There is a video link at the bottom for those who prefer an audio version

Today I would like to introduce to you the token Hydro from the project Hydrogen.

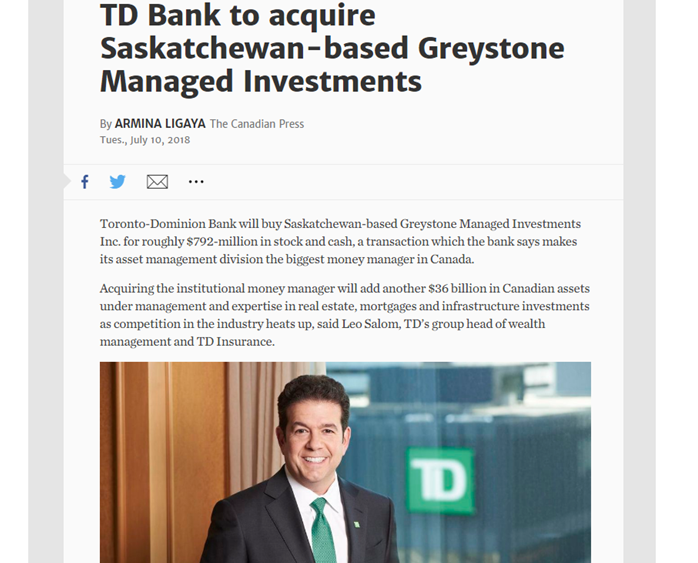

The thing that caught my attention was this article on TD Bank a couple of weeks ago.

This article wasn’t about Hydrogen, it was about TD Bank buying over another financial institution. But in that article, there was one sentence that said

“The bank is partnering with U.S. firm Hydrogen on these products”. That got my attention.

TD bank is the world’s 13th largest bank with an asset value of over 1.2 Trillion dollars. That’s 4x the entire crypto market asset worth. If this piece of news was true, then Hydrogen would have itself a partnership that was worth more than the partnership of EOS, ADA, LTC and TRX combined. It would be as big as Stellar and IBM’s partnership and we all know what that announcement did for Stellar’s token price last year when that was announced. The news of that one partnership literally pushed Stellar into the top 10 cryptocurrencies.

I honestly believe the actual news was a leak. It was not meant to be announced because neither Hydrogen nor TD Bank had made such an announcement. I believe the person writing the article leaked a news that he shouldn’t have.

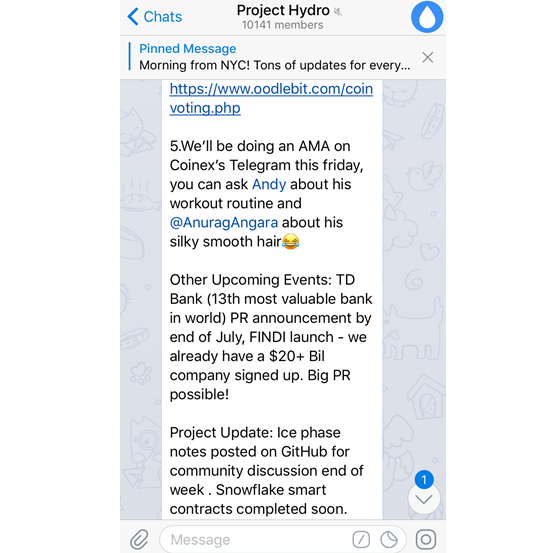

Now sometimes, after a news is leaked, e.g. a partnership announced beforehand or a coin being listed on an exchange beforehand etc.. the result can be devastating and the whole deal could even be called off, simply because the news was leaked unprofessionally. So in this case, I wanted to see what would happen and have been keeping a close eye on the situation. Quite recently, on their Telegram group, the team pinned a message that said

“Other upcoming events: TD Bank PR announcement by end of July, FINDI Launch—we already have a $20+ Bil company signed up. Big PR possible!”

So I believe the TD Bank partnership is legit news and they are possibly getting other big partnerships on board as well. In other words, this project is probably going to get a lot of momentum in the very near future.

25% of all Blockchain projects currently revolve around the financial industry. Hydrogen describes itself as “the FinTech Blockchain”. It’s a rather generic description that makes it hard to know how this project stands out from other financial Blockchain projects.

But Hydrogen is actually a very unique project in the way it approaches the Fintech scene.

Most financial based Blockchain e.g. Ripple, Stellar aim to improve the financial transaction itself. They aim to introduce a cheaper and faster way to do cross-border payments etc… But the difficulty they face is firstly scalability because the Blockchain is primary made for security not speed and secondly they face difficulty of mass adoption because using their technology demands that the financial company e.g. the bank has to make huge adjustments to their current practice to use Blockchain technology.

Hydrogen though is a second layer solution to financial transactions that adds an additional layer of super security and open ledger to all the transactions, after the bank has done it’s thing. In other’s words, it doesn’t interfere at all with how they bank currently runs, it just adds a second layer of security. It’s non-intrusive, easy to adopt, and that’s why banks and other major financial institutions will find it easy to use. It’s providing the benefits of the Blockchain decentralised open ledger, with zero disruption to existing current practices.

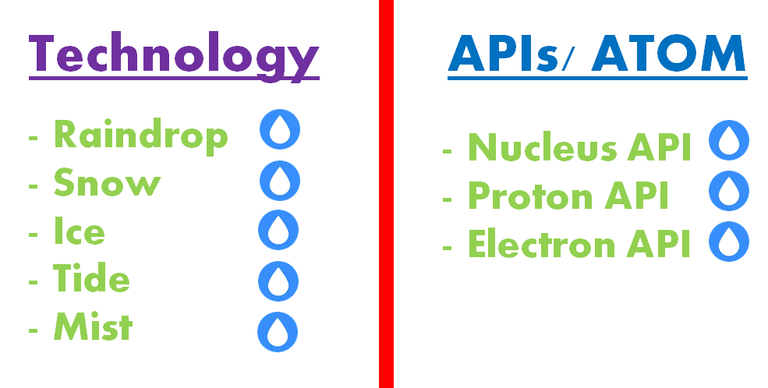

To understand Hydrogen, you need to understand 2 aspects of the project, the Technology and the APIs.

The technology of Hydrogen has 5 core features called Raindrop, Snowflake, Ice, Tide and Mist.

These are the 5 technologies they are bringing to provide the advantages of Blockchain technology to financial institutions.

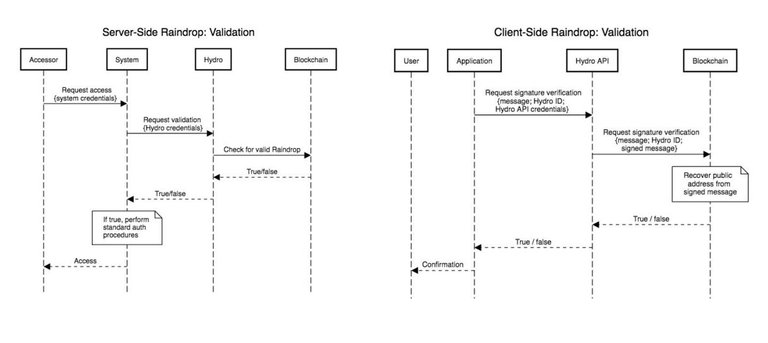

- Raindrop is a protocol that enables single of multi-factor authentication process. This authentication process helps to prevent system breaches and data compromises.

This feature is already up and running.

It’s a rather complicated feature that comprises of both a server side validation and a client side validation. Think of it as validating an account before doing a transaction.

So for example, if I wanted to send a large sum of money to your crypto wallet. What I might do is send a micro-transaction, a small sum to your wallet, initially to confirm the transaction has gone through before sending the larger sum. In a similar but much more complicated way, raindrop does it, but as the name raindrop suggests, the protocol validates very specific transactions that are unpredictable, like the raindrops in a storm. And rather than sending the user and amount directly and having it sent back, Hydro defines a transaction and the user must execute it from a known wallet. This can only be done by having direct access to the wallet in question.

Currently the safest way most people know to do financial transactions, even us using crypto exchanges, is the 2 factor authentication. But as you can see, Raindrop as an authentication feature, has so many additional features, google authentication can’t even compare with it.

I believe security of accounts is paramount, and people are willing to spend to protect their account and their assets. We’ve seen 2FA take off over the last decade, and I think we will see Blockchain authentication solutions like Raindrop take off over the next decade.

The next core feature is Snowflake. This is basically an identity management system. So just as other projects such as Ontology, TheKey or SelfKey uses the immutable untamperable nature of the Blockchain to create identity for individual and institutions, Snowflake does the same to create unique identities for each participant. Unlike ID cards or passports which can be faked, or digital IDs which can be hacked and tampered, Blockchain identities are decentralised, open ledger, meaning they can never be hacked or tampered with, a Blockchain identity is even more accurate and secure than a passport.

So just as every Snowflake in real life is unique and different in pattern from another, this Snowflake technology creates and uses unique digital fingerprints for users.

Both Raindrop and Snowflakes are working products and each have their own whitepaper which is accessible from the Hydrogen website.

The other three technologies Ice, Tide and Mist are not released yet. But Ice will be a service to stamp and record contracts on the Blockchain, Tide will extend payment solutions to the unbanked and Mist aims to integrate AI into this Blockchain project to utilise machine learn and network optimisation.

And that’s the technology of Hydrogen in a nutshell, an impressive technology with a wide array of features that is very practical to the financial industry.

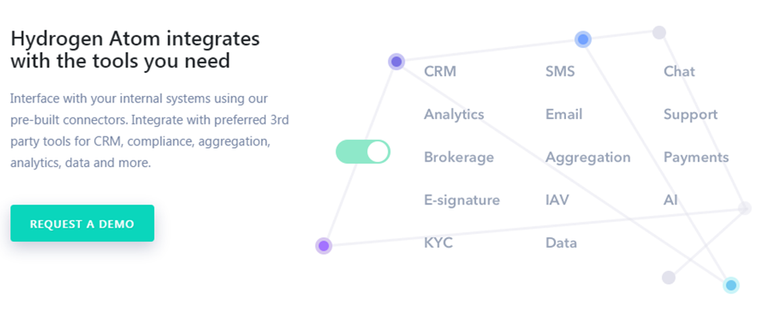

The way that Hydrogen makes this technology usable by the banks and financial institutions, is by creating what is known as the Hydrogen Atom.

The Atom is basically a platform on which API modules are built. APIs are not applications. They are applications for applications. So your mobile phone will have various applications. One of those applications might be Ubereats. Ubereats will have different features e.g. payment service, restaurant menu you can choose the food from, GPS to track the delivery etc.. each of these features, are known as an API.

Hydrogen doesn’t ask banks to discard their existing software and learn a new program. Instead, they create APIs, to integrate into existing software. So again very minimal disruption and a very low barrier to adoption.

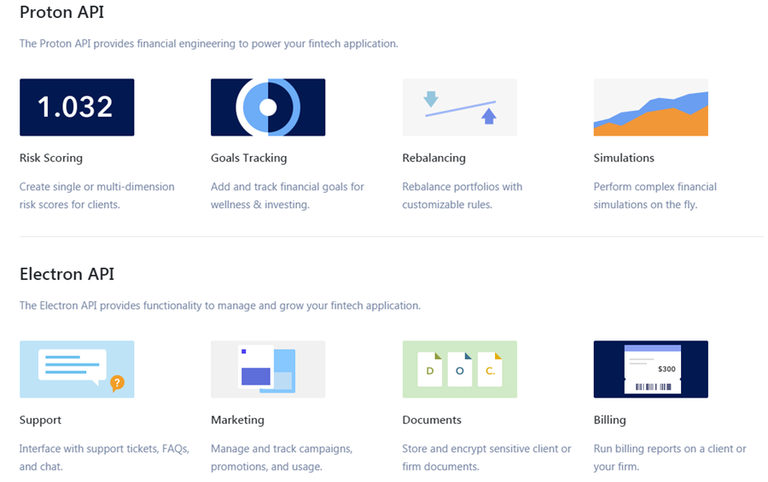

The APIs they are creating include:

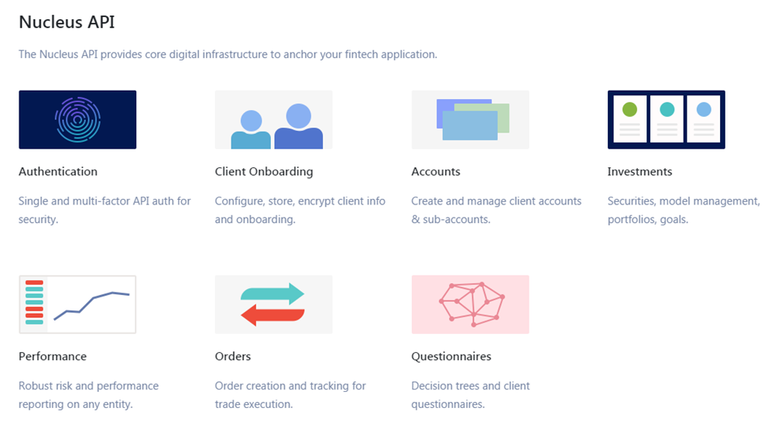

Nucleus APIs—These are APIs that provides the core digital infrastructure to the Fintech Application. They include services such as authentication, storing and encrypting client information, management of client accounts and more…

Proton APIs which provides financial engineering to the Fintech Application e.g. Risk scoring, goals tracking, simulations and more

Electron APIs which provide functionality to grow the Fintech Application e.g. Support, Marketing, Billings etc..

So it’s basically a very holistic platform that covers all the essential needs of a Fintech company.

The entire project is also designed to have a lot of token use, which is great for token demand and price.

Raindrop will use Hydro tokens to pay for authentication attempts, Snowflake will require Hydro Tokens by companies that use the identity data, Ice will use Hydro tokens to pay for the stamping of contracts, Tide and Mist we will have to wait and see as those features are not due until 2019, but they are planned to integrate Token use as well.

The Hydro technology is run by smart contracts, and the easiest way for companies to access these smart contracts is by using the APIs. But should they not wish to install or use the APIs, they can still use the smart contracts, by “staking” Hydro tokens, and what this does is it locks the tokens into an escrow contract that fuels the smart contracts.

So it’s a good project, with good technology and good token use.

This is the team behind the project. One thing I don’t like about their website is there is not resume or links to the resumes for any of their team members. Almost every other website gives a little spill or link to linkedin for the staff. But this profile page only has a few faces and names. You can find their resumes by searching them up individually, but it’s pretty troublesome.

The Co-founders are twin brothers, Michael and Matthew Kane. They previously founded a company called Hedgeable in 2009, which has since won Finovate best of show award in 2015 and 2017 as well as UK great tech awards top Fintech 2015. So it’s good to know they have previous success and experience in the Fintech space. Hedgeable their previous projects has also attracted Venture Capital funding, so I’m hoping Hydrogen will at some point attrack similar VC attention.

For now, their website does not list any advisors, partners or investors. Which is a bit of a downer for me personally, because 25% of all Blockchain projects are focused in the financial industry. That’s about 500 projects. With dominant big projects like Ripple and Stella, it’s going to take more than just a good technology for a project to stand out from the rest. Good advisors and investors do more than give advice and money to the project, they are prominent, successful individuals in the industry who have a personal stake to see the project succeed and many times we’ve seen connections and in-roads to big partnerships happen because of these personal relationships. So I think these are important aspects of any project to consider and it would good of Hydro to update these details when they can.

Of course the upcoming partnership with TD Banks, itself is huge news and that’s an outstanding partnership I expect to have a big impact on this project and it’s standing in the crypto market.

The other thing the project doesn’t have is a clear roadmap for the whole project. This is the roadmap for their Technology, and it’s simple and easy to read. But a project is more than this, it would include plans for marketing milestones, getting the APIs out etc… So whilst we can appreciate the technology of the project is expected to be completed in late 2019, I think the website is lacking a proper roadmap to help provide accountability and expectation to the community.

Only other consideration I have for this project is about scalability.

As we mentioned before, Hydrogen is a second layer security solution to financial transactions. It doesn’t need to have super high throughput, e.g. Ripple, Stellar etc… but it still needs to have a decent throughput if it is to be used by multiple big financial institutions. The way I think of it is like a cashier and book keeper. Ripple and Stellar and the other projects that focus on doing the actual transactions are like cashiers who need to have high speed. The book keeper is the person who processes the record of the transaction after it is done. It doesn’t need to be super fast, but it still needs to be fairly fast in order to keep up with the volume of work.

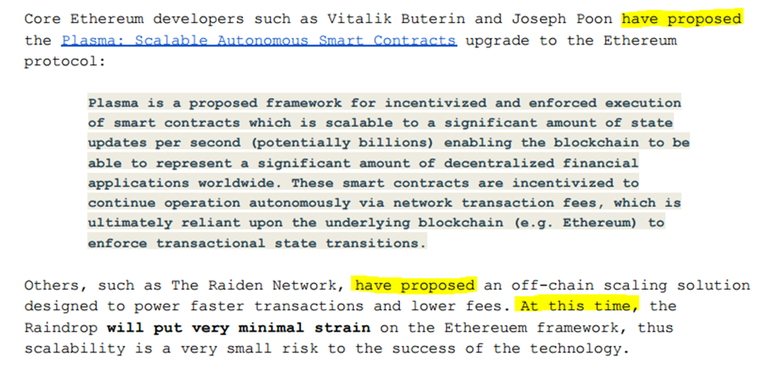

Hydrogen is built on the Ethereum Blockchain which I think is a terrible Blockchain for Dapps at the moment. It’s entire scalability capability is dependent or limited by how scalable Ethereum is. The best they can offer is that Ethereum has proposed to implement Plasma or Raiden. But the thing is Ethereum has been looking at sharding solutions for years, and nothing has been practically achieved yet. It is still very very slow. Look at what happened over the past few weeks, with one exchange Fcoin flooding the network, the entire Ethereum network came to a crawl and gas wars erupted. Price of doing a transaction was ridiculously high and timings for transactions were as slow as 3 hours. Ethereum has not gotten better compared to cryptokitties 8 months ago. It is still very very slow. I also think alot of the practical scaling solutions that I do see workable on Ehtereum are the second layer solutions e.g. Loom, OMG etc.. but these will benefit new projects being built, not so much project that are already built on Ethereum. Just because a new project is able to implement Plasma, doesn’t mean Ethereum can also use Plasma. The difference is that Ethereum has a thousand Dapps built on it and running, to implement any scaling solution to Ethereum is like trying to upgrade a train engine whilst it is running at full speed. It’s incredibly hard. Im not saying it’s impossible, Im just saying it’s very hard. So when projects say in their white paper Vitalik has proposed Plasma or Raiden Network as a scaling solution, I don’t buy it. That’s not enough to put my mind at ease. Il believe when I see it actually working and Ethereum actually having cheap and fast transactions. Until then, any project that is restricted by Ethereum in terms of scalability is not out of the woods.

The other thing they mention is at this time, raindrop will put very minimal strain on the Ethereum framework. That’s fair enough. But the key phases are “at this time.” And “minimal strain”. With a mega partnership coming on board and the other features expected to roll out by end of 2019, at some point this project will be a significant volume on Ethereum. Furthermore, it doesn’t matter if Raindrop doesn’t put much strain on the Ethereum network. What matters is that Raindrops depends on the Ethereum network to function. Which means, even though they put very little strain on the Ethereum network, all you need is one joker like Fcoin to flood and clog the system up for everyone using the system, whether it’s Hydro or you and me doing a simple Ethereum transaction to suffer.

So my concern is not with this project and it’s technology. I think the technology is great. My concern is with Ethereum and how bad the network is at the moment, and the fact that Hydro is working on the network. They are a working product and need to function well now, not in the future when Ethereum can finally scale, but now when Ethereum has not yet scaled, so personally, I think they would be better off moving to an Ethereum compatible platform. That’s just my very unprofessional and layman’s way of looking at things.

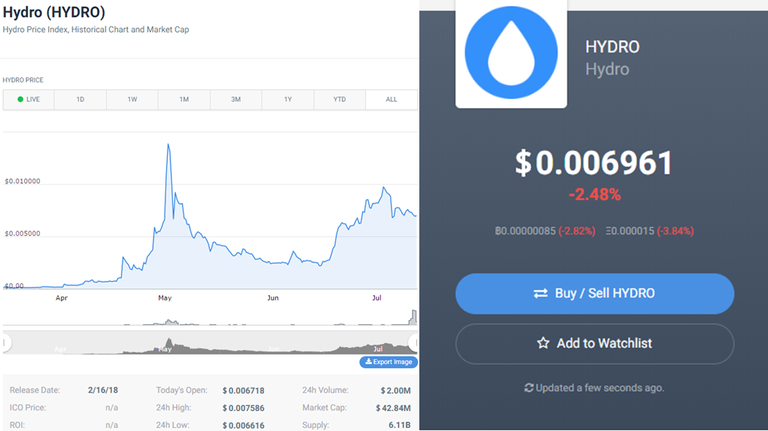

Rounding up with a look at the token price. It’s a fairly new coin that’s just under half of it’s all time high. If you ignore that pump and dump in May, in general, the token price has been rising despite a recent bear market. Many other tokens only saw a recovery much more recently when the market turned green. This coin recovered earlier. This means that people are paying attention to the TD Bank news, but also the investors who know about this project are believing in it and loading up.

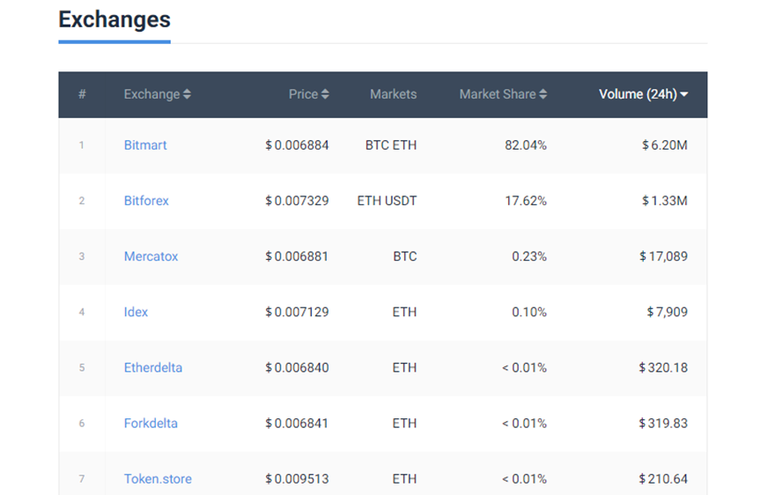

The overall marketcap is very small. It’s only $42.8 million and it’s ranked 282 on CMC. I think this project is undervalued and under-recognised for a number of reasons. Firstly, it’s a big market with about 500 other projects, it’s easy to get lost in the sea of financial Blockchain projects, secondly they didn’t have any notable advisors or investors or partners to help them acvhieve the market penetration, which is about the change with TD Bank partnership coming on board. But also they are only on very small exchanges.

They are not on any major or even medium sized centralised exchanges. As much as we prefer decentralised exchanges, the truth is the centralised exchanges are the ones with trading volume at the moment. So there is no volume for this project yet. On Etherdelta, Hydro token only had a trading volume of $320 in the past 24 hours. It’s 320k, it’s $320 only. I’m picking a small exchange to highlight how small the trading volume on this token currently is. If it even hit a medium sized exchange e.g. Kucoin, the trading volume and price could rise.

So all of this suggests to me that Hydro is a very undervalue coin, with a lot of room to grow. All it needs is a catalyst to catapult it into mainstream attention (which I believe is coming with the TD Bank announcement) and when investors notice this project and take a closer look at its fundamentals, I think they will find this is a solid project and like it.

So personally, I think Hydro is a project worth paying attention to, definitely worth knowing about in the crypto space.

None of this is financial advice, just my personal thoughts on this project. Always do your own homework and make your own decisions.

Drop a comment below, let me know what your thoughts on Hydro is, what do you think about their scalability on Ethereum, do you agree or disagree with what my thoughts. I’m not always right, and I would love to hear your thoughts on this one.

Thank you so much for reading this. If you liked this, hit that upvote and subscribe, we got some other great projects coming up for review, so make sure you follow us for that.

It’s Friday, I hope you guys have a great start to the weekend, enjoy yourselves and catch you guys again very soon!

Congratulations @cryptolite! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @cryptolite! You received a personal award!

Click here to view your Board

Congratulations @cryptolite! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!