This is the first of our weekly article series about a promising blockchain startup, LEXIT.

In this article, we will be featuring #LEXITco platform and its niche, the Mergers and Acquisitions (M&A).

LEXIT is the first marketplace for companies and Intellectual Property (IP). It allows entrepreneurs to trade their Intellectual Property, technology and copyrights from halted projects or even sell their whole startup. LEXIT's blockchain-based tokenization models and the disinter-mediation of appraisement and matchmaking services enable them to make Mergers & Acquisitions (M&A) as easy as selling cars or real-estates. This is LEXIT's main goal - 'To Revolutionize Mergers & Acquisitions (M&A)'.

First off, let us know first the basics of Mergers and Acquisitions (M&A).

What are Mergers & Acquisitions (M&A)?

Mergers and Acquisitions (M&A) are defined as the consolidation of companies, a Merger, where two companies combine to form one, or an Acquisition wherein a company is taken over by the other.

Aside from the two mentioned, there are four more types of transactions included in this financial corporate activity.

The third one is Consolidation, wherein stockholders of both companies agreed to create a new company.

The fourth is Tender Offer, at which point one company offers to purchase the outstanding stock of another firm at a desired price. The communication is usually done directly to the other company's shareholders and bypassing the management and board of directors of the same.

Fifth is the Acquisition of Assets, which means one company acquires the assets of another company by purchasing its assets. This transaction typically happens during bankruptcy proceedings.

Lastly, the Management Acquisition or Management-led Buyout (MBO) where a company's executives purchase a controlling stake in the company, making it private. Oftentimes, these former executives collaborate with a financier or former corporate officers in order to help fund the transaction.

All these six financial transactions are included in the Mergers and Acquisitions (M&A) where in all cases, two companies are involved.

The Reasons for Mergers and Acquisitions?

A lot of companies in the world, no matter what industry, do merge with and acquire other entities. It is not just something that they do but is a big part of the corporate world. Mergers and acquisitions happen for many strategic business reasons, but most commonly are economic at their core.

The following are a rundown of reasons why companies do such corporate financial activity:

a. Synergy

This word is most commonly used in M&A where companies combine business activities to increase performance and decrease operation cost. It is important that a company finds another company to merge with that has complementary strengths and weaknesses.

b. Growth

The acquiring company will have the chance to grow market share by buying a smaller competing company for a price. This transaction is called horizontal merger.

c. Diversification or Sharpening Business Focus

Both of these purposes are commonly used in M&A. A company who merges with an unrelated business is called 'diversification', which is to minimize the impact of that particular industry on the company's profitability. Whereas a company who merge with another business who have deeper market penetration in a particular industry is called 'sharpening business focus'.

d. Eliminate competition

In order for the company to gain a much bigger market share, it will try to eliminate future competitions by buying the target company's shares. However, this will not be easy as it requires a large amount of premium to convince the target company's shareholders to accept the offer.

e. Increase Supply-Chain Pricing Power

This deal allows a company save a certain amount of cost by buying out one of its suppliers or distributors. If a company buys out one of its suppliers or distributors, they will be able to cut margins from the cost of the products they buy from that supplier or decrease the cost of shipping their products by that distributor. This is called vertical merger.

LEXIT - Disrupting the way in which companies and their IP are being bought, sold, and licensed.

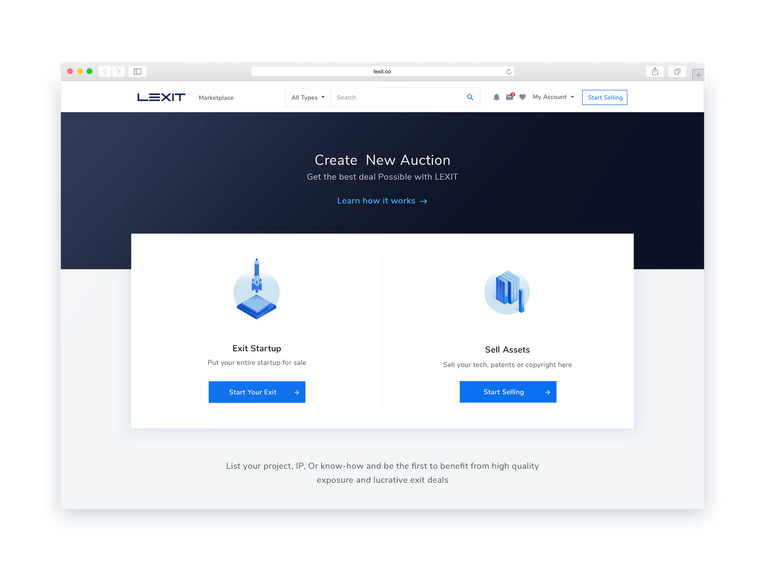

M&A transactions are oftentimes done with a third-party or a mediator. Mediators are most of the time costly and faced with issues on the process. LEXIT aims to revolutionize M&A by replacing these expensive and inefficient mediators, with a distributed network of independent assessors and matchmakers.

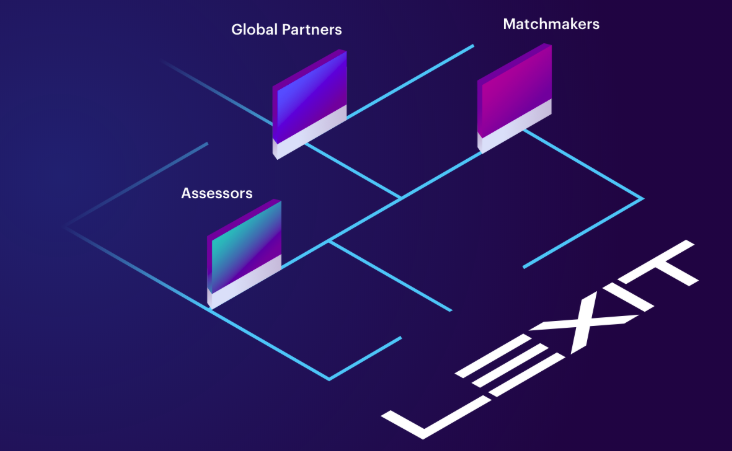

Here's a detailed illustration of how the LEXIT network works:

The LEXIT easy-to-use marketplace allows buyers and sellers to meet directly, all together, enabling market forces and network dynamics to bring M&A to unparalleled pace. Every project listed on the platform are verified, analyzed and assessed by a distributed network of appraisers and industry specific specialists. These service providers joining LEXIT are screened, highly qualified contractors, subjected to a reputation and rating system, created by the buyers themselves.

LEXIT maintains a global partner program of highly conected players in the Tech ecosystem, in order to cut the best deals in the space. Global Partners and Matchmakers are incentivized to reach out to their large business networks and connect thousands of buyers and sellers.

This is how LEXIT streamlines M&A, comparing the traditional way and the LEXIT solution:

LEXIT platform allows for M&A processed to be completed four times as fast and at one-fourth of the costs of the traditional way. It empowers entrepreneurs to discover the real value of their assets on a vibrant and highly liquid marketplace, avoiding overpriced prepayments. Also most importantly, there will be an efficient market for IP and patents for the first time, enabling companies to trade assets in the most convenient way, just like buying or selling a car or real-estate.

The LEXIT Token (LXT)

LXT is a utility token which powers the LEXIT Marketplace. The token is the lifeblood of the LEXIT solution opening invaluable utilities for all market participants.

For buyers, LXT tokens allows them to access extended reports on listed projects, hire additional experts for their services and contract sellers in a discrete way.

For sellers, tokens can be used to pay listing fee on the platform, to complete KYC and extended evaluation process and to pay for active outreach.

Here is the LXT's token flow:

Watch this video to learn more about LEXIT:

Or visit their website to know more about the team, advisors, whitepaper and more.

Stay tuned for the next article.

Disclaimer:

We do not offer investment advice. In any form of investment you should always do your own research. All of the information posted here are taken from the Lexit.co.

Great project tho. Anyway i just wanted to share this link to all. Seems bit familiar kindly check it thank you! :) https://loci.io/2018/07/18/loci-announces-formal-establishment-of-loci-nexus/