The author has created the express call to visit Bitcoin cashs ticker name as BCH because of the actual fact that Bitconnect already has the BCC title.

Is all the confusion round the new Bitcoin fork pain your head? probing for some steering on however this whole heroic tale goes to pan out? Is Bitcoin money about to go to the moon? Well, this piece may simply cause you to a lot of confused, as a result of theres plenty quite meets the attention once it involves Bitcoin cashs value spike.

If you had listened to the vocal crypto intellectuals on the Twitter feed leading up to the quarter day split Bitcoin money was dead within the water. everybody was merchandising BCH-futures for zero.1-0.15 BTC. Naturally, this was the best value this false faker oxyacetylene by crypto-advocates-gone-corporate was ever about to reach. it {absolutely was} absolutely ridiculous to even think about that individuals were really defrayment their own bitcoins to buy even a lot of Bitcoin cash!

Bitcoin money shoots up in value

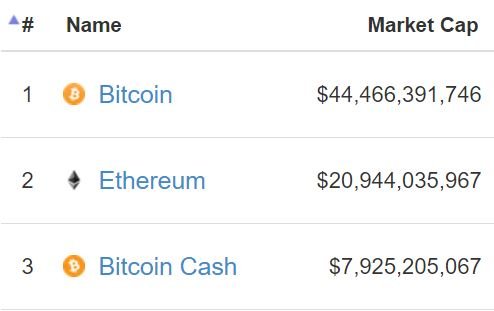

At the time of writing, a full day when the fork, Bitcoin money has seen a close to 2 hundredth increase on the average, peaking as high as ~$1000 in bound exchanges like YoBit. Coinmarketcap square measure listing BCH because the third largest cryptocurrency, returning in at a banging $8 billion USD at the time of this post.

Screenshot captured at ~17h00 Greenwich Time.

Today, the Twitterati square measure still singing an identical tune, however theres a delicate distinction the atmosphere within the air has turned from that of arch dismissal to one thing nearer to a tense stand-off. There square measure still capricious tweets of got out at $400, no regrets going around, however they speak Associate in Nursing underlying message: BCH is obtaining a lot of traction than expected.

Whats very going on?

Taking a step back and looking out at the massive image, the crypto intellectuals of Twitter won't be entirely incorrect in their assessment. Theres plenty quite meets the attention to BCHs close to 2 hundredth increase within the price. Heres a brief list of what may well be unnaturally (at least more-so than traditional speculation) increasing Bitcoin cashs price:

Ferdous Bhai, founding father of 21MIL same a offer shortage of BCH on exchanges is causative to the worth spike as offer is failing to satisfy demand from the promotional material, because the blocks square measure returning in therefore slowly. the foremost recent block took 9+ hours.

An unknown mining pool primarily based out of a hostel in port, referred to as MHz pool, has deep-mined the foremost BCH blocks so far. The MHz Pool owner explicit that they began mining the BCH blocks for fun and to push the mercantilism center that that they had simply created. the bulk of miners within the pool have already switched back to BTC when their victorious subject matter stunt. this can be because of the actual fact that each coins have equivalent difficulties to mine, and therefore the come back on BCH was too poor.

The takeout is that no large-scale operation is obtaining the BCH blocks bent the amount expected and thats a shortage that might cause a synthetic value spike. a lot of on this on purpose #3.

Jimmy song on Bitcoin money

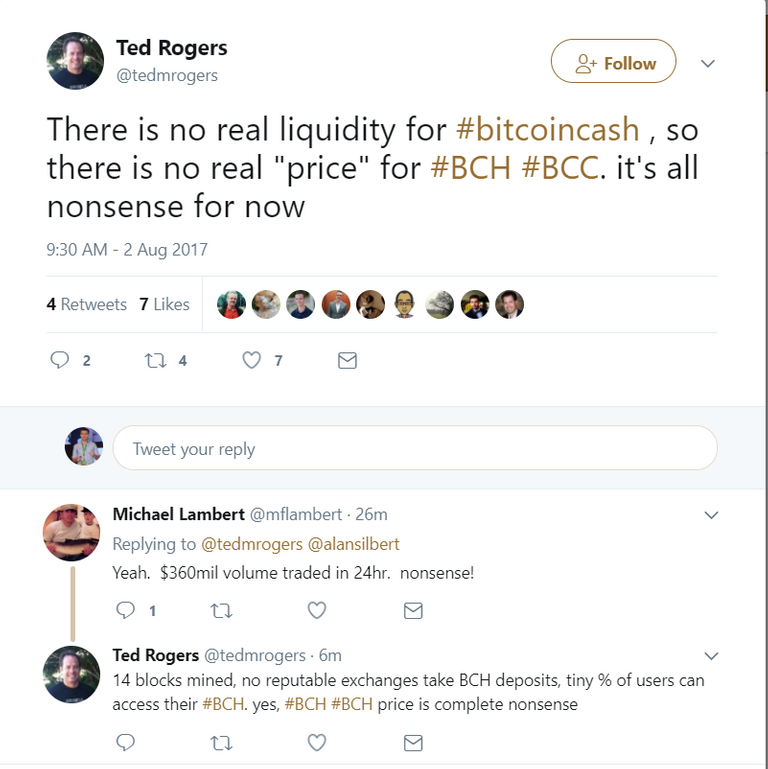

Screenshot captured at ~17h00 Greenwich Time.

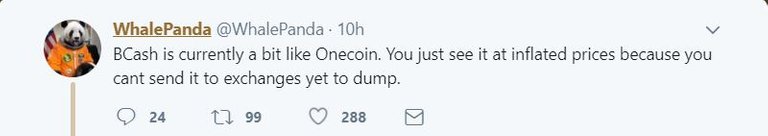

There square measure in progress arguments that Bitcoin money is nearly entirely illiquid

This would invalidate each the market cap listing Bitcoin money at the third largest cryptocurrency within the world, also as its current value purpose. The bitcoin maximalists stand robust on this argument. scrutinize this Twitter exchange for reference of each conflicting views:

The reality of the matter is that if no blocks square measure being deep-mined, then no real amounts of BCH will be deposited on exchanges to be sold . the worth discrepancy between the exchanges that square measure handling Bitcoin money is proof of illiquidity in distinction to the market volume figures provided.

Once we have a tendency to begin seeing an everyday flow of BCH blocks returning in and folks will really sell their Bitcoin money, we have a tendency to might even see a pointy downward spiral as offer overwhelms demand particularly if it all starts flowing in sort of a dam breaking that may be the case with this large build-up of eager sellers. The crypto market is not any alien to ~200% upwards value spikes in an exceedingly day, similarly, it will welcome a fair bigger value fall.

Its a prospect this first push doesnt total and BCH doesnt get the hashing power it has to be property over the long. If this can be the case, it might have ruinous consequences for consumers UN agency square measure putt extra money into BCH hoping its about to moon.

wow great information

i like it verry good information

great news

great post

nice post

good news

I am Groot! :D