Are you a trader looking for the next moonshot, or an investor in it for long term profit? If you're new to crypto chances are you're a mixture of both. It's important to know the difference between trading and investing, and having a balanced portfolio that works best for you.

This series will cover:

- The Fundamentals

- Building A Short Term Portfolio

- Adjusting While You Grow

- Building Your Long Term Portfolio

- Principles, Protection, & Future-Proofing

I'll be using my own strategy & portfolio management as an example throughout this series, but that doesn't mean you have to as well. Part of the fun of this is customizing it yourself. There's no ideal portfolio, only an ideal portfolio for you.

With that said, let's get started!

Investing Vs. Trading

At it's core, there are simply two types of strategies:

- Investing

- Trading

Investing is a strategy for building wealth in long term positions. Crypto investors (should) perform research and think about a coins value in the future, since whatever they put in is meant as a long term hold. They'll often use the profit made off these coins to diversify into others. This is what we'll be focusing on.

Trading is a strategy to make profits in short term positions. Crypto traders (should) rely mostly on technical analysis and market cycles to evaluate when a coins value will rise and fall. They often get in and out of certain coins, and will make money by buying low and selling high. Unless this is your job, you probably suck at it.

There are many people who are successful as day-traders, but it takes a lot of skill and a certain personality to handle it. It's a job. And a job that requires a lot of attention.

Resist the urge to chase stuff that's skyrocketing, and don't panic when stuff begins to plunge. There's a reason why people say "hodl"!

Only a small part of our portfolio will be allowed for occasional trading.

Our time is best spent investing.

Not only investing our money into cryptos, but also investing our time into understanding them, how they work, what their purpose is, and how they'll hold value in the future.

It's basically impossible to value what a coin or token will be worth in the future, because nobody knows. All we can do is keep ourselves as informed as possible.

Diversification

A tried and true technique to manage your risk.

There's no perfect number for how many coins you should have, and the number will depend on how much money you have invested. Regardless, it's important to know that you should diversify, but not over diversify. Keeping this balance strengthens your portfolio.

Our portfolio will be diversified into 4 tiers, which we'll define broadly based on market capitalization:

- Low Risk — $10 billion+

- Medium Risk — $1 billion → $10 billion

- High Risk — $100 million → $1 billion

- V. High Risk* — less than $100 million

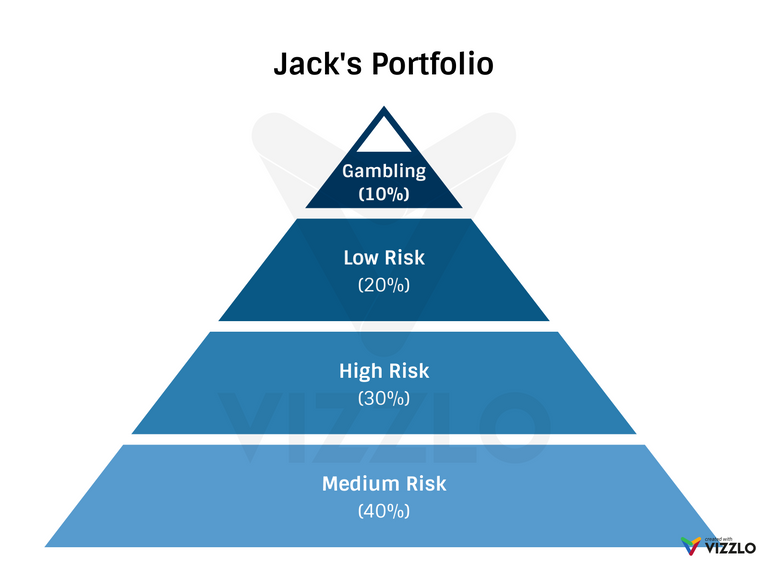

The ratio of these categories will vary from person to person. If you have an appetite for risk your portfolio might look like 10%/20%/30%/40%, or the opposite if you're more on the cautious side of things. You probably have an idea where you fit.

My own (short-term) portfolio looks like this:

I've got a somewhat neutral approach right now, leaning towards high risk. This is because I don't have a huge amount invested and I'd rather take chances since I don't have much to lose. However, if/when my portfolio grows I'll shift to a more conservative balance (since I'll have more to lose).

Types of Cryptos

Different coins have different functions. Part of my diversifying strategy is spreading out into different types of coins.

These include:

- Bitcoin & Clones (Bitcoin Cash, Litecoin, Bitcoin Gold)

- Privacy Coins (e.g. Monero, Zcash, Dash)

- Internet of Things (IOTA)

- Smart Contracts (Ethereum, NEO)

- Zero Fees (Raiblocks, IOTA)

There are also cryptocurrencies that don't run on their own blockchain, but on a platform that decentralized applications can be built upon. The most popular platform being Ethereum. They're called tokens.

Tokens are a bit more complex, but can broadly be broken in 2 categories:

Utility Tokens — These tokens are called utility tokens since you need them to access the specific service. As an example: Binance has tokens (called coins, but misleading) that can be used to pay for fees on their exchange. Binance does not have its own blockchain and it's not used as an exchange of value. It runs on Ethereum and is used strictly for Binance traders.

Tokenized Securities — These tokens represent a share of the business or application. An example is the Crypto20 index token. Owning a C20 token is owning a portion of their index fund, so the fundamental value is tied to the performance of the index fund. It's not a currency, and runs on the Ethereum blockchain.

Some Important Considerations (Opinion)

Nobody knows the future of crypto.

Seriously. The future is so uncertain because nothing that's comparable has ever happened before. It could revolutionize our world. It could crash and burn. Nobody really knows. It's important to remember this and be wary of those who are so certain about things.

Don't invest more than you can lose.

I'm sure you've heard this before, but it's worth repeating. I think there will be many micro-crashes followed by one big crash within the next 5 years. The people who will hurt the most are the speculative retail investors, AKA you and me. Just my opinion.. like I said: Nobody knows. Protect your hard earned money.

The valuation of everything is bonkers.

This is a speculative market flooding with fool investors. There are theoretical projects with valuations in the billions with just a whitepaper. It's crazy. Re-read my previous point.

Familiarize yourself with Amara's Law:

We tend to overestimate the effect of a technology in the short run

and underestimate the effect in the long run.

I don't really know what I'm talking about.

Honestly, I'm learning all this on the fly just like everyone else. I'm not an expert. I've never invested money before. I'm just a young dude who is excited about the future of crypto. Question everything!

Conclusion

That's it for now! This first part turned out way longer than I expected, but I actually learned a lot myself while reading up on some specifics (particularly about tokens). The following parts will be shorter, I'm sure, since now we'll actually get into my personal strategy and less about information.

Hope this helped, and is a good resource for anyone in the early stages of investing in cryptocurrencies.

@beanstalk you were flagged by a worthless gang of trolls, so, I gave you an upvote to counteract it! Enjoy!!

Congratulations @beanstalk! You received a personal award!

Click here to view your Board of Honor

Congratulations @beanstalk! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!