Today on the CryptoPig Channel we have some pretty exciting news to cover. Firstly, Bakkt, the cryptocurrency exchange of the New York Stock Exchange (NYSE) owner, Intercontinental Exchange (ICE) has revealed that its much anticipated physically-settled bitcoin futures contracts will go live in July this year. Second up, Germany’s Borse Stuttgart stock exchange has approved the listing of XRP and Litecoin (LTC) on its platform. Thirdly, Microsoft is set to launch its Ion decentralized identity verification solution upon the Bitcoin distributed ledger.

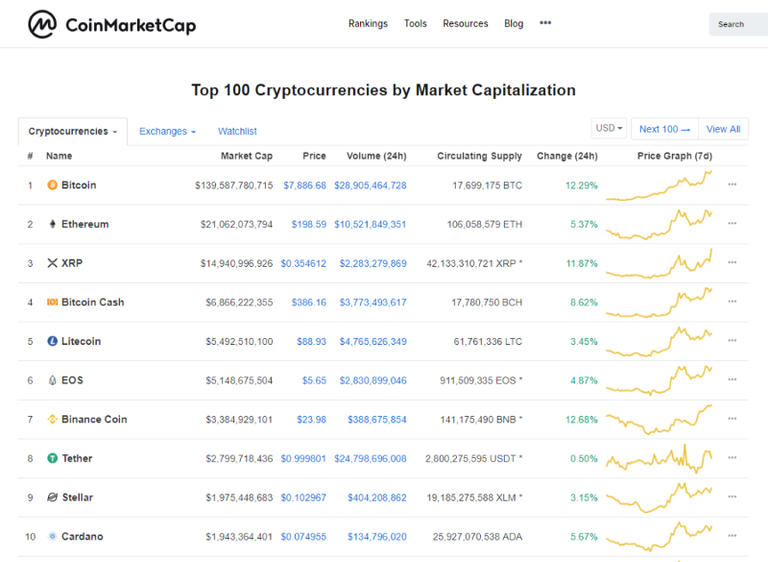

Let’s look at CoinMarketCap to see how the market is performing. And what do we have here guys, very very green and lush market with Bitcoin, XRP, Binance Coin all in double digits. Bitcoin, definitely seen as the flagship cryptocurrency has increased by 12.29 percent. While Ethereum also in the greens has also increased by 5.37 percent. But if we move down to Ripple, we can also see a very very big increase of 11.87 percent. So guys, what’s happening here? This is definitely fantastic news for all us HODLERs. If we look to NewsBTC, analysts believe that Bitcoin is now firmly in Bull Market Territory!!

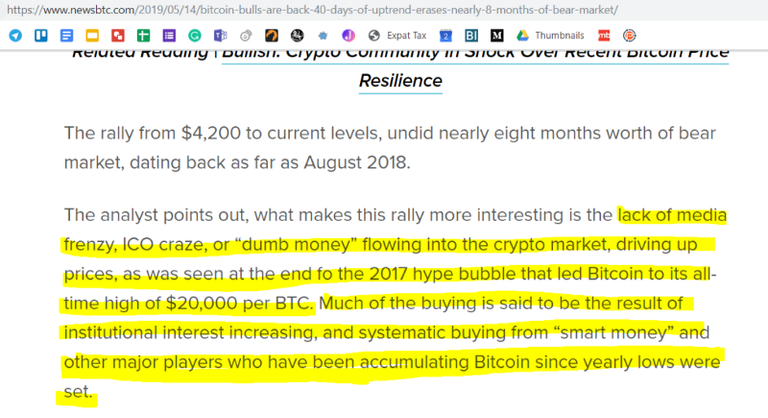

Perhaps $3,200 was Bitcoin’s long-term bottom. As you can see here in the charts, Bitcoin’s price may actually increase to hit the $8,000 mark. The great thing is, as pointed out by Newsbtc, there is “the lack of media frenzy, ICO craze, or dumb money flowing into the crypto market, driving up prices, as was seen at the end of the 2017 hype bubble that led Bitcoin to its all-time high of $20,000 per BTC. Much of the buying is said to be the result of institutional interest increasing, and systematic buying from smart money and other major players who have been accumulating Bitcoin since yearly lows were set. What did I say just yesterday guys — Bitcoin adoption is definitely coming!

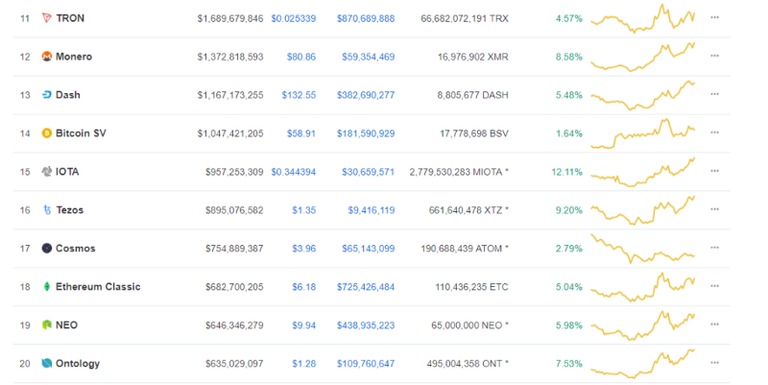

Now if we scroll down to the top 20, we can see a similar trend appearing. Everyone is in the greens — We’ve got IOTA even shooting up to 12.11 percent and Tezos almost at the double-digit mark on 9.20 percent. So I know I’ve spent a bit longer on this segment today, but the bull run definitely calls for some celebration and some questions. Mike Novogratz and Fundstrat’s Tom Lee believe that Bitcoin will achieve a significantly high price in 2019, believing that major contribution from institutional investors will be the primary reason for Bitcoin and the markets price increases. So I just want you guys to think about that, whether you think that’s actually going to happen, and what potentially truly exciting times it is ahead!

Now guys, let’s get straight on the news! According to a report by Cryptoslate, Bakkt, the cryptocurrency exchange established by the parent company of the New York Stock Exchange (NYSE), has announced that its physically-settled bitcoin futures contracts will go live on a federally regulated futures exchange later in July. Bakkt says it plans to list two bitcoin futures contracts: a daily settlement bitcoin future, which allows investors to transact in a same-day market, and a monthly bitcoin futures contract that allows traders to trade across several months.

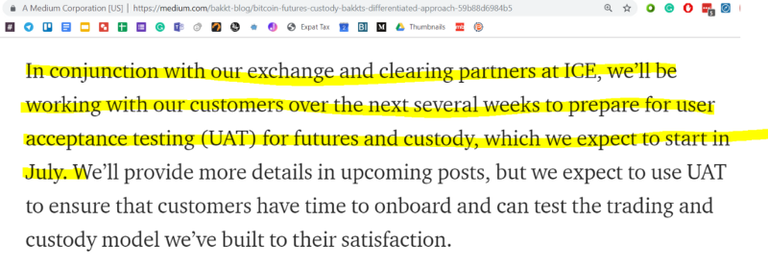

“In conjunction with our exchange and clearing partners at ICE, we’ll be working with our customers over the next several weeks to prepare for user acceptance testing (UAT) for futures and custody, which we expect to start in July,” declared the Bakkt team. Now, what does this mean for bitcoin and the entire crypto markets? Unlike the CME and CBOE bitcoin futures contracts, Bakkt’s futures will be settled in real bitcoin instead of cash. Therefore, the trades on Bakkt will have a huge effect on the price of the flagship cryptocurrency, since it interacts with bitcoin’s supply and demand. Interestingly, Bakkt has made it clear that it will “contribute $35 million into the clearinghouse risk waterfall,” in a bid to align its interest with those of investors, thereby boosting their confidence in the project.

Now, onto the second news item for today! Per a report by CCN, Borse Stuttgart, Germany’s second largest stock exchange and the ninth biggest in Europe, has greenlighted the listing of litecoin and XRP exchange-traded notes (ETNs) on its platform. Now, what does this mean for litecoin (LTC) and XRP? Just like exchange-traded funds (ETFs), ETNs function as regulated, transparent, and protected financial vehicles that enable investors to bet on various assets. In essence, the launch of cryptocurrency-backed ETNs on Borse Stuttgart could potentially increase the liquidity of the altcoins for institutional investors. “For the first time in Germany, investors can now buy and sell exchange-traded notes (ETNs) based on the cryptocurrencies, Litecoin and XRP. The four securities issued by XBT Provider in Sweden track the price of the two cryptocurrencies in relation to the euro and the Swedish krona” declared Borse Stuttgart.

Now, onto the third news item for today! Per a report by Coindesk, global tech giants, Microsoft have adopted the bitcoin blockchain for the creation of Ion, a decentralized, open source project that focuses on identity management. Reportedly, the Bitcoin-powered Ion project is aimed at improving communication between different networks. These days it is now possible for people to use their login credentials for Facebook to sign in on other sites, thanks to special identity protocols. In the same vein, Ion functions as a decentralized identifier that enables people to prove their identities.

At current, the Ion solution is in Bitcoin’s testnet, however, sources close to the matter have hinted that the project will go live on the Bitcoin mainnet shortly, making it possible for interested Bitcoin node operators to contribute to the project. “To have Microsoft say they are not scared of bitcoin, and in fact, it has some very good properties and we are willing to take advantage of those properties, is, I think, a step in the right direction,” said Christopher Allen, the co-founder of the World Wide Web Consortium (W3C) for decentralized Identity (DID) solutions.

So guys, there’s a lot going on but once again, I want to know what you think about everything. Are you confident about Bakkt’s bitcoin futures contracts? Do you think that it will affect the price of Bitcoin positively? What are your thoughts about the new Litecoin and XRP ETNs by Borse Stuttgart? And how do you see Microsoft’s Bitcoin-powered decentralized identity management project? Let me know what you guys think just down the comments below. If you liked the content please subscribe and watch our latest videos. It’s Cindy with CryptoPig, Catch you guys around!

Please join us at our Telegram Group and follow us.

Disclaimer: Cryptopig content is written by a team of blockchain passionate people. We are not registered as investment advisors. Don’t take the information in this post as investment advice and make sure you do your own research before investing. Cryptocurrencies are a very risky investment, never invest more money than you can afford to lose.