Cardano is hailed as one of the smartest projects in the crypto world. Yet when you ask around or even try to read around, few people can really give you a concise overview of what Cardano is really all about, because it’s so complicated. Key words like Daedalus and Oborous and Haskell ring a bell, but what do they really all mean? Today, in this post, we will try to give you the most comprehensive overview of “Everything about Cardano”.

there is a video link at the bottom for those who prefer an audio version

To really understand Cardano, you need to understand 2 aspects of the project, its philosophy and its tech.

We’re gonna take a look first at its Philosophy and a little bit of background:

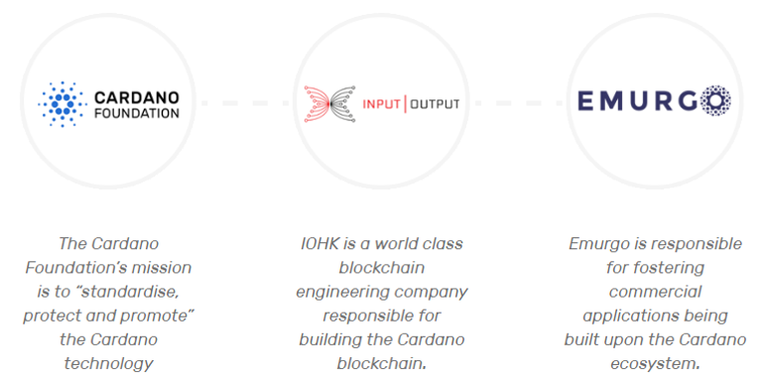

There are three companies behind the Cardano project, Cardano Foundation, IOHK (which stands for input output Hong Kong) and Emurgo.

From the name Cardano, one might have the impression that the Cardano Foundation was the company behind the engineering of the Cardano project. But its actually IOHK who is responsible for the design and development of the Cardano project.

IOHK was founded by Charles Hoskinson who was actually one of the co-founders of Ethereum with Vitalik Buterin (the current CEO of Ethereum) back in the day.

If you ever watched any of Charles Hoskinson’s talks on youtube, he will strike you as a very intelligent man. IOHK team is also very impressive with about a hundred team members all heavy weight academics with many doctorates on board.

Being part of Ethereum’s original founders, Charles Hoskinson saw the weakness in the project as a 2nd gen platform and the need for further development of the blockchain, and so in 2015, he started IOHK together with Jeremy Woods. IOHK is not a name known to many lay token investors, but they are really one of the leading blockchain engineering companies in the world. Besides Cardano, another major blockchain project they engineered which you would recognise is the well known Ethereum Classic.

Towards the end of 2014, there was an initiative by a group of cryptocurrency enthusiasts, investors and entrepreneurs who basically hired IOHK to design and implement Cardano. The Cardano Foundation was then created to standarise, protect and promote the Cardano protocol technology. The last company to join the Triad was Emurgo, a company that focuses on supportingand developing the commercial ventures of their partners.

Having been designed by Charles Hoskinson himself, the philosophy behind Cardano is actually based on the philosophy of IOHK which is based on the principle of “cascading disruption”

Cascading disruption is the idea that most of the structures that form the world’s financial, governance and social systems are inherently unstable and thus minor perturbations can cause a ripple effect that fundamentally reconfigures the entire system.

So what is the cascade ripple effect that Cardano is trying to bring into the market?

The name Cardano comes from Gerolamo Cardano, (the Renaissance era Italian mathematician, physicist, biologist, physician, chemist, astrologer and personal friend of Leonardo da Vinci)

It’s a very fitting name for Cardano because Cardano is the first blockchain project to take a peer reviewed, scientific approach in developing it. Let me explain what that means.

You may not know it, but majority of the blockchain projects currently in existence actually have a large part of their code copied from the original bitcoin code. They use it as the foundation for their coding before modifying it to their needs. And the architecture or structure of what these codes are building are not actually original innovative structures, are also actually modelled after existing commercial systems.

Cardano however, examined and identified the major problems in the field, they then build from scratch an entirely new blockchain with a completely new structure never seen before.

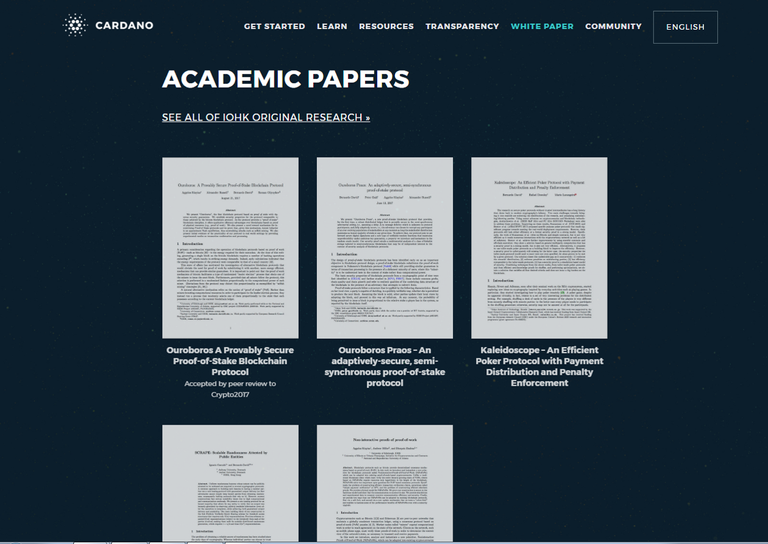

This was designed after a lot of academic research and papers, and you can see this all on their website. And each paper or tech that was proposed by the team, had to undergo peer reviewed by many PHDs and experts in the field before a verdict was given whether or not to use it. So foundationally it has the strongest academic foundation as a blockchain project.

In their own words, Cardano describes their philosophy as “Cardano is a project that began in 2015 as an effort to change the way cryptocurrencies are designed and developed. “

So this is the cascade effect that Cardano brings to the blockchain world. It is designed to be a masterpiece that will introduce the concept that blockchain projects can be built based on due diligence in scientific and mathematical reseach, in fact due deligence should be paid to these matters in the design and development of the project.

If Cardano can outperform it’s peers to prove that its approach is superior then potentially we are looking a game changing approach to how blockchain projects are designed and developed.

Now we are going to take a look at the Technical aspects of Cardano and show you why it is hailed as one of the smartest projects in the crypto space. Unfortunately, because it is one of the smartest projects in the cryptospace, it is one of the most complicated, with many unique features. But I will try my best to explain things to you quickly and painlessly in simple, layman terms.

TECH

To be a successful project, Cardano needs to address and overcome the weaknesses of its predecessor—Ethereum.

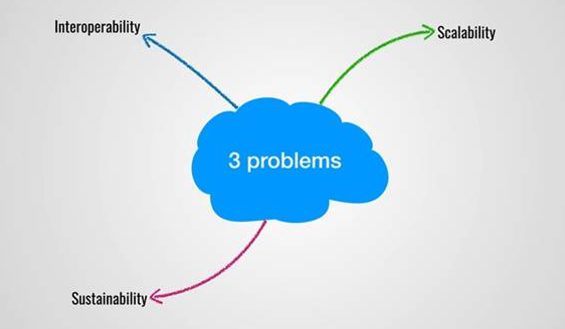

There are basically three difficulties that Etereum faces as Charles Hoskinson himself, as a co-founder of Ethereum identified.

The three difficulties are: Scalability, interoperability and sustainability.

Scalability-- Scalability means speed and data management, and this is what we sometimes think of as transactions per second, but it’s also more than that, it also involves the underlying network supporting those transactions. Think of it like the transactions per second is a reflection of the processor of the system, but the underlying network is the bandwidth that supports the processes. There is also another aspect to scalability that many people neglect and that is data volume. Blockchain is a permanent ledger or storage of information. Which means over time the storage becomes bigger. The bigger the storage or bigger the chain, the longer the time needed for data to travel across it, this slows down the whole system which is what Bitcoin is facing now.

The second problem is Interoperability. Interoperability means its ability to interact with other blockchains as well as world systems e.g. a world financial system like Swift. Without interoperability, a product can have the best tech, but be completely isolated and not able to be used by secular companies. This is actually one of the biggest hurdles why blockchain projects are facing against mass adoption. Even across blockchains, Ethereum can’t communicate easily with bitcoin, and many blockchain projects boast of how fast and how secure they are, but they are not actually able to implement their technology into real life businesses, because they are not compatible across softwares.

Lastly, sustainability asks the question “how do we pay for things”. Blockchain projects especially platform projects are not companies. They try to decentralise as much as possible and minimise costs, and many times, a lot of the funds come from the ICO or initial fundraising stage. After that, it depends on the project taking off and becoming somewhat self-sustainable with open input from the community. But nonetheless, there still needs to be a team behind the project to sustain it, so where does the money come from then? A lot of earlier blockchain projects with poor sustainability solutions are actually facing financial struggles now e.g. paying their staff. As token holders, we don’t want to be in a project in this situation because it would mean then that the team would have to sell their tokens in order to raise money which would mean a token dump and respective token price drop.

Now let’s take a look at how Cardano solves these problems and more.

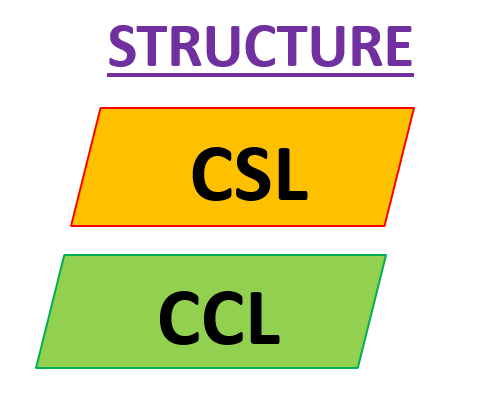

Cardano architecture is developed in two layers.

The first layer is known as the Cardano Settlement Layer or (CSL) and the second layer is known as the Cardano Computation Layer or (CCL).

This duo layer structure affords a lot of flexibility because it allows businesses to tailor the design, privacy, and execution of every smart contract to suit their specific needs.

The first layer, CSL essential is the ledger that records the accounts for all transactions and the second layer CCL is the layer that functions based on the reason why the transactions occurred.

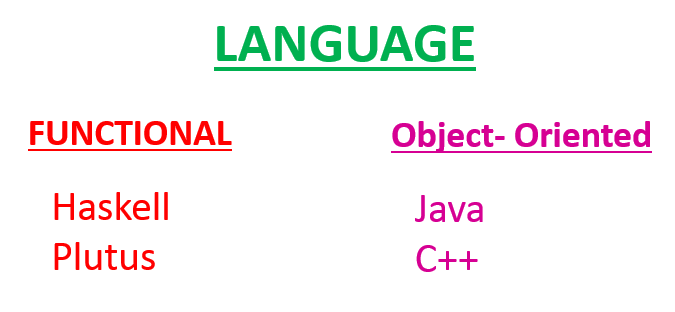

You might be asking why do we need a layer that is based on the reasons for the transactions. The reason is because of the programming language.

There are different groups of programming language, but Haskell belongs to what we call Functional group whilst Java and C++ the most common languages belong to what we call Object-oriented language. Which means, Java and C++ , you write a code and something happens, write a code, something happens. But in functional programming, the process itself is based on why is it happening. So the outcome isn’t straightforward a code and an outcome, it takes into consideration why it needs to happen. E.g. if there’s a lot of transactions happening, there is a chance that there might be a case of overpayment with object oriented programming, but functional programming lowers the risk humongously because it checks the process based on the reason why the value is being moved from one account to another. So in simple terms, it’s a lot more secure than the other languages. The entire Cardano project was written in Haskell and they also invented their own programming language known as Plutus. Basically, Plutus is the Haskell that is tailor made for smart contracts. Because remember Haskell is still a generic programming language, and certain things like computations make it abit harder to use in developing smart contracts, but Plutus is the tailored made version of a functional programming language for smart contracts.

Next is their concensus algorithm.

(As decentralised projects, blockchain projects use the community, you and me as the workers to do the decentralised work. Workers are called miners or stakers or voters etc… based on the system, but essential they are functioning as nodes. The way each blockchain projects uses the nodes, is called its concensus algorithm.)

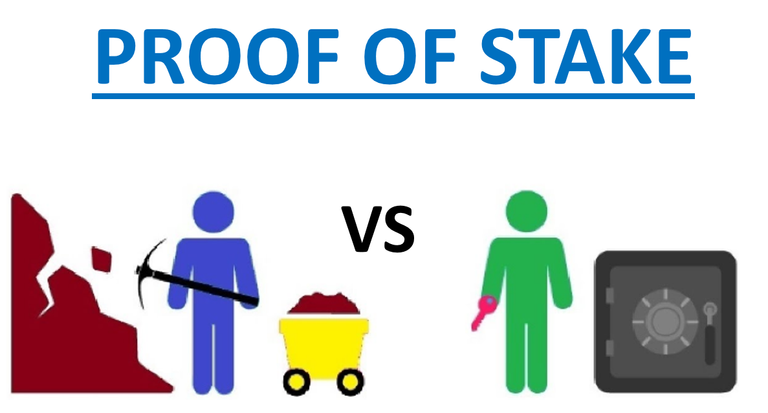

The traditional concensus algorithm was Proof of Work. This is used by Bitcoin and involves raw computing power to process the data. This results in large use of electricity to run the system.

Proof of stake is different. Instead of using the computer power of the nodes, it uses the tokens owned by the nodes to generate a new block on the block chain with a probability proportional to the amount of coins they have. So basically, It’s using a mathematical equation instead of raw computing power to process the data. It is tremendously more cost saving and electricity saving compared to proof of work. Ourorborus was the first proof of stake model invented in the blockchain space by IOHK and Cardano was the first blockchain project to use proof of stake, but since then several other projects have began using proof of stake as well.

Anyone with a positive stake can be a stakeholder, but it the ones who can mint new blocks are called slot leaders. Think of them as the equivalent of masternodes in Bitcoin.

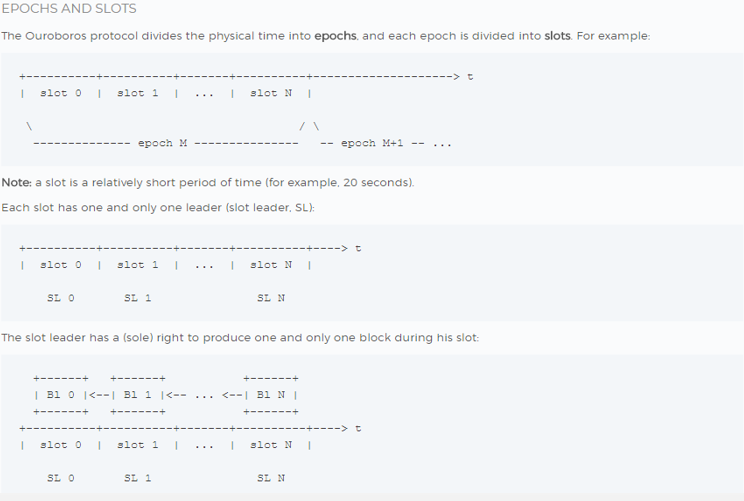

Every project that uses proof of stake differs slightly in terms of the details, e.g. the election process, the slot times etc…. Ouroboros divides the physical time into epochs and each epoch is divided into a fixed number of slots. Each slots represents a new block.

The slot leader is responsible for creating the block. Epochs last for 5 days. Slot leaders are chosen during the previous Epoch. What is important for people who are interested in staking is that an account’s chance of being chose is based on the amount of tokens it’s staking. More tokens, more chance of being chosen. Also each participant needs at least 1% of the total supply of ADA. Given the current market cap is 4.6billion, unless you have 46million to splash around, most of us will have to participate in a staking pool.

Ouroborus is Cardono’s solution to transaction speed. As a concensus solution it has a much faster transaction speed. It is also the only proof of stake at the moment that is provably secure against grinding attacks, nothing-at-stake attacks and long range attacks. This security is a very attractive feature for the platform.

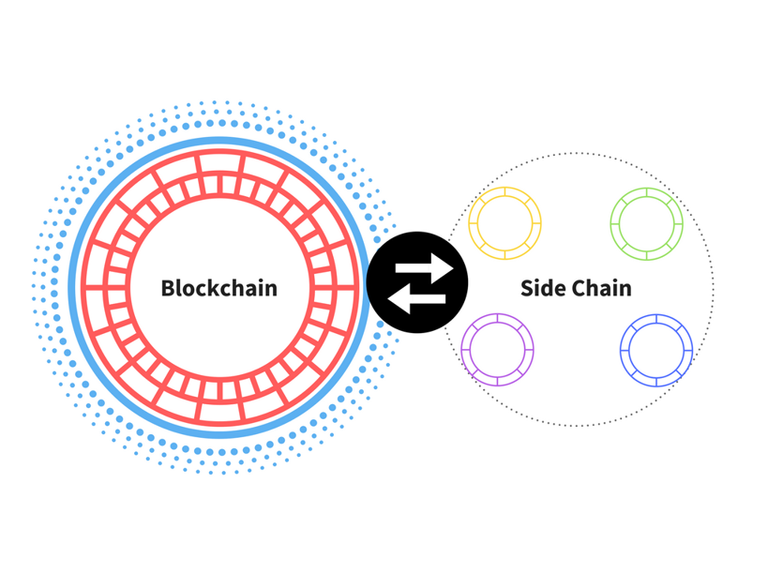

The next feature of Cardano that promotes stability and interoperability is side chains.

Cardano’s actual blockchain model is built in the shape of side chains.

This means that if the platform suffers any problems, the whole blockchain does not have to suffer as the developers can simply remove the malfunctioning sidechain and repair it.

Besides stability, side chains are also part of Cardano’s solution to data scaling. We spoke earlier as the blockchain grows, from mega bytes to gigabytes to terrabytes etc.. the volume is going to increase exponentially and there must be an efficient way to process and store it. In Bitcoin’s architecture, every node processes and stores every piece of information, but this method is not sustainable as the blockchain grows. Cardano employs a mixture of pruning, subscriptions, compression and partitioning to spread different parts of processing and storage amongst different nodes. This allows the system to scale effectively. Side chains are heavily used to achieve this data scaling process.

The main problem with sidechains in general is their security. There are attacks on side chains and even attacks on the main blockchain through side chains. Cardanos changes this by introducing a provably secure side chain technology that fixed all known avenues of attack, which they call Non-interactive Proof of Proof of Work (NIPoPoW). Now this is piece of work in progress, because NiPoPoW was initially desgined back in 2016 for proof of work blockchains. So Cardano has to recreate it to make it a NIpoPos version.

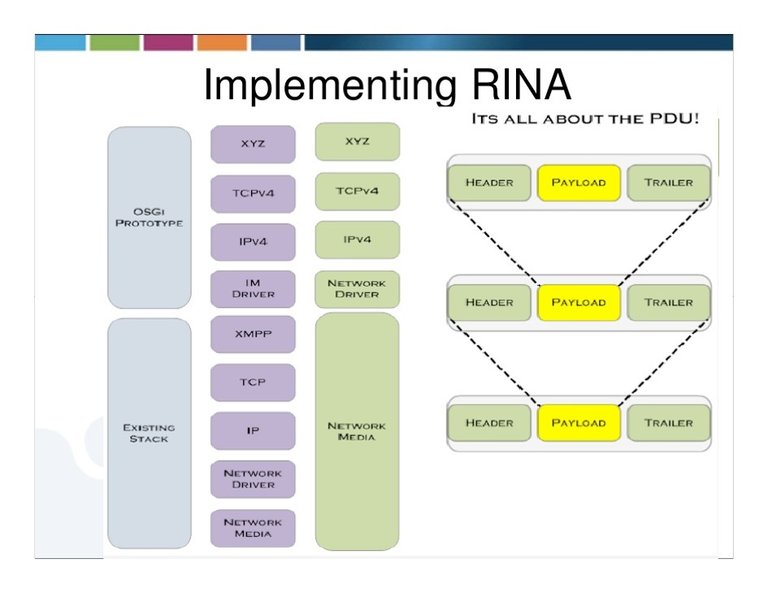

Another piece of Cardano tech that is still in the works in RINA or (Recursive Inter-Network Architecture). This is a new technology created for decentralised systems that solves bandwidth issues by functioning in a heterogenous network rather than a homogenous network. This is only expected to be completed in 2019.

Second last tech of Cardano I want to introduce to you is their Quantum Computing Resistant Solution.

Quantum computers are like super computers that can perform faster calculations and unparalleled processing power. They are one of the main foreseen threats to blockchain, because they can potentially decrypt encrypted codes.

Meaning they could decrypt and blockchain data. This potentially puts the entire blockchain world in danger. Yet very few blockchain projects actually try to address it or put counter measures in place to protect their privacy. This is a huge problem. Cardano is one of the few that does, but more than that, it is also one of the leaders in the Quantum Computing research and will integrate a technology called BLISS-B to add quantum computer resistant signatures to the Cardano System.

Lastly for their tech, Cardano’s project wallet is Daedalus.

But as you can imagine with this project, their wallet is a few more features than the standard wallet.

Daedalus is actually a separate project from Cardano. It is build on Electron which is an open source project maintained by Github that combines both Node and Chrome. Right now the project is specifically for ADA tokens, but in future, other cryptocurrencies like Bitcoin and Ether etc.. can also be hosted on it.

For now, Daedalus is centralised, meaning only the team can build APIs on it, but in future, the plan is to make it open source, so other programmers can also build apps on the wallet. They also try to help make it easy for programmers to build apps by using easy programming language like JAVA and also provide the framework for creating APIs.

For users, the wallet has unlimited accounting and you can manage as many accounts as possible as well as have powerful backup features to recover your funds at any time. Your private keys and spending passwords are also encrypted at a very high level and held only by the user. You can even export a paper certificate, so that’s maximum security as we know now. And they’ll also have hardware wallet compantibility, which is great, but its with Ledger, so booo, if you watch our ledger being hacked video you’ll understand why so many people myself included are moving from Ledger to Trezor. And lastly they will also have multi-signature wallets which are like a shared account you can share with someone else.

Currently without doubt, Daedalus is one of the best crypto wallets in existence.

Ok, finally we finish talking about their tech. If you’ve managed to follow us uptil this point, well done! We don’t have much more to go, so hang in there with me!

Looking quickly at their economics. 2 things:

- Token

The Cardano token is the ADA token, named after Ada Lovelace, a 19th century mathematician recognized as the first computer programmer in the world and daughter of the poet Lord Byron.

And just as we different units in money e.g. dollars and cents, ADA is the larger unit of the currency, but there is actually a smaller unit of the currency known as lovelaces, where 1 ADA is worth 1 million Lovelaces.

Unlike some projects like Ethereum who have cap limit to the total supply, The maximum amount of ADA tokens is capped at 45million.

Every good blockchain project must have good token mechanics. Good tech alone is not enough, because the token price only goes up if the token is being used, so token mechanics are important.

Ada tokens, are used in 6 different ways

i) As a native token in apps on the computation later

ii) As a payment for transactions on the settlement layer

iii) Transaction between users via the wallet

iv) As an exchange currency on crypto market

v) Used for staking in the concensus algorithm

vi) And finally used in the Treasury (which we will explain in just a second)

So as you can see, there, great use case for the token, which is great news for the token investor.

- Treasury

The 3rd problem of Ethereum we spoke about earlier was sustainability—how to sustain the economics of the project. Cardano addresses this problem by creating the Treasury.

The treasury will be endowed with some portion of newly minted ADA as well as all transaction fees.

The funds in the treasury will be used to fund various things like research, development, marketing etc.. The community does get a say in how the funds are spent, the developers will put forward a proposal on how the funds are spent and the community gets to vote on ideas they think are most important. So this deals with the problem of sustainability by ensuring there is an ongoing stream of money to fund innovation and progression.

The last thing to look at for Cardano is their roadmap.

Once again this is not your standard one page roadmap

Cardano’s roadmap’s roadmap has 5 stages, Byron, Shelley, Goguen, Basho and Voltaire. Each of these stages represent a different main feature and have their own roadmap.

Byron phase was their beginning phase, it included the launch of their mainnet, user survey, feedback submission etc… This phase is pretty much completed.

The second phase is Shelley phase which is focused on developing the features that help decentralisation. E.g. Ouroborus, multisignature transactions, networking etc…

A recent Shelley update by their Director of Engineering, Duncan Coutts, announced that they would be focusing Shelley efforts on the wallet updates for now and the platform decentralised features after.

An exciting update on Shelley that has just been announced a few days ago is the launching of stake pool registrations on their testnet. So if you are interested, you can check this out.

The third phase is Goguen and this has to do with designing their virtual machine on the CCL layer and their programming language.

I think there are 2 updates in particular to look out for here one is the launching of the IELE testnet which is expected later this month, and the other istheir virtual machine which is 50% done.

The IELE is a sublayer on their CLL (cardano computation layer), and it hosts the virtual machine. A virtual machine for any blockchain platform, is like a simulator where you can input your smart contracts and see what the final product looks like. It gives potential investors a chance to test Cardano smart contracts and confidence that their project can be launched on Cardano. It makes Cardano potentially very attractive to users who want to swap over from other platforms e.g. Ethereum. In other words, very good for business. And it is expected to take off later this very month.

The last 2 layers, Basho which focuses on performance and Voltaire which focuses on scalability and sustainability e.g. the treasury model, have not been launched yet.

What I really like about their roadmap is that they update it almost monthly and there is a timer that shows how long more until the next update.

They also do regular youtube videos to update the project. It definitely gives the impression of a team that is working very hard and keeping accountable to their community.

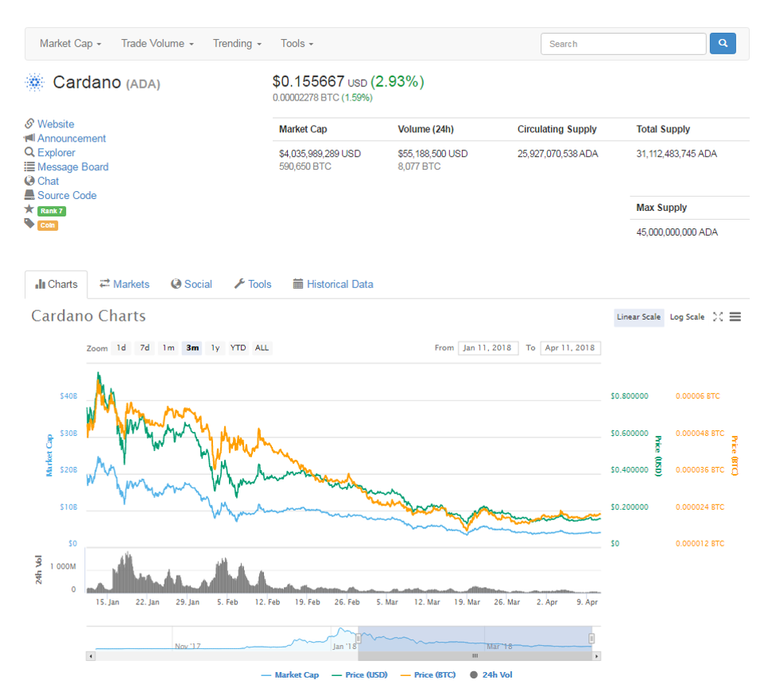

Finally, rounding up by looking at a price prediction

Cardano is now sitting at $0.155 cents. At its peak 4 months ago it was sitting at $1.28, and I remember this time last month thinking to myself, if Cardano drops below $0.23 that’s a great price to buy in. And now because the market has crashed even further, its sitting at $0.155! It’s crazy how cheap this coin is.

Cardano might be the coin that got hit the hardest amongst the top ten. It’s almost 10% of its all time high. That’s 90% drop. The reason I think it got hit so hard, is because this is not a project that hypes itself up. Cardano has never launched major marketing strategies etc… it has always relied on its actual tech to attract potential investors. And when the market started to crash, because it was so quiet and unassuming, it got hit really hard. But when the market starts to pick up which many experts are predicting end of April/ May, and new money comes into the market, I think Cardano will pick up. Because new investors coming in after a crash, are likely to be more cautious and pick projects that have great use-case and tech, rather than the mad altcoin bull-run last year, which was literally people throwing money at every altcoin in FOMO.

I think Cardano is going to have an exciting month, with Gogeun testnet predicted to be released this month. That is one of the reasons why they are in our top 3 coins for the month for April. Feel free to check out our post “Top coins for April” to find out what are the other coins we recommend. But even if that didn’t Gogeun testnet didn’t launch this month, I think as a long term investment, Cardano is a great buy at this price. How often would you get one of the top ten coins at an almost 90% discount?

Lastly, we’ve repeated this so many times, it’s becoming a saying on our channel, but we recommend not just investing in a project or idea, but to investing in the people behind the project. The worst project with the best people will work out, because they will tweak and adapt the project to make it a good product. But the best ideas with the wrong people may not work out. A lot of blockchain ideas are good ideas, but few have really great teams behind them. Cardano has one of the best and biggest teams, it also has working products (mainnet and wallet already launched) and are still working to improve it. A lot of platform projects roadmap ends once mainnet launches, for these guys, mainnet launch was literally the beginning. Consider this, they are already very secure in the top 10 coins and less than half of their features have been released. They got so many other features to release the worth of the project is only going to go up from here. I’m very bullish on Cardano. I think they are going to be a top coin in the market for a very long time, I thinking for myself they are a great HODL, especially with proof of stake coming up.

That’s it guys! That’s everything I know about Cardano. Thank you so much for joining us. I hope you guys found this helpful. If you like this video, make sure to hit that like and subscribe. Leave us a comment and let us know what you think of Cardano! We are building a library of good and reliable coin reviews on this channel, so make sure you follow us to make sure you don’t miss out on any of our reviews.

We’ve also started a Telegram group just 1 day ago. We aren’t a big group yet, but we certainly have good quality and awesome conversations going around. Do check us out if you feel like it.

Ok guys, wont keep you any longer. Have an awesome day wherever you are and we will catch you later!

We are not professionals or financial advisors, the above is purely our personal opinion and not financial advice. Always do your own homework and make your own decisions.

Thanks for the post, it a nice one

MAX SUPPLY 50M I THINK

Cardano is the number 1 coin for me amoungst the top 10 coins.

Cardano will be huge

For me too.

ALOT of people do not know about this project

Can anyone direct me to information about how do we expect staking pools to work for security?

I got a bunch of ADA had them for a long time and I don’t understand everything about it but it does sound very good.

Awesome Infos. Thank you so much!!