BANKllect is a decentralized peer-to-peer bank network.

Its main task is to create an unique and new generation bank ecosystem where each its participant will have a possibility to choose a needed bank service and earn on it.

The key difference from currently presented crypto bank solutions (Bankera, Polybius, Datarius, Crypterium, Change, etc.) is that BANKllect proposes a series of bank-focused services in the way different from what the traditional banks do.

At the heart of BANKllect network is a participant. The participant is an individual or company with or without initial financial capital (fiat money, coins, tokens). Our own technology «Proof of Participation (PoP)» allows the participants to earn money by a degree of its activity in BANKllect network.

THREE WHALES OF BANKllect

Self-regulated Intellectual System (SIS)

At the heart of SIS lies three core principles:

Equal conditions of collaboration between participants of BANKllect network.

Inviolability of participant data.

Transparency of participant activity.

SIS determines a series of rules of participant collaboration. SIS gives an unique possibility for participants of BANKllect network to themselves establish norms and rules during the process of signing (accepting) of a single-side or multi-side smart contract. The participants will be able to themselves track and control as the activity of BANKllect bank as the execution of smart contracts.

Anti Money Laundering System (AMLS)

At the heart of AMLS lies two innovative technologies:

System of analysis of participant activity.

Algorithm of cross-referenced identification.

System of analysis of participant activity is based on an advanced technology of multilayers Rosenblatt perceptron. It allows not to only identify direct actions of participants such as money transfer, debit of participant wallet, credit of participant wallet, loans of any kind, but indirect actions such as relationship to financial bank deals.

Algorithm of cross-referenced identification is based on methodology of directed graph. The algorithm allows to practically identify any participant with minimum initial data about his or her activity.

Client-Guard System (CGS)

At the heart of CGS lies a flexible system of client classification. The system allows each participant of BANKllect network to decide what kind of his or her personal or business information will be public or not. CGS gives an unique possibility for participants of BANKllect network to save their most important information in cryptographic BANKllect bank cell. BANKllect bank proposes an official guarantee of safety of participant cell. Moreover, insurance of cell entry will be included.

BONUS PROGRAMS

The bonus programs are specifically designed for a possibility of its investors to get an access to a variety of BANKllect bank products through a usage of sphere coins.

Bonus Programs Information

The bonus programs are specifically designed for a possibility of its investors to get an access to a variety of BANKllect bank products through a usage of sphere tokens.

There are four bonus programs for pre-ICO, ICO, SCO and TCO, respectfully.

1-2 Days : 10% additional tokens

3-7 Days : 5% additional tokens

8-28 Days : 2.5% additional tokens

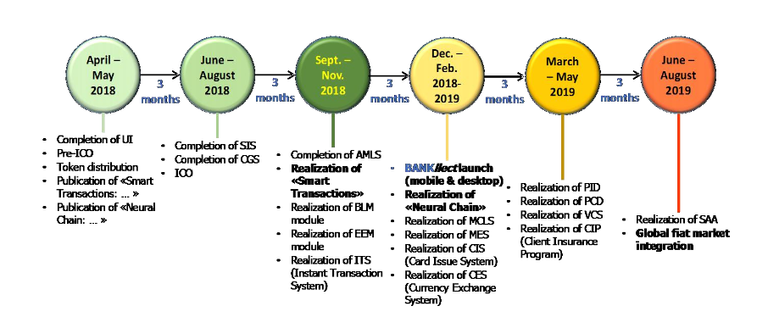

Development roadmap

Visit Website :

https://www.bankllect.com/

White Paper :

https://docs.wixstatic.com/ugd/570870_6692ff2d06f54b4a8f97439650dca001.pdf

Ann Thread :

https://bitcointalk.org/index.php?topic=3196480.0

Facebook :

https://www.facebook.com/bankllect/?modal=admin_todo_tour

Twitter :

https://twitter.com/bankllect

WARNING - The message you received from @davidike is a CONFIRMED SCAM!

DO NOT FOLLOW any instruction and DO NOT CLICK on any link in the comment!

For more information, read this post:

https://steemit.com/steemit/@arcange/phishing-site-reported-postupper-dot-ml

If you find my work to protect you and the community valuable, please consider to upvote this warning or to vote for my witness.