AChain is actually a project that has been around since 2014, it’s actually older than Ethereum or Neo. It currently has about 80Dapps built on it, which is double that of NEO and its Chinese community is about 2 million people. That’s huge. The reason why AChain is still unknown to many people, is because until the start of 2018, it was purely a Chinese product with a Chinese website and Chinese whitepaper. It only really began marketing itself to the Western world a few months ago. Since then, it’s gained a lot of traction, because of its forking mechanism. You know how Bitcoin forked into Bitcoin Cash and everyone who held Bitcoin received free Bitcoin Cash? Same for Ethereum and Ethereum Classic, everyone who held Ether when it forked received free Ethereum Classic? AChain uses a forking method to scale, and so holders of AChain are potentially set up to receive lots of airdrops from the forks over time. Because of this, AChain is now the favourite platform for many token investors. To find out more about AChain, keep reading this article!

AChain describes itself as “Building a Boundless Blockchain Reality”. To understand what this means, you have to understand the technology of this project, and Il try to describe it for you simply.

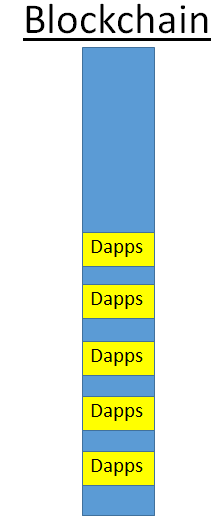

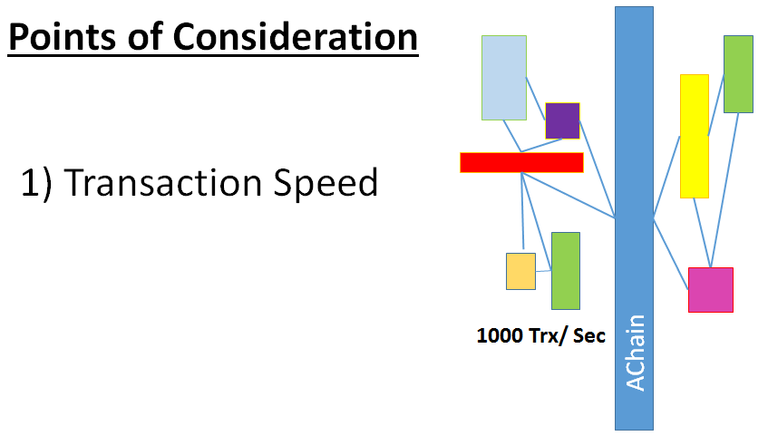

In a classic Blockchain, all Dapps are built on the Blockchain and uses the blockchain’s computational power. A well known example is Ethereum, Ethereum was designed to run at 1000 trx/sec, but because of the number of Dapps built on it, currently it is only running at 13 trx/ sec.

The new popular model a lot of 3rd Generation Blockchains are using is side chains. So each Dapp actually hosts their own mini Blockchain that is linked to the original Blockchain and has similar characteristics e.g. same economy, same consensus algorithm etc..

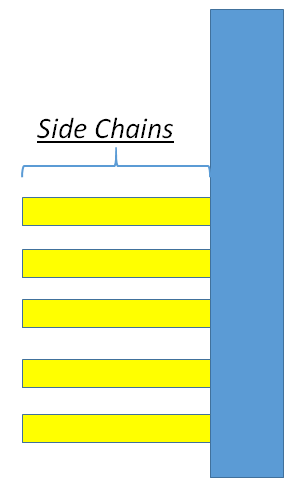

Achain solves scalability not by using side chains but by using hard forks. A hardfork is a new Blockchain that shares the same history as Achain until the point that it is born, and from there, it basically has it’s own technology and is linked to Achain anymore. The advantage of a fork is that it is fully customisable. So for example, a game app might need high transaction speed but can accept low security, so their Blockchain will tailor to that. But a legal firm, will need a high level of security but can accept a lower transaction speed, so their blockchian will look different.

So by providing forks and high customisation, Achain will basically any Dapp to find its home in their network. Strictly speaking, Achain is not a Blockchain platform, but a Blockchain network.

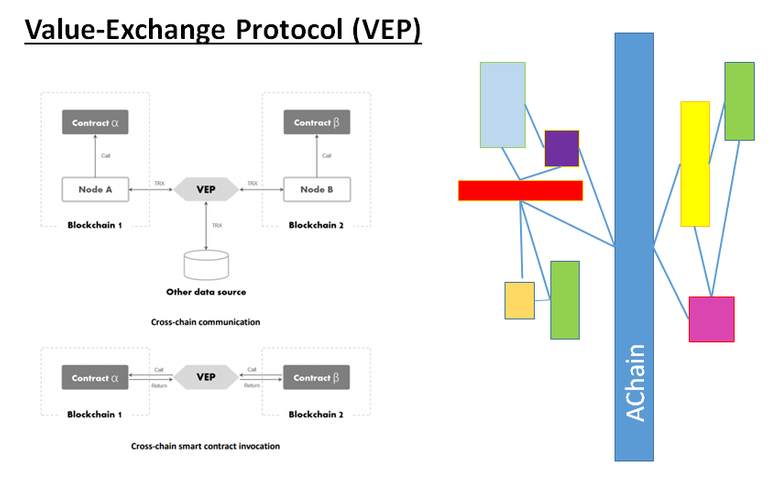

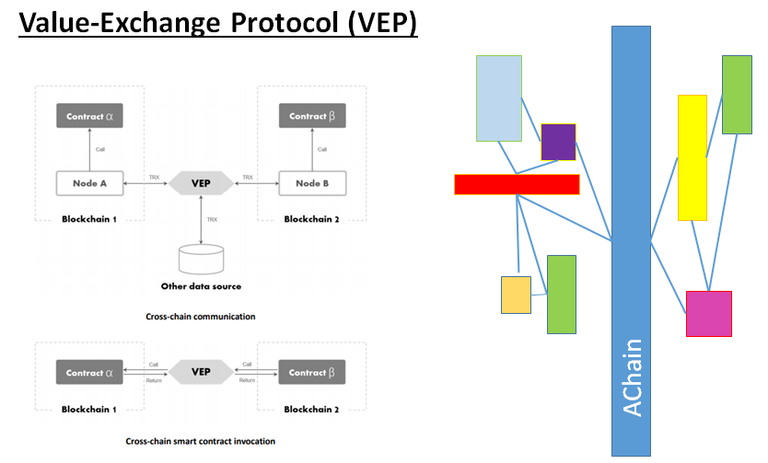

To be a network or a single project, Achain needs to provide some way for the different Blockchains to link with each other. This is done by a technology called the Value-Exchange Protocol or VEP for short. Interoperability is a big issue in Blockchain protocol at the moment, and VEP effectively solves interoperability for Blockchains within the network by providing both Cross-chain communication and Cross-chain smart contract invocation, which means the same smart contract, can run by pulling information from two different chains. E.g. one chain is about borrowing loans and the other is about personal credit. So a smart contract can be set up to automatically grant a loan on one Blockchain when the credit rating hits a certain standard on the second Blockchain.

One thing to point out though, is that when we talk about interoperability in Blockchain, we are usually talking about interoperability between systems e.g. between NEO and ICON etc.. two different ecosystems. VEP only addresses interoperability within the Achain network not outside.

They did mention that they are hoping to embrace non-blockchain data e.g. enterprise databases, but this is not confirmed yet and there has been no mention of an inter-operability solution with other Blockchains that I know of yet.

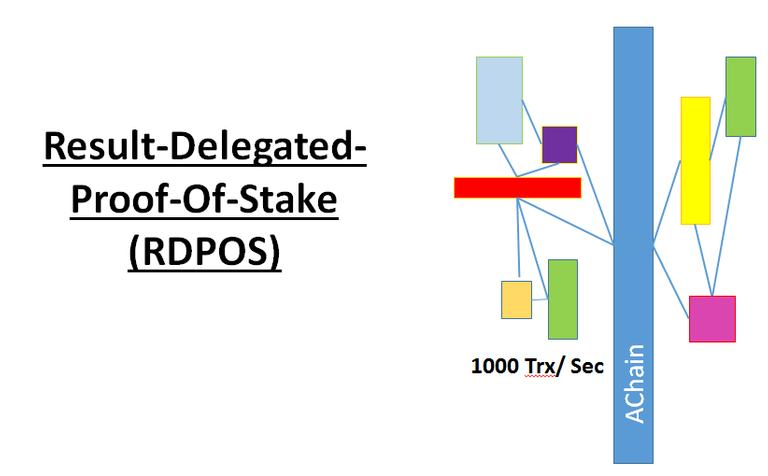

Consensus algorithm is the engine of a project. Just like the engine of the car determines how fast a car can run, the concensus algorithm to a large degree determines how fast a Blockchain can run. Bitcoin uses Proof-of-work (POW) which is the most secure but slowest. Proof-of-Stake (POS) was the next popular mechanism, where you stake your coins to reach concensus, but this allowed monopolisation of the system by big players, so Delegated Proof-Of-Stake (DPOS) was created to introduce voting into POS to ensure fairness.

Achain has designed their own unique concensus algorithm called Result-Delegated-Proof-Of-Stake (RDPOS). Unfortunately their white paper doesn’t explain what is RDPOS, it just describes the benefits of RDPOS which is that it reduces congestion and optimises the process, allowing for a transaction speed of 1000 trx/sec. I’m abit concerned about the transaction speed, and Il explain to you why in a minute.

Just quickly looking at the rest of the tech

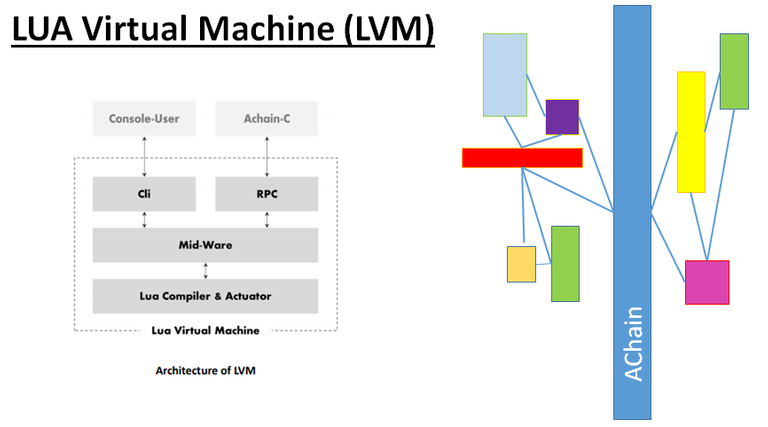

Achain’s initial programming language was Lua. A very common programming, we haven’t seen many Blockchains use it, but it’s a light and simple coding language, which offers flexibility and speed. Their virtual machine is therefore the LUA virtual machine, but it is worth noting that Achain is making it’s technology language agnostic, meaning compatible with many other languages e.g. JAVA, Python, C++, Go, and even Solidity.

Another aspect to promote ease of use is their BAAS (Blockchain as a s Service) which is an incubator to help new developers use their technology. Think of an incubator as lowering the technical expertise required, so that anyone with basic coding knowledge can create a fork on Achain. So that makes it very easy for developers to join the Achain network.

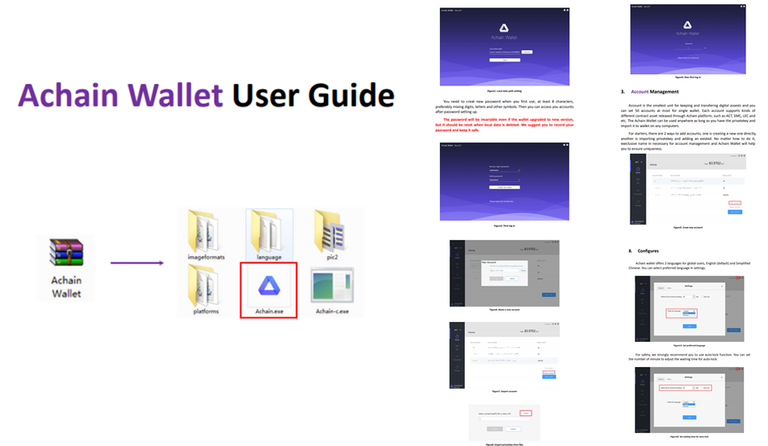

Achain has a great wallet. It’s easy to find on their website and very easy to use as well. It’s a zip file you download and unzip, and it’s ready to use. You don’t even have to install it. There is an entire document that teaches one how to use the wallet, and it is very clear with diagrams. It’s a great document.

Achain has or had a feature called loyalty program, where if you used their wallet or a compatible wallet and locked in to the loyalty program, over time there would be 5 snapshots based on the growing size of the Achain Blockchain and token holders who joined this program would be rewarded with free Achain. The earlier you join, the more you receive because the rewards from each phase is the average amount of Achain you have across all 5 phases. So if you only join in phase 5, your amount staked would be 1/5th than if you had held the same amount from phase 1.

I’m not sure I’m a fan of this, I think it disincentivises new users from joining, because new users would gain so much less that early users. If I was a new investor, why would I want to join a program where I am unfairly disadvantages against early users, and there are other available options out there e.g. projects like VeChain or Neo where the staking rewards are equal for all participants at any point in the history.

Points of consideration

So at this point in the presentation, I just want to mention some points of consideration I think it’s worth thinking about this project

- Transaction speed

Achain was designed back in 2014. If you look at Ethereum which was designed around the same time and only running at 13 trx/sec currently, Achain’s 1000trx/sec back then was mind blowing. But 1000trx/sec these days isn’t that amazing. To give you an idea of numbers, about a year ago, most new Blockchain platforms were targeting 1000-2500 trx/ sec with a bottleneck at 2500trx/sec. That was the magic number that most Blockchain technologies were struggling to overcome. But currently with sharding and other scalability solutions, a few Blockchains are reaching 10k trx/sec and some even more.

Some of you might be thinking, “No Achain can scale to millions of Trx/ sec”. The network of Achain can scale to millions of transactions/ sec. Because the network speed is the total addition of ALL the forks. But as a company building a Dapp, you are not using the whole network, you are only using one Blockchain, one fork. And currently the maximum transaction speed of that one Blockchain is 1000trx/ sec only.

Visa for example runs at 45k-65k trx/sec, Facebook is like a million trx/sec at least, Facebook has 54,000 likes/ sec. So 1000 trx/ sec is definitely not enough for enterprises.

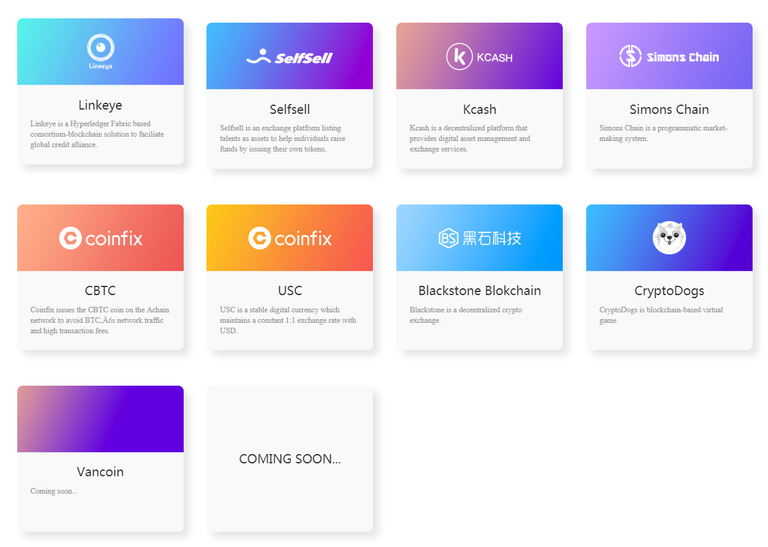

Achain has a lot of Dapps on their platforms, if you look at the Dapps, they are Dapps very similar to the kind of Dapps built on Ethereum. E.g. Ethereum has cryptokitties, Achain has cryptodogs which has a very similar interface. For that kind of purposes, no problem. Achain can handle it easily.

But Achain was actually built for enterprise use, meaning big companies, the VEP, the BAAS, the LUA Virtual Machine, these are technologies designed for big users. But at the moment the transaction speed doesn’t actually support enterprise use.

This is why despite having over 80 Dapps built on their network currently, there is not a single Enterprise Dapp.

However, because Achain is a forking network, if it has to upgrade it’s technology, it’s a lot easier for it to do so than a big platform like Ethereum. But I definitely think the scalability of each forked Blockchain is something that needs to be addressed.

- Token Value and Return of Interest

We always say, as token investors, we are not invested in the success of the company but the success of the token. So share holders own a share of the company and the success of the company means the shares go up. But token holders do not own a share of the company, we only own the currency of the company. And in certain unusual cases e.g. Ripple, the technology of the company doesn’t use the token and so the company becomes successful, but the token price doesn’t rise.

Achain is a forking network, which means the token use of each forked Blockchain is completely unrelated to token use on Achain. So even though they have 80 Dapps currently built with their technology, their token use has not gone up 80 times. There almost a plateau effect on the actual use case or demand of the Achain token because the use of the Achain token is limited to a single chain in the network only.

A lot of investors are thinking Achain token price will shoot up like Ethereum, I don’t think it will, because Ethereum 800 Dapps are all built on Ethereum and so there is Ether use case and thus a high demand for Ether. But none of the fork Blockchains will use Achain tokens. So I think Achain’s token price will rise as the market inflates, but that is market inflation which will apply to every coin on the market, but as investors we want a coin that will inflate more than others, and that additional boost comes from token demand, which comes from use case and I don’t see Achain tokens (ACT) having great escalating demand.

Some people are hoping for more loyalty programs. But there is a limit to how much loyalty programs Achain can do because they can’t indefinitely keep giving free coins away.

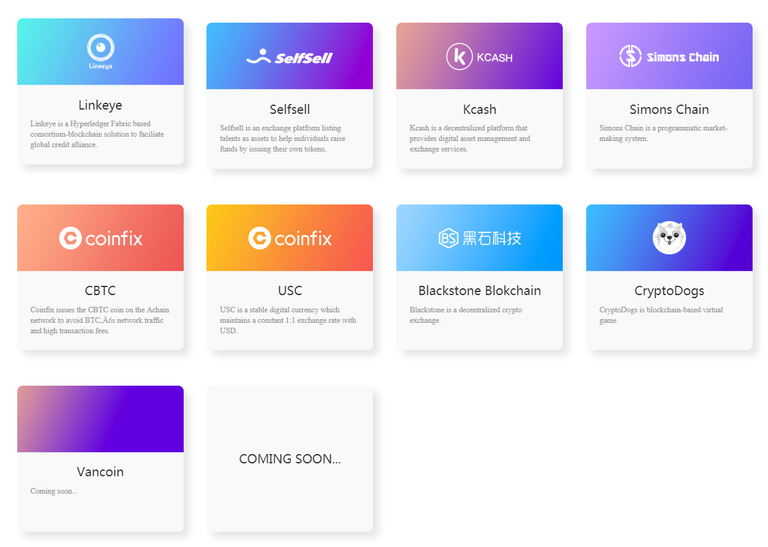

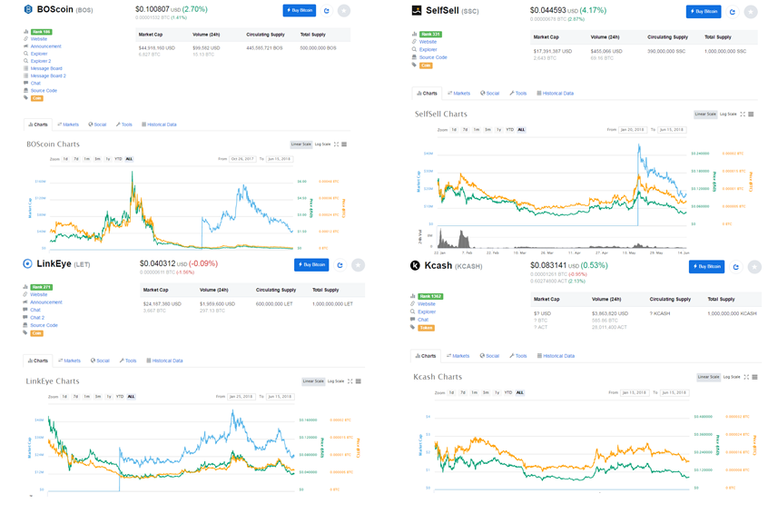

Some people might say the return of interest or ROI for token investors is not in the ACT tokens but in the forked chain airdrops. Yes, you are right. That is the place where you will get the most returns as an investor. Or is it? Unlike Bitcoin fork to Bitcoin Cash or Ethereum fork to Ethereum Classic, you are not guaranteed a drop from the forks. Achain has set it up so that it is optional for forks to drop free coins, and the amount they drop as well is completely variable. I spent two whole days asking around, out of the 85 Dapps they currently have on their platform, how many actually have dropped coins for the token holders. The information isn’t available on their website, and the answers I got were, KCash, Selfsell, Linkeye, BOS, OLC, ABTC (which is now AOA). 6 Dapps only. Maybe there’s more, but I couldn’t get any more names from anyone, even their admins on their social media groups.

Maybe it’s not the quantity of the drops, it’s the quality. E.g. NEO airdropped Ontology, which is a great coin and now worth over $1 billion in marketcap. That’s was worth the wait.

I looked up the 6 coins on Coinmarketcap, 2 of them OLC and ABTC I couldn’t find, KCash didn’t have a marketcap set yet, even though it’s been on the markets since January, so these 3 fork airdrops haven’t given any returns yet, LinkEye, Selfsell and BOScoin where all small marketcaps with BOScoin the highest of $44 million marketcap and the other two less than $25 million. So as a token investor, you have to be aware that when you invest in Achain, the bulk of your returns will not be in Achain but in these Dapps. You decided if it’s worth while or not.

Achain doesn’t quality control the Dapps on their network. It’s very keen to get users and the bar to do a fork is very low, anyone can build on them. So that’s something for token investors to be aware of. Maybe these projects are great, but take a look at a platform like NEO, who has only half the number of Dapps on their platform, but it’s really good projects like Zeepin, Ontology, TheKey, NEX, SwitchNeo and more, and then you decide for yourself whether it’s the same quality of Dapps and project that you want to believe and invest in.

The last point of consideration to mention is again related to the types of Dapps build on Achain is the interoperability use.

- Interoperability use

Achain uses VEP as its interoperability solution and as we pointed out before, it is a very good technology but it is only useful within the network, it cannot be used to connect to other Blockchains. Which means that Dapps on Achain are constrained to work within Achain, unlike other true interoperability platforms like Wanchain, ICON, AION etc..

But more than that, is the types of Dapps to connect with. Other enterprise platfroms e.g. Vechain or SophiaTX are also targeting enterprise, but they have specific technology within each side chain e.g. SAP compatibility technology, that make it very attractive towards Enterprises. Achain’s feature is flexibility, and they don’t offer any enterprise specific technology. It’s a very good but generic technology. Which means that the variety of Dapps built on it will be huge.

So consider this, firstly if I build on Achain, my Dapp is really only interoperable with other Dapps in the Achain network, the quality of those other Dapps are not guaranteed, but more than that, the Dapps may not even be related to my field!

Looking at this list, what do CryptoDogs have in common with Selfsell or Linkeye? Nothing? So they may have the best interoperability technology to communicate with each other, but do they need to use it? There is no reason for them to interact with each other. Now I’m sure some Dapps will want to interact with a few other Dapps in the network, but the degree of interoperability is going to be a lot less than a more intentional ecosystem like Vechain or SophiaTx or NEO or even Tron who is aiming for the entertainment industry.

Team

Achain website has no team member page. This is the first legit Blockchain project I’ve seen that doesn’t have a team member page. There is not information on any of their team members on their website.

From side reading and videos, their CEO is Cui Meng (picture above), who is a very successful young man. He graduated from Beijing University in 2010, and won the title of outstand entrepreneurs at an age younger than 30years old. He’s been in the Blockchain industry since 2013, so really one of the early guys, and he definitely understands the technology.

Unfortunately, we have no information on their website about any of the other team members, advisors, partners etc… in a lifestream I think they did say they currently have over 40 members and growing, so it’s a huge team behind the scenes.

Roadmap

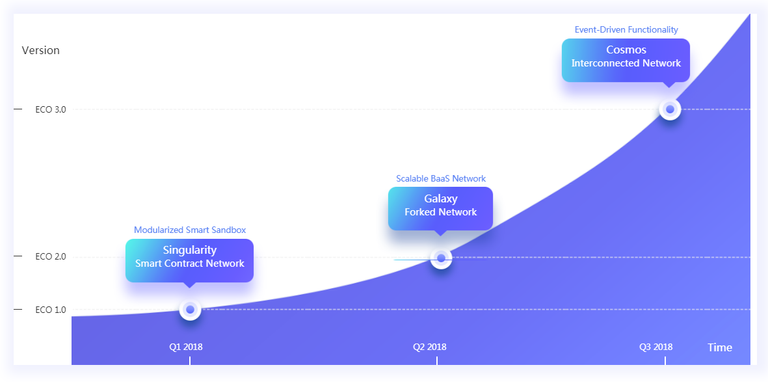

Their roadmap has 3 stages:

i. Singularity, from 2014-2016 (time line according to whitepaper which is very different from website)—which focused on the network’s security and scalability and smart contracts.

ii. Galaxy, from 2016-2017 (time line according to whitepaper which is very different from website)—which focused on building sub-chains for different industry and building on the customisation of the project.

iii. Cosmos, 2017-2018 (time line according to whitepaper which is very different from website)—which is where we are at. And this stage is focusing on Baas and VEP technology. And as mentioned before, they are working on connecting with enterprise databases and other non-blockchain resources.

So unlike many other Blockchain platforms who are in their early phase of development, Achain is actually very far into their development, and in terms of their tech, there is little risk that it will not be developed, because they have already developed it. A lot of other projects, sound good on whitepaper but struggle to produce a working product of the same quality. But Achain has already done what their whitepaper promises.

Conclusion

So that’s Achain guys, I think overall the forking technology is very interesting and has it’s pros, but also some weaknesses. Forking is a great solution for the technology, but not necessarily for setting up an ecosystem or network, or token use or other considerations that I’ve mentioned above. A Blockchain protocol project is definitely more than just the technology, it’s about economy as well, especially for the token investor.

But as I always say, it depends on the team behind the project. No project starts off perfect, but good teams will change and improve and lead the project to success, so I think there’s still a lot of room for Achain to grow and I think it’ll be very interesting to see where the team takes the project in the future.

Let me know what you think of Achain in the comments below. Are you invested in it, why you love it etc..

None of this is professional advice of course, just me sharing my unprofessional thoughts with you. Always do your own homework and make your own decisions.

Thank you so much for joining us. If you found this post helpful or informative, please give us that upvote and follow. Have a lovely start of the weekend and we will catch you guys soon!