The most popular market for US individuals to purchase EOS tokens has been Bitfinex, but the platform will not support ERC20 tokens for US customers starting August 16th.

The SEC has announced new regulations and guidelines in reference to 'ICO' distribution tokens, which has lead to an even more restrictive cryptocurrency market in the US than before. While EOS tokens are trading on many different exchanges, many individuals feel much safer knowing they are utilizing a platform and exchange that they trust and have faith in. Most of the EOS trading volume has been coming from numerous Chinese exchanges, but many individuals feel much more comfortable on exchanges that are licensed and that they trust. Individuals within the US have been able to purchase tokens outside of the Ethereum distribution contract, but these types of actions make me fear that the ability may change in the future.

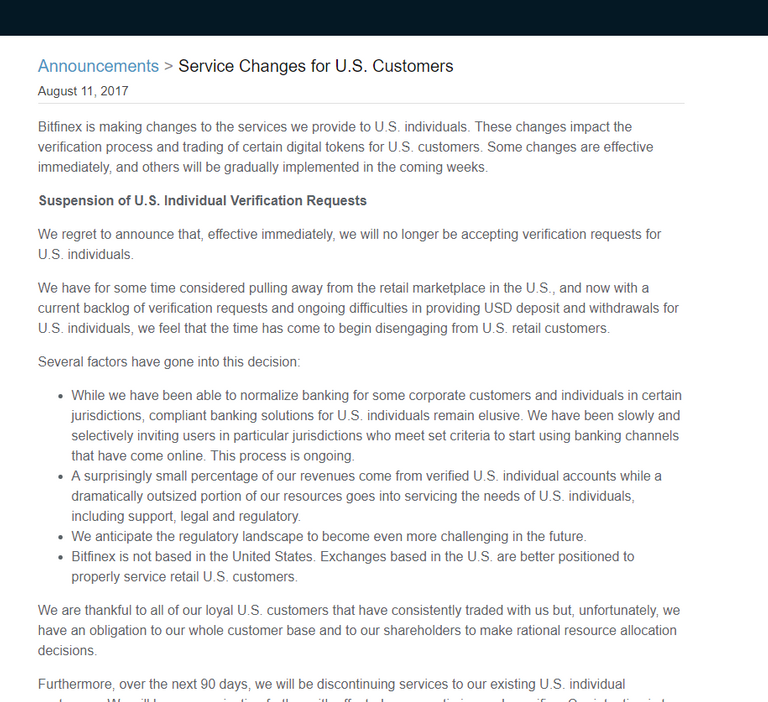

Bitfinex was an initial investor in the EOS project and has an ownership stake in the project, so the platform wouldn't have come to the decision to de-list the ERC tokens unless it was advised to do so. I don't believe that the SEC has put forth any formal or additional regulations, but they did issue a report containing 'suggestions' for businesses and individuals. The SEC claims that their overall goal is to protect individuals from loosing money, but are attempting to do so without realizing the negative effect their actions ultimately have. While it may be harder for me to acquire and trade in EOS in the future without Bitfinex, there is nothing that could stop me from acquiring stake in the project during its early stages.

Why does the decision to de-list EOS make me nervous?

If EOS had any possible option to not remove EOS tokens they would have definitely acted upon it, because of their interest in the success of the project. While EOS doesn't make up all that much volume on Bitfinex compared to many other markets, it served as a portal for individuals within the US to legally and easily acquire stake in the upcoming EOS platform. As more trading activity takes place, the token and project as a whole are much more likely to get more attention and exposure, which is something that Bitfinex would want to promote. While trading volume and activity will likely move rather than disappear, it will still impact US citizen's individuals ability to acquire their stake safely. This is by no way the fault of Bitfinex, as they were simply responding to the pressure likely put on them through these new SEC guidelines. I fear that these guidelines could become more formal and restrictive in the near future, and could impede individuals with in the US the ability to partake in these lucrative distribution contracts.

Bitfinex has been one of the biggest and most popular Bitcoin and cryptocurrency exchanges for some time now, and has likely given many individuals more faith in acquiring stake in the EOS platform. Traditional investors are much more likely to invest in a project that they can acquire stake in from a reputable and licensed exchange, and the decision to remove EOS from Bitfinex will likely make the tokens even more difficult to legally acquire for residents of the US. This post was meant to serve mainly as a PSA, but I intend to write a follow up to this announcement over the following days.

I hope that you enjoyed this post, and I urge you to leave any input, questions, ect. in the comments below! Another post will be going deeper into these issues in the following days, so stay tuned. Thanks for reading!

Link to SEC guidelines: https://www.sec.gov/litigation/investreport/34-81207.pdf

Bitfinex announcement: https://www.bitfinex.com/posts/216

image source:2

Very sad for all concerned.

It's another brick on the road to surfdom.

"Peasants should not hold any kind of property, it's for their own good."