You DO NOT lose money until you sell

This is an important tenet to remember!. Especially when you are playing in a speculative market like crypto currencies.

You have to decide if you are investing or speculating. There is money to be made on both sides of this, but you have to be clear what your strategy is.

A lot of folks get actually end up buying high and selling low because of FUD (Fear Uncertainty and Doubt).

Personally I am not into speculating in this market. In order to win at speculating you probably have to dedicate more time to try to anticipate the market.

Investing, you can actually buy something and trust your instincts. But you have to do your homework.

I typically look for more than just a proof of concept. Hopefully there is some working tech and good people behind it.

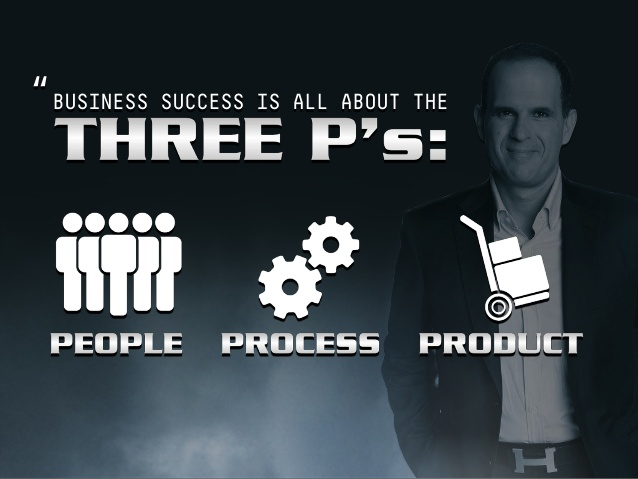

Remember what Marcus Lemonis says: A Business has 3 components: People, Process and Product. You need all three to make a solid winner.

( )

)

Hopefully this helps some in framing your thought process.

Pura vida,

Mandatory HODL comment. ;p

HODL!!!

This is a misperception that is propagated throughout Internet message boards and inexperienced investors. The truth is, you lost your money the second you traded it for an asset. Your options are to trade it back at a later date for a profit or loss. The idea that just because you haven't closed a round-trip trade means you haven't lost money is a fabrication. You should always evaluate investment options based on the NOW and not prior price of entry or exit.

@gimperion If you invest $1 and the price goes up to $100 or goes down to $0.01, you don't lose that dollar or win the $100 until you decide to execute a sale at $100 or sell it at $0.01 for a loss. Once you make the investment you certainly traded your money for a good or bad asset, but what defines that is the market fluctuation and your actions based on that.

You don't lose money just for trading.

False, the value in your portfolio fluctuates based on the market clearing price at which you can off-load that. Just because by accounting standards, the position is not closed and not evaluated as a loss as a profit, doesn't mean your ability to extract value from that position hasn't changed.

When people think along the lines that you mentioned, they get stuck in bad trades, holding through periods of long declines in hopes that they can clear a sale at their buying point ie bagholding. I'm not suggesting that selling then rebuying lower is a better option, I'm just saying only inexperienced (and irrational) traders valuate their portfolio position by via profit/loss accounting methods.