It's never too early to learn the lingo!

New to the cryptocurrency world? Wondering what all the different phrases and acronyms mean? Does it feel like you're trying to read a foreign language? If your answer was yes to any of these, then this is the guide for you. Enjoy this A to Z list of the most common lingo used in the cryptosphere.

A is for ATH

This is an acronym that means 'All Time High', which is the maximum price achieved by a cryptocurrency since it hit the markets. For example, 'The ATH of Bitcoin is over $20,000, but I reckon it will hit a new ATH later this year'

Bonus A - Averaging Down

This is a method used by investors to reduce the average price paid for a cryptocurrency which requires them to take additional positions if a price drops, therefore lowering the average price paid. A risky strategy, but can be beneficial if you believe the price is due for a rebound.

B is for Buy the Dip

A common phrase when investing, the practice of buying a cryptocurrency after it experiences a drop in price. For example, 'Bitcoin has dropped by 10% in the last 24 hours, I think it might be time to buy the dip'

Bonus B - Bitcoin

The grand-daddy of cryptocurrency, the O.G., the No. 1 cryptocurrency that still commands well over 40% market share.

C is for Cold Storage (AKA Cold Wallets)

These are places to store your digital assets if you are planning to keep them for a length of time and not trade them immediately. Can be in the form of hardware wallets, paper wallets, desktop wallets or even a USB drive. All have their advantages and disadvantages, but have the common trait of keeping your private keys offline, and therefore (theoretically) a safer place to store your cryptocurrencies. One established and popular hardware wallet is Trezor, available via the following link https://trezor.io/

D is for DYOR

DYOR stands for 'Do Your Own Research', a common phrase used whenever most YouTubers or Bloggers are talking about a particular coin to avoid being classified as a financial advisor, and subsequently the legal responsibilities that follow. For example, 'This is a great coin and I think it will go up by 25% in the next month, however this is not financial advice and you should always DYOR'

More importantly, you should always do your own research before investing anyway, never just rely on the word of your favourite blogger. It's your money you're risking.

Bonus D - Dumping

Generally happens when there is a drop in the market, and more and more investors start to sell off (dump) coins as panic sets in.

E is for Exchange

Anywhere you are able to buy and sell your cryptocurrency, either against other cryptocurrencies or traditional fiat. The pros and cons of each exchange vary, and most traders will have accounts on multiple exchanges. Fees, liquidity, coin availability, locational legal restrictions, and level of KYC required are just some of the considerations when selecting which exchanges to register on. Find some basic comparisons of various exchanges on this website https://www.bestbitcoinexchange.io/

F is for FOMO

This is the 'Fear Of Missing Out', an emotional reaction to a rising price and the feeling that if you don't make your purchase quick (no matter how much the price has already risen), then you will miss out on an opportunity to make money. One of the many reasons why emotions should always be kept in check when investing. FOMO can cause prices to rise sharply as investors with FOMO force the price to move too fast too quickly. It is one of the reasons that many people believe saw the cryptocurrency markets jump up sharply at the end of 2017/beginning of 2018, and therefore inadvertently caused the subsequent drop.

Bonus F - FUD

'Fear, Uncertainty, Doubt' is basically FOMO in reverse, a negative emotional reaction to market movements. FUD can accelerate and exaggerate downward market trends as investors look to cut their losses, with no other reason than they panicked when the market started dropping. A FUDster is someone who spreads FUD, and they are as welcome in the industry as the word sounds.

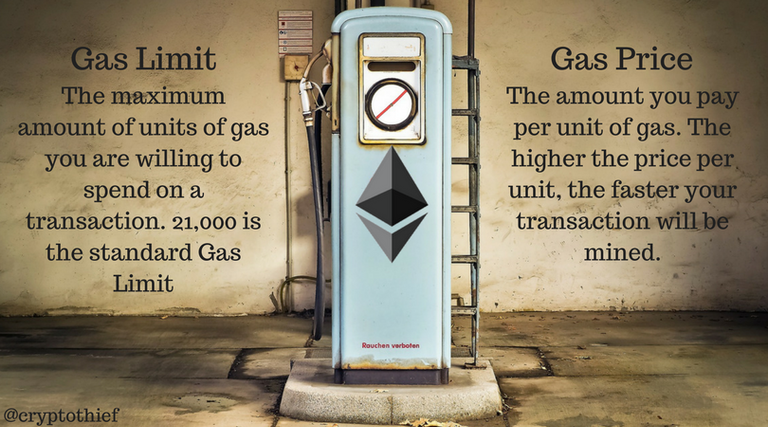

G is for Gas

This is basically the fees paid for transactions on the Ethereum network, paid to the miners in ETH for the computation. It is broken down into Gwei, and set by the transaction creator selecting their Gas Limit and Gas Price. The total cost of the transaction will be the Gas Price multiplied by the Gas Limit. Miners prioritise transactions by the amount of Gas they will earn, so generally it is beneficial to set a higher price, although this is not always necessary. An approximate guide on how much gas to use for a transaction at any particular time can be found at https://ethgasstation.info/

H is for HODL

Seen on virtually every cryptocurrency site in existence, this simply means holding for the long term. Not for day traders or swing traders, these are investors in for the long haul. There is a theory that HOLD became HODL after a drunken poster on Bitcointalk misspelled it (https://bitcointalk.org/index.php?topic=375643.0), others say it means 'Hold On for Dear Life'. Either way, the result is the same.

I is for ICO

These have grown massively in popularity over the last 12 months, with new ICOs cropping up across all industries throughout the world. It stands for 'Initial Coin Offering', and those with a passing knowledge of traditional stock trading will notice the similarity to IPO (Initial Public Offering). ICOs are when a company is creating a new cryptocurrency and wants to raise funds by selling it to the public. A risky form of investment, as you will be investing in the very early stages of a company, but can bring huge rewards to investors in the right ICO. There are many websites offering reviews where potential investors can do their research, one such example is https://icobench.com/

J is for J Curve

Without getting too technical, this is when a cryptocurrency experiences an initial wave of support driving the price upwards, followed by a drop in price due to varying factors such as investors cashing in on profits, project roadblocks and delays, initial interest waning from lack of updates on progress etc. This is then followed, generally over a longer period of time, by another upward curve as the project hits key points in a roadmap and investment flows back in creating an increasingly steep rise. It is called a J Curve as, hopefully, the price doesn't actually bottom out, and is kept in play by project supporters, consequently creating a J(ish) pattern on trading charts.

K is for KYC

This is a long standing requirement in traditional trading markets, and is becoming more and more necessary for cryptocurrencies. 'Know Your Client' is a legal requirement by companies who need to be able to provide evidence that their investors are who they say they are and therefore comply with national legal requirements. ICOs will generally require some form of KYC, although most still only request very basic KYC depending on the level of investment. This can be a passport copy, proof of address, a verified telephone number or a number of other identification options.

L is for Lambo

Lambo, short for Lamborghini, a word that indicates a status of wealth. Cryptocurrency investors have adopted it when discussing the state of the market in an (overly) positive manner. An annoying phrase for many and used sarcastically by even more, it is a word you will see on every cryptocurrency forum, and there are many early cryptocurrency investors who have realised the dream of buying their own lambo. For example, if someone is asking when the currency they're investing in is going to make them rich, they will say 'When lambo?'

M is for Moon

Pretty much the same as 'Lambo', a word used when investors are speculating future prices of a currency and being extremely optimistic, specifically hoping that the price will go as high as the moon. For example, 'When is this coin going to moon/go to the moon?'

Bonus M - Mining

The process of mining coins on the blockchain, or in other words, using computational power to complete complex transactions. While it can be done on a regular desktop computer, laptop or even mobile device, most miners use specialised equipment to maximise profit (running costs include electricity and internet connection, plus the initial equipment purchase). Once these transactions are verified, they get added to the blockchain for anyone to see, a 'proof of work'.

Miners are rewarded in the specific currency they are mining by completing a block, containing a pre-determined number of transactions. Reward value varies depending on the currency being mined, and miners will aim to mine either the highest current (or expected future) value currencies. Where there is a limited supply of mine-able coins, e.g. Bitcoin has pre-set 21 million maximum supply, the difficulty of the computations and therefore time required to mine a block will increase. This reduces the reward distributed for each block, at the same time as increasing the amount of computational power required. A website indicating which currencies are currently providing the highest return can be found at http://whattomine.com/

N is for Node

A node is any computer connected to a particular cryptocurrency's network, and will be connected via P2P protocol to a minimum of eight other nodes, keeping a record in the form of a decentralized ledger of every transaction that has taken place since the cryptocurrency's creation. They underpin the transactions by connecting with each other, and once a certain number of nodes agree on a block solution, the block is mined, storing all validated transactions on the 'blockchain'.

Operating a 'masternode' will earn you dividends from every mined block, but in order to run one, you will generally have to have a considerable amount invested in the specific cryptocurrency and hold it in the masternode address. Masternodes enable performance of additional tasks to a regular node, including instant transactions, increased privacy and more. Masternode operators will normally be long-term investors, due to the extra running requirements.

O is for Open Protocol

This is the decentralized nature of cryptocurrency, the foundation upon which it is all built. No one person, country or organisation controls any particular blockchain, with consensus required from multiple users before any blocks are mined or code changes can be made.

P is for POW/POS

POW is Proof of Work, and POS is Proof of Stake.

POW is the process whereby multiple sources of computational power are used to solve complex mathematical problems, with the first miner to solve each block getting rewarded/paid. Each solution is verified multiple times before the block containing the transactions is stored on the public blockchain. The difficulty increases over time, incrementally raising the cost of solving the problem and consequently the computational power required. The supply of the currency will increase (but at a decreasing rate) as more blocks are mined until it reaches it's maximum supply. Bitcoin is one of many cryptocurrencies that uses the POW method.

POW is less popular, but growing in use due to the increasing amount of power required for POW. It differs in that it does not reward miners for solving the mathematical problems, instead it requires them to hold a certain amount of the specific currency - their stake. Miners earn by taking the transaction fees generated, and are incentivised by their own investment to maintain the blockchain's integrity, and therefore the currency's value. Centralization is avoided by randomization, which can mean completely random nodes being selected to forge the next block; or by coin age, whereby a node can only be selected if they have passed a certain amount of time since they forged their last block. Currencies that use the POS method include Rise, Divi and Dash.

Q is for QR Code

Required to set up optional (but highly recommended) 2FA on exchanges to access your account. Once scanned on your phone, you just need to enter the randomly generated code as an additional security measure on your account. Always remember to back up the QR codes, as if you lose access to your phone, you will also lose access to the codes.

R is for ROI

'Return on Investment' - this would normally be shown as a percentage, to enable comparisons between different sized investments. It is calculated using the following formula.

S is for Satoshi Nakamoto

The mysterious, unidentified founder and creator (or creators) of Bitcoin. In October 2008, Nakamoto published a paper called 'Bitcoin - A Peer-to-Peer Electronic Cash System', following up 3 months later in January 2009 with the first Bitcoin software that launched the network and the first units of Bitcoin currency. Nakamoto's known addresses contain roughly 1 million Bitcoin, with a value of approximately $7 billion (as of April 12th 2018). A number of people have either laid claim to being Nakamoto or been identified as possible contenders, but no-one has been able to prove it to the community as yet. Here's a link to the whitepaper that started it all https://bitcoin.org/bitcoin.pdf

Bonus S - Shilling

Creating hype to trick investors into believing that a particular currency has future value, causing the price to rise and selling for a profit. This can be done by 'shillers' bombarding social media platforms with promotional posts and attracting more attention than the coin deserves. Many accounts will be fake accounts set up exclusively for this purpose. Another way is by paid advertising disguised as expert/professional reviews, luring investors in with positive feedback and questionable claims. This is why it is important to research a variety of different sources before taking the plunge on an investment.

T is for Token

Tokens are different from coins in that they do not have their own separate blockchain, they are built on top of an existing blockchain (a prime example is Ethereum and ERC-20 tokens) and by using smart contracts, can offer a multitude of uses. Waves and Neo are another two examples of this. Tokens can be used for token based voting, dApp currencies, securities dividends and more. Following the standard blockchain template enables anyone with the programming skills to create their own token. To create a token on the Ethereum blockchain, you would need to use Solidity, their associated programming language. There is a course on Udemy where you can learn this process. https://www.udemy.com/ethereum-and-solidity-the-complete-developers-guide/

Bonus T - Total Coin Supply

This is the total number of coins for a single cryptocurrency that are currently mined, minus any that have been confirmed to be burned, but not necessarily circulating for any number of reasons (the circulating supply is the number of coins being used or traded, or being held by public investors). This can be because a company is holding a certain amount of coins for future use, possibly as team incentives, to pay future value providers or any number of other reasons specific to the project. Maximum supply is the total amount of coins that will ever be in existence, e.g. Bitcoin's maximum supply is 21 million.

U is for UTXO

'Unspent Transaction Output' is a record of money received that has not yet been spent. Cryptocurrencies incorporate this technology on their blockchains to determine what spendable balance any specific user has available. This ensures that the output of any one transaction can only be spent once, and the transaction will be rejected if it determines there is insufficient UTXO.

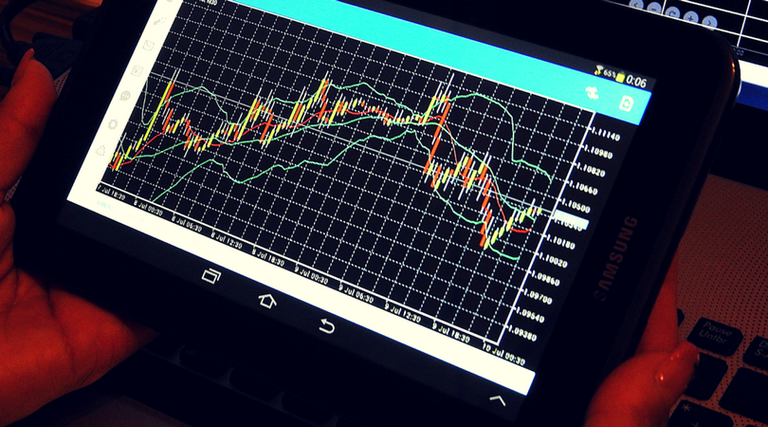

V is for Volatility

The unpredictability of the crypto markets, causing prices to rise and fall by huge margins on a daily basis. This increases the risk of investing, but also means that there are constant opportunities to realise huge returns. Traditional stocks are considerably more stable; a year's worth of ups and downs in these markets can be played out within days on the crypto exchanges. Just don't forget that increased volatility doesn't just mean rapid profits, it can (and often will) lead to rapid losses. The chart below shows the volatility of Ethereum over the last year, from April 2017 when it was less than $50, January 2018 when it topped $1300, and the April 2018 price of just over $400 (correct as of April 12th 2018).

.png)

W is for White Paper

A document that describes the purpose of a cryptocurrency. It can contain details on the technology, the team behind it, the roadmap indicating progress so far and future milestones, commercial implications and more. This should be the first port of call when considering an investment (especially in an ICO), as it gives an overview of the project and an indication of it's potential. A poorly written whitepaper, or a lack of detail within it, will discourage investment. Some projects - especially those with complicated tech - will release two versions, one explaining the tech in complex detail for investors with a greater understanding of the technology, and one for the 'average Joe'.

Bonus W - Whale

Investors (either individuals or institutions) holding a large amount of a specific cryptocurrency, even able to manipulate the market when buying and selling because of the size/volume advantage they hold over other investors (more prevalent in smaller marketcap currencies). Continuing the metaphor further, consider the markets as the ocean, and whenever whales make a move (buying or selling), they create waves (price movement up or down). The key is to ride these waves and not get swallowed up by them, keep an eye on unusually high buy or sell orders. Just don't develop weak hands and be duped into panic selling a coin that you believe in.

X is for XRP

The community splitting cryptocurrency which enables organizations to send secure, instant, international transactions at a fraction of the cost of the traditional method. Controversial because of it's centralized control, a big no-no in the eyes of most cryptocurrency believers, and because of the huge difference between the max supply compared to circulating supply - another alarm bell that underpins the value of other cryptocurrencies, and makes it a little too similar to traditional fiat for the ground breaking crypto community. Firmly entrenched at number 3 in terms of marketcap, it is here to stay for the foreseeable future.

Y is for YTD

'Year to Date' can be used in two ways, meaning either the calendar year (from January 1st up to the current date) or the 'fiscal' year, which will still run to the current date, but the starting point can vary as it can be chosen by a company (normally for financial reporting purposes) and can end on the last day of any month apart from December.

Z is for Zero Confirmation Transaction

This is when a transaction has been submitted to the blockchain, but is yet to receive any confirmations. Transactions that have only included a small mining fee are likely to take longer to be confirmed, as this is the main criteria miners use when selecting transactions to process. Most wallets will automatically select an amount suitable for the transaction, or offer a range of fees depending on confirmation time (longest - cheap, standard - average, shortest - expensive). This enables someone creating the transaction to decide how fast (approximately) they would like it processed.

Other notable words and phrases:

Airdrop - a form of marketing campaign whereby a cryptocurrency is distributed for free, normally to a large number of people who fulfill certain criteria. This can be that they already hold a minimum amount of a certain coin that is related in some way, or they might have to complete certain social media tasks promoting the project to qualify. It is being used more and more frequently by new projects to build awareness and facilitate adoption, but can also be used to reward investors (holders) of an existing currency. Most airdrops are high in volume of recipients, but low in value, although some can prove to be worth considerably more than their initial value if the price subsequently rises.

Alt-coin - Any cryptocurrency (an alternative coin) other than Bitcoin, notable alt-coins are Ethereum, Litecoin, Monero and Ripple, but there are thousands more.

AML - Anti Money Laundering, laws preventing the use of ill gotten gains being converted to legitimate currency.

Arbitrage - guaranteed profit made by trading the same currency on different exchanges by taking advantage of the different rates on offer, possible if (after the margin and fees are taken into account) a sell price on one exchange is higher than the buy price on another.

Bagholder - someone left hold an investment that has had a huge drop with no immediate sign of recovery.

Bear Market - a market that is on a downwards trend, opposite to a Bull Market.

Bull Market - a market on an upward trend.

Blockchain - a constantly evolving digital ledger, updated with every transaction made.

dApp - decentralized application, where the backend code is open source and available for all to see on a P2P network, and offers rewards for verification in the form of their currency.

Faucet - a website which gives away free cryptocurrency, unfortunately normally only small amounts, so more like a faucet dripping than in full flow.

Fiat - traditional currencies, issued by governments and controlled centrally, e.g. dollar, euro, pound etc.

Fork - this is when a new version of a blockchain is created, and the two versions run parallel to each other. A hard Fork is when all nodes must update to the newest protocol, any that do not update will see all new blocks as invalid. A Soft Fork is when nodes that don't upgrade and are still running the original protocol will see the new blocks as valid. A majority of nodes must have upgraded to the new protocol for the soft fork to work.

Key - your public key is your wallet address, a unique combination of numbers and letters that you use to send and receive cryptocurrency. Your private key is the password/digital signature you need to access your wallet, and therefore should not be disclosed to anyone.

Liquidity - a sufficient supply of the currency is available to enable traders to buy and sell in volume, and can be converted to your preferred currency.

Margin Trading - trading with borrowed money, up to multiples of 10/50/200 times of initial amount. This initial amount is used as collateral against the loan. Risky trading strategy as if the market moves in the wrong direction, you could lose your full investment, but if it moves in the right direction, the rewards can be huge.

Market Cap - Market Capitalization is calculated by multiplying the circulating supply of the cryptocurrency by the current price. It is one of the reasons why investors search out smaller market cap currencies, as they believe there should be more potential room for growth.

Open Source - this is the practice of making source code available for public scrutiny and/or altered with consensus of peers. Reduces the risk of malicious code being inserted without public knowledge.

Panic Selling - investors running scared and dumping coins when the price crashes, often with no concrete reason other than the market is dropping, and selling at any price they can get. Another reason why emotions should always be ignored when trading.

.png)

Pump and Dump - the rightly maligned practice of artificially increasing the price of an asset (usually done as a group at a specific time), before dumping it (and cashing in a profit) when it reaches a certain price causing the price to drop rapidly. Those who unwittingly invested near or at the top are now left bagholding (see above).

Satoshi - the smallest unit of Bitcoin is 1 Satoshi - 0.00000001 BTC. Also known as Sats.

Smart Contract - an automatic way of executing a transaction (be that money, property or anything that holds value to the buyer/seller), within the terms and conditions set out. These will dictate, without involving a third party, what will happen once the 'fee' is paid. Any conditions/rules can be written into the smart contract, protecting both parties involved, as it will automatically follow the conditions as stated.

TA - Technical analysis is the various tools/charts used by traders to try and predict future movement by using historical data. Examples of technical analysis include Moving Averages, Fibonacci Retracement, MACD and RSI (Relative Strength Index). The following site is useful for both creating your own (and reading other trader's) analysis. https://www.tradingview.com/cryptocurrency-signals/

Vanity Address - a personalized Bitcoin address using specific letters and/or numbers as part of the sequence, instead of the usual randomly generated addresses, e.g. 2PARTY4Df38rAC9pQw3R44An9L57yVc1A6

Weak Hands - an investor who loses (has lost) confidence in a project and panic sells when the price starts to drop, rather than keeping the faith and hodling.

Whitelist - a registration process used by ICOs to sign up potential investors (and sometimes limit the amount of investors for popular projects), normally giving them a conditional guarantee that they can purchase either a set number of coins or purchase the coins at a preferential rate.

2FA - Two Factor Authentication, an extra layer of security on top of a password requiring an additional identification method normally on your phone. Helps to prevent unauthorized access to your accounts.

51% Attack - also know as a 'majority attack' on a blockchain, requiring control of 51% of the computing power. This would enable them to revise transaction history and to prevent new transactions from confirming.

Getting to grips with the above acronyms, words and phrases should make the learning process a smoother one.

This article is for entertainment purposes only, and should not be used to make investment decisions at any point. As mentioned above, always do your own research and invest only what you can afford to lose.

Good luck.