You heard of bitcoin? Ethereum? ICOs? Smart-contracts? Or simply crypto-currency? Are you a fan of new technologies or nerds? No worries, we will try to answer your questions in this dedicated file. The first record of a long series dedicated to crypto-money.

Crypto-money for Dummies :

To avoid losing everyone, let's start with a simple explanation, without technical jargon.

The virtual currency was originally created for one purpose: to create trust between two people who do not know each other, without intermediaries (banks, notaries, etc.).

All transactions are registered in a huge database (called blockchain, for chain of blocks), controlled by users. Indeed, users will validate all transactions with their signature, which avoids cheating and theft.

This control function is handled by users, who are paid for it. These are the miners. Transactions are integrated into blocks, so these blocks (transactions) are mined (verified).

Trust is thus created: through transparency and traceability.

What is the bitcoin?

LeBitcoin is a digital currency called cryptographic. In reality, it's like your 20 dollar bill except that it is not a "palpable" currency and nobody (no central control body) controls it.

The Bitcoin appeared in 2009 following the desire of Satoshi Nakamoto to define a new monetary system that would be self-sufficient and would work alone. He first reflected on the support of this money: the blockchain.

How does the Bitcoin work?

The Bitcoin is based on a technology initiated also by Satoshi Nakamoto and one of his friends, Hal Finney, it bears the name of: blockchain (chain of blocks in French). You may have already heard about it.

The blockchain is a technology for storing and transmitting information. It can be compared to an enormous database which contains all the exchanges carried out on it since its creation. An image that I like very much defines the blockchain as "a very large notebook, which everyone can read freely and for free, on which everyone can write, but which is impossible to erase and indestructible." - Jean-Paul Delahaye.

Finally, the blockchain is also secure (because distributed, among others) and transparent. It operates without a supervisory body: that is, there is no "European Central Bank" as for our Euro.

But it can also be updated: users are indeed the key to this technology, but if they chose to implement new features? Well, it's totally possible! By means of votes: users, through the pools and thus the computing power, will be able to choose updates to be incorporated and the blockchain will update itself if a sufficient number of users approve this update!

The blockchain network continues its development with a classic open-source project mechanics. Only the new functionalities must be put into production by the computer network operating the bitcoin

What is the use of the bitcoin?

The bitcoin can be seen as a currency, it serves in particular, as for the Euro or the Dollar, to exchange or transfer goods or services. It can be useful as much to pay your friends, to pay your bills or to do your shopping!

Today, more and more players accept the bitcoin as a means of payment: physical traders, online shops and even casinos! Bitcoin has also become a "currency like any other" in Australia. You can now find distributors in the United States and many other countries. La Maison du Bitcoin in Paris is a trading post that also conducts training courses.

Payment is not his only vocation; It can also be used to validate transactions, or to make sure the online vote, to certify a diploma ... The applications are very numerous in very varied fields.

What is the Ethereum?

Ether is, like Bitcoin, a digital currency. However, the Ethereum protocol allows some additional features, and in particular, the creation of smart-contracts.

The smart contract, as we shall see later, is a self-executing contract: contracts (like those used in our daily lives) are written in the code of the blockchain. The protocol does not just register them: it also checks their application to validate the transaction.

The Ethereum protocol appeared in 2015, launched by developer Vitalik Buterin, it is a secure exchange protocol (like the blockchain), but with the possibility for users to create intelligent contracts.

Why the Ethereum while Bitcoin was already there?

The Ethereum appeared 6 years after the Bitcoin, but it brought an unprecedented novelty: the creation of smart-contracts.

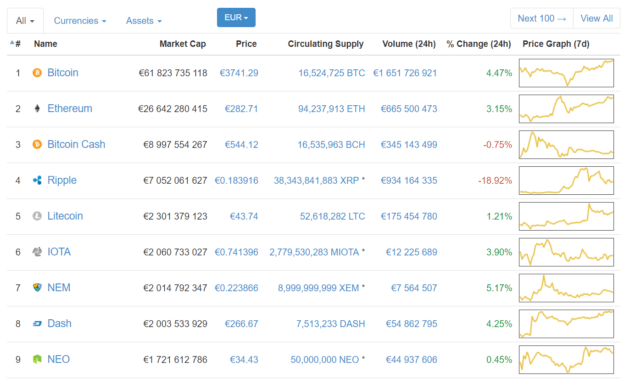

Moreover, why limit ourselves to the Bitcoin when we can create dozens and tens of different currencies? Today, there are more than 1,000 of them and they all have a very special utility and a different use.

How many crypto-currencies are there?

Today, there are more than 1000 cryptomonies! And new ones appear as they go! In fact, creating a cryptomonte is not much more complicated than setting up a piece of code! Moreover, you can very well recover the protocol of Bitcoin and create your own fork, that is to say: your own virtual currency.

Each currency has its own characteristics (protocols, settings on algorithms, a way of functioning, or ambition or direction) that make them suitable for one use or another.

Does crypto-money have value?

The cryptomonnaie has a global capitalization: 153,934,452,032 dollars to be exact, at the time of this writing. The Bitcoin owns about half of this capitalization. The 1000 and some existing cryptomonas thus share the rest. On CryptoCurrency Market, you will find all the virtual currencies.

What gives value to these currencies to be explained in two points:

The market, the simple law of supply and demand

The use of money

Trust

As you can see, each currency has a difference value that can be explained by several factors:

Supply and demand

The way the blockchain is secured

The level of difficulty of the blockchain

The utility of money and its ease of use and storage

Perceptions of its value by the public, media and investors

Innovation brought by currency

The trust of traditional systems

Legal and governmental positions

Regulation, technical challenges, reputation problems

Is crypto-money designed by bandits?

Yes…. and no. All the cryptomata have distinct characteristics. For example, the Bitcoin, based on a totally public blockchain would allow anyone to trace all transactions, since they are all visible. On the other hand, systems are emerging that promise their users to "wash" their Bitcoin, so that they become untraceable.

Above all, there are cryptomonas much more apt to be used by thugs. We can talk about Monero or Zcash, cryptomonies that advocate 100% anonymity.

What does it mean to "mining the bitcoin"?

Mining Bitcoin means participating in the blockchain. As all transactions are grouped into blocks, users must check each block to prove its validity. For each mined block, the blockchain created from the Bitcoin (12.5 BTC about today).

More and more users are regrouping by "pool" of mining. Indeed, the difficulty to undermine 1 block becomes so strong that they decided to pool their computing power in order to increase their chance of recovering the gains of the block.

Each mined block is also supplemented by the total costs for transactions sent by users. If mining interests you, we will devote a file to this practice.

DAO? What is that ?

TheDAO was a big shock for Ethereum. TheDAO, for "autonomous decentralized organization" was a very important project. Indeed, TheDAO was a participatory investment fund based on the blockchain Ethereum, but with a much greater "decentralized" vision.

However, in mid-June 2016 and after 150 million euros raised (in Ether), the smart-contract is "cracked". "Cracked" between quotation marks, because it is not really a hack, but only a hijacking of the code: the hacker used the smart-contract in another direction and managed to withdraw for nearly 60 million euros.

The problem is that TheDAO advocates the fact that "code is the law" then since the hacker was in agreement with the code, TheDAO could ... nothing to do.

Users (and investors) therefore had to choose a solution. The solution chosen was to proceed to a hard-fork to recover the funds and blacklist the address of the hacker. However, as all the users did not agree, the blockchain Ethereum was split in two: one, official, retained the Ether name with its symbol ETH and the other Ethereum Classic with its symbol , ETC.

TheDAO case has scared a lot of users. Sensed to be non-piracy and very secure, it turned out that flaws could exist. Today, we see for many ICO slogans saying "TheDAO, not yet" in order to prevent users from a potential scam.

Given that TheDAO was the first major flaw in these protocols, it marked the spirits and many decided to give up.

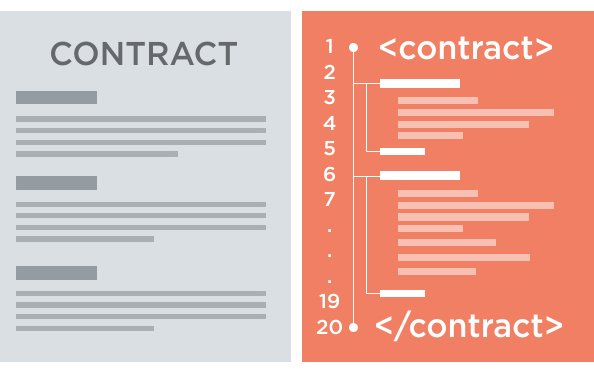

What is a smart-contract?

A smart-contract is an intelligent contract based on the blockchain. A piece of computer code that represents a past contract. Each line of code can be seen as game rules. The network stores this contract, but also checks its execution in the same way it checks the validity of all transactions.

Simply put, it is a two-part contract (or more) that will only be effective when both parties agree with the terms mentioned. Smart-contracts can be useful in many cases: negotiation, raising funds, creating tokens and many other areas.

They are simple, reliable and inexpensive. The execution of an intelligent contract can be checked publicly on the blockchain, the contract data are falsifiable and can not be modified / removed and since one can not disconnect all the participating machines to the blockchain simultaneously, It is very reliable.

A smart-contract works very simply: it only verifies that the execution conditions are fulfilled or not. Once completed, the contract runs automatically. For example, a company A offers a company B a quote. Company B does not agree with the terms and modifies them. Finally, the new terms are accepted by company A: it then validates the contract. Company B also validates as it has successfully negotiated the terms. When the two companies agree, the contract runs automatically and it is impossible to return to the terms.

What future for smart contracts?

This is a big question, but smart-contracts can be widely used and appreciated in today's world. Indeed, many companies or individuals sign and use contracts every day. Thanks to smart-contracts, these processes could be greatly optimized and simplified.

The smart-contracts should, in my opinion, remain on the blockchain Ethereum, but also appear on the Bitcoin, in order to facilitate all trade, whether commercial or not.

Note that smart-contracts are not limited to Ethereum, many decentralized applications are today developed on the basis of these "smart-contracts": Augur, Slock.it, Maker, Digix ...

What is an ICO?

In the parallel world of crypto-currencies, blockchains and distributed consensus, the rule of the game is to create its own currency with the service that is proposed. It's simple and easy: if you want to create a new currency with its model, you simply need to duplicate the Bitcoin protocol.

Initially, some people (early adopters) with the team of co-founders are the only ones to distribute the currency in question and to accumulate massively. Then individual investors like us say "why not" and buy for a handful of euros thousands of this new currency. As a result, this currency is starting to gain in value, which will allow co-founders to raise funds. This is what we call crowd-investing, participatory investment. Traction of the project and currency will then encourage investors to invest, but also users to commit and work for the project.

The value of the currency will both be due to the fact that this new currency is used on the platform, but also that it gives a right to vote on the direction of the project, since it is open source.

We just summarized the ICO, but it's a bit more complicated.

An ICO, for Initial Coin Offering, is a token (one part, if you prefer) put up for sale before a currency is placed on the market. You bought tokens, which will then be converted into currency.

There are many ICOs, which appear every day. What is important to check as part of an ICO is the purpose of the created currency, the team behind and the rules of currency operation. Normally, all these elements are summarized in what is called a white paper. This is the equivalent of one (a part) of a business plan. ICOs are a way to raise funds for startups. Obviously, some ICOs are scams (scam or other negative terms).

Specific examples of ICO?

Among the biggest ICOs we can find:

TheDAO, the most infamous ICO

Bancor Protocol: 130 million euros in just 3 hours

Brave: 35 million euros in 30 seconds ...

Status.im: 300 million euros in a few hours

And many others ! (See tokenmarket)

I hope that this first file on the cryptomonies will have pleased you! Do not hesitate to send us your comments and remarks!

I hope you like this post! You can follow me @anis33 so you don't miss my future posts

Nice post bro! I really like to see this kind of information because when I started at this world I couldn't find this type of posts so I know how hard it can be to understand this crypto-world. Keep working!

thank you @cryptogeyser