Cautious on Crypto, but bullish on blockchain?

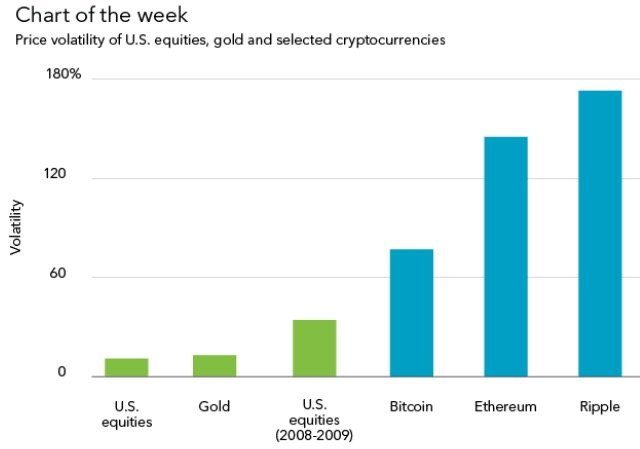

According to a recent commentary made by Blackrock, the volatile nature of cryptocurrencies makes them tricky investment targets. On top of the dramatic price swings, cryptocurrencies face major challenges such as weak regulation and frequent security flaws at cryptocurrency exchanges. Valuation is difficult, as cryptoassets have no cash flow, earnings or interest rate (same as Gold).

Cryptocurrency uses vary from a speculative bet to a means of payment. The market is continually evolving, however. Established exchanges have launched cash-settled Bitcoin futures, but so far the reception has been mild. High margin requirement is one of the reason why. A global regulatory framework may be on the horizon—how to regulate cryptocurrencies is on the agenda of the next G20 meeting.

Cautious on Crypto and bullish on the underlying blockchain technology—this is an emerging consensus among policymakers and business leaders. Blockchain, a distributed ledger technology, enables secure peer-to-peer transactions. This means no intermediaries, but also no trusted and centralized authority. Companies in a wide spectrum of industries, ranging from logistics and pharmaceuticals to financial service, are looking into its disruptive potential. Yet challenges abound.

Take the financial industry for example: A blockchain-based, single shared financial database could eliminate inefficiencies and risks associated with human processes, but adoption at scale would require a massive shift in software development and a well-constructed maintenance model. Regulators and central bankers would also need to play a big role for the industry to take a more solid footing, we believe.