Coinvest empowers anyone to virtually invest in individual or a curated index of cryptonized assets through one coin.

Cryptocurrency has been the hottest buzzword in 2017. We’ve never experienced such a historic rise in value for any other asset, commodity, or currency in such a short period of time before now. While there has been significant adoption and momentum in cryptonized assets this year, there is an underlying problem with the industry. A significant portion of the world is still unaware, doesn’t understand, or finds it extremely difficult to invest in and use cryptocurrencies. Frustrated with the complexity, fragmentation, and quality of investment options available on the market, we decided to come up with a solution.

Welcome to Coinvest.

Coinvest is the world’s first decentralized investment trading market for cryptocurrencies. We are determined to democratize cryptocurrencies by creating tools to provide mechanisms for consumers to seamlessly, securely, and safely invest and use cryptocurrencies.

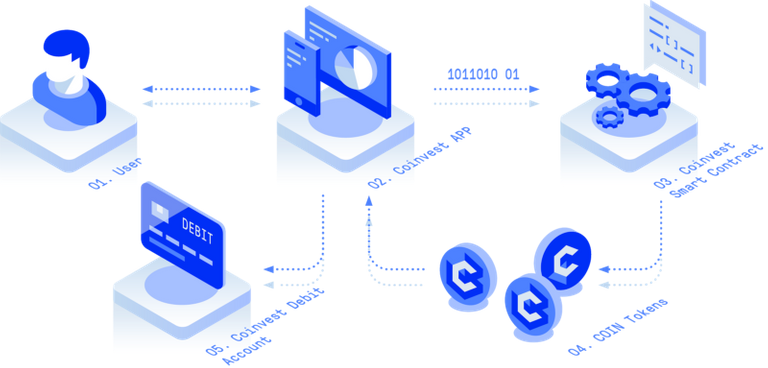

Coinvest is creating a future where users have one platform, one wallet, and one token (COIN), that enables anyone to create a digital investment portfolio to invest in multiple cryptocurrencies. Thereby reducing the cost, risk, and complexity associated with investing in cryptocurrencies on centralized exchanges or investment funds. Centralized third parties that are often needed in traditional investment use cases are replaced with smart contracts that act as autonomous agents and programmatically compensate all users, investors, and owners within the entire Coinvest ecosystem.

1-Create a Coinvest Virtual Portfolio with Your Favorite Cryptocurrencies

2-Trade and Withdraw Investments (+ Profit) Directly with our Smart Contract

3-Easily spend cryptocurrencies using your debit card account

By leveraging blockchain technology, Coinvest’s solutions scale globally and provides:

''Simplicity''

Investing in cryptocurrencies today is an extremely difficult and a intensive process. Exchanges require KYC authorization which can take hours (if not days) to validate. Coinvest legally bypasses the KYC process as there is no exchange in fiat currency, assets, and as the Coinvest smart contract is the custodian of your deposited funds.

''Convenience''

Securely storing cryptonized assets is imperative but not trivial. Some coins and tokens have different standards and require different wallets. As a consumer, you have to choose between different wallet options (such as hot, cold, paper, etc.) depending on your risk appetite. Storing assets yourself is feasible for some; however, complicated and risk hacking and user-error. With Coinvest, there is no storage of investment assets as all portfolios are completely digital.

''Function''

Prices in cryptocurrency can be extremely volatile. Acquiring assets at the wrong price and time can be the difference in gains or losses. There are currently limited investment options that empower users to execute flexible buying options such as shorting and price limit orders. Coinvest is one of the first in the industry to offer this functionality.

''Diversification''

Unlike current exchanges, Coinvest offers index funds containing a portfolio of cryptonized assets related to components such as market capitalization, industry, etc. The index funds enable users the ability to invest without individually and actively purchasing assets themselves. Meanwhile, providing broad market exposure, low operating expenses, and low portfolio turnover.

''Autonomy''

There are currently no investment vehicles that enable investors to curate and invest in an index of cryptonized assets created by themselves. Current investment, index, and mutual funds are managed by third-party asset managers and offer no flexibility and control of the fund itself. Personal curated index funds on Coinvest empower users to control the assets, distribution percentages, rebalances, and withdrawals of their own individual fund.

"Decentralization and Security"

Investing in cryptocurrencies require sending funds direct to an exchange or investment fund (which inherently creates centralization and high risk as they are the custodian of your funds). Exchanges and investment funds also hold and control your funds until you request to withdraw them (pending no lock out periods). Coinvest does not accept any funds (fiat, cryptocurrency, etc.) or payments direct from users. User funds are held in escrow and controlled by the Coinvest autonomous bot (computer code) within a smart contract in the Coinvest protocol. Users can withdraw funds or close their positions at any time and obtain distributions automatically via the Coinvest smart contract. The Coinvest investment process requires no human involvement or interaction.

"Backed Collateral"

All investments made through the Coinvest platform are backed by the cryptonized assets themselves. To ensure liquidity, Coinvest employs two reserves. Investments will only be executed based upon available assets in the reserve, ensuring the security of all users. A percentage of company revenue is allocated for additional purchases to increase liquidity and scale the reserve in relation to growth.

With Coinvest, users have a number of opportunities to gain value from leveraging the platform and the overall COIN itself. These include:

"Trading Rewards"

Coinvest has implemented a loyalty system to rewards users that frequently leverage the platform. Similar to loyalty reward programs, users can accumulate additional COIN based upon trade volume. Every ten trades results in a bonus distribution of COIN equivalent to one trade back to the user’s wallet.

"Trading Profits"

As with traditional trading, users can obtain value from profitable trades in their investment portfolio.

"Index Fund Management"

Coinvest empowers users to create their own personal index fund using a curated list of cryptonized assets; thereby, becoming their very own index fund manager. Other users can invest alongside (into) other user’s index funds to gain the benefit of portfolio returns without having to research or managing a trading account themselves. The creator of the index fund then collects half of the trading fee revenue for each trade into their fund.

"COIN Value Appreciation"

Users can obtain value from standard demand appreciation from the COIN itself.

While Coinvest is a new company, we are lead by industry professionals with decades of individual experience from companies such as Microsoft, American Airlines, and IBM. Our advisors are respected leaders within their industries and include the CEO of companies such as Mashable and Republic. Together, with the blockchain community, we are seeking to disrupt the complex unsecure investment channels that exist today. Instead, empower users to easily invest and use cryptocurrencies through solutions that are open-source, free of third-parties, and completely decentralized. We are extremely excited to execute our mission and hope that you become part of the journey.

For more information, please visit our website at http://coinve.st.

Join our Telegram to join our community conversations or say hi to us at any of the channels below:

-Email: [email protected]-Telegram: https://t.me/CoinvestHQ

-BitcoinTalk: https://bitcointalk.org/index.php?topic=2381017.0

-Facebook: https://www.facebook.com/CoinvestHQ

-Twitter: https://www.facebook.com/CoinvestHQ

-YouTube: https://www.youtube.com/channel/UCX-pE6nXFg3uK2_cMQ5n6jA

-GitHub: https://github.com/CoinvestHQ

-Medium: https://medium.com/@CoinvestHQ

-Reddit: http://reddit.com/r/Coinvest

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@CoinvestHQ/welcome-to-coinvest-cf24284c9394