When fear surplaces greed: After the crash cryptocurrency might face a long bear market, marked by pessimism, falling prices - and real evolution. In this article you find some tips and ideas about the upcoming bear market, based on analyses of prior Bitcoin bear markets.

When fear surplaces greed: After the crash cryptocurrency might face a long bear market, marked by pessimism, falling prices - and real evolution. In this article you find some tips and ideas about the upcoming bear market, based on analyses of prior Bitcoin bear markets.

Prices of crypto are sinking, falling, crashing. Not just today, but for a month, and not just for certain currencies, but for all. This makes it likely that the bubble peaked at $20,000 for one Bitcoin or in $800billion for all coins. Likely 2018 will be a depressing year in the sign of the bear. The price will try to find a bottom, wherever it is.

Sure, it is possible, that the current crashes are just a correction of the excessive chapters of the bull market, which swelled the giant bubble of late 2017. However, the crashes come too frequent and too strong, to bet your money on this theory.

Here we assume that a bear market will dominate the crypto markets. Hence, we give some tips what to do and present some ideas about bear markets in crypto, based on the history of former Bitcoin bear markets.

History doesn’t repeat itself - but it rhymes

Sure, you can’t read the future from the past. No matter how often somethings happens in a certain way - next time it can always happen in a completely different manner. However, you can assume that history says at least something about how the bear market could play out.

In the past, Bitcoin has build up two major bubbles. After they burst, a long bear market followed (we ignore the smaller bubbles of 2010 and 2013 for simplicity). Each of these big bubbles marked the peak of a reward era. For those of you who don’t know - reward era is the term in Bitcoin-speak for those episodes of about four years in which miners get a certain amount of Bitcoins for blocks. This amounts halfs at the end of each era. In the first era miners got 50 Bitcoins, in the second 25, and in the third, in which we currently are, 12.5.

One of the most fascinating aspects of Bitcoin is that each of these reward eras had its own sequence of bubble, crash and bear market. It is like there is a law behind.

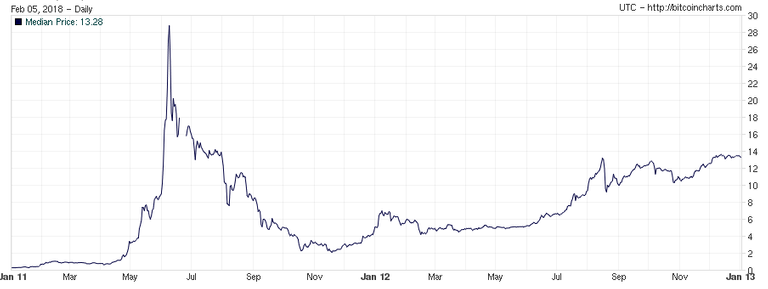

The bubble of 2011 in a 2-year-chart. All charts from Bitcoincharts.com

The huge bubble of the first era peaked in June 2011 at around $30. Compared to the beginning of that year, Bitcoin increased its value by nearly a factor of hundred. After the bubble had bursted, a sharp degression followed, and several month later, in November 2011, the price reached its lowest point with $2. From here on it climbed up again, but only slowly, and it was not before spring 2013, when the bull market came back.

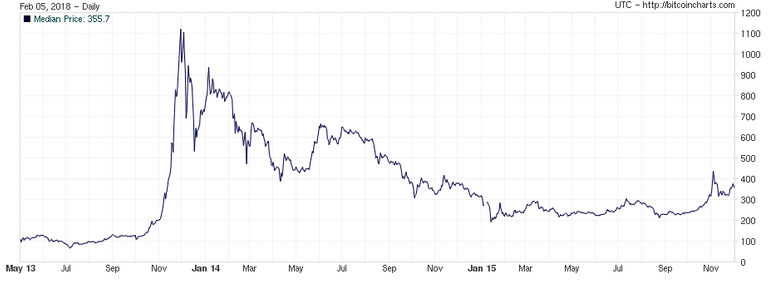

The bubble of 2013/14 in a 2.5 year perspective.

During the wild year of 2013 the price of Bitcoin rose from something like $10 to more than $1000. Again, it increased by a factor of 100. After the bubble popped in December 2013, the price declined for a long period. More than one year later, in January 2015, it fall on a bottom of about $200. From here a slow growth succeeded, but only in November this year the climb became significant.

The bubble of late 2017. You can complete the line to find out what the future will bring.

The large bubble of 2017 lifted the Bitcoin price from something like $500 to nearly $20,000. after its burst, the price fell below $8,000. How will it play out? Nobody knows for sure, but the charts of the old bubbles tell a certain story.

Hold!

You don’t realize your losses, until you have not sold your coins. In every markets you find those people, which buy high, when everybody wants to buy, sell low, when everybody wants to sell, and forget the thing, until the next bubble rises, in which they buy again, for even higher prices. Obviously, this is not the formula for success.

In all prior Bitcoin bubbles there has been no point in time, at which it was a bad deal to buy Bitcoins. On the peak of the bubble of 2011? Or in late November 2013, when Bitcoin reached $1,200 for a short moment? Both date have been bad, observed with a short timeframe, but excellent buying opportunities in a long term retrospect.

Sure, there is no guarantee that history repeats itself. But if you bought Bitcoin because you believe in the long term vision of cryptocurrencies, than the recent crash did change nothing at all. Fiat money still sucks, and crypto still has the potential to become the single one currency for the whole world. The fundamentals remain strong, maybe stronger than ever before.

However, if you invested too much in Bitcoin, you should reconsider. You can’t sleep at night, because you are afraid of going deeper in the red? You are looking on the charts every ten minutes, hoping that the rally returns, and all you get is a pain in your stomach? If this is your life, your should at least sell some of your coins, even if this makes you realize your losses. It can’t be as big as the load you took off from your mind.

But if you can afford it, both financially and mentally, you do better to keep at least some of your cryptocoins. Just in case there will be another bull market in the future. If you plan to build up your coin stock, you will even enjoy the bear market, as it is poised to bring excellent buying opportunities. Look out for them!

Bear Years are Labour Years

Bull markets are driven by an excessive optimism. There is nothing, that is not bought, and there is no assets, from which investors don’t expect a multiplication of prices. Maybe there is nothing more characteristic for the bubble of 2017 as the ICO madness, the ascent of trivial shitcoins to multi billion dollar coins and the herd of “unicorns” - coins which a market cap above $1billion. At some time the number of unicorns grow above 40, and in time of writing there are still more than 20.

A bull markets buys the promise - while the bear markets demands performance. The bubble, which marks the peak of a bull market, flushes a lot of money into the market. During the bear market this money has to work and create fruits. It has to advance Bitcoin and other cryptocurrencies and has to occupy markets for transactions. The famous Fred Wilson said in retrospect about the Dotcom bubble:

“A friend of mine has a great line. He says ‘Nothing important has ever been built without irrational exuberance’. Meaning that you need some of this mania to cause investors to open up their pocketbooks and finance the building of the railroads or the automobile or aerospace industry or whatever. And in this case, much of the capital invested was lost, but also much of it was invested in a very high throughput backbone for the Internet, and lots of software that works, and databases and server structure. All that stuff has allowed what we have today, which has changed all our lives… that’s what all this speculative mania built.”

The bull markets attracts investments, the bear markets realizes them. This also counts for Bitcoin: After the bubble of 2011 a lot of Bitcoin companies have been founded, like BTC China, Bitcoin.de, Bitstamp or Blockchain.info; after the bubble of 2013, exchanges emerged all over the world, as well as ATMs, hardware wallets, and a wave of adoption in commerce begun. Bear markets correct promises, but also fulfil them.

It is hard to predict what the next bear market will bring. One idea would be that the last bull markets has been driven by investment and speculation, and that the next will be driven by adoption and consumers. In this case Bitcoin Cash, as the only coin obligated to simple massive onchain scaling has good chances to succeed, while Bitcoin Core will have a hard time to realize their Lightning Network vision and Ethereum will be crowded by smart contracts.

If you are not just in for the Dollars, but interested in the technology and its socio-economic effects, a bear market is much more interesting than a bull market. When greed is replaced by fear, real evolution has just started. As an investor, you need to watch out for the real world uses cases of cryptocurrencies. They are indicators of the bottom.

The Markets have Evolved

In 2014 the world of crypto has been easy. You had bought some Bitcoin and hold them until the next bull market set in. Those who have been patient and trusted in the vision of cryptocurrency instead of falling for the fear got a huge reward.

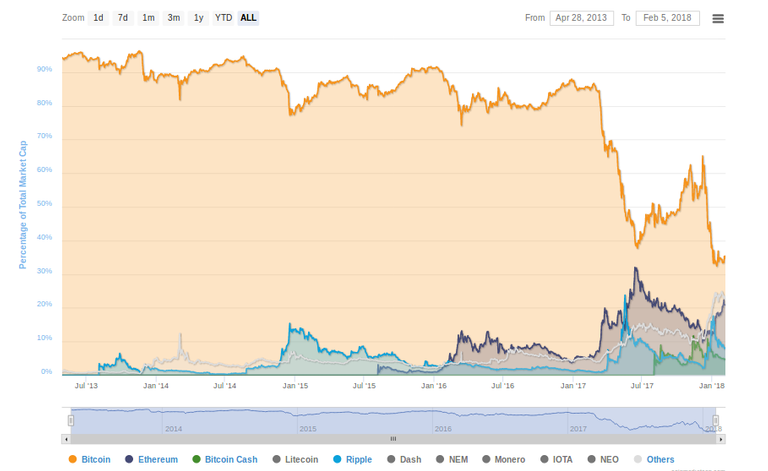

In 2018 the world has changed. The market has grown above Bitcoin, even if some Bitcoin maximalists don’t want to see it. The market share of Bitcoin has has dropped from formerly 90 to just 35 percent. Beside Bitcoin Ethereum, Ripple, Bitcoin Cash and, maybe most notably, the “other coins”, have gained significant shares.

If we assume that in the bear markets it’s all about using a currency, there are several scenarios how this can play out:

- Bitcoin’s Lightning Network becomes the huge success its supporters promise, Bitcoin will eat the market shares of its competitors and get to 70 or 80 percent again.

- Ethereum will continue its impressive ascent, solve the scaling problems with a mixture of onchain methods like sharding and offchain instruments like payment channels and sidechains. This can make Ethereum as dominant as Bitcoin has been formerly.

- Bitcoin Cash realizes Satoshi’s vision of massive onchain scaling. Maybe this time the demand for widespread merchant-adoptions is here, and Bitcoin Cash serves it without all the complex constructions Bitcoin Core demands from everybody who wants to use Bitcoin.

- Another coin emerges and gets to the top. Who knows?

Maybe the most important chart about the current market: The Bitcoin dominance index. In orange the market share of Bitcoin, the purple, blue and green lines represent the share of Ethereum, Ripple and Bitcoin Cash. The white line is the share of other coins. Source: Coinmarketcap.com

It will be painful to hold shitcoins without use cases in a bear market. But you will not get a relief by holding only one coin, be it Bitcoin, Ethereum or Bitcoin Cash. In 2018 you need to diversify your investment and observe how each coin’s vision plays out in real life.

Beware of the Bull Traps

A standard enemy in a bear market is the bull trap. It attracts inexperienced investors to throw good money after the bad money.

If a bubble contracts, it usually performs the “Dead Cat Bounce”. This macabre analogy points to a dead cat bouncing down the stairs. It falls, bounces upwards, then down again, up a bit, and down again … some investors, who sold with a loss, because they panicked, panicking again, this time because they fear to miss an opportunity to buy in again.

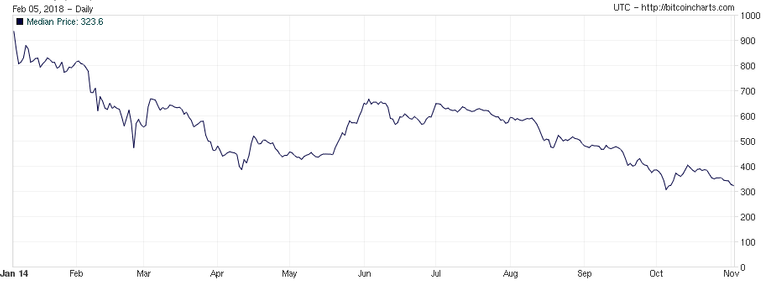

One of the worst bull traps of the last bear market: The apparent recovery in early 2014.

Every bear market has apparent recoveries, and often they seem to be driven by strong support. It is hard to discriminate them against real recoveries, and the over optimistic crypto community tends to be too fast to celebrate the comeback of the bulls. The bear trap exploits wishful thinking.

In early 2014, after sufferings from a series of hard crashes, the price seemed to have found a bottom of $400. From here it climbed up again, reaching even $700 in June. However, investors who believed that this marks the beginning of a new rally, have been caught in a trap: The price fell down again from here, dropping to $300 in October. Again, a short term recovery set in, topping at $400 in November. And down again it went, until it reached the final bottom in January 2015.

Beware of the bull traps - but learn how to detect the real bottom

Don’t be All In!

Selling everything for a loss is a bad idea. But it is not less bad, to sell nothing at all. The bear market will probably not end in a few month, but rather stay for something like a year. There will be more crashes, more recoveries, and even more crashes. Where the bottom exactly is, if we prematurely reached it with $7,000, or if it will end at 2,000 or even below, is hard to say.

If you are all in in this situation and hold only cryptocurrencies, you reduce the scope of your options to act. A bit of Euro or Dollar on exchanges allows you to trade the dips and to take the good opportunities to buy at the bottom. If you are not all in, you can reduce the losses through falling prices by increasing your stock of coins.

Tradewell.

Top Image: Grizzly, taken by Max Goldberg on the Kenai Peninsula in Alaska, shared with Flickr.com. Licence: Creative Commons

Congratulations @bergmann! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Congratulations @bergmann! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!