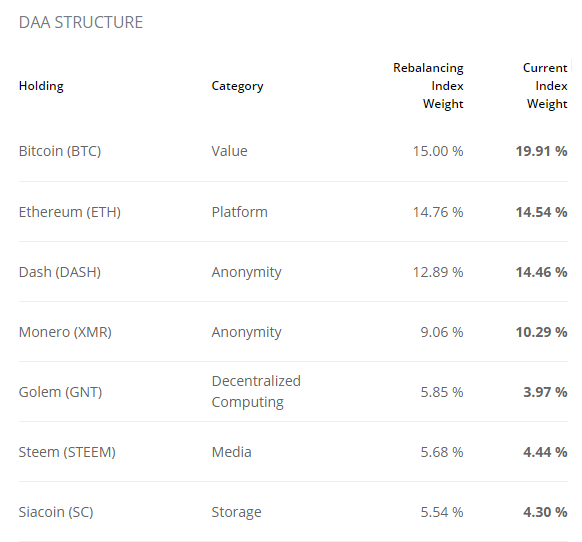

Iconomi is a digital assets management platform that aims to simplify investing in cryptocurrencies, ICOs etc. The platform will connect Digital Assets Array (DAA) managers with investors. Eventually, anyone should be able to join the network in any way they want. DAA managers apply their own management strategies and create portfolios; investors choose the most appealing strategies and make investments, paying fees to portfolio managers. This features will be implemented by the end of 2017, but at this moment, ICONOMI platform offers closed and actively managed DAAs in from of ICNP and ICNX. On august 1st they enabled registration for all users except U.S. residents. You can now buy ICNX directly on the platform and deposit BTC, CFI, ETH and ICN, token of the Iconomi.

ICNX- is index of cryptocurrencies and reflects the whole market, assets are added to the index according to certain eligibility criteria. Components and their corresponding weights in ICNX are updated every month as the market is very volatile and grows at fast pace. At this moment, assets in this index represent 92% of total cryptocurrency market capitalization and include 21 different cryptos . According to ICONOMI representatives, ICNX will soon be tokenized and added to major exchanges. If things go as expected, this DAA might become extremely popular among people who believe in potential of blockchain market. It’s also a great option for newcomers who are confused with complex technology and diversity of digital assets- you can simply put your investment capital in the index of the whole crypto world.

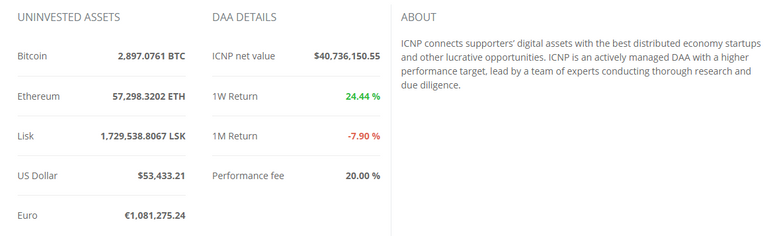

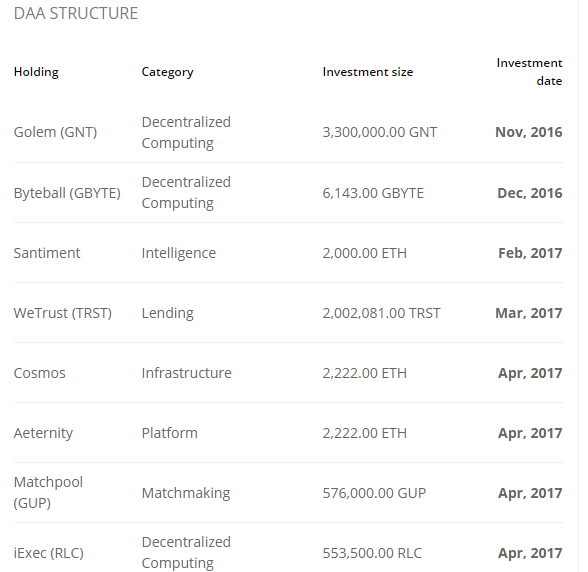

ICNP- another DAA on the platform that aims to discover promising projects with growth potential and participates in pre-sale fundraising campaigns or ICOs. ICNP was initially funded with 40% of 10MM usd raised during their ICO in 2016. Current net value is now $39,986,317, with investments in 10 projects and 60% of the capital left for further investments. This 60% of yet not invested assets is in Bitcoin, Ethereum, Lisk, US Dollar and Euro. ICNP has been managed by a team of experts appointed by ICONOMI itself. Basic idea behind this DAA is to analyze the market, seek for projects that target unmet needs and maximize ROI. The advisory team created a separate project , Co- FoundIT (CFI) , but they work on ICNP as well. You can participate in ICNP and get ROI only by accumulating and holding ICN tokens.

ICN- at this stage, it’s a token of Iconomi that is used for various operations on the platform. Holders of ICN tokens will profit from:

1 . ICNX static fees in from of 3% annual management fee and 0.5% fee for exit.

2 . ICNP gains or so called performance fees- after closing a position in one of the investments, 80% of the profit will be reinvested in ICNP and 20% will act as a platform revenue stream.

3 . As soon as DAMP (digital assets management platform) is launched and everyone is able to introduce custom DAAs, they will set different fee structures for their service and as Iconomi currently states, the platform will collect 30% of the collected fees. If it will succeed to attract lots of users, profit will logically increase.

Distribution of profit is managed through buybacks- Iconomi will weekly buy ICN tokens on the open market and burn them ( send to Iconomi burn address), therefore reducing the supply. Now there are 86 million tokens and total supply is capped at 99,900,350 ICN. There has been lots of confusion about ICN token, how it is positioned, in which way profits are distributed and how valuable it may be for the platform. At first, Iconomi team announced that ICN was a share of the company and token holders would receive dividends. But as cryptocurrencies don’t yet represent ownership of the company due to uncertainty of legal structures, so they repositioned ICN into a token of the platform that is used for certain actions and all token holders are benefiting from buybacks. Even though the value proposition could be clearer, ICN is still worth considering as a long term investment, along with ICNX.

UPCOMING CHANGES

On August 4, Iconomi team announced that individuals can now submit applications and a apart of them will become first DAA managers on the platform. Iconomi shows particular interest towards investors with digital or traditional asset management experience. Minimum seed amount you have to provide is $100,000 and deadline for applications is 13th August.

In the following months , Iconomi is going to add some useful features such as an option to link a Visa debit card directly to the account, new tools for DAA managers and investors etc.

COMPETITION

Currently there are no direct competitors apart from Melonport, which is still on early stages of development. Melonport aims to be a truly decentralized platform, while Iconomi uses a traditional web application approach. In the long run , decentralized project sounds better, but currently Iconomi is easier to manage and more effective, not to mention that it’s already a working project.

Of Course, if the implementation is successful, new direct competitors will emerge but Iconomi may have a solid advantage by that time.

SUMMARY

All in all, Iconomi is undoubtedly an interesting project that targets a market with huge potential. It’s important to remember that Iconomi and its DAAs represent the whole crypto world and it’s success or failure is tied to performance of digital assets. From my point of view, a need for a digital assets management platform is only going to increase and if Iconomi manages to stay in the game, then the future is bright. ![]()

Interesting blog. I was about to start a similair discussion. No matter how populair a coin is. People should always do a proper background check. It surprises me how many coins are out there that don't have their basics right. An interesting website I found: https://www.coincheckup.com For a complete crypto analysis on every single tradable crypto out there.