I still see too much speculation in crypto currency. “I believe or I feel” this crypto currency will go to the moon is not analysis. Speculative projections only create more speculation. The value of crypto currencies will always be in the technology and its ability to meet real use cases not on hype trains. In my opinion, we need more skeptics who challenge our assumptions and people who analyze the market in the lens of macro and micro economics.

One of the biggest questions on a crypto currency investor today is are we in a bubble? Yes and no. The chance for high profit is something all humans have flooded to. This "herd effect" existed in the gold rush, the creation of the stock market, and gold. In the crypto world, I seem some dangerous side effects such as hyper inflation and growth. As well as some good signs like segmentation and the projected growth of digital based transactions. Regardless, my hope is to provide a balanced perspective on both sides of the coin. None of my crypto posts will address the positives without the negatives and vice versa.

One of the major milestones that crypto currency needs to achieve if its to have a future is maturation. It must address actual use cases in a sustainable way. One of the signs of maturation is a principle in economics called segmentation.

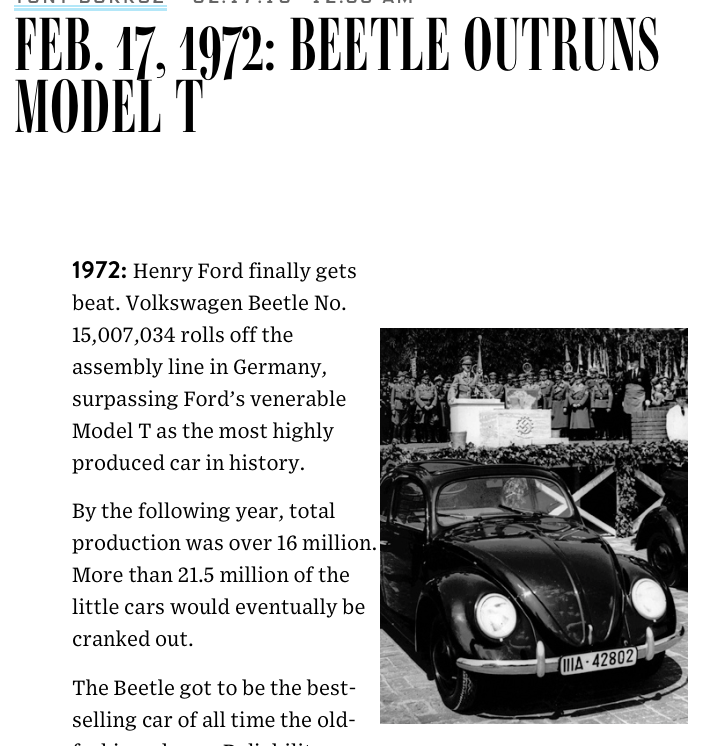

The Ford Model T and the Auto Industry

Segmentation is when distinct and sustainable industries and sub industries form in a market. For example, take the car industry. Ford used the assembly line to produce cars at twice the speed and half the price, which allowed working class families to own an automobile. The company grabbed so much of the market share that Ford truly believed, both during the highs and lows of the Model T, that his car would be the only car people would ever need. So much so, he invested millions to increase the Model T's functionality across terrain and went to great lengths to stifle competition. For example, if he found out another car was adding better lights, the next version would have it. He took full advantage of his ability to out produce.

Then, why did cars before the Model T like Buick not go bankrupt? Why did Ford T get outside by model such as the Beetle?

Segmentation and competition. The market is not a fully controllable force. There are too many factors, known and unknown. In this case, Ford and his predecessors were focused on function. If we can provide a car that can go on muddy roads and paved streets, why would anyone want a different car? We can be the everything and thus the everyone automobile.

From this belief steems their business model , which was the tested in the market and ultimately failed. As cars became more common and affordable, people wanted to differentiate themselves with other car owners. The wealthy still wanted their gold Buicks and the newer generation wanted something more visually distinctive like Beatles.

Think of now. When you see a mini van we think soccer mom and all the stereotypes that comes with that stigma. A beat up Toyata? A new driver or someone who’s barley making it. A worn down pick up truck? Probably someone in construction.

The desire to be different was so strong the car became a symbol of social identity and turned into legitimate market use cases. When these use cases hit critical mass they create demand and and companies create products (supply) that meets this demand.

The above only describes identity and value segmentation. There is also separation based on technology such as gas mileage, horse power, transmission. Also design like color, lines, interior material, and so on. Safety becomes important for families. To add more complexity, what people want changes throughout the course of their lives.

Ford forgot the complexities of market competition that allowed his Model T to succeed. His business model was wrong. As cost of materials went down and efficiency improved, form became as important as function. However, although not great for Ford,this segmentation was fantastic for the auto industry as a whole.

People got more choices. It spurred on innovation between companies competing for different use cases and niches. The auto industry boomed for decades until recently, where resistance has grown due to an over saturated market.

We can see the principle of segmentation in almost every “mature” industry from laptops, cell phones, air conditions, and so forth. That’s why, in many budding industries, economists look for segmentation as a key indicator for potential stability and market maturity.

Segmentation in the crypto world

There are some similarities AND drastic differences in the crypto world. I will start with the former and the simple story before we get into the complexities.

Bit coins started as a decentralized peer-to-peer sharing system allowed for anonymous and global transactions. Although Bitcoin has greatly evolved outside of its intended purpose, the rest is history.

For example, scale has become a huge hurdle for Bitcoin. The sheer volume and size of each transaction has resulted in slower transaction times and higher feels, which is at the heart of Bitcoin Improvement Plan 148. Currently, Bitcoin has a block chain size of 1MB and does not have Segregated Witness. As a result, both the amount of transactions and the distribution of data inside the Bitcoin block chain is slow and inefficient.

Another issue that arises from this potential hard fork is Bitcoin would no longer be immutable. Even the blue chip of the crypto market cannot persist and this volition will disrupt the market. Remember, even crypto currencies that are hoping to be independent of Bitcoin movement like Ether, traces Bitcoin in dips and rises. As Bitcoin is the blue chip of the crypto world, instability in Bitcoin means instability for the market as whole.

There are also some privacy issues with Bitcoin that was released by the OBPP or the Open Bitcoin Privacy Project 2016 report. These vulnerabilities include the merging of co-owned funds, the re-use of bitcoin addresses, the linking of network identities, and exchanges themselves. Just a word of caution here, whatever exchange you use, if you do not have your private keys AND control network activity, you don’t truly own your keys.

To sum everything up, Bitcoin has some major flaws in scale, how decisions are made, privacy concerns, and network speed. People want these things and hence we are seeing the development of real uses cases. From these real uses cases we are getting demand and alt coins are responding to them. Hence, segmentation in real time.

Some cautions to the story

Now for the differences, the crypto market is a hyper accelerated market. It is on dog years. Six months in the crypto world is like 3 years in traditional stock markets in terms of technical improvement, core leadership changes, price fluctuations, and so on. Projects sporadically die and are picked up usually be a single developer.

Hyper accelerated markets also provide more of a challenge than just timing. In regards to segmentation, it accelerates the product maturation cycles. So, what could normally take 50 years to mature and bubble could be 5-7 years for example. Booms and recessions could happen every two years versus 10.

We can see this in the rate of forks of major coins. PIVXX is a fork of DASH. ETH Classic is a fork of Ether as result of the DOS hack. Now BTC may split. So, the pace of innovation is moving faster than the development of demand and its use cases. That’s why when you see some crypto currencies you scratch your head and ask what problems are they solving? They are solving theoretical problems and some are very far away.

What might crypto segmentation look like?

The crypto currencies I have been most successful with are ones I examined through the lens of use cases and the ability of their technology to meet them. So, instead of thinking in large and dangerous groups like “alt coins” – the very thinking that causes massive bubbles – I find it best to think in terms of segments. This strategy prevents you from dangerously linking the success of un related coins. For example, there is no fund called the “stock market.” You invest in the NASDAQ, the S&P 500, and so on. Similarly, if crypto booms and matures, we may start to hear, “I am invested in the Privacy industry of crypto but I’m also diversified into the fintech sector where stronger encryptions are maturing from a use case into a legitimate demand.”

How is the cryptomarket currently segmented?

I grouped some alt coins through segments to provide a simple visualization of the principle. Here, I just list the pictures. There is no easy summary here as a plea to do your own technical research - not a hype youtube video. These lists are not inclusive either of the coins in that segment or of the segments in general. The inclusion is also not an investment recommendation just a quick web search for some of the more popular ones in the segment.

The conclusion

No matter what you hear online, including me, crypto is still based on speculation. We are only a 101 billion market. The NASDQ is 6.8 trillion. That’s why I always tell people not to dive in without research in to the technology, their dev teams, and road maps.

Segmentation is a good sign but I completely concede we are far off. Adoption, beyond transactions, have yet to be seen. Many of the crypto currencies people invest in don't even have products yet or a history of delivery. People are putting FIAT in the hopes of making a big return in a short amount of time. Short term thinking exposes investors to herd like movements in the market. We see an increase of short trading, consolidation, booms, and busts.

No matter how much I love crypto currency, as an analyst, I have to put those emotions and biases aside. The crypto market presents an exciting opportunity to get in on the ground floor and also the risk of the collapses that come with that. We are on unpaved road so go in with eyes wide open.

great thoughts, hard to find content like this

Amazing post.

To driving on the roads as we pave them.