BlockNovum published its second public investment research report covering Binance Coin (BNB), the native token of the world’s biggest cryptoasset exchange.

The report consists of two parts:

1. Valuation of the BNB token price based on a long-term fundamental view of its utility value.

2. Qualitative assessment of Binance, the company behind BNB, based on BlockNovum’s due diligence methodology for early-stage blockchain startups.

Find our key results in the executive summary below, or read the full report to get an in-depth look at Binance / BNB.

Future cryptoasset investment research reports with valuations of handpicked cryptoassets are offered via a subscription model or on-demand. For further details please get in touch with us at [email protected].

Download the full BNB Investment Research Report (20 pages) here:

Executive Summary

Valuation

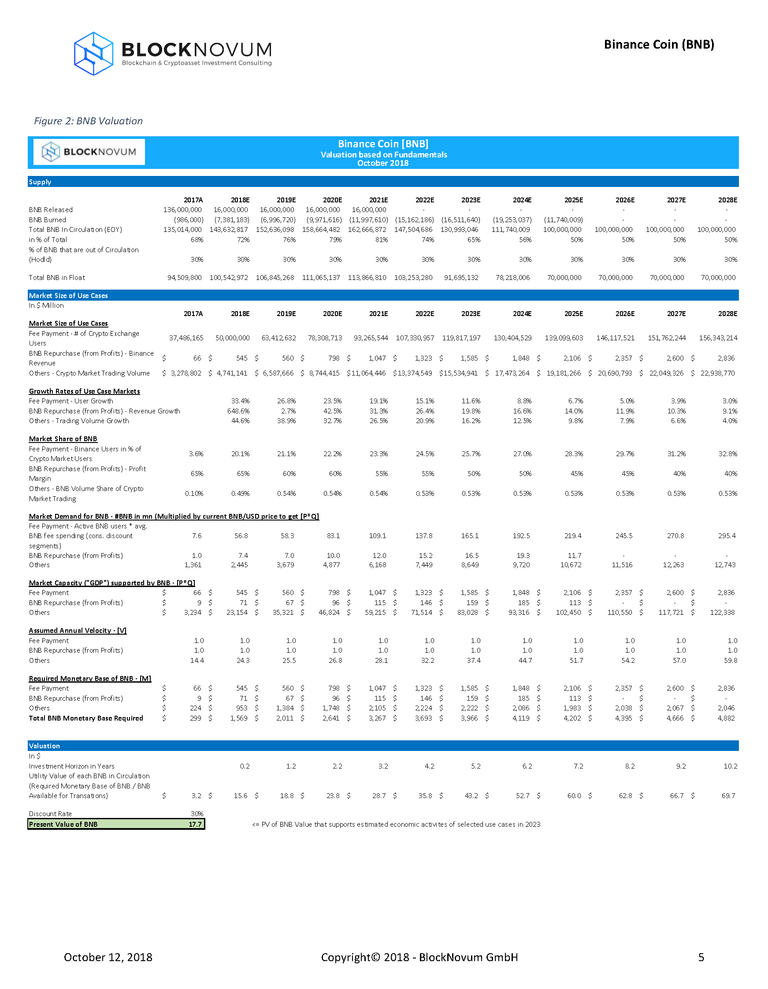

BlockNovum establishes a price target of $17.7 per Binance Coin (BNB) for long-term investors. We see this price justified by the present value of the underlying future utility values of three modeled BNB use cases until 2023:

- Payment of trading fees on Binance exchange with BNB (incentivized through discount).

- Repurchase of BNB through Binance profits.

- “Others” including BNB demand for investment purposes, gas for decentralized exchange, voting power, referral bonus etc.

We expect 88% of today’s BNB present value to be based on current utility and 12% on speculation of future utility value.

Qualitative Assessment

BlockNovum believes that Binance was able to grow a massive user base and become the biggest crypto exchange due to its ability to move incredibly fast. They managed to assemble a team, get ICO funding, and launch a trading platform in a matter of weeks. The right market timing combined with their ability to onboard users very quickly, their wide ranging offering of popular cryptoassets, and their capabilities to handle large number of users was definitely one of the key points for Binance's early success. The BNB coin with its utility for discounted fees and with its profit buyback mechanism was innovative for its time and further supported user growth.

While moving fast, Binance might have also stepped into some legal greyzones, by avoiding local regulations through rapid relocation to other (more crypto-friendly) jurisdictions. In general, we also have some concerns around Binance’s governance structure and company data availability. Furthermore, it can’t be ignored that Binance listed several low-quality tokens on their exchange, which might leave a tainted reputational mark.

Nevertheless, we see Binance as well-positioned as the leading cryptoasset exchange for a future where cryptoassets become more and more accepted in the broader public. Binance’s CEO Changpeng Zhao (“CZ”) and his team realized that by building a whole ecosystem around Binance and its native BNB token, Binance can positively influence its own market position and set itself up for long-term success. With their various initiatives, such as Binance Labs, Binance Blockchain, ICO launchpad, Academy, Crypto bank etc., Binance is offering services along the whole value chain and is distinguishing itself against their competition. As a result, they managed to become one of the leading exchanges and with CZ they have a popular crypto persona as their CEO.

Investment Thesis

The various initiatives with the BNB token at their center make us feel optimistic about BNB’s ability to capture long-term value. This view is confirmed by our long-term fundamental-based valuation that yielded a present utility value of one BNB token at $17.7. Therefore, BlockNovum issues a Buy rating for BNB since the current price lies significantly below BNB’s calculated current utility value and discounted PV. BNB seems to be undervalued considering the size of the “economy” that the Binance ecosystem facilitates.

About BlockNovum

BlockNovum is a Swiss Blockchain and Cryptoasset investment research & consulting firm. We provide professional assessments, fundamental valuations, and market research reports for the emerging asset class of cryptoassets & blockchain startups. Our target client segment includes institutional investors (VCs, family offices, [Crypto]-funds & other asset managers) with an interest in allocating capital to cryptoassets or blockchain startups. Additionally, we also offer our reports and consulting services to accredited investors, such as business angels.

Mission: Founded in 2018, we are a young startup that wants to advance the quality of fundamental cryptoasset research to a professional level to provide institutional investors with high quality market research, due diligence, and valuations.

If you are interested in similar reports or customized consulting services, please contact us at [email protected]

You can also find us on: Website, Twitter, LinkedIn

Disclaimer: This information is not intended to be nor should it be relied upon as a complete record or analysis; neither is it an offer nor a solicitation of an offer to sell or buy any security or cryptoasset mentioned herein. Nothing contained herein constitutes investment advice and is not to be relied on in making an investment or other decision. Full disclaimer in the complete report.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://blocknovum.com/binance/

Congratulations @blocknovum! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!