Trends from the Trenches by Anthony Scarpulla

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us...

That famous intro from the Tale of Two Cities feels like quite a fitting metaphor for the up and down nature of the blockchain space. While I’ve only been riding this roller coaster and working in the industry for just over a year (which automatically certifies me as a blockchain expert), I’ve witnessed many fluctuations and trends both rise and fall in the space. For this piece, I thought it’d be interesting to sum up the major trends I’ve seen develop throughout 2018 while observing how Constellation fits into some of them. I’ll be drawing from both personal experiences and citing online resources along the way. Without further ado, let's dive in.

The Emergence of Blockchain Consortiums

Over the past year, there has been a dramatic rise in the number of blockchain consortiums in existence. I think the space as a whole has realized that the only way we’re going to solve the lingering issues of scalability and widespread adoption is by working together (as cheesy as that may sound), and stepping outside of our individual blockchain boxes or silos. Per a recent article on this trend by Deloitte, “A recent study counted some 61 blockchain consortia across a dozen industries globally—significant growth versus the prior year.” Blockchain consortia are groups of companies that come together with the joint purpose of advancing shared objectives, which might include “defining use cases, setting standards, developing infrastructure and applications, and operating a blockchain network.”

To take a moment to toot our own horn, Constellation has been extremely active on this front as of late, as we’ve become members of both the HyperLedger and MOBI consortiums. To further cite the relevance of consortiums, HyperLedger, and the Enterprise Ethereum Alliance, just announced their collaboration last week, with the goal of “accelerating the adoption of blockchain technologies for businesses.” With the rise of blockchain focused consortiums has also come an increased level of accountability and professionalism. Here's what our CMO Zac Russell had to say on the subject:

"Over the past few months, the rise of consortiums and collaborative groups signals the realization that protocols and projects can’t work in isolation. It’s early days, and we need to share knowledge, resources and ultimately create integrations across platforms. This is the only way the industry will be able to scale and deliver on the promises and hype of 2017."

VC Investment Up, ICO Funding Down

2018 has seen a drastic rise in VC funding, while traditional ICO funding has plummeted 90% since the start of the year. Per a report from the blockchain research group Diar, VC investment in blockchain and crypto through the first three quarters of the year totals at $3.9 billion — up a staggering 280% from 2017. On the flip side, traditional ICO fundraising has been on a steady decline since raising $2.4 billion in the month of January, with only $300 million raised in all of September.

What’s the reason for this sudden flip-flop in funding models?

Diar points to the overall market correction that plummeted token values, and left companies seeking an alternative model of fundraising, one that is also much more regulatorily compliant.

“Non-equity ICOs are not only scrutinized by the regulators but the founders also have very misaligned incentives as there is no contractual obligation to deliver a product - a reality that to date seems to be the case with few launches, and even less adoption. The amount that was raised through ICOs, as well as the number of projects successfully completing an ICO, is now approaching a one year low.”

Our COO Ben Jorgensen penned a recent article that echoed a similar sentiment, calling for a more mature and balanced fundraising approach that embraces both the VC and traditional cryptocurrency investor worlds:

“A new era in cryptocurrency is upon us, and it will include participation and insight by both institutional and cryptocurrency investors, while ultimately requiring blockchain technology companies and the applications built on existing technologies to behave like mini-IPO’s being accountable to a myriad of personas from tech enthusiasts, crypto communities, users and enterprise organizations, and investors.”

Regulation Flirtation

RegulationSEC, the CFTC, the FEDs, and the [IRS] can’t come to a consensus on crypto. Here’s what the billionaire venture capitalist Tim Draper had to say on the matter: has been another hot topic item throughout the past year. In comparison with more progressive countries such as Malta and Gibraltar, I think it’s fair to say that the U.S regulatory efforts have been quite lackluster up until this point. While we’ve seen a handful of states take some slightly progressive stances (]hooray, you can pay your taxes in Bitcoin in a few years!](https://cryptoslate.com/regulations-global-adoption/)), on the whole, it’s been a muddled and confusing effort from Uncle Sam. All the alphabet agencies seem to have differing opinions on how to classify cryptocurrencies, as the

“I did not anticipate that the regulators would put a dark cloud over all this innovation. I had hoped that there would be some clear simple rules and we could then get on with it. But I guess there are a lot of old-school banking lobbyists trying to cling to the status quo. Years from now, governments will be judged by how well they manage this transition from fiat to crypto.”

To avoid picking on just the U.S here, they aren’t the only ones who can’t make up their minds. China, Korea, Russia, and the EU all have varying and dizzying takes on crypto regulation. I would love to see the U.S be a bit more proactive and become regulatory trailblazers, but time will tell.

In regards to governments who are managing this transition in a more pro-crypto way, let’s take a look at the tiny nations making big moves, Gibraltar and Malta. On July 5th, the Maltese Parliment passed 3 bills into law and became the first country in the world to provide clear and official regulations for those working in the blockchain and DLT space. Shortly before these laws were passed, Binance announced that they were moving their entire headquarters to Malta, prompting the birth of the nickname “The Blockchain Island” for Malta.

Why are these relatively tiny island nations paving the way for progressive crypto regulation? One Maltese official for Digital Economy Innovation, Silvio Schembri, made a great point to this regard. While the major nations are busy worrying about how to regulate the financial gains from cryptocurrencies, he outlined how Malta is more focused on the long-term development of the underlying technologies:

“We are not looking at short-term gains here, but rather at the long-term evolution of blockchain and DLT technology. For example, if we think about an issuance of an ICO, operators typically present a white paper with the ICO details. While other jurisdictions are looking at the white paper to see if it’s certified, it’s the technology behind that white paper that implements what is written. Currently, no one is looking at the technology. That is something that we are doing differently,” said Schembri.

This isn’t to say that there is no hope for the U.S to make haste and come to some sort of consensus on how to regulate the industry. Just as recently as September 25th, over 50 industry leaders convened in Congress for a roundtable discussion to address many of the unsolved regulatory issues. One of the chief complaints echoed by various participants was the notion that the 72-year-old Howey Test should not be the measuring stick to determine whether or not a cryptocurrency is a security. The SEC has already declared that they don’t intend on changing security laws to cater to crypto, so it remains to be seen what actually shakes out from all of this. To sum this all up, here’s what Coinbase’s Chief Policy Officer Mike Lempres had to say on the subject: “We all want a fair and orderly market, we want all the same things regulators do. It doesn’t have to be done in the same way it was done in the past, and we need to be open to that.” Amen, brother.

Hungry Bears and the Year of (f)Utility

Let’s start off by killing two birds with one token (see what I did there?) and get the crypto markets price decline out of the way first, along with the hyped up notion of 2018 being the “Year of Utility”. As Coindesk and othersoptimistically declared towards the end of 2017, 2018 was to be the year when we’d “see tokens that provide true utility float to the top.” The general hope was that all the upward momentum and hype that the industry generated would roll over into the following year, and businesses and consumers alike would actually be utilizing dApps and integrating these blockchain projects into reality, while we’d simultaneously shift out of the speculative money-hungry nature of the crypto craze. This hasn’t exactly played out.

As illustrated by the handy Doge-laden graph I’ve made above, we’ve been ensnared in a nearly 10-month long bear market ever since the bulls went running wild last through last Fall and Winter. Ethereum and other big name tokens are all currently sitting around their lowest valuations of the year, and it’s anyone’s guess as to where things go from here. While this sharp drop-off probably lost a lot of new investors some hard-earned dinero and shook out a lot of shitcoins, I don’t think this decline in the total market cap is all that worrisome.

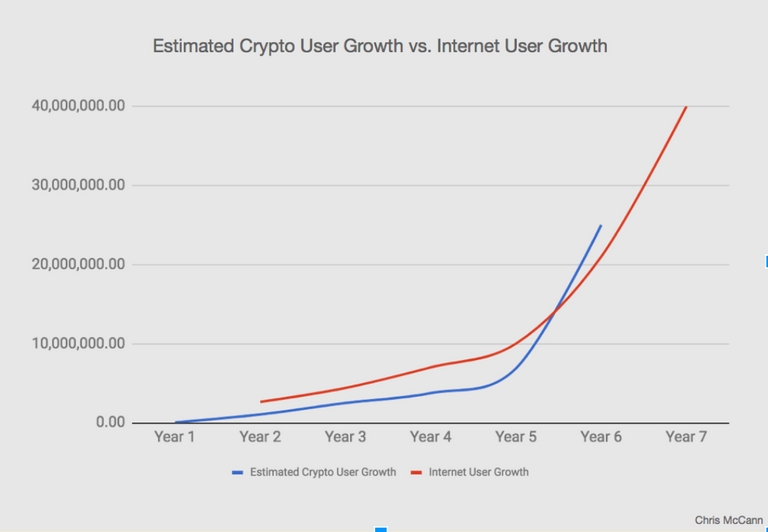

graph via Chris McCann

Many have correlated these early days of crypto-adoption to the early days of the internet, and I think that’s a fair assessment. As seen in the above graph, we’re right on track with the early days of the internet in terms of user growth and adoption, and I expect that trend to continue to follow suit. When I first stumbled down the crypto rabbit hole around a year ago, I was quite high on the notion that all of these new and disruptive (don’t you just love that word?), world-changing projects would be usable within the comings months of the year. I thought my life would be more decentralized by now, and that my brain would be uploaded on to the blockchain and I’d be eating bitcoin for breakfast. Fast forward to the present, and I’ve come to realize how nascent this tech still is, and how long it actually takes to frickin’ code the future.

This year hasn’t exactly seen the predicted rise of utility-driven companies and tokens either. It’s been more of a year of futility rather than utility. A year of failing ICO’s and floundering shitcoins, and confusing regulatory guidelines. Personally, I see the bear market as a sign of maturity, not just in the sense of shaking out those who dreamed of riding ICO’s and random token investments to the moon and beyond — but in the sense that it’s forced those within the industry to focus more on the things that actually matter — which is driving adoption, building usable and scalable tech, while letting the market figure itself out. Despite the bear market, companies and enterprises alike have started to band together in order to hasten the development and adoption of DLT tech (namely in the form of the aforementioned rise of consortiums).

Become a Constellation Member

Participate in our Community

Join our Discord Channel

Join our Telegram Community

Join our Facebook Group

Follow us on Twitter

Chat with us on Reddit

Check out our Technology

Read our Whitepaper

Download our TestNet on GitHub

View our TestNet Visualizer

Stay Educated

Sign up for our Newsletter

Watch our overview videos on YouTube