Hi everyone, I'd like to preface this article by saying I'm not an expert, just someone who's made observations in the market that I've seen echoed often. This is my attempt to consolidate those observations for you!

So You Wanna Invest?

Good on you! Cryptocurrency is an exciting new market full of great opportunities and technological innovation. Many believe cryptocurrencies to be the beginnings of Web 3.0 and the future of the decentralized internet.

REALLY?! BRB LET ME MORTGAGE MY HOUSE!!!

Hodl on there, kid. Cryptocurrency is still a very speculative market prone to dramatic price fluctuations. Even as I write this article we've seen Bitcoin move from an all time high in the $2700's to the low 2000's in about 48 hours. As much hype as there is, there's really no telling where the prices will go day to day, much less in the long term. You could buy at a peak and see the value of your investment drop by 50% overnight.

You still didn't convince me why I shouldn't just go all in...

While it may be a safe bet to expect blockchain and smart contract technology to be the underpinnings of the future internet, nobody knows who's going to come out on top, and you'll get a diverse range of opinions based on who you ask. You might be investing in the next Amazon.com, or you might be investing in the next Flooz (Don't remember what Flooz was? neither did I).

OK, Well What do I do, then?

You can break down a conservative crypto strategy in to 3 basic tenants:

1)Don't invest more than you're willing to lose

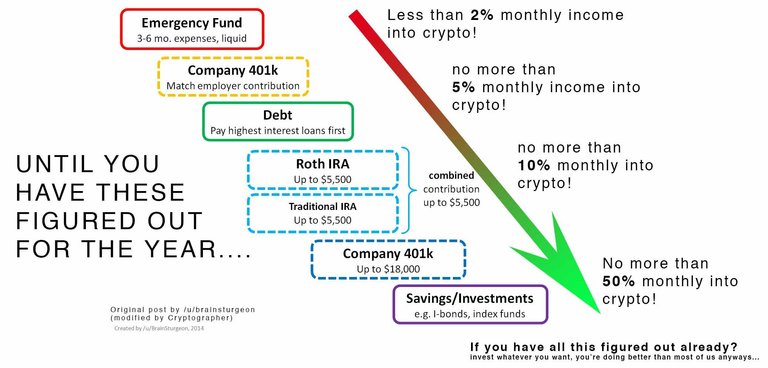

- Nobody knows if your investment is going to the moon or underwater, or somewhere inbetween. Make sure you're financially stable enough to wake up tomorrow and see half of your crypto earnings gone and not bat an eye. See my chart at the bottom of the article for more info on this.

2) HODL. Don't try to play the market. Don't daytrade.

- Read the subreddits and you'll see story after story of people getting burned trying to short or margin trade these currencies. You're not a professional trader, don't act like one. At the very least, wait a year to cash out to take advantage of long term capital gains and avoid the headache of calculating those transactions for taxtime. Also, KEEP YOUR MONEY/COINS OFF THE EXCHANGE.

3) Do your homework. (No, watching 1 youtube video does not count as homework.)

-If you don't believe in the technology you're investing in long-term you're going to get weak hands when the prices undergo their monthly rollercoaster ride. Really understand and research what you're investing in, and don't give in to hype when picking out what you want to invest in.

So Exactly How Much Should I Be Investing If I Want To be Responsible?

Everyone will give you different answers, but for this article, I'm using traditional investment benchmarks to help inform you about how much you should be investing in crypto month to month. Because it's such a volatile market, you're going to want predictable traditional investments to offset the huge losses you may see in crypto. And if you have things like a high interest rate loan, I'm not going to tell you to *not* invest in crypto, but you may want to consider keeping it down to the amount you spend on Starbucks every month until you pay off that loan. -C

Keep posting bud :-) enjoyed reading your analysis

Thanks!

I'm glad you posted this. I've seen many people maxing out cards, liquidating assets, lastly taking out mortgages.

(:

yeah. It's going to make for a lot of sob stories next crash. I just want to inject a bit of common sense into the way people invest in these things.