see the launch of several decentralised exchanges, such as Kyber Network (KNC). No one can predict how successful these exchanges will be an these decentralised exchanges come with their own set of problems as well. The current batch of decentralised exchanges that are up and running honestly provide quite a substandard user experience compared to the centralised ones. As always its good to invest with both eyes open and do your own research. Personally, I believe that there will be enough room for both centralised and decentralised exchanges.

With that being said, there is nothing to stop the COSS team from moving their exchange from a centralised one to a decentralised one, should there prove to be significant advantages. Binance (a centralised exchange) has also already stated their desire to move to a decentralised structure in the future.

There is also the risk of falling further behind existing large centralised exchanges that have already been running for quite some time. That would be less than favourable. Network effects play a huge role in the successes of these exchanges. Volume brings customers, customers bring volume, volume brings liquidity, customers bring ICOs, ICOs bring volume etc.

Hence I would like to see COSS speed up the progress and really knock it out of the park with their marketing campaign. It would also be great if the team could make sure that their platform can handle the additional load before the marketing launch so as to not turn new users away from the platform due to overloading.

In Summary

Pros

- Fixed 50% Revenue split of ALL transaction fees

- New revamped UI before the end of the year

- Very low present market cap in comparison to competitors

- Very healthy, friendly and active community

- Responsive team

- A lot of upcoming improvements and feature additions to look forward to

- Platform to move out of BETA

Cons

- Current UI is BAD

- Low awareness regarding COSS at the moment

- Many kinks in the platform to be worked out

- Competition with existing higher-volume exchanges

- Arrival of decentralised exchanges

The Final Word

I have been slowly moving to make COSS at least 25% of my portfolio since November. I have already received a couple of weekly fee splits. The amount received today is very small but it shows me what I can expect in the future. Since November, with the trading volume steadily increasing, I have already seen an increase in the weekly fee split received. Its quite a good feeling receiving free tokens every week in your COSS wallet. If you only need one reason to invest in COSS I would have to say its the fee split.

You can make a sound bet that the trading volumes of all cryptocurrencies will increase in 2018 and this puts exchanges in a great position to benefit. The value of the COSS coin is very much related to the volume of trading on the exchange itself. Hence, a COSS token holder stands to benefit even more.

Sure, buying such into such a small cap token is more risky than getting one of the large cap coins. But you don’t get those outsized returns by buying into cryptos that are already so highly valued. With so many upcoming improvements to the UI, engine, platform and the marketing campaign coming up, I have very high hopes for COSS.

Have fun, good luck and may we see each other on the moon (:

If you disagree with anything or would just like to chat, drop a response below. I’m open to constructive feedback and thoughts.

Peace out.

Disclaimer: The trading of crypto-currencies has potential rewards, and it also has potential risks involved. Trading may not be suitable for all people. Anyone wishing to invest should seek his or her own independent financial or professional advice. This article is not financial advice and should not be taken as such. Invest at your own risk.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@adilabdulhalim/the-alternative-coss-io-870b032e25e4

Congratulations @adiltrooper! You received a personal award!

Click here to view your Board of Honor

Congratulations @adiltrooper! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!