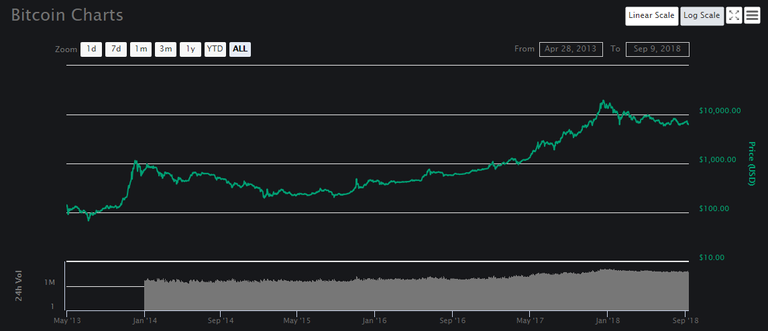

Man oh man, how this BTC chart is giving me headaches!

I'm not confused about the broad long-term projections, those are easy enough, but the medium-term ones are making my head spin!

Of course life is continuing to throw curve balls just to keep me on my toes: I was just starting to get my blogging rhythm back when Mrs Brain fell ill, turning me into a (probably not very good) nurse. With my nursing shift looking quiet last night, I thought I was free to blog. That was right up until the 22:00 "we need your help immediately" call from work. Got to love the military. The Mrs is looking a bit better and work has been fairly quiet today, so I'm taking this gap while I have it...

I seem to be posting a lot about BTC lately, this should come as no surprise. The market is in a state of flux as the bear market converging triangle approaches its apex and bullish movements start to test resistance levels, looking for a breakout. My last post was a BTC one, and I got it a bit wrong. BTC failed to stay in the channel as I had shown, which is another way of saying that I failed to predict its rapid downwards movement. The rest of the post is perfectly valid, my accuracy was just a bit off and so the dip came sooner than what I had anticipated.

The first BTC dip this last week was sharp and sudden and was followed up by a second dip. This should not be alarming to anyone, I have most certainly been predicting another BTC dip down to the $6000 support region for several months now, you can see that in almost any of my posts which mentions BTC. What I said about this in my previous post most certainly still holds true:

It might break through resistance, I'm in two minds about that, but I consider it more likely that BTC will only break out of the large tapering triangle a month or two later, after it has dipped back to around $6000 again.

Obviously BTC did not break through resistance this time round, but it's now only a matter of time.

BTC - 09 September

A matter of time: that bring me to the problem, and the source of my BTC headaches. It's also the same reason why my last post was a little off. A TA chart plots only two things: price and time. Time is 50% of TA, a vital component, but that doesn't make it easy to read. I always say that TA is open to interpretation and this is a prime example of such interpretation (and the issues associated therewith).

BTC is in a converging triangle, as it has been for the whole of 2018 so far. The problem is that the beginning of this triangle is extraordinarily poorly defined. Each time a wave changes from bullish to bearish, or vice versa, it gives us an important clue that enables our TA to become more accurate. The rapid price drop this week was just such a clue. We need these clues to help us better determine the exact shape of the converging triangle. Yes, TA is not an infallible law that can predict the future, but it does have a lot of value in longer-term patterns like this, and getting those patterns accurate is therefore important to the accurate prediction of resistance levels, future price reversals and breakouts. Here is the problem with BTC at the moment:

Made by Bit Brain with TradingView

I just don't know where to start the upper line of my triangle in that mess. A few times I thought I have, but other times I've missed the mark bit.

This example from my 05 September post was obviously a bit off:

Made by Bit Brain with TradingView

Perhaps I just got a bit unlucky. Digging around in some other charts while making this post, I came across this chart which nailed the price turnaround point absolutely spot on. I'm not sure when I drew this chart, but it was definitely prior to the 05 September one. It's a pity that I did not use it instead! (It was hidden on the BitFinex chart, normally I use the BitStamp one).

Made by Bit Brain with TradingView

Of course that chart may also be wrong, though the converging triangle is maturing to the point now that it is becoming far more predictable. My current triangle that I am now using is represented by the blue lines. Orange lines represent other possibilities. You can see just how many there are. There are probably even more than what I have indicated here:

Made by Bit Brain with TradingView

This seems to tie in with short and medium-term Fib levels. The short-term Fib levels can be seen two charts above. From this you can see that the next price rise should encounter some resistance at around $6800. Maybe.

Maybe?

Maybe. The BTC waves have decreased to the point that a price breakout can happen on any wave. We are far enough down the converging triangle for a breakout to occur, no matter which set of lines you may be using to draw your triangle. Generally a breakout happens after the price has moved two thirds of the way down the triangle. We are certainly in that territory now. Sideways movement remains a possibility, but I struggle to see sideways movement remaining stable in such a volatile market when adoption of cryptos is taking place in so many industries. I expect an upwards break. But no, I don't know when that will be!

While we are talking BTC, I may as well share my revised medium-term Fib levels:

Made by Bit Brain with TradingView

Don't confuse these with the short-term levels shown earlier, those only apply to more recent price data. The chart directly above applies to the last 6 months or so. As you can see it does break down if you trace it back to the start of 2018. The "horror show" proves to be a challenge for Fib levels too! (Though you can use it in even longer-term TA Fib levels).

What I am therefore waiting to see is a bullish breakout that:

- Breaks out of the converging triangle

- breaks well above the 0.236 Fib level ($7350), and preferably also

- breaks well above the 0.382 Fib level ($8300).

For me that would be a 90%+ certainty indicator that the bull market has returned to crypto.

If the price breaks downwards and hits $5000 then I give up and will hang up my blogging shoes!

Yours in crypto,

Bit Brain

Bit Brain recommends:

Published on

by Bit Brain

"If the price breaks downwards and hits $5000 then I give up and will hang up my blogging shoes!"

Does this apply if it first go above $7350, and then head under $5000?

If so I call that lol.

Ha ha, I'm afraid it does! Let's hope you don't have to make that call!

Bitcoin price decreasing day by day

Posted using Partiko Android

I suppose that "decreasing day by day" is one way of interpreting this chart. The way I interpret it is "increasing year by year".

Nothing's changed, I'm sorry but I am still very confident that we will be breaking below current lows and quite frankly I fully expect BTC to still breach $5000 by quite a bit. Hope it doesn't make you hang up your blogging shoes... But this is just how it tends to go. Surviving the dips is easy until a real one shows up.... surviving crypto winter is what makes true hodlers!

I'm off my blogging game for a bit, going on vacation tomorrow, but should be back blogging after next week, otherwise I would've made an updated BTC post of my own

Glad to see you still alive and kicking PB!

I swear you bearish people are going to cause a dip below $5000 based on combined sentiment alone! Funnily enough that can happen, though honestly I would still be surprised to see it.

I wish you a very happy vacation. Hope it is sunny and warm and features lots of cocktails! Unless of course you are going snow skiing and don't drink alcohol, in which case I wish lots of cold weather and warm hot chocolate - or something along those lines. (I tried to go skiiing once, but Norway ran out of snow - true story). I'll be looking forward to your return to blogging.

Don’t hang up your blogging shoes BB. There’s a better than 50/50 chance price goes below $5K. Of course, that could change in an instant with some type of catalyst (positive news). Either way...it’s not worth giving up blogging. You’re too entertaining my friend. ;-)

By the way, hope your wife feels better. My better half and I have been ill with something for about a week now. No fun.

Ah workin' - I don't think my shoes are in any danger - at least not yet... (see my comment to pandorasbox about combined bearish sentiment). Positive news is a constant, as it has been for months already! Here let me help a bit:

https://www.coindesk.com/interstellar-arrives-visa-citi-backed-chain-acquired-by-stellar-startup/ https://www.coindesk.com/can-bitcoin-save-argentina/ https://www.coindesk.com/crypto-research-firm-adds-2-nobel-prize-winners-as-advisors/ https://www.coindesk.com/crypto-assets-are-here-to-stay-says-eu-commission-vice-president/ https://www.coindesk.com/australian-state-pilot-puts-drivers-licenses-on-a-blockchain/ https://cointelegraph.com/news/winklevoss-brothers-launch-fiat-backed-stablecoin-after-new-york-regulators-green-light https://cointelegraph.com/news/citigroup-to-let-investors-trade-custodian-held-cryptocurrency-sources-claim https://cointelegraph.com/press-releases/uks-fastest-growing-online-pharmacy-uk-meds-to-implement-blockchain-technology-with-stratis https://cointelegraph.com/news/blockchain-trust-company-paxos-launches-ny-regulator-approved-usd-backed-stablecoin https://www.ccn.com/72-of-cryptocurrency-investors-plan-to-buy-more-this-year-survey/

and those I found within 10 seconds from a couple of my main news bookmarks.

Sorry to hear that you and your better half has also been going through the wars, been sick is never fun. My poor wife switched from one thing to the other - and when the wife is miserable, the misery tends to spread! This was not my favourite week of the year... I hope that all of you sick people are restored to 100% health post haste!

Sorry to hear about the wife. Same thing in my house...when the women aren't happy, no one is happy. ;-)

Those are nice articles. I could literally send you hundreds more just like it. We've been seeing a divergence in price and tech for months. No one disputes the tech/infrastructure improving. That's not the kind of news I'm referring to. I'm referring to market moving news like, an ETF approval, mass adoption by amazon, something along those lines.

I know you're more a fundamental guy and looking long term. On that, I couldn't agree more. I'm about as bullish as one can get long term. But as a trader, I'm also looking short term...i.e days, weeks. Unfortunately, that's not looking great if you're a bull.

Still...positive news could turn things around on a dime. Until then, we have to trust the charts...and they don't look great. That said, we could see a short squeeze shoot price up above $7K. Due to that possibility, I closed 80% of my short position and moved my stop from $7,400 down $6,800 on the remaining 20%. Things are getting interesting...Damn I love this market. ;-)

Yes, you certainly make sense. I still can't get over this ETF hype though - I really consider it to be ridiculous. To me something like the news of Yahoo Finance offering direct crypto trading is far more important. I guess market FOMO/FUD is truly random in nature (or selectively media influenced).

I sure would like to see a short squeeze! As you suggest, it's probably now just a matter of waiting for the right catalyst to turn the market, everything else is in place.