My approach to cryptocurrency investing is a bit boring...

I look at the fundamentals of the project, the team, its competitors, etc. so I minimize the risk of losing money on my investments. IF YOU WOULD RATHER FOLLOW THE HYPE TRAIN, THIS IS NOT FOR YOU.

In this post, I will be breaking down the fundamentals of Verge and evaluating if it is the right fit for my portfolio. (Obligatory "this is not investment advice, do your own research" warning here)

1. Value Proposition

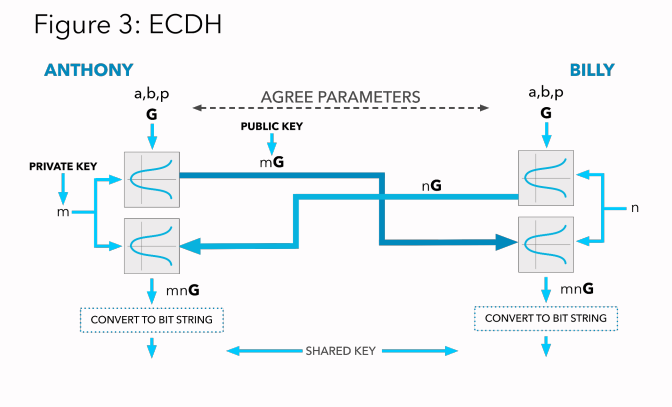

In this category, I attempt to discern exactly what the Verge project is, why it is important, and what value it provides to the Blockchain industry as a whole. When it comes down to brass tacks, Verge is a privacy coin. It utilizes the same technology for hiding recipient's identity that Monero does; Stealth Addresses. In fact, both coins use the same algorithm, detailed in Verge's "Blackpaper"...

Monero and Verge differ in how they hide the sender's identity, however. Monero uses an innovative ring signature technology, while Verge is attempting to utilize TOR and I2P technologies to accomplish this task. I don't want to get to distracted by the technological differences, as that could be its own post, but it is worth noting that Verge has not finished integrating TOR and I2P into their platform yet.

Overall, I think the need for privacy is apparent, and the utility of private transactions is above average, so I gave Verge an 8/10 for this category.

2. Organization / Team

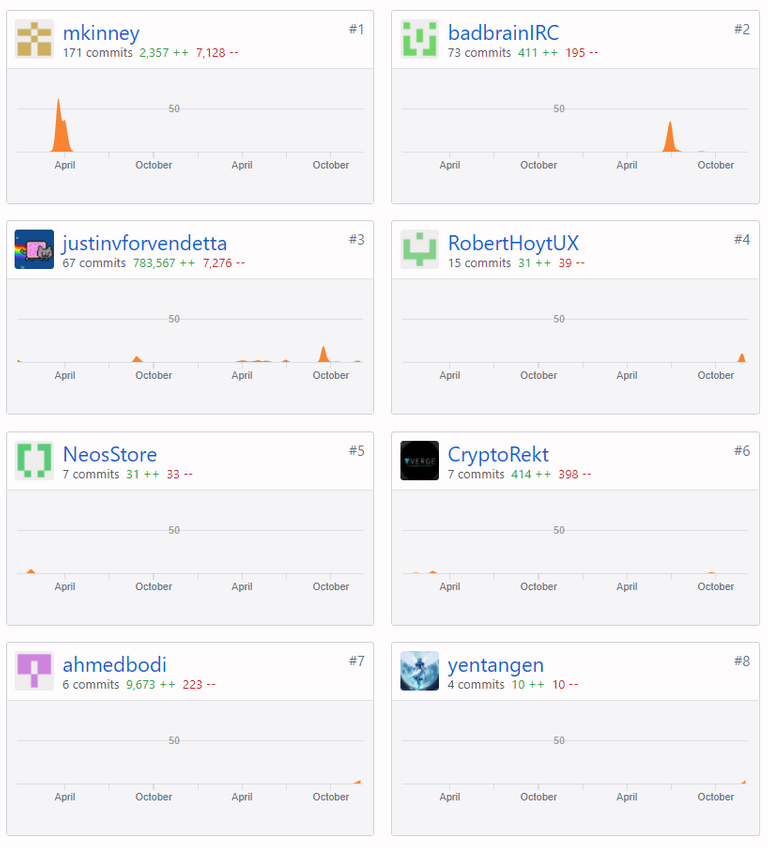

In this category, I take a look at the size of the team working on the project, asses if they are capable of fulfilling their promises, and if they are proud of their work. Verge is a open source project, and, because it is a privacy coin, it makes sense that the people involved want some anonymity, but the size of the team appears to be much smaller than the Verge Blackpaper suggests:

This is apparent when looking at the GitHub repository for the project (where they keep all the Verge code). According to the Blackpaper, there are 28 active developers for Verge. According to the GitHub, being generous, there are about 8:

If you count adding 10 lines of code to a project in a whole year an "active" developer.

Overall, it is clear Verge has a very small group of active developers, who are all anonymous. It is hard to have confidence in the continued development of the project because of this. I gave Verge a 3/10 in this category.

3. Development / Roadmap

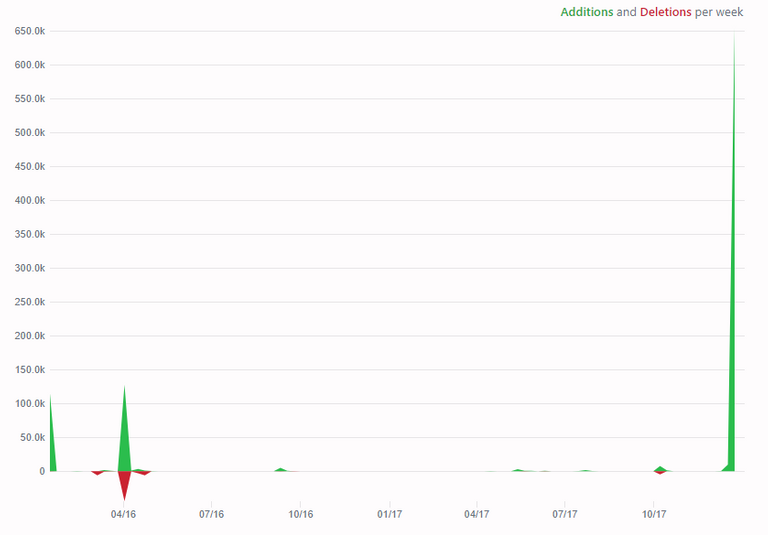

In this category, I try to asses how the team is doing in relation to completing objectives on their roadmap or making progress in the code. As you could see in the last section, not much development has been done in the last year in relation to the Verge project. From my research, it looks like most of the work done in the last year was to release the new Blackpaper to try to breathe life back into the project. If you still have doubts, just look at the image below, which details the code development for the past year. (I think the recent spike is incorrect, but I could not verify that.)

As a side note, it is not supposed to look that scarce. Especially for a project that is supposedly under active development.

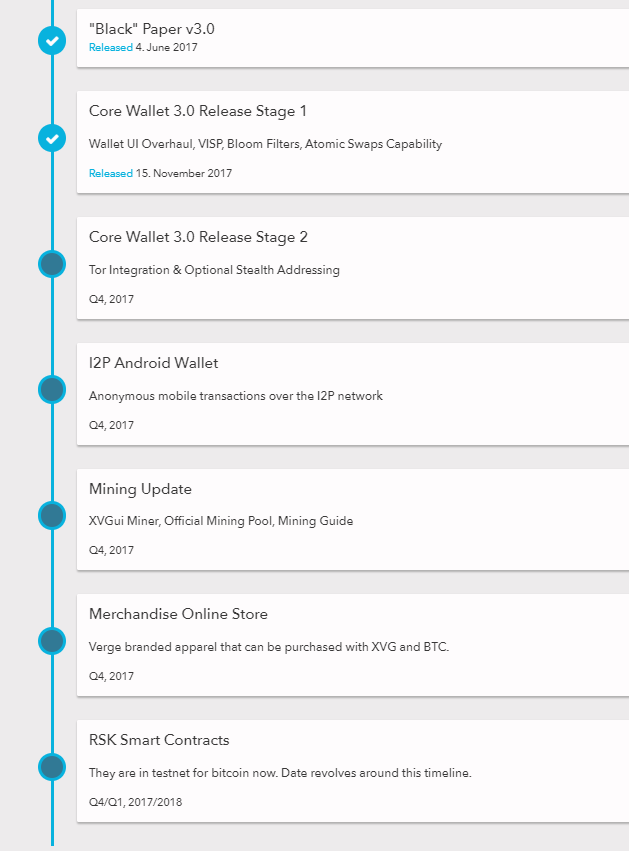

It probably will not surprise you that they are falling behind on the roadmap published on the Verge website:

There are 2 days left in Q4 of 2017, better get coding!

I am not sure why I scored Verge so high in this category, now that I am reviewing it again, but I gave Verge a 4/10 in the development category.

4. Coin Value

In the coin value category, I like to look at how the coin is actually used in the network and the monetary policy surrounding the coin. Verge is a proof of work coin, similar to Bitcoin, but it uses a 5 algorithm system to further reduce centralization of mining power. I cannot speak to the efficacy of this method with regards to reducing centralization, but it is not a novel approach. Many other coins use a similar 5 algorithm proof of work system. There are 16.5 billion, that's right Billion with a B, Verge coins. There is a 0.1 XVG cost per transaction which goes to pay miners. Verge claims a 5-10 second transaction time with a throughput of 100 transactions per second. I am not sure if this is due to the relatively small size of the Verge network, the 5 algorithm proof of work system, or some other technological advantage of Verge, but I doubt it is unique to this coin.

Overall, the amount of Verge coins is massive, but there is a fixed supply. I thought Verge was average in this category, and I gave them a 5/10.

5. Competition

This category is pretty self explanatory. I found a great Steemit article here that details all the different privacy coins and their strengths and weaknesses. I won't go into the details in this article, but it is apparent to me that a lot of projects are trying to tackle the problem of anonymous transactions on the Blockchain.

Because Monero also uses the core Stealth Address technology found in Verge, it is hard to give Verge a great score in this category.

I ended up giving Verge a 4/10 or slightly below average score in the competition category.

6. Price

This is probably going to be the most popular category in this whole review. "Why do the fundamentals of a coin matter when you can get rich off of it anyways?" Smh...

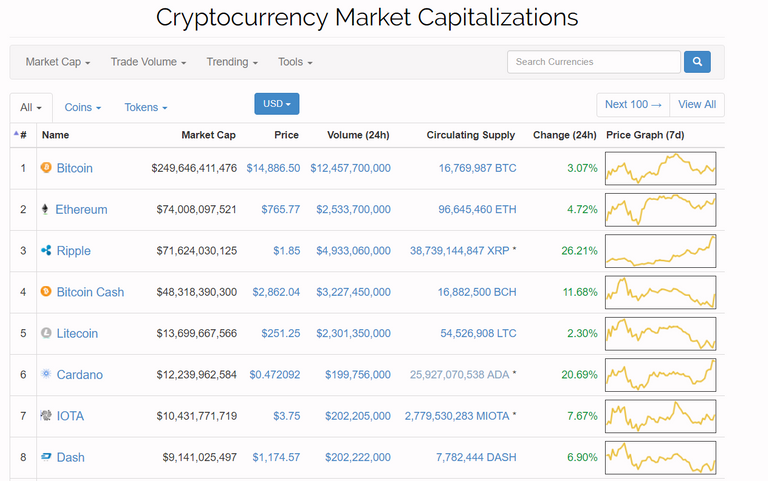

Let us go along with this thinking and try to evaluate the greatest potential price Verge could see. Below is a snapshot of coinmarketcap.com for today.

We can see Dash (another privacy coin) is ranked at #8 with a valuation of just above $9 Billion. Currently, Verge is rank #20 with a valuation of $2.2 Billion. Let's say that Verge became the top privacy coin, and its valuation grew to $10 Billion. This would push Verge just above Dash in terms of market cap. That would be a jump of about 400%, which is not unheard of in the crypto world. Given that Verge's current price is around 15 cents, this would put Verge at 60 cents per coin. This is hardly the next Bitcoin.

Even with all of my doubts about the fundamentals of the project, I know the market is irrational, and Verge could pass Dash in terms of market cap. A 4x return is pretty juicy, so I gave Verge a slightly above average score in the price category 6/10.

7. Community

In this category, I will be assessing the size, knowledge, and mindset of the Verge community. Please don't crucify me!

For my research in this category, I mostly looked at the sub-reddit sizes for this coin.

These are pretty average in the crypto world. Especially for a coin that is being hyped like crazy. The overall knowledge and mindset of a community is very hard to judge, so take this with a grain of salt. But the general feeling I had after reading a few posts in these communities was that people were getting in on this coin to chase profits. This doesn't inspire much confidence in me, personally.

3,300 Subscribers - https://www.reddit.com/r/verge/

29,000 Subscribers - https://www.reddit.com/r/vergecurrency/

Overall, Verge earned a 3/10 in the community category.

8. Reputation

Reputation, or how the larger Blockchain community views this project, is also largely a subjective category. If you do not feel I am being fair, I welcome you to score these categories for yourself. From my experience, the reputation of the Verge project is slightly below average. If you were to ask a random person on Blockchain forums about Verge, they would probably tell you it was over-hyped and that the technology doesn't deliver on the project's promises.

I was sad to find that was the case in my research.

Verge earned a slightly below average 4/10 in the reputation category.

9. Partnerships

It is not uncommon for Blockchain projects under development to not have any partnerships with other companies, as those usually form after the project finishes developing innovative technology. Verge has no meaningful partnerships to speak of, outside of a small list of vendors that accept their currency:

But, I will not hold this against the project too much. Verge earns an average 5/10 in the partnership category.

10. Risk

The final category I consider when looking at investing in a cryptocurrency is the risk profile. To accurately score a coin in this category, you must consider the scope of the project (how hard it will be to complete), competitors, and the talent of the team working on the project. Successfully completing Verge will take significant development, and from the previous sections, it is apparent the development team for Verge is almost non-existent. For this reason, I consider Verge to be above average in terms of its risk. Verge earns a 3/10 in the risk category.

Total Score: 45/100

Usually, I like to invest in projects around the 80+ range. I think it goes without saying 45 significantly falls below my criteria for investing. I hope you found the article helpful, and maybe learned a bit about the Verge project. Always do your due diligence before making any investment!

If you prefer watching my review, or just want to hear my lovely voice, check out my video review here:

Very thorough review; git, etc. I've subscribed to your YouTube.

Thanks!

Great review! @originalworks

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

Hello colleague @crypto-decoded, I hope you feel very well :D. Very good post, I voted for it and resteem. I would like to invite you to follow me on my page @emmanuel250998 where I will be uploading every day the latest news about the world of cryptocurrencies. I also invite you to vote for my last post:

https://steemit.com/bitcoin/@emmanuel250998/bitcoin-price-will-range-from-usd6-500-to-usd22-000-in-2018-according-to-wall-street-analyst

I would very much appreciate your support. A big hug and greetings from Venezuela ;)

Add this post on twitter and you will be crucified... Verge has some investors who already made a lot of money out of it and who are aggressively promoting it.

If their dev would be as productive as their marketing/PR on twitter, this coin would have a future.