People keep asking how to invest in crypto-economy step by step. What I need to know? How not to lose money? How to choose right cryptocurrency that will skyrocket?

In this guide you will find exhaustive answers to many of those questions. But before I will explain you how to invest, I will better answer the question, why the hell do you need to invest your hard acquired money? I will try to explain it as simply as possible.

Invest because it is growing

There is such a thing. Over last 20 years with the invasion of the Internet, many people have earned amazing amounts of money on one simple thing as a Network Effect. What the hell is that? In 70-s there was one engineer Robert Metcalfe. He fully invented what we now call Ethernet. In order to make a profit on this invention, he was selling the network cards. At that time people did not understand why the computers need to connect to the network. Robert realized that it is necessary to find a reassuring argument that would prove that his network card is a panacea for all their illnesses.

This goes by a simple rule : The network’s value is proportional to the square of the number of users in this network.

Well, you buy 10 computers without a network card and their conditional costs is equal to 10. But with network cards - conditional costs of 10 computers will be 45! This is 4.5 times more profitable! “Wow” — corporate workers said and began to buy Robert’s network cards.

It turned out that Robert’s consideration is quite reasonable! You can use it for assessment of the Telecom companies which was rolled on a planet with redoubled force. The capitalisation of Telecom companies depends on the number of its users. And the dependence was not a straight line but a quadratic. At the dawn of the social networks, venture capitalists quickly remembered the cherished formula and applied it to such things as Facebook, Twitter, Skype, etc. So the Metcalfe’s law has led to the fact that millions of Ethernet grids has evolved into what we now call the Internet.

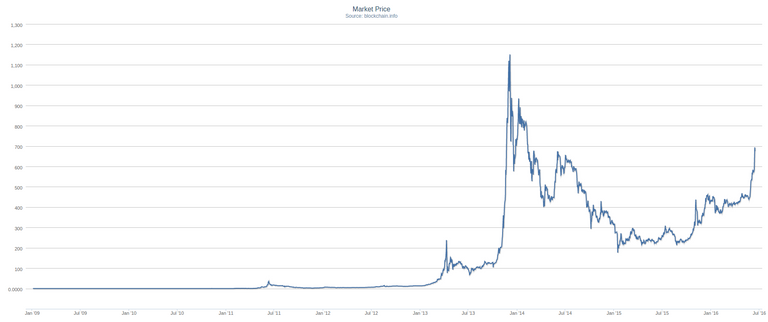

Simple truth — if the number of network users is steadily growing, the exponential growth of our investments is expected. Thus, Facebook was worth more than $ 300 billion. The formula is simple. Looking for a network which is growing steadily at the very beginning => put money => wait => profit! The question is — why Bitcoin? Because it’s the same network and it’s growing. Is growing quickly. Judge for yourself:

2010–10 thousand users

2012–100 thousand users

2014–1 million users

2016–10 million users

Of course, these figures are very approximate, because there is no way to determine the exact number of users. The numbers listed above is my own assessment.

Question: How long it will grow and when the growth will slow down?

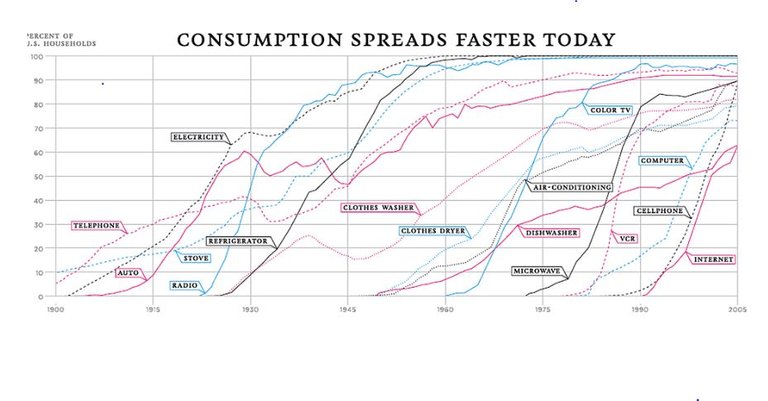

Answer:Blockchain technology refers to a class of technologies “No Way Back”. This is when Homo sapiens starts to use something and could not imagine how they lived without it. Here’s a graph in the case of TV, electricity and other technologies:

Growth will be carried out at the S curve until saturation occurs.

There are about 3.5 billion people who use the Internet, and about 20 billion connected devices or just bots. Considering that the Bitcoin network has properties that are not offered us by any Government or Corporation, we can assume that there is a high probability that the majority of connected people and machines will use this network. What are these properties?

*No taxes

*Free opening of accounts. They are simply calculated from your private key :-)

*Low transaction fees

*Predictable and transparent clearing. You always know what is the status of any transaction

*The transaction cannot be rolled back

*Nobody asks the personal identification information

*Nobody can write off your money

*Nobody can block the account

*No stupid limits

*Suitable for all forms of property, not just currency.

*A complete history of all transactions

*Possibility of privacy and anonymity

The list of benefits can go on and on, but you get the idea. This is a kind of manna from heaven, which is better money in comparison with paper dollars. But most importantly:

It’s just the economic miracle of mathematics, cryptography and computer science.

Invest to not be cheated.

In the current economic circumstances the deception is carried out in 3 ways:

Disguised theft.

The part of inflation caused by the “printing press”. Watch movie “The Big Short”

Trivial racket.

It is not enough for Government to steal you money secretly. They openly steals from people by adding value to taxes. According to my estimates, at least half!

HALF

No warranties.

Banks may go bankrupt. They simply tell you “sorry, there is no your money”. The point is that any of your assets at any time may not be yours. The state does not guarantee the safety of your money. The Government requires you to keep your money in the banks, and your right of property in the public registers. People naively believing that there is no any alternative.

I believe, in the future, blockchain technology will become immutable mathematical guarantor of the preservation of property and economic freedoms.

Foreseeing the collapse.

There are so many predictions of the collapse of the American financial system. Even billionaires already say this openly. Let’s say that it will not happen. But if it happens, we will not go back to the existing world order. Such events in retrospect are called Black Swans. Nobody thought that the Second World will happen, that the Internet will appear, that Trump will become a President. But in retrospect, all these events are obvious, and have a rational explanation. The collapse of the Fiat system would be the same. If the American economy collapses, the world will literally be in chaos. Our history in this regard is even more interesting because if the US economy collapses, other economies collapse even more.

The mortgage crisis of 2008 proved this clearly. But it didn’t teach anything.

But what’s surprising here? How this bubble could burst if there is no alternative? For some reasons no one admits the idea that an alternative to сurrent outdated system is already there. Which is great! That suggests that a Black Swan is not such an unlikely event. In the case that a negative event has at least some probability, smart financiers are recommended to hedge risks. Let’s guess 3 times, what’s the alternative?

Right — is Bitcoin.

Look in The Future

There is another argument in favor of the Blockchain: robots and artificial intelligence. The reality is that we don’t know exactly when computer algorithms will be able to solve all the problems that we can, including creativity.

Today is 2017. The computing power of the device which cost $1000 approximately equal computational abilities of the mouse. In accordance with Moore’s law in 2025 (and perhaps earlier, e.g., in 2022) the cost of computing by humans biological brain will be compared with the cost of computing by computers.

Let me give you some real live examples from different areas:

The Future of gaming is in Dubai

Computers for Autonomous robotics made by 21.co

AlphaGo victory over Lee Sedol

The algorithm that broke one of the strongest players of Go is available on Github and it is called “Tensor Flow”. Any school student can click on the “Fork” button and make everything what comes into his mind. This accessibility of really smart technologies will inevitably lead to the emergence of a new generation of smart devices. Autonomous robots will be able to earn money and consequently make economic decisions. And as soon as the first striking example occurs — the Homo sapiens may get nervous. His job may be under threat.

There are more Bots than humans. This amount will increase and Bots will become smarter. Thus, the risk of devaluation of your (and my) intelligence is real. And the longer you deny it, the faster your brain will depreciate in value. The point is that the blockchain for the robot economy is convenient to them. It is understandable, it is reliable, and it is easy to integrate. The Blockchain for the Internet of Things is a new megatrend. It is obvious that without the blockchain — robot’s economy simply impossible. The solution is right here:

Investments in the blockchain as a hedge against the depreciation of your own intellect.

In addition to the von Neumann architecture, there will be will come quantum computers in the future. The Moore law for quantum computers will work in the square.

So, you have some incentive ideas in your head and you already want to buy Bitcoins. Your blood start to boil. The brain anticipates an incredible profit. All the free energy is concentrated on the sources of investment.

Calm down! Turn ON your Brain

The blockchain is a really cool technology and it is growing rapidly. But there is no guarantee that you will be able to make profit. I will list some necessary conditions that must be followed to increase the probability of a profitable outcome.

Before invest-improve your technical competence.

A mandatory condition for safe investments in the crypto-economy is a basic computer literacy. If you don’t know how computers works, then think twice before putting your wealth. Then the question arises: How do you I know if I have this basic computer literacy? These bullet points will help you understand a little bit more about it:

*You have the same password for almost all services.

*Length of your passwords is less than 20 characters or it is copied phrase from the book.

*Do you use anti-virus software and believe that it will protect you.

*You don’t backup your data.

*You have no idea about what is data synchronization and why it is needed.

*You don’t know what is “trust a website”, what is “operating system and hardware security”.

*You can’t generate a mini-lecture for at least 10 minutes when you ask the question: what actually happens when a browser is driven google.com and then pressed Enter?

*If you answered “Yes” to even one question — your computer literacy want to be better, and you need to take this into account when investing in the crypt-economy. Otherwise, you have a high probability that something will go wrong.

Define strategy

You have already realized that there is no freebies, and risks, in fact, are more than you thought! You need some time to determine how much to put down for investment. General recommendation: from 1% to 10% of an available financial assets you currently have. If you have confidence in your own computer literacy, then the percentage can be increased up to 30% and even 50%.

It is very important to start from amount of your financial assets. An appropriate financial assets are currency, stocks, bonds, shares. Property, cars and other things that can be touched, are not included here. Although, I’ve heard a story about one guy who sold his apartment and bought Ether on all the money. Heroes must be known in person, so let me know if you read this!

So, if financial assets are greater than $100k — you’re lucky:). Buy cryptocurrency in the amount of from 1% to 10%, depending of your risk appetite.

If your financial assets are in a range of $10k-$100k — you have something to lose. You are neat, consistent and purposeful. Allow yourself a little risk and roll up to 3%-20%. Your well-being is not significantly affected in a case of losses, but it can teleport you into the category above sooner than you would want to leave your current work.

If financial assets you have are up to $10K — you are still ahead. The amount is already nice, but it is not enough to feed itself. When there is a stable source of income, start from 5%, and when you will be confident — raise the rate up to 40%. Think about your strategy: 5% for retirement. When you got paid — put 5% on the blockchain. If you maintain schedule within 1–2 years you will be pleased with your investments.

If you do not have anything, then best suited strategy is “all-in”, because you have nothing to lose. With such financial discipline — hardly something will help you! So is there any chance that something will changes in your life .

But I’m still a kid!

Great! Bitcoins are for you! Governments, banks and even your parents think that you can’t have something for possessions, without their permission. Prove to them that this is not true. If you are reading this article, probably your computer literacy is much better than most of the people around you. So don’t believe them. They are stupid. By the time you finish school, banks may disappear altogether, Governments may become autonomous code, your parents may lose their job in connection with the invasion of artificial intelligence, and your kettle might be richer off than your entire family. But if you’ll have a few bitcoins and tens of Ether, your coevals will look at you differently. Girls will love and parents will be proud. Look at Vitalik Buterin. His first bitcoins appeared when he was 16 years old. It was interesting. He began to write and study. Then he didn’t go to University, but created Ethereum. Now, professors of the world call him Mr. Vitalik Buterin. If you will start to accumulate anything from 6, 8, 10, 12 years you will have a good future.

Prepare to wait a long time.

If you’re not ready to freeze your money less than for 3 years — close the tab and move on. There is nothing for you. Blockchain market is in the embryonic stage. It may be rocking back and forth. The clear strategy is Buy & Hold. Bought and keep. I recommend to plan it as a long-term investment with some simple strategy of fixing. For example, detecting 10% each time when the net asset valuation increased 5 times from the previous commit. Well, it’s simple! But this strategy will only work if you define the investment horizon in a radius of 3–10 years.

Find entry point

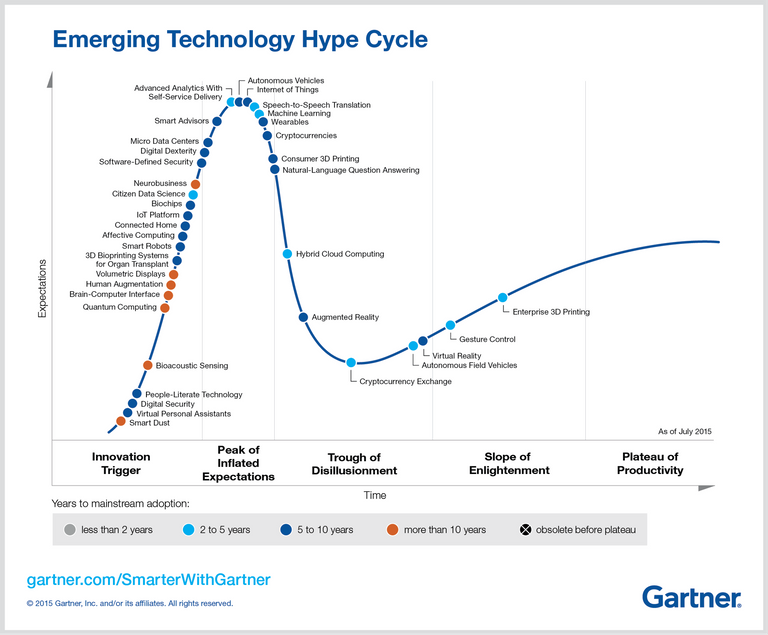

Here’s what is thing about. There are all sorts of technology is growing unevenly. The guys from Gartner explained it very simply:

New technology occurs and all at once are amazed from the new technology. This is called the peak of inflated expectations. But the technology is still not working as it should work. Therefore, the technology comes at some point of disillusionment. And then it either disappear or becomes productive.This principle works for all technologies.

So. In our history, all looks the same.

Any blockchain system grows very similar. I am telling this in order to give you one simple idea:

*Do not buy when everyone amazed.

If you see that in the last month something has increased several times, this is a great reason to look at buying, study, and find a more optimal time to enter when the market goes down.

Strategy “Buy & Hold” also means that if you find an interesting asset, it is the time to start buying when it falls, and purchasing until it starts to grow.

What is crowdsales or ICO?

Previously, I have discussed about assets that already existed and were traded on the markets. But where did they all appear? After all, it’s better to be at the forefront of “something great”. Essentially there are two options:

Some Satoshi Nakamoto or John Connor appears on some forum and says: — “Here is the soft, let’s do mining.”

Some Vitalik Buterin or Den Larimer appears on some forum and says: “Here is the code. Let’s chip in together.”

Both approaches in different cases makes sense. Sometimes, these two approaches should be combined. But in the second case, we have the opportunity to participate in the creation of something which is risky. Thus was created Ethereum, and many more.

Question: how to determine that this is something where I put the money is great, but not some sort of regular wiring?

Answer: Behold the root. We look at three things:

_A Coherent Whitepaper. _

Real science should stand up for such projects. The people who create such things should be able to clearly express their thoughts on paper. Otherwise, the probability that the project is successful goes to zero. Here are two whitepapers: Concept and Protocol that were at my disposal (when I took the decision to invest in Ethereum). I saw these guys with a head on his shoulders. Here are a few papers (Steem.it, Augur, Digix) where I have issued a positive decision. Here’s, an example of a paper of the project which took off. Do you ask why? Because it is natural for the question arise in your head regarding the competence of the creators. In General, there is a need of serious thoughtful approach and the ability to analyze all kinds of stuff.

_Source code. _

It has to be open source. No code, no proof that you are generally able something to develop. In the case of Ethereum PoC v0.5 it was on C and v0.6 on Go. Theorists have no place here. You also must understand that in the end you need to trust the code that will work, but not the people. A story with TheDAO confirms this.

_Strong team. _

It’s not important whether you have anonymous team or not. People should make a good things. Everyone makes their own research here.

If at least one item has not converged, then don’t risk. Of course, there are a lot of additional factors:

The Consensus Algorithm.

Let me just say that this is a complex topic which makes me passionate about this story. It is hard to explain in one line. But you should pay attention to it, yeah.

Economic model.

This is an interesting area, due to which this industry will grow very quickly. Also it is the subject for a whole separate book. In General, the economic model needs to be effective, the system must have all necessary economic incentives to achieve the desired goals!

The structure of the distribution.

If founders want to own 90%, that is a centralized thing, and the risks increase. The norm in ICO is the reward of the team in the amount of 10% -20%.

_A technological approach. _

Some comrades are trying to create their own independent network of one feature. Or on the contrary try to implement over an existing network, which requires an independent network. Here it is necessary to pay attention, since architectural mistakes in the design of the blockchain system very quickly kill a potentially interesting project.

Generally, all these criterias are not exhaustive. However it is enough to understand that making such decisions requires analysis and understanding of whole picture.

Guys from cyber.fund collect significant ICO in their radar.

About “pseudo Blockchain investments”

Yes, there is such a thing. Recently a lot of my friends sent me a project in the field of bitcoins and blockchain with a question: Look? What do you think?

99% of them are not the Blockchain investments at all. Basically, there are different companies registered in different jurisdictions and they provide variety of services. Here an example of such company. If the property is not registered on the blockchain and has its ends on paper in some jurisdictions, it is not a blockchain investment at all. Such an organization will never be more marginal than organization consisting of a code and not paying a bribe to all sorts of crooks. Of course, there are many situations where this approach is needed. Especially in the services at the junction with the Fiat economy, because the Government learned very well how to keep the ball of money holders.

This article is NOT about investing in such kind of companies. It is highly recommended NOT to invest your hard-earned bitcoins in such enterprises because risks are much higher.

It is a time to buy your first Bitcoins

Anyway, a journey to the blockchain investments begins from buying Bitcoins, as all existing cryptocurrencies and assets are traded primarily to Bitcoin. Of course, you can start from mining. But this article is not for those guys who are willing to wrestle over how to buy hardware to solve problems with electricity, cooling, to suffer with the software, and then monitor it around the clock. Such guys are not needed in this article. They’ll figure it out. This article is for the lazy you. You want to make a decision, press the button (alone and green), and immediately get incredible profit.

If you are lucky and your country do not prohibit the purchase of bitcoins (e.g like in Russia) you can buy Bitcoins by credit card or Paypal.

But at first — know how to store your money! Start from this article.

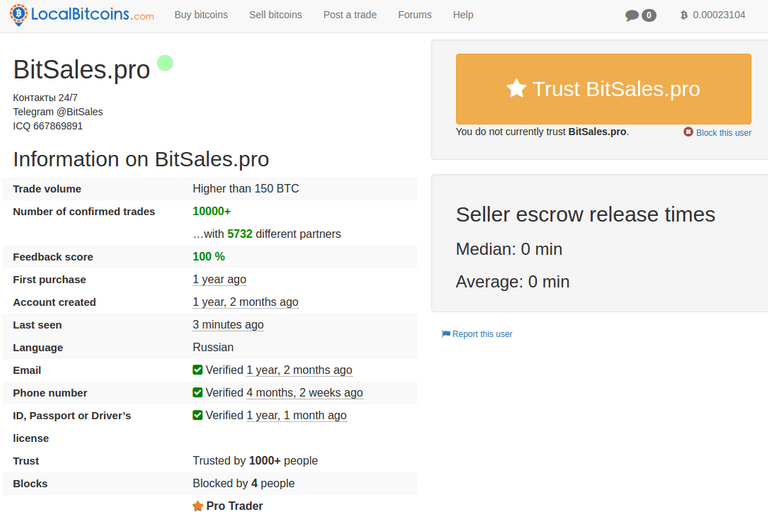

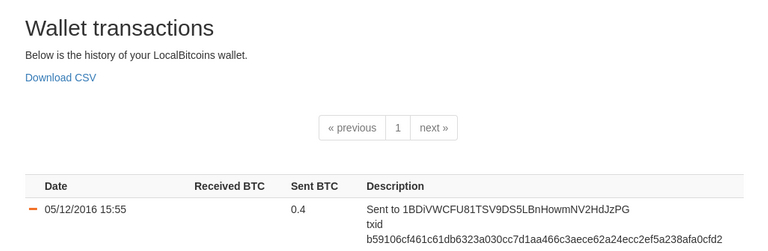

So, go to Localbitcoins. This is such a great global Bazaar where everyone can handle Bitcoins for the national currency. Vendors have build great reputation. So of course you can be cheated, but traders do value their reputation and the whole thing works quite well.

Sign up. Go to the Security tab and go through the quest to get the “Strong” title.

You can skip this step, of course, but I have warned you. Yeah. By the way, remember that the password must be unique and long. Next, select the seller. Not all sellers are good for you . The amount may be not suitable for you or a transaction method. Sometimes seller can be muddy. Your task is to find a guy who has a large number of transactions, faster transaction processing, good rating, etc. Have a good time.

Once the ad has attracted, go into it and look for seller’s terms which are written on the right. Read them carefully! If you agree, enter the quantity you wish to purchase and write a short message. For example :

I’m here for the first time. I can be blunt. But I’ll try not to be blunt. And Yes! I will use bank transfer from “name of the bank”.

And here the solemn moment! Big green button! Press. After a while you will get the answer. Send money according to specified details.

After payment go to the ad and click on the “I paid” button. The seller may wait for while, and after some time, from 1 minute to hours, you will see updated balance in your account, and the transaction is deemed closed. If you like it, feel free to give good feedback to the seller. They love it and you can get feedback in return. You will be back, right?

Congratulations! But it is early to rejoice. While bitcoins are stored in Localbitcoins it’s not your bitcoins, but their. So we go to the next step.

Thus, we assume that you successfully create secured wallet and your private key is only you and no one else.

Well, you copied the address from your local wallet and now we return to the section Wallet on Localbitcoins. Paste the address from clipboard in the address box, then enter the amount of bitcoins — every last Satoshi. And click “Send from wallet”.

You can see the address where money were sent, and the most valuable information is txid or transaction id. By this ID you can very easily check Localbitcoins, if he is lying to you or not. Copypaste this ID. Next, go to the website of any block explorer and enter this ID in the search. For example, here or here. By the way, it is the first historic transaction that Satoshi started.

I should mention a little about block explorer. One of the sweetest pieces of blockchain technology is the ability to overlook this database (it’s called the blockchain or chain of blocks) in real time to any person and robot on the Earth! It has nothing to do with auditor. Every last bit can be seen and proven. The government and banks do not want to give you such openness, because all the crooks will immediately light up.

What next?

So, you look in your wallet and get proud of your bitcoins. But, intuition tells you that it can’t be actually so great. There is must be a catch. The source code of the bitcoin nodes (they confirm a transaction) is open-source, the entire historical database is available and verifiable, the source code for the wallet is opened. There must be a catch. The catch is that your bitcoins exist only as digital recording and this fact is accepted by all other users of Bitcoin network. For proving the right of ownership you can only provide a digital signature calculated using your unique private key. It turns out that this is the nature of digital ownership of new generation. We have to live in this digital illusion, in which the key religion and science is math, not even physics. That’s the trick.

Enough sentimentality. Now you have your bitcoins, but the path only begins, because the blockchain technology, which made the Bitcoin has spawned with a lot of interesting things.

Where to invest bitcoins?

This section generally worthy to write a separate book . I will not stoop to the recommendations exactly where to invest, but just go through some areas to plant ideas.

Decentralized infrastructure

Any computer in any network does three things:

*(1a) receives some data, then

*(2) makes some transformation, i.e. calculates, then decides that

*(3) save for longer, and that

*(1b) forwards in response to the request. Our brain works identical. From this you can make the assumption that all decentralized infrastucture will move in three directions:

*Decentralized computing. Ethereum is the leader here. This is the most potentially powerful segment.

*Decentralized storage. In this segment there are 5 teams. Ethereum Foundation, Storj Inc, MaidSafe, Neboulos Labs and Protocol Labs.

*Decentralized transport. Motivated mesh networks are inherently complex, so in this segment there is no working solutions. We are waiting for it. I am really looking forward to. While the Internet traffic is so easily controlled by all sorts of crooks, the story is not so beautiful.

Blockchain apps.

And here the fun begins:

Organizations.

There are about 1 billion legal entities.

The capitalization of the public organizations — about $100 trillion. Evaluation of private is a mystery, but probably no less than 3–5 times more than the public. All of them can be transferred from paper to the blockchain. My bet is 10 years. All organizational artifacts, such as stocks, debts, rights, votes, etc are there.

_Robots. _

The blockchain allows (1) people to reliably control different robots using cryptographic keys, (2) organizations to coordinate the robots owned by organizations or leasehold, (3) robots to possess themselves, i.e. to be Autonomous, Independent, Free. When I say “robots”, I mean not only humanoid robots with AI, which we used to see in movies. I mean, all the electronic objects to which we have become accustomed to: phones, computers, cars, drones, machines, locks, sockets, and even light bulbs. Absolutely anything which will be powered by electricity.

_Currencies. _

Capitalization of M0 now is around $70 trillion.

_Bets. _

The capitalization of the derivatives is not less than 20 times bigger than M0 and is equal to more than $1 quadrillion. Just a crazy amount of money.

Real estate.

I could not estimate. I think that a lot. All rights — in the archaic registries. Draw your own conclusions.

Products.

In the future, the manufacturer will create digital token on every produced item that will reflect the property to him. This token will move from one organisation to another during their entire life path.

Temporary law.

Tickets to cinema, planes, trains, parties, events. It is also a large market that I don’t know how to evaluate.

Passports.

There about 50 billion passports in the world. I’m not talking just about humans. Every technical object has its own passport. It is pointless to evaluate this market, because it’s priceless.

Titles.

Here goes a variety of academic diplomas, certificates, badges, reputation points, awards, and other bullshit that is attached forever to a digital ID and cannot be zeroed by the holder.

Digital content.

Books, images, VIDEO. A very large market of copyrights for digital content.

Governments.

Guess on your own. About 50% of the economy is controlled by these entities. Do not be surprised if they will be dematerialised in a computer code, and they will lose a substantial part of this share.

Virtual worlds.

There are about 2 billion gamers. Every game has its own economy.

It’s time to make a decision

After reading this point, dear reader, you hopefully realised that investing in cryptocurrencies is interesting, cool and really promising, but it seems difficult. So you need to decide (1) to invest your bitcoins independently or (2) to entrust this task to someone. Each approach has its pros and cons. Let’s see them in order.

Pros:

*Full control over the process. No need to trust someone your money.

*A lot of stuff to learn. Really interesting process.

Cons:

*Labor-intensive. Will take a lot of time and effort for training.

*Difficult. You need to understand the economy, business, engineering, code, and whatnot.

*Responsability. You can lose everything because of the lack of computer literacy.

Where to invest?

So, you weighed all the “pros” and “cons” and decided to do it yourself. This is commendable decision. My initial idea was that all people can and want do it themselves. Today, unfortunately, this is not quite true. At this stage, such projects like cyber•Fund may help you.

Roughly speaking, it is possible examine the state of the economy in one place. Cyber.fund adjust the price and number of tokens in all significant blockchain systems. But the most important is cyber•Rating. The complete methodology is disclosed in this paper.

Transfer money to the exchange

Once you realised where to invest, you need to send bitcoins to the exchange, where the target asset is being traded . In our case it will be Poloniex. The truth is that Poloniex may disappear tomorrow and we will got a new meme in the Internet.

Therefore, you make these operations at your own risk. I estimate the probability of closing for each particular exchange during the year is 10%. In this series, and Coinbase and Poloniex and all sorts of banks like Xapo.

But now we use Poloniex because there are a lot of currencies and good liquidity. Decentralized trade is one of the most promising areas, but it is still at the very beginning. I think with the development of projects such as BitShares and BitSquare for one year or two years it will be a worthy alternative to Localbitcoins and Poloniex with good liquidity.

If Poloniex for some reason do not satisfy you, there are still a lot of other exchanges. Have fun choosing them. The process is the same everywhere:

*Go to the site

*Register. If you have a lot of money, verify the passports and photos

*Transfer bitcoins from wallet to the exchange

*Choose the traded pair

*Buy at the current price or place order

*Withdraw what your bought to your wallets

*Keep in mind that all serious. Exchanges are real.

Install wallets and clients.

Here comes the fun part. This step depends entirely on what you decided invest. Without this step, you will not be able to guarantee the long-term safety of your investments. I can say that on every official website of every blockchain system there are links to different wallets. Which trust or not to trust — it is your decision. I will list the tools that I use myself:

Mist. Official Ethereum client. For many things.

*OpenLedger. Official client for BitShares network. For many things.

*CounterWallet. The official web client of the Counterparty Protocol. For Storj tokens and others.

*OmniWallet. Official web Protocol Omni. For SafeNetwork, Synereo and others tokens.

This is not an exhaustive list, but may cover 80% of the needs for a beginner. Each of these software requires that you saved the private key. Do it.

I have described in details the best way for storing Bitcoins and Ether in this article

After all of these procedures, you need to withdraw assets from Poloniex to your wallets. Save the private key as closely and carefully as you can. After these steps, the property becomes yours.

Please, write your comments and questions below. And one more thing: let’s spread the knowledge. Recommend and Share this article. Thank you for reading!

And don't forget to upvote this article this would help me to post more articles like this.

If you have any other topics which you want to ask then post in the commnets , I will make next article about that.

Congratulations @ask-me! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP뉴비는 언제나 환영!/응원!이에요.

팁! : 프로그래머, 개발자 관련글은 kr-dev태그를 보통 쓰더라구요.

1.0416666% 보팅

In english please ??

do not use kr-newbie tag

Good points in this blog. Thanks for bringing this to my attention. You read this stories about people selling their cars to buy cryptos and I think to myself: Don't invest money you don't have. We really need more insights in the market and previous investment results (even though they don't deliver any guarantee for the future). This is quite an interesting website I found: https://www.coincheckup.com I don't know any other site that gives such good inisghts in the team, the product, advisors, community, the business and the business model, etc. Check for example: https://www.coincheckup.com/coins/Bitcoin#analysis For the Bitcoin Analysis.