- KYC Breach on the Binance Exchange - Claimed as Mere FUD

The issue of a leaked KYC or “Know-Your-Customer” database started on August 7 when Binance has allegedly fallen victim to a hacker who posted more than 10,000 personal photos of the crypto exchange’s customer data in various Telegram groups.

The hacker reportedly asked for 300 BTC which was then worth around $3.5 million in order not to release the compromised information.

This privacy breach, however, was dismissed by Binance’s CEO, Changpeng Zhao as mere FUD or one that is characterizing fear, uncertainty, and doubt.

In Twitter he said,

Don't fall into the "KYC leak" FUD. We are investigating, will update shortly.

Also the Binance exchange’s security team made the following statement:

“At the present time, no evidence has been supplied that indicates any KYC images have been obtained from Binance, as these images do not contain the digital watermark imprinted by our system.”

According to them, the hacker was not able to produce an irrefutable evidence that could prove as to the legitimacy of his claim that Binance’s KYC has been truly breached. Binance points out that the hacker simply demanded 300 BTC.

The cryptocurrency exchange further tried to remedy the situation by offering 25 BTC to anyone who can help them identify the hacker/s.

Were the personal information and private data of Binance exchange users been really compromised?

Will this affect the cryptocurrency trading volume of Binance?

Will this negatively influence the perception of bitcoin and altcoin investors on the exchange?

As of this writing, Binance still has a 7-day trading volume of $6,020,177,631 based on CoinMarketCap’s data.

- China is Now Ready for a Central Bank Issued Chinese Digital Currency

Chinese central bank, the People’s Bank of China, through its Deputy Director Mu Changchun, has announced that the country’s own digital currency has already been developed after many years of research.

Reportedly, the Chinese digital currency will be using a pure blockchain architecture that will use a two-tier operating system for the following reasons:

“First, China is a complex economy with a vast territory and a large population… Second, (...) in order to give full play to the resources, talents and technological advantages of commercial organizations, promote innovation, and compete for excellence. Third (...) to resolve risks and avoid excessive concentration of risks. Fourth, if you use a single-tier operational architecture, it will lead to financial disintermediation.”

With 1.3 billion Chinese population, it can be easy to assume that any government-issued digital currency most especially in a country with such a political nature as China, will easily be adopted by the masses.

Will the Chinese digital currency be the needed push for greater worldwide adoption of the blockchain technology and digital currencies?

- Litecoin Dusting Attack on Binance Exchange Affects Nearly 300,000 Addresses

According to the blockchain data and metrics company, Glassnode, the dusting attack against Litecoin on the Binance exchange affected 294,582 addresses. This number is against the reported data by Binance which was only 50 addresses.

But what are dusting attacks, anyway?

According to James Jagger, project lead at Binance Academy,

“Dusting attacks generally involve a combined analysis of the dust sent to many users, allowing people to break the privacy of bitcoin or litecoin and potentially launch phishing campaigns or cyber-extortion threats.”

But who was behind the litecoin dusting attack? Again, James Jagger answers CoinTelegraph,

“The person behind the dusting attack owns a mining pool based out of Russia, EMCD[dot]io. They reached out to express that their intent was to advertise their mining pool to the users of Litecoin, however, it's unclear from our perspective or anyone else's as to whether there were alternative motives. The owner of the pool was not aware that he was subjecting all these users to a dusting attack and spreading fear among the Litecoin community.

It's interesting to note, that even if this was not the intent of the mining pool owner, he provided a base for malicious actors to analyze. You see, the person responsible for conducting the dusting attack doesn't necessarily have to be the one collecting the data, they can just merely be providing a service so that someone else can collect all the information and analyze it at a later date.”

If you are afraid that you can be the next target for a dusting attack, it is best to always monitor your fund and your wallet. Check whether there are unexpected funds coming into your private crypto wallet. Don’t use the unauthorized small deposits into other transactions. Installing a VPN or virtual private network, antivirus, and encrypting your wallets can also help prevent such attacks.

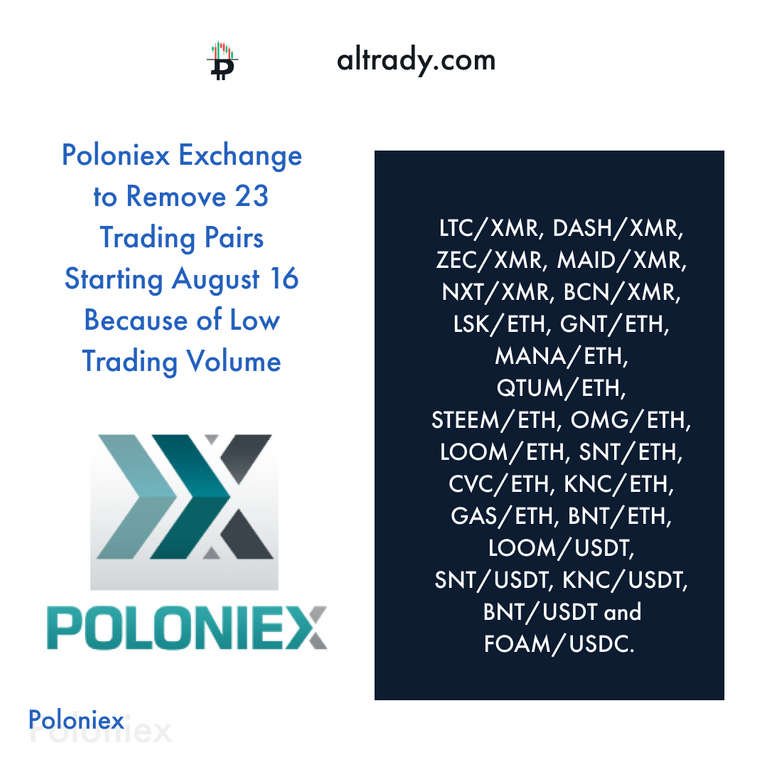

- Poloniex to Delist 23 Cryptocurrency Trading Pairs Because of Low Volume

On August 16, Poloniex is set to remove a total of 23 trading pairs because of consistently low trading volumes. Although the pairs will be removed, the crypto asset can still be independently traded. The following cryptocurrency pairs are set to be removed by the 16th:

LTC/XMR, DASH/XMR, ZEC/XMR, MAID/XMR, NXT/XMR, BCN/XMR, LSK/ETH, GNT/ETH, MANA/ETH, QTUM/ETH, STEEM/ETH, OMG/ETH, LOOM/ETH, SNT/ETH, CVC/ETH, KNC/ETH, GAS/ETH, BNT/ETH, LOOM/USDT, SNT/USDT, KNC/USDT, BNT/USDT and FOAM/USDC.

- Poloniex Promises to Return Around 1800 BTC or $13.5 Million to Exchange Users Affected by May Flash Crash

In May of this year, cryptocurrency exchange platform, Poloniex, lost around 1,800 Bitcoins (BTC) because of a flash crash involving a certain token named CLAM. The CLAM crash happened in less than an hour and suddenly affected 80% of the entire CLAM tokens at the exchange.

In order to regain the full trust and confidence of their users and the entire trading populace, Poloniex promised to continually and gradually bring back the lost digital assets to their crypto exchange users until the entirety of the lost funds have been reimbursed.

The first reimbursement happened on June 14 where around 180 BTC of the lost crypto funds have been returned. The second reimbursement will start in late August

Get more updates on https://blog.cryptobasescanner.com/

Free 30 days subscription trial on https://altrady.com!