While there are cryptocurrencies popping out in the market like popcorn, as investors/users, it’s really difficult to cope up with all those coins. And as a cryptocurrency, it is really difficult to compete. As every other cryptocurrency promises speed, security and less fees. But there’s some flaw in the structure of architecture of the coin at its core. That flaw is speed & fees. Which Litecoin is attempting to solve and we think its already solved. This post is all about that.

Without eating much your time, let’s jump in right away.

What is Litecoin?

Litecoin is a peer-to-peer Internet currency that enables instant, near-zero cost payments to anyone in the world. Litecoin is an open source, global payment network that is fully decentralized without any central authorities.

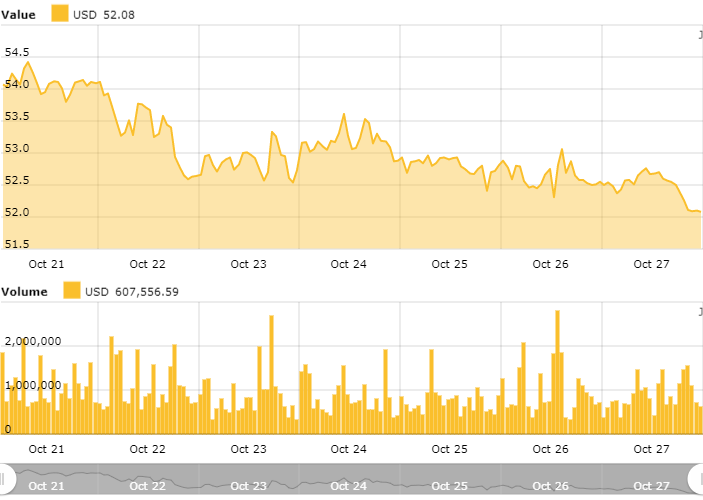

This is how the official website describes Litecoin. Take a look at the table below for the Litecoin price and it’s market cap.

Litecoin has shown tremendous growth since the time it was launched. We did some digging and have found out that Litecoin price has grown by a whopping 8000% since early 2017 till date.

If you are looking for cryptocurrency trading, we would definitely recommend Litecoin. As a comodity, Litecoin has proved time and again that its not a lite bird in the park.

Before we dive deep into Litecoin’s core, let us have a look on a bit about Litecoin. It’s dense ahead, let’s start smooth.

The Origin Of Litecoin

Charlie Lee, an ex-Googler, who had a vission of creating lite version of Bitcoin which would be much more powerful than the prime cryptocurrency. Charlie Lee is super active on social media and through his blog.

Litecoin was pushed to the market on October 7 2011 via github and the network went live on October 13 2011.

How does Litecoin Work?

Since Litecoin is a hard fork of Bitcoin core client, it has inherited a lot of its properties, the most major one being the mining procedure.

If you are totally new to cryptoverse, we recommend you reading our detailed guides on Blockchain, Cryptocurrency, & Cryptocurrency Mining.

At the core of most of the cryptocurrencies, it’s the blockchain that power its operation. To brief you on how blockchain works, here’s a easiest explanation.

Imagine blockchain as a kitty party, where 5 ladies get together have fun, gossip, eat & win prize at the end. Each of the ladies put in $100 and one of those 5 ladies will will $500 in a lucky draw.

In this case, if you are one of the lady, who are you trusting your money on? Is it the Bank? The Government? Third party system? No!

You are trusting a ‘community’ who have no control to manipulate the lucky draw. If you have defraud and win the prize, you will have to convince everyone to let you win the price.

Is that possible? Definitely not.

Same thing happens in blockchain too. The cryptocurrency spent broadcasted to the blockchain, which is a public ledger, where the transaction goes to each and every member of the community (node) and is verified for its genuineness.

This way, the whole community is responsible for their own money, yet power the whole network with security no one altering even a single bit of data on the blockchain.

Cryptocurrency is one of the most powerful blockchain application till date. Sure there are many upcoming applications that will not disrupt the centralized systems but will also do what Internet was supposed to do but hasn’t done yet.

This was a brief on blockchain. Now, let us tell you how Litecoin works and what’s at the core of the the ‘Silver’ of cryptoverse.

Like Bitcoin, even Litecoin uses Proof-of-Work to run the mining procedures. Mining is the second most important activity involved as part of maintainace of the network. A group of volunteers use their computational power to run algorithms that verify the already existing transaction and generate new units of the cryptocurrency, in this case, The Litecoin.

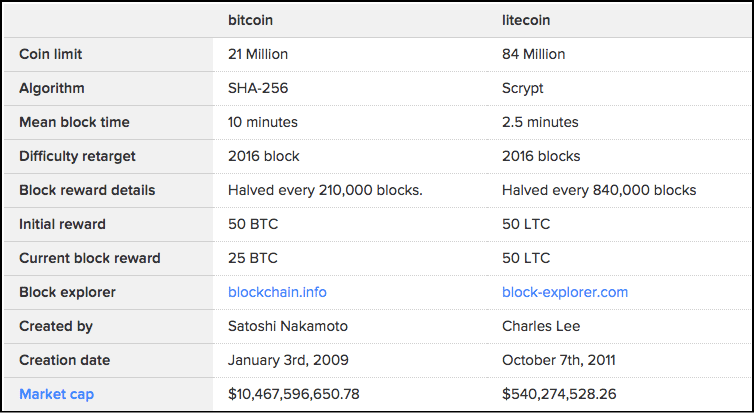

See how different is Litecoin from Bitcoin though it’s a hard fork of its core.

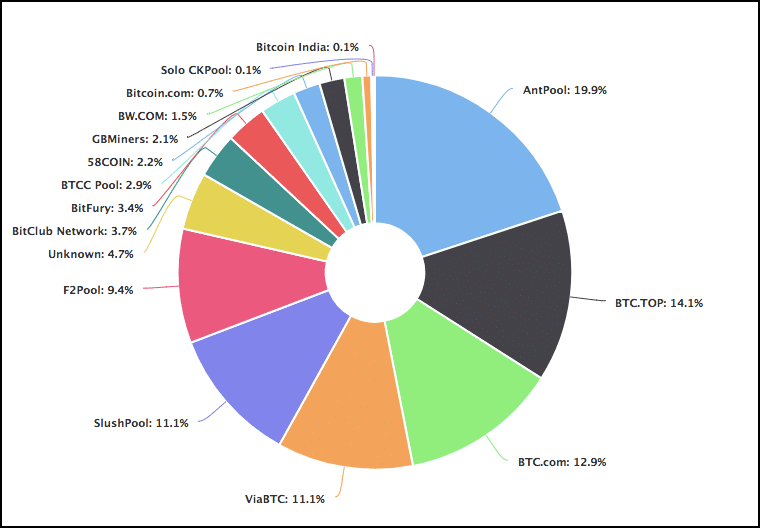

Bitcoin, since it start expanding, had one major problem. The very thing that Satoshi Nakamoto, created the Bitcoin for is slowly dying. Bitcoin mining is becoming more and more centralized as the mining algorithm used by Bitcoin network, SHA256 requires a lot of energy to run the ASICs. There are mining groups, who’ve literally bought plants filled with powerful ASICs for bitcoin mining.

Take a look at the how a handful number of mining groups are dominating bitcoin mining.

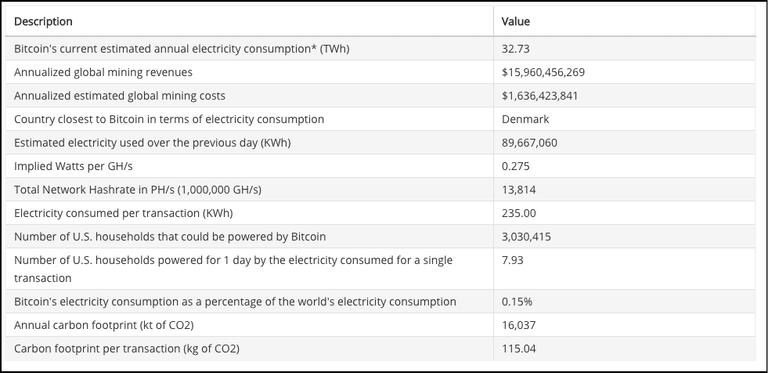

Take a look at the power consumption of bitcoin to have a brief idea of the problem which Litecoin solves like a pro.

Bitcoin consumes nearly 33 TwH of power globally, which is more than Oman, Morocco and Serbia.

With all these problems in mind, Charlie and his team, did not want SHA256 to be the mining algorithm and them came up with SCRYPT.

What is Scrypt for Litecoin?

Scrypt, as a mining algorithm is very efficient than SHA256. However, there’s a catch here. SHA256 is brilliant at parallel processing, i.e, the algorithm can manage multiple processes simultaneously. However, this hits hard on the memory and hence slows down the process.

On the other hand, Litecoin uses core SHA256 but sequentially. If A and B are the processes, Litecoin’s Scrypt will address A and then B, this way, there will be less clutter around the algorithm and speed will be manageable. Parallelization, like in case of Bitcoin becomes an issue since the blocksize in bitcoin is only 1MB, i.e. blocks not more than 1MB can reside in the bitcoin blockchain. However, there are reports of blocks that go beyond this size, which is kind of spooky. Here’s why the blocks are bunching over 1MB.

Litecoin has not only chopped down the memory issue, but it has also made the mining much more affordable. Sure, the sequential processing is a problem but it can be solved with high memory capacity devices, which can be as cheap as memory cards. This is ridiculously cheaper than ASICs that cost a bomb of money. So, if you’re planning to get into Litecoin Mining, you’re welcome already.

One bad new, companies like Zeus, Flower Tech have come up with Scrypt ASICs which means the centralization in Litecoin Mining is going to begin. As ASICs are incredibly powerful, efficient and productive, big guns will buy it, mine more and hence living little to nothing for individual miners.

This was on the mining algorithm. Let’s talk on the transaction speed

Litecoin Transaction speed

Now that Litecoin has a huge followership and users, the speed is continuously going down. While Bitcoin is at the top of the list ‘Slowest transaction speeds’ with transaction speed averaging at 10 minutes per block, Litecoin is hovering around 2.5 minutes per block.

Furthermore, the median confirmation time can bulge more than 30 minutes. Which is common across the payment systems, in peak time it is quite natural to slow down. Faster confirmations are really useful for small merchants and consumers who tend to buy goods & services every other day.

People can pay using Litecoin within 5 minutes and save their time. Sure, there are banks and other central third party authorities who do this much faster, but maintaining account in tradtional banks is invte to a lot of fees in the long run.

Furthermore, if you are a miner, you can reap more than you invest. Since the block mining speed and verification speed is faster than Bitcoin, you are likely to make much more than you’d ever make in Bitcoin Mining.

Sure, you can bring up an argument saying that mining one bitcoin is better than mining 1000 Litecoins, considering the price factor. But if you calculate, the cost & time you invest in mining one bitcoin is way more than mining 1000 Litecoin is.

Flood attacks in Litecoin blockchain

Speaking on transactions, there is something called Flood attacks in the cryptoverse. What this basically means is the blockchain is attacked by spam transactions. In Jul’15, Bitcoin was chocked with a similar attack. At one point of time, there were 80,000 transactions in mempool.

Litecoin founder, Charlie Lee said that Litecoin blockchain deals with this attack by making the attack as economically infeasible as possible. In other words, the price inflates. In an interview with cointelegraph, this is what he said.

“The reason why it is immune to this attack is because it was attacked in a similar fashion (though to a much smaller degree) years ago. I noticed this flaw in Bitcoin and patched it in Litecoin.

The fix implemented in Litecoin is just to charge the sender a fee for each tiny output he creates. For example, in this specific attack, the sender is charged one fee for sending to 34 tiny outputs of 0.00001 BTC. With the fix, that fee would be 34 times as much. So it would cost the attacker a lot more to perform the spam attack. The concept is fairly simple: the sender should pay for each tiny output he/she creates.”

Introduction to Atomic Swaps

Litecoin came up with awesome technique to save the end user’s time & money by implementing atomic swaps in the Litecoin blockchain. Consider this example. You have 1 BTC & you want to exchange that with your friend who has 1000 LTC. Traditionally, you’d go to an exchange and get your BTC exchanged for 1000 LTC, pay the fees and then get LTC for yourself.

With Atomic Swaps, you don’t need to rely on any exchange. You can simply utilize this feature and swap without paying the fees and wasting time on exchanges. Atomic swaps use HTLC (Hashed Timelock Contracts). HTLCs are basically protocols that opens a temporary channel between peers without any prior deadline. Cryptographic proofs are used to acknowledge. Atomic Swaps is a vast topic, which will be covering in a dedicated post. For now, let’s shift our focus on the Litecoin’s market.

How to buy Litecoin? Value for money

Whether you want to invest in Litecoin or want to use it for consuming daily life products/services, you can do that with Litecoin now. Sure, there aren’t many outlets & stores accepting Litecoin as Bitcoin, but there are good number of outlets & merchants who accept it.

Before you spend it, let’s show trusted ways to buy Litecoin.

There are a lot of trusted exchanges featured in the official website, which are as follows.

These are top exchanges currently in the market and they’re super reliable. However, these exchanges are not decentralized exchanges which makes them prone to cyber attacks. Time and again there have been cryptocurrency hacks where the hackers have stolen cryptocurrencies worth Billions.

This leads to the next section of this post.

How to keep Litecoins secure? Where to store?

Cryptocurrencies are a piece of code with a monetary value. They need space to reside, just like a document or picture of your dog. But cryptocurrencies need highly specific software for us to manage it. It cannot be stored anywhere, since it can’t be read by those software.

There are special wallets for this. Some are software, some are hardwares. There are exchanges who provide wallet facility but we don’t recommend that. Since the exchange might shut down or face an attacks and in that case you might lose the digital assets you owned.

Let’s have a look at the wallets you can trust your Litecoins on.

Hardware wallets for Litecoin

The official website recommends the following hardware wallets for storing Litecoin.

CoolWallet S: This wallet provides cold storage solution for Bitcoin, Litecoin and many other altcoins. This is world’s first mobile hardware wallet with a built in exchange. That is, you don’t need to buy a separate hardware wallet to keep your funds safe.

Opendime: USB based hardware which you can technically use like a debit/credit card. If you want to spend LTC, just insert the wallet in a USB at the store, and you’re done. It trust no one but you. So you’re funds are safer than ever.

Ledger: Our personal favorite and global leader in hardware wallet space. It supports 30 plus cryptocurrencies so if you have multiple investments, Ledger is the best thing to have.

Trezor: Trezor holds the prestige of being the first hardware wallet in the cryptoverse and has a stature no wallet can achieve. It has super strong security features which are very hard to crack.

There’s KeepKey & Bitbox, but we don’t personally trust. You can give it a try and we will also review it in upcoming posts.

Mobile wallet for Litecoin

For mobile users there are many wallets that can keep your Litecoin safer than ever. In spite of the vulnerabilities of using mobile phones, these wallets are trust worthy.

Lite.IM: This wallets makes LTC transaction via telegram messenger and very safe. It’s available on Android & iOS.

LoafWallet: The first standalone wallet Litecoin wallet for Android & iOS

Jaxx: This wallet is beyond Android & iOS. It’s available for 8 platforms. Furthermore, its the first choice of Litecoin users.

Web wallets for Litecoin

Coinbase: Needs no introduction. Coinbase doesn’t offer too many options to trade on but its very particular of the regulated cryptocurrencies and allows only those coins. It’s the best web wallet to rely on.

Desktop based wallets

Litecoin Core: Developed by the official Litecoin developers, is one of the best desktop based wallet to rely on. Its available for Linux, mac & Windows.

Exodus: This wallet supports multiple cryptocurrencies and hence it’s also the best space to keep your coins in. This wallet is also available for windows, mac & Linux.

Note: You can spend Litecoin on Debit cards and many other merchants. Here’s the full list.

Future of Litecoin

Unlike Bitcoin, Litecoin’s founder is very much available for guidance and leadership. At least, Charlie Lee is right on track of Litecoin’s vision. As a cryptocurrency sure Litecoin might struggle a bit because of small blocksize and Scrypt ASICs but as a commodity, Litecoin is a legitimate source to invest in. It has grown exponentially in past and it will grow in upcoming times too.

Charlie wrote a letter to the mining community to support SegWit in Litecoin as a blockchain can manage the memory problem well. Once the SegWit is on the roll, Litecoin is only going to get faster.

Final thoughts on Litecoin

While Litecoin has been taking the cryptoverse by storm, it’s not exaggeration to say that Litecoin is going rule the cryptocurrency trading space in coming time. While Bitcoin is struggling to keep up with the high hopes of its bullish predictions, Litecoin is slowly getting a lot of limelight.

If not a commodity, Litecoin has already proven to be a problem solver. Competing with Bitcoin it’s not easy to withstand the pressure and competition & Litecoin has done it quite perfectly. Not sure of the people who are investing in it, but Charlie Lee is here for making a difference.

Resources

Understanding Litecoin

- What is Litecoin?

- Litecoin Website

- Litecoin Development Website

- Litecoin Wiki

- Charlie Lee’s talk at Coinbase

Keeping up with Litecoin

If you like this post do us a favor, please share it across social media platforms, this motivates us a lot. This will also help many understand Litecoin better.

Originally published at https://www.bitfolio.org/Litecoin-review-LTC.

Wow this was a very well written post. LTC is one of few alts that I still have in my portfolio along with BTC and Steem. I've been considering increasing my core position in LTC going forward because I like how the transactions are faster than with BTC and your post has given me more confidence that I'm doing the right thing holding onto my LTC. I've moved most of my BTC off the exchanges and into a hardware wallet and it looks like I'll be doing the same with my LTC here shortly.

Thanks for the info! I don't really post any more but I've followed you and look forward to seeing more great content like this. It's nice to find quality reading on steemit. It used to be really difficult but it seems that lower quality posts (and the number of posts per day) are declining in frequency as the price of steem has dropped. In a way maybe it's a good thing.