So, Old Man Got $30K Fine from SEC for the Fraudulent Intentions to Raise $5M.

But how about punishing those who had actually raised dozens of millions in clearly dishonest ICO campaigns?

Yeah, that is old news. On the 14th of August U.S. Securities and Exchange Commission (SEC) issued the press-release on penalizing David T. Laurence and Tomahawk Exploration LLC for the attempt to raise money for oil exploration project in Kern County, California, during the sale of Waves-based digital tokens named “Tomahawkcoins.”

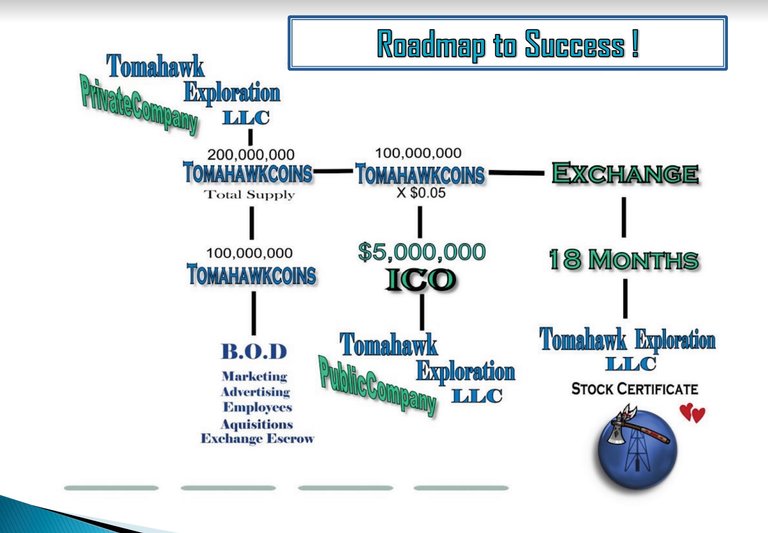

It was happening from the 30th of July to the 30th of August in 2017 with 100 000 000 of tokens supposed to be sold, priced at $0.05 (and the rest 50% of total supply – 100 mln – allocated to “marketing, advising, employees …”, etc.)

Money raised was assumed to fund the cost of drilling the 10 wells, each of those, based on company’s projections would be generating $500 000 per year, totaling in $5,000,000 a year revenue projection.

I won’t be exhausting you with more details. But I have the white paper to peruse for you. And I must warn you it’s quite an entertaining read.

The SEC’s found that white paper was filled with “inflated projections of oil production that were contradicted by the company’s internal analysis” and mentioned that Tomahawk owned leases for drilling localities while it did not.

Also, old fraudster (although in my personal opinion he is just an old naughty man who was trying to play around with some fancy new technologies), the brain of this significant conspiracy, was described in promo materials as a guy with a “flawless background.”

But he had a couple of extremely dirty socks in his laundry bag.

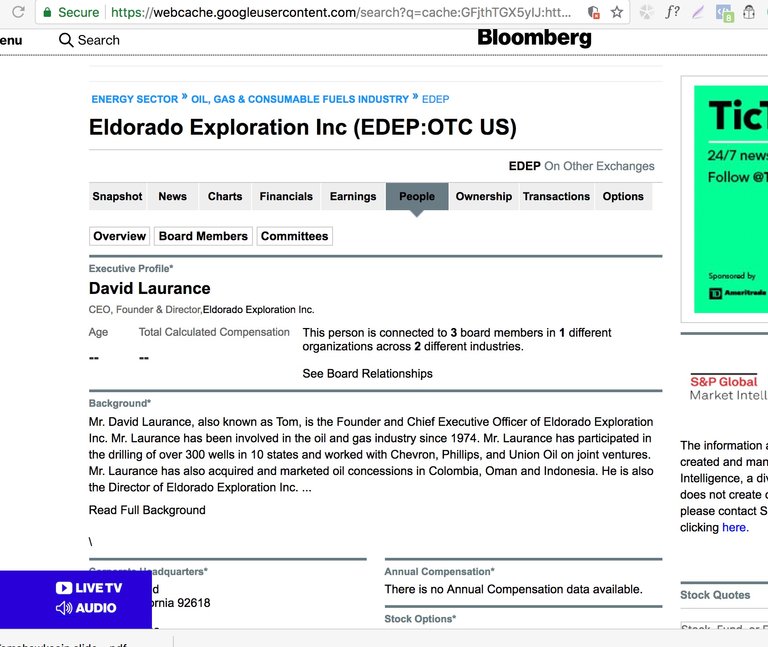

His LinkedIn profile doesn’t say much, but Eldorado Exploration, Inc., mentioned in Laurence’s position leads us to his Bloomberg page and some details about his previous glorious deeds. (UPD: while I was writing this piece Bloomberg turned on a redirect from Laurence page, but luckily we have a screenshot).

In 2008 with his Eldorado Exploration David was planning to become “a fully reporting bulletin board trading stock (PINKSHEETS: EDEP). But I guess it never worked out.

This old hard cookie also failed with his more contemporary endeavor – Tomahawkcoins distribution; they were unable to raise money. But as SEC noticed the company still issued around 80 000 of TOM tokens to fund the bounty campaign and pay the community for promo and marketing. Long story short … “TOM tokens are securities because they are investment contracts…and because they represent a transferable share or option on a security,” concluded the commission.

Guys from Law.com managed to reach Laurance by phone and this 76-year-old claimed he thought this ICO was only promoted to qualified investors and that “this was not supposed to be for John Q. Public”.

The David (Tom) Laurance ended up with $30K of fine and prohibition to participate in any penny stock offerings or being an officer or directory in any registered company.

But why this story is worth elaborating at all?

I am currently in the middle of an investigation of Ubex token sale. Wherever I go on the internet I see their banner, whichever ICO rating website I visit – I see those highest rates, and that started to bug me.

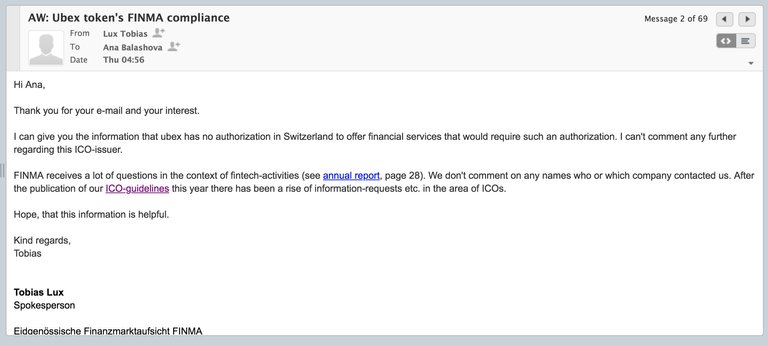

Anyways, this report is due to be published within the next week. But while researching, I found some bogus claims made by the project’s team. E.g., in the document related to the tokenomics of their token (page 9 of this doc) they were talking about “Full compliance with SEC and FINMA.” So I reached out to both organizations to ask if it so, because from where I was standing in my investigation Ubex token was clearly a security and some questions have to be asked.

I got the response from FINMA (and it’s clear that Ubex ICO makes some bunch of false claims, I checked ICO guidelines shared in their email 🙂 ) but SEC never bothered to replay by now.

My point is – why to pursue someone who didn’t even raise any money if you have lots of fraudulent things going on right now and people (including US citizens) are participating and losing their money over the fact that someone is covered with “Full compliance with SEC”?

Stay tuned.

Congratulations @coinjive! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!