Portfolio Management and Cryptocurrencies (#1)

Hi everyone! I realized I never did a proper introduction before diving into my first posts, but I'm excited to be part of STEEM and to really start blogging.

Over the coming weeks, I'm going to focus on two growing passions of mine:

- Portfolio Management (U.S.)

- Cryptocurrency Investing Strategies

A quick word to the wise - given how late I was to the crypto game (...so late...), I view crypto as a part of my overall long-term portfolio. While some of my thoughts will be on shorter term strategies, I'll tend to be looking at a longer investment horizons. With that in mind, the biggest question on my mind has been...

How much crypto should I have in my total investment portfolio?

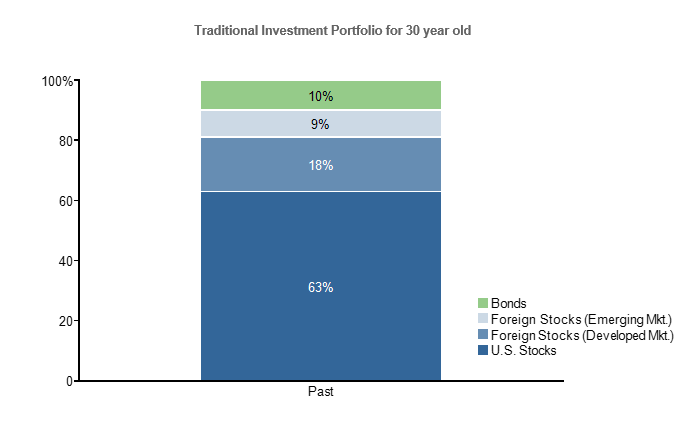

To understand that, it's helpful to know what the U.S. experts say first on portfolio optimization:

- 120 - your current age is the percent of equities vs. bonds you should have in your portfolio. So if you're 30, you should be holding about 90% in equities and 10% in bonds.

- 15-30% of your stock portfolio should be in foreign stocks (remember U.S. is only 20% of the global stock market)

- 7-10% of your stock portfolio should be in emerging foreign stocks since emerging markets contribute about 10% of to the world's stock market cap. They've also historically been viewed as the RISKIEST investments

That means, the classic portfolio would look something like this:

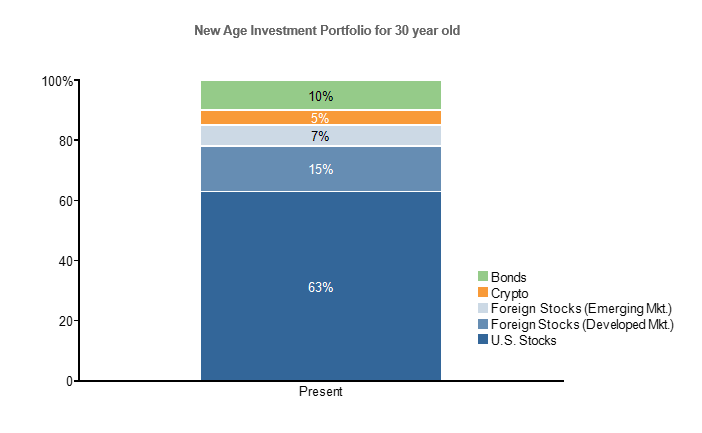

...so...how much crypto?

Yup, good question. 5%.

...what?

The main reasons you invest in foreign stocks is because of 1) the opportunity for higher returns than U.S. stocks and 2) to hedge. Developed foreign stocks tend to have a beta of anywhere from 0.7-0.8 while emerging market stocks of 0.3-0.5 in relation to U.S. stocks. (Beta is a measure of how closely the stocks correlate to U.S. stocks - more to come on this in a later post)

Crypto betas are all over the place right now but they're currently in the .6-.8 range, so they're somewhat similar to foreign equities. They don't move perfectly with the U.S. stock market (makes sense), and I'm assuming that they'll diverge even more in the future. My best guess is a beta closer to the .5 range.

To keep my portfolio balanced then, I landed at 5% in crypto and reduced my foreign stocks by 5%. My view is that crypto has WAY MORE UPSIDE and also is a nice hedge to U.S. equities. BUT I also don't want my crypto amount to exceed my emerging market allocation since I think the RISK of cryptos is also higher.

Obviously, this isn't going to make me a billionaire over night, but it allows me to sleep well at night. I have enough skin in the game to really profit off the rise, but am still protecting my retirement in case some absolutely bananas happens. And either way, I need to rebalance at least every year...

This is exactly the percentage my buddy recommended and he's a financial planner haha. He's a big fan of vanguard. I personally don't dig too deep into it.

I had a 401k from my last job that I decided to take most of and put in crypto. I feel like the upside is there and I honestly don't trust the stock market this year. I'd like to get more in cryptos actually. Nice write-up, I'm looking forward to some of your upcoming posts!

Haha nice! Maybe I have an alternate career calling...

Honestly, I wish I was more comfortable putting more into crypto but I'm not quite there yet. Then again, the stock market is so crazy these days, crypto is probably a better long term play. Maybe straying from my own rules before long!

Honestly, I thought you were gonna say you were in finance, well put together post my friend, really quality and clearly laid out

Very interesting article with some good points. I tend to agree with the breakdown and the reasons for presenting it as such. I think that works out to about how mine is although I haven't run the numbers. Although whichever area I'm more actively trading in usually commands a little extra % to keep things interesting.

Thanks @cbk! And definitely - my crypto % definitely fluctuates a bit and with the potential market correction coming, I may find myself actively trading crypto way more than stocks

BIG NEWS: Build your passive income with daily payoutsearning SBD with me. Daily. The easy way!This post has received a 28.57 % upvote from @voterunner thanks to: @bigtx31. from @voterunner! Read more about

Congratulations @bigtx31! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPYou got upvoted from @adriatik bot! Thank you to you for using our service. We really hope this will hope to promote your quality content!

If you believe this post is spam or abuse, please report it to our DiscordYou got a 1.78% upvote from @upmyvote courtesy of @bigtx31! #abuse channel.

If you want to support our Curation Digest or our Spam & Abuse prevention efforts, please vote @themarkymark as witness.

Sneaky Ninja Attack! You have been defended with a 2.00% vote... I was summoned by @bigtx31! I have done their bidding and now I will vanish...Whoosh