Bitcoin and other cryptocurrency loans don’t work like fiat loans. They are different and come with multiple different challenges. However, even with these challenges the future for Bitcoin loans is ripe with growth and possibilities.

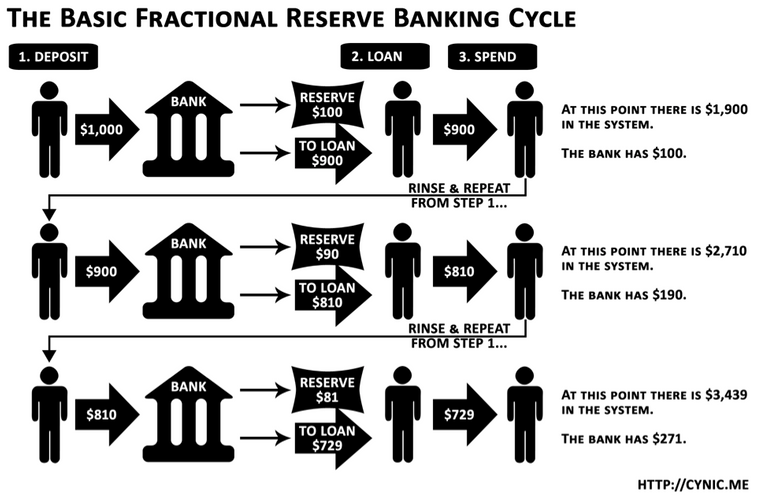

First a little background on fiat loans. Fiat money (which the origins of the word literally mean “let it be money”) is no longer backed by anything and is just a unit of account created by central banks. When you go to your bank and get a loan you are actually getting some money freshly printed out of thin air. Sound crazy? Well it kind of is. Fiat banks operate on Fractional reserve banking. This is a complex topic and I implore you to research it more, but essentially it means banks can lend out money they don’t have. And Banks then borrow money from Central Banks who are the ones that actually can print the money physically or on a spreadsheet from nothing.

The below diagram shows how fractional reserve banking creates money or expands the money supply.

Why Bitcoin is Different

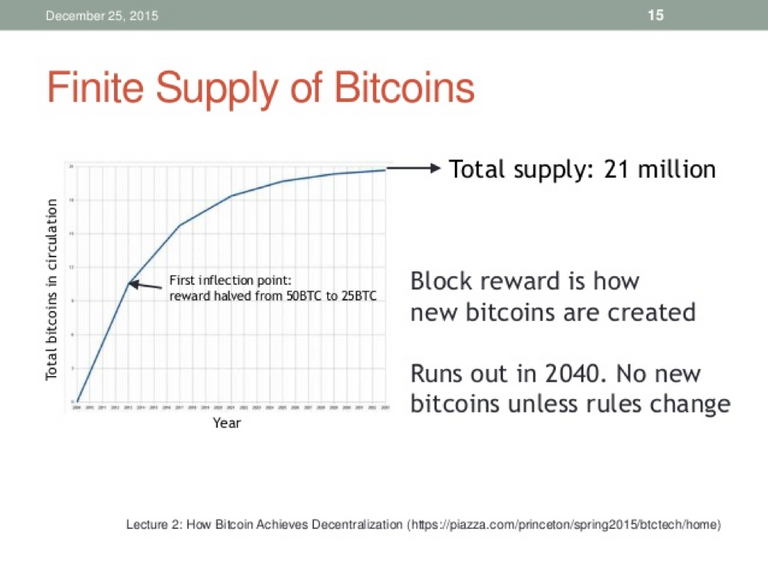

Bitcoin is possibly the best money the world has ever seen. However, it's not as “good” at being loaned as fiat money. Fiat money, due to its nature of being created from debt, is really good at being used for debt. Bitcoin, as a sound finite money (like physical gold) cannot be created out of thin air. This makes it economically a much better money, but it also means banks can’t print more bitcoin to fund your loan. Bitcoin is mined in an electronic process which is comparable to physical gold mining. And just like physical gold, you cannot just create bitcoin. It takes a lot of resources to mint new Bitcoin. Bitcoin also has a limited supply of 21 Million. So unlike fiat money which literally has no supply limit, Bitcoin has a limit.

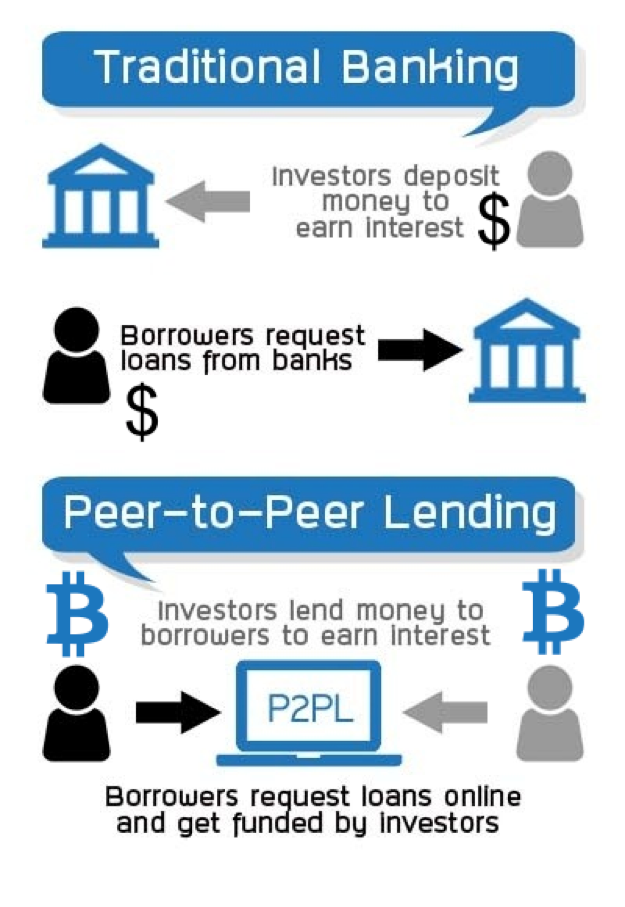

All of this means that if you borrow Bitcoin, you are borrowing directly from Bitcoin owners. There is no trickery or fake Bitcoin.

This means that all Bitcoin loans effectively become peer to peer. Which is why it makes sense that the only Bitcoin financial platforms are in fact P2P.

How P2P Bitcoin Loans work

P2P bitcoin loans are pretty simple. Let's say for example you want to take out a 1 Bitcoin loan at one of the 2 main P2P Bitcoin lending platforms Btcpop.co or Bitbond.com. The premise is that you create a listing (or contract) just like a loan contract at a bank. The contract spells out the principle, when payments are due, and the interest amount for the loan. Up to this point it was pretty similar to bank loans.

At this point with a bank loan the banker would have to either personally underwrite (take on the risk of default) the loan themselves or sell that debt contract to another banker (common in large commercial loans or mortgages). However, with a P2P loan there really is no 1 banker with a lot of BTC to lend out to the loan. Instead the loan is published to a large audience of Bitcoin investors looking to earn interest on their BTC holdings.

The individuals in this audience then get to decide if they want to underwrite (take on the risk) of this loan for the reward. So 1 investor could fund the whole thing, or hundreds of small investors. But ever single satoshi comes from another owner of Bitcoin in this process.

Risks of Bitcoin Loans

Now that you better know how Bitcoin loans work it's important to understand the risks involved with taking or investing in them.

- Bitcoin is very volatile: The Bitcoin Price can go up or down very fast. This makes it impractical for most people to borrow Bitcoin. For example a 1 Bitcoin loan taken out at $3000 price turned into dollars. 1 Month later 1.01 Bitcoin is due as payment at 12% APR. However, the price went up to $4000 so that 12% APR is now effectively 416% APR.

- Bitcoin is very hard to collect: Bitcoin has the great feature of nearly 100% ownership. So if you own Bitcoin nobody else is getting it. But it also means that it doesn’t work to collect on Bitcoin debt. So even with a legal process on Bitcoin debt collection... enforcing it is another matter.

So with those things in mind be very careful with Bitcoin loans. If you invest in Bitcoin Loans its a good idea to make sure there is collateral behind the loan (like Btcpop.co's Collateralized Bitcoin Loans). And if you are taking out a Bitcoin Loan, make sure you are exposed to the Bitcoin price. That way your APR stays what you agreed and doesn’t skyrocket. . . .

If you follow me, I will also follow you in return!@bitcoinlending, I gave you a vote!