My heart was pounding when I made my first crypto asset purchase, like some naive gambler at a poker table in Las Vegas, pushing his chips all in. But when you’re gambling on the strip the rules are so precise and orderly. There’s a dealer who helps ensure you don’t make any mistakes and break the rules of the game, needlessly wasting your money, and the casino ensures every player competes fairly.

Crypto asset trading doesn’t work like that. In this lawless world — which makes Wall Street look like a lemonade stand — if you make a mistake, there’s no bank to call to get your money back or to contest a fraudulent transaction. This space is fully decentralized — if you’re using certain crypto asset exchanges — and each person is 100% responsible for their actions. For some people they enjoy the padded walls of the current financial state, but for others they yearn to be in control of their own fate.

I might be turning into the latter type of person.

Like many people, I’ve come to learn about crypto assets after the spectacular gains that Bitcoin has made in the recent year, where it’s appreciated more than 931% in value.

To put it into perspective, had a person invested $100 in Bitcoin in 2011, they’d be a multi-millionaire right now.

I had to learn more about this burgeoning technology.

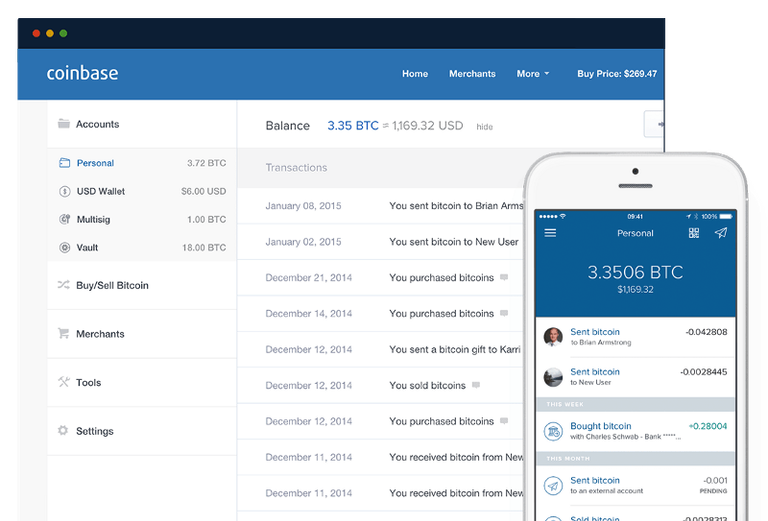

I’d actually crypto traded before using Coinbase — which is by far one of the most popular and easy exchanges to get into — but this didn’t seem like real digital currency trading to me. When I thought of crypto trading I didn’t think of the gorgeous, simplistic user interface of Coinbase.

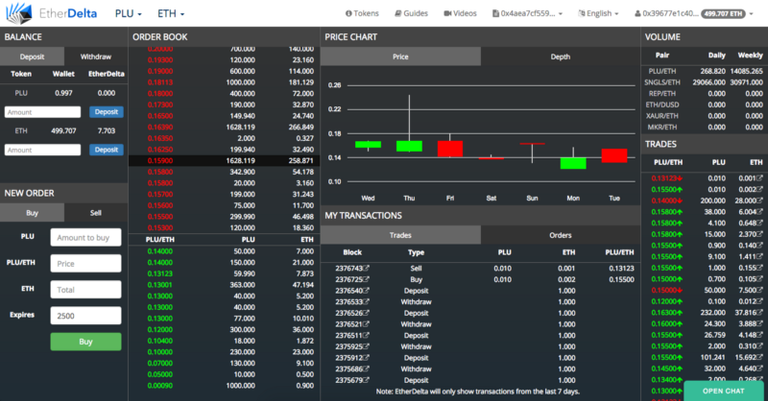

I thought about something complicated like Ether Delta, where the screen looked like something a day trader might see.

This relatively tepid market space of Coinbase wasn’t the danger I sought. I wanted to get into the ultra-high stakes world of Initial Coin Offerings (ICOs) and purchasing crypto assets that had recently completed their ICO.

So that’s what I did.

I began by researching different options on the reputable crypto asset website Smith and Crown, and found a lengthy writeup about a project that I could support because of their underlying vision and their transparent business practices, e.g. a white-paper, a working prototype and verified team members.

It’s called Horizon State and the goal of the project is to allow people to use blockchain technology to secure digital ballot boxes for government elections. Instead of standing in long lines at polling places, people can now vote from their smartphones or computers and then sign the vote with their own private key, much like we do with a digitally signed email to verify our identity and authenticity of the message.

I’ve dreamt of the days of when Americans might be able to unseat the powers that be in Washington D.C., and empower each citizen to cast a secure vote on every single issue, or at least on the more important issues.

I envision a United States where we keep our government intact, but the congressmen and senators are now ceremonial figureheads — much like the King and Queen of England — and we use blockchain technology to tell our elected representatives how they will vote for our district or state.

And while this might be far down the line, I believe Horizon State — or a project like it — that merges the security of blockchain and the technological ease of smartphones and computers, will one day get us there.

However, when I went to support the Horizon State ICO I found the buy-in window had already closed; I’d have to wait until it was publicly available to trade on a crypto currency exchange. But as I was sitting around on a Sunday afternoon weeks later, I saw a Facebook post from the Horizon State team that said their “decision token,” as it’s called, was now trading on the Ether Delta exchange.

The way the decision token works is simple. It’s not a stock or security in the company; rather, if your city decided to use Horizon State’s blockchain technology for their next election, the voters would have to use a decision token to cast their vote. This process would be much cheaper than the current system of paper ballot boxes and be infinitely more secure because of the blockchain.

So by buying this decision token from Horizon State, investors believe their blockchain software will get implemented around the world and their will be an increasing demand for this crypto asset, of which there’s only a finite number. So the more people that Horizon State gets to adopt its technology, the greater in value their decision token becomes. This holds true for every new digital currency that is issued through an ICO; the technology has to get adopted for the crypto asset to be worth anything longterm.

After some research, I figured out how to transfer my existing crypto assets from Coinbase to the Ether Delta exchange, where it would have to be converted into Ethereum, which is the underlying backbone of many new ICOs.

This was a nerve-wracking experience because I knew with a simple mistake on the keyboard I could be sending my hard earned cash — around $1,000 — to the wrong ethereum wallet. But I also liked this. Too much in society is “nerfed” down for everyone. And it was exhilarating to have the ability to be in charge of my own money with no safeguards in place, and therefore be fully responsible for my own actions.

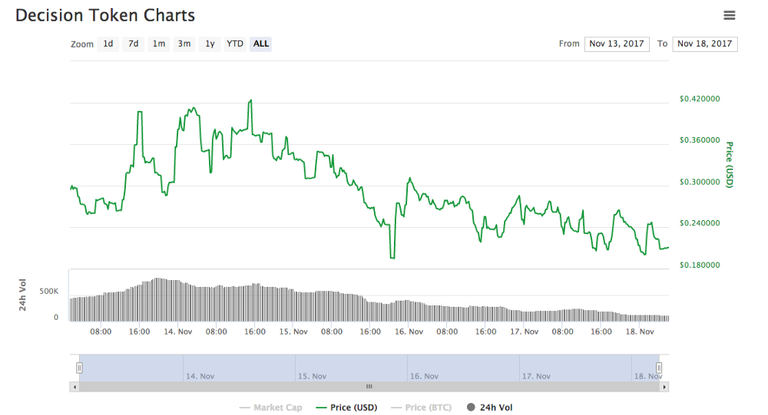

I made my first “real” crypto purchase for around .00069 ETH a decision token, which is around 25 cents USD.

I was immediately terrified. I watched the trades from other people go by on my screen in a flurry of red and green numbers and decimal points. The red meant people were selling their tokens for that price; the green meant people were buying into the market. I continued to check the market for the next couple of hours and I was surprised to see my initial investment rapidly appreciating in value. By the end of the day, my tokens were worth $1350 USD.

I was pleased with how things had gone and decided to keep my money in the decision tokens for the rest of the night. Another note about crypto exchanges is they don’t have set hours; they operate 24/7/365.

I was rather restless, dreaming about the status of my small crypto purchase, but when I woke up in the morning I was happy to see my portfolio was now valued at $1750. “Wow,” I thought to myself, “If only I’d invested my entire short term savings account I’d have $20,000 now!” But I knew this was the way to start losing money, almost like a gambling addiction. I was more intrigued to learn about the crypto asset space and how people are buying these tokens during an ICO and then trading them on the free market.

I wanted to buy and hold the decision tokens from Horizon State because I truly believe in the vision and values of the project. But it became apparent, at least to my native eye, that the market was being flooded with speculators, and the price of the decision token was higher than the market was willing to bear for the short term future. So I decided to exit my position when the price was .0013 ETH a token or around 40 cents USD. I’d made a healthy return for my first purchase, and sure enough after selling my tokens, the price started to sawtooth and decline in the following days.

I could’ve dropped $10,000 into the decision token on my first day of trading and made a monster return, but I could just as easily have seen a huge loss in my principal. My meager $1,000 investment in crypto assets was the right number for me, especially being that I’m so new to the space.

As bad as I felt about it, I played speculator for a few days after selling my initial investment. I made a little, lost a little, but in the end I came out with a little more than I did after my initial selling point — around $1,850 give or take with the fluctuating price of Ethereum.

The Coinbase world of Bitcoin seemed so renegade when I first learned about it, whereas now it seems like I would be investing in high grade government bonds after the rollercoaster experience of those few days with a brand new crypto asset like the decision token.

Hopefully you were able to learn some things if you’re completely new to the space and you’re interested to learn even more now, or maybe you were just entertained if you have the knowledge already.

All I know is I’m excited to have a bleacher seat to this ever-evolving world of crypto assets. No matter what happens, it’ll be an exciting ride.

(Of note, I plan to reinvest my money in the decision token after the market settles down.)

Here's my original Medium post of this story: https://medium.com/p/ffa028270962/edit