A Letter to Jamie Dimon

给Jamie Dimon的一封信

And anyone else still struggling to understand cryptocurrencies

和那些正在努力理解数字货币的人

本文翻译自:https://blog.chain.com/a-letter-to-jamie-dimon-de89d417cb80

译者:区块链中文字幕组 小丹

翻译时间:2017-10-20

Dear Jamie, 亲爱的Jamie,

My name is Adam Ludwin and I run a company called Chain. I have been working in and around the cryptocurrency market for several years.

我是Adam Ludwin。 我经营一家叫Chain的公司,在数字货币市场工作好几年了。

Last week you said a few things about Bitcoin:

上周你说了一些关于比特币的事情:

THIS IS THE LAST TIME I TALK ABOUT BITCOIN.

这是我最后一次说比特币了

BITCOIN IS 'A GREAT PRODUCT' IF YOU ARE A CRIMINAL

如果你是罪犯, 那比特币个'伟大的工具'

GOVERMENTS LIKE TO CONTROL THEIR ECONOMIES, CURRENCIES

政府喜欢控制经济和货币

GOVERMENTS ARE GOING TO CRUSH THEIR BITCOIN ONE DAY.

政府有一天会摧毁比特币

"WHO CARES ABOUT BITCOIN"

"谁在乎比特币"

PEOPLE WHO PURCHASE BITCOIN ARE STUPID

买比特币的人是愚蠢的

I DON'T UNDERSTAND THE VALUE OF SOMETHING WITHOUT VALUE

我不理解没有价值的东西的价值

I COULD CARE LESS ABOUT BITCOIN.

我对比特币一点也不在乎。

It’s easy to believe cryptocurrencies have no inherent value. Or that governments will crush them.

人们很容易相信数字货币没有内在的价值,或者政府会摧毁他们。

It’s also becoming fashionable to believe the opposite: that they will disrupt banks, governments, and Silicon Valley giants once and for all.

但同时越来越多人相信另一面: 它们会一劳永逸的瓦解银行, 政府和硅谷。

Neither extreme is true.

两个极端都是不正确的。

The reality is nuanced and important. Which is why I’ve decided to write you this briefing note. I hope it helps you appreciate cryptocurrencies more deeply.

现实是微妙的,也很重要。所以我决定给你简单写点,希望它能帮助你更深切地领会数字货币。

Let me start by stating that I believe:

先从我相信什么开始吧:

The market for cryptocurrencies is overheated and irrationally exuberant

数字货币市场过热, 非理性繁荣

There are a lot of poseurs creating them, and some scammers, too

很多人打着数字货币的幌子, 也有很多骗子

There are a lot of conflicts of interest, self-serving hype, and obfuscation

有很多利益冲突, 炒作, 和混淆

Very few people in the media understand what’s going on

媒体界很少有人懂

Very few people in finance understand what’s going on

金融界很少有人懂

Very few people in technology understand what’s going on

技术界很少有人懂

Very few people in academia or government understand what’s going on

学术界或政府很少有人懂

Very few people buying cryptocurrencies understand what’s going on

投资数字货币的很少有人懂

It’s very possible I don’t understand what’s going on

可能我也不懂

Also:

并且

Banks and governments aren’t going away

银行和政府并没有消失

Traditional software isn’t going away

传统软件并没有消失

In short: there’s a lot of noise. But there is also signal. To find it, we need to start by defining cryptocurrency.

简而言之: 有很多的干扰因素,但也出现了信号。要探索它,我们得从数字货币的定义开始。

Without a working definition we are lost. Most people arguing about cryptocurrencies are talking past each other because they don’t stop to ask the other side what they think cryptocurrencies are for.

没有有效的定义, 我们就会迷失。大多数争论数字货币的人都不在同一个点上, 因为他们没有询问对方关于数字货币的定义。

Here’s my definition: cryptocurrencies are a new asset class that enable decentralized applications.

** 这是我的定义: 数字货币是一个新的资产类别, 它使得去中心化的应用成为可能。**

If this is true, your point of view on cryptocurrencies has very little to do with what you think about them in comparison to traditional currencies or securities, and everything to do with your opinion of decentralized applications and their value relative to current software models.

如果是这样,那对数字货币的观点, 是不同通过对比数字货币和传统货币/证券, 或者对比去中心化软件和现有软件模式得来的.

Don’t have an opinion on decentralized applications? Then you can’t possibly have one on cryptocurrencies yet, so read on.

还不知道什么是去中心化应用? 那你也不可能了解数字货币, 让我们继续吧。

And since this isn’t about cryptocurrencies vs. fiat currencies let’s stop using the word currency. It’s a head fake. It has way too much baggage and I notice that when you talk about Bitcoin in public you keep comparing it to the Dollar, Euro, and Yen. That comparison won’t help you understand what’s going on. In fact, it’s getting in the way. So for the rest of this note, I will refer to cryptocurrencies as crypto assets.

由于这不是数字货币和传统货币的对比, 那我们不要再用货币这个词,它的负担太重。 我注意到,在公开谈论比特币时,人们会不断把它和美元,欧元和日元做比较。 这种比较不会帮助你了解发生了什么。 事实上,它起了阻碍作用。 因此,在本说明的其余部分,我将把数字货币称为加密数字资产。

So, to repeat: crypto assets are a new asset class that enable decentralized applications.

所以, 重申一下: 加密数字资产是一个新的资产类别, 它使得去中心化的应用成为可能。

And like every other asset class, they exist as a mechanism to allocate resources to a specific form of organization. Despite the myopic focus on trading crypto assets recently, they don’t exist solely to be traded. That is, in principle at least, they don’t exist for their own sake.

和其他的所有资产类别一样, 它们作为一种机制分配资源到特定形式的组织

To understand what I mean, think about other asset classes and what form of organization they serve:

要理解我的意思的话, 来考虑下其他资产类别以及它们所服务的组织形式:

Corporate equities serve companies

公司股票服务公司

Government bonds serve nations states municipalities

政府债券服务国家,州,市

Mortgages serve property owners

抵押贷款服务业主

And now:

现在:

Crypto assets serve decentralized applications

加密数字资产服务去中心化应用

Decentralized applications are a new form of organization and a new form of software. They’re a new model for creating, financing, and operating software services in a way that is decentralized top-to-bottom. That doesn’t make them better or worse than existing software models or the corporate entities that create them. As we’ll see later, there are major trade-offs. What we can say is simply that they are radically different from software as we know it today and radically different from the forms of organization we are used to.

去中心化应用是一种新的形式的组织和软件。它们是一种用于构建、融资和操作软件服务的新模型, 其方式是自上而下地去中心化。这并不会使它们比现有的软件模型或创建它们的公司实体更好或更糟。正如我们稍后会看到的, 会有重大的权衡。我们所能说的仅仅是, 它们与我们今天所知道的软件截然不同, 与我们习惯的组织形式截然不同。

How different? Imagine the following: you grew up in a rainforest and I brought you a cactus and told you it was a tree. How would you react? You’d probably laugh and say it’s not a tree because there’s no point in a tree being a stumpy water tank covered in armor — after all, water is abundant here in the rainforest! This, roughly, is the reaction of many people working in Silicon Valley to decentralized applications.

有什么不同?想象一下: 你在雨林里长大, 我给你带了一个仙人掌, 告诉你那是一棵树。你会怎么反应?你可能会笑着说这不是一棵树, 因为在树的定义里没有任何一点提到被刺覆盖的粗短水箱--毕竟, 雨林里的水是丰富的!这大概是硅谷许多人对去中心化应用的反应。

But I diagress. I owe you an important explanation:

我先打个岔。 我欠你一个重要的解释:

What is a decentralized application?

什么是去中心化的应用

A decentralized application is a way to create a service that no single entity operates.

去中心化应用是创建一种不能被任何单个实体操控的服务的方式。

We’ll come to the question of whether that’s useful in a moment. But first, you need to understand how they work.

我们过会再来讨论它是不是有用。但是首先, 你需要了解他们是如何工作的。

Let’s go back to the birth of this idea.

让我们回溯一下这个想法的诞生吧。

It’s November 2008. The nadir of the financial crisis.

那是在2008年11月,金融危机的最低点。

An anonymous person publishes a paper explaining how to make electronic payments without a trusted central party like Chase or PayPal or the Federal Reserve. It’s the first decentralized application of this kind ever proposed.

一个匿名的人发表了一篇论文, 解释如何在没有像大通、贝宝或美联储这样的受信任的中央机构的情况下进行电子支付。这是首次提出的这种去中心化应用。

It’s a decentralized application for payments.

这是去中心化的支付。

The paper is titled Bitcoin.

这篇论文名叫比特币。

How does it work? How is it possible to send an electronic payment without a designated party who will track and update everyone’s balances? If I hand you a dollar that’s one thing. But data is not a bearer instrument. Data needs intermediation and validation to be trusted.

它是如何工作的?它如何能发起一笔电子支付,而没有指定机构来跟踪和更新每个人的余额?如果我当面给你一美元, 这是一码事。但数据不是一种承载工具。数据需要中介和验证才能被信任。

The paper proposes a solution: form a peer-to-peer network. Make it public. Announce your transaction to everyone. In your announcement, point to the specific funds on the network you want to spend. Cryptographically sign your announcement with the same software key that is linked to those funds so we know they’re yours.

这篇论文提出了一个方案: 组织一个公开的点对点网络, 向每个节点广播你的交易。 在广播消息中申明在这个网络中你想要花费的资金, 再用对应的秘钥签名,我们就知道这笔资金是属于你的。

It almost works. We need one more thing: a way to make sure that if you broadcast two competing announcements (that is, if you try to spend the same funds twice) that only one of your attempts counts.

这几乎就能运行了。但还有件事: 我们需要一种方法来确保,如果您广播两个相互竞争的交易公告 (比如, 同一笔钱你想使用两次), 只有一个生效。

Bad solution: designate a party to timestamp the transactions and only include the transaction that came first. We’re back to square one. We have a trusted intermediary.

糟糕的方案: 指定一个机构给交易加上时间戳, 然后只处理第一个来的交易。我们又回到起点了我们有一个可信的中间人。

Breakthrough solution: let entities compete to be the “timestamper!” We can’t avoid the need for one, but we can avoid designating one in advance or using the same one for every batch of transactions.

突破性方案: 让节点竞争成为这个“见证人”。 我们不能避免需要一个, 但我们可以避免预先指定或每次交易都使用同一个。

“Let entities compete.” Sounds like a market economy. What’s missing? A reward for winning. An incentive. An asset.

“让节点竞争” 听起来像市场经济。 但缺了点什么? 获胜者的奖赏。一种激励。一项资产。

Let’s call that asset Bitcoin. Let’s call the entities competing for the right to timestamp the latest batch of announced transactions “miners.” Let’s make sure anyone can join this contest at any time by making the code and network open.

让我们称这种资产为比特币。让我们把这些竞争交易记账权的人叫做"矿工"。让我们通过公开代码和网络,来确保任何人任何时候都可以加入这个竞赛。

Now we need an actual contest. The paper proposes one. On your mark, get set: find a random number generated by the network! The number is really, really hard to find. So hard that the only way to find it is to use tons of processing power and burn through electricity. It’s a computing version of what Veruca Salt made her dad and his poor factory workers do in Willy Wonka. A brute force search for a golden ticket (or in this case, a golden number).

现在我们需要一个真正的竞赛。这篇论文提议了一个:找到一个由这个网络生成的随机数! 这个数字真的很难找到,找到它的唯一途径是进行超量的计算。

Why the elaborate and expensive competition to do something as simple as timestamp transactions for the network? So that we can be sure the competitors have incurred a real financial cost. That way, if they win the race to find the random number and become the designated timestamper for a given batch of transactions, they won’t use that power for evil (like censoring transactions). Instead, they will meticulously scan each pending transaction, eliminate any attempts by users to spend the same funds twice, ensure all rules are followed, and broadcast the validated batch to the rest of the network.

为什么要通过这么复杂而昂贵的竞争来达到简单加个时间戳就可以搞定的事情呢? 因为这样我们才能肯定竞争者有了真正的财务成本。 这样, 如果他们赢得了找到随机数的比赛, 并成为指定交易的仲裁人, 他们就不会使用这种权力做坏事 (例如修改交易)。 相反, 他们将仔细审视每笔待处理的交易,排除那些尝试把一笔资金使用两次的交易, 确保遵循所有规则, 并将验证过的交易广播到网络的其余部分。

Because if they do indeed follow the rules, the network is programmed to reward them…

因为如果他们真的遵循了规则, 那么网络会奖励他们。

… with newly minted Bitcoin, plus the transaction fees, denominated in Bitcoin, paid by the senders. (See why they are called miners and not timestampers, now?)

奖励他们新挖矿出来的比特币, 加上发送者支付的交易费。(现在明白他们为什么叫矿工, 而不是打时间戳的人了吧)

In other words, miners follow the rules because it is in their economic self-interest to do the right thing.

换句话说, 矿工们遵守规则是因为他们做对了事就有经济利益。

You know, like Adam Smith said:

就像亚当·斯密说的

It is not from the benevolence of the butcher, the brewer or the baker, that we expect our dinner, but from their regard to their own self interest.

我们期待的晚餐, 不是来自屠夫, 酿酒商或面包师的仁慈,而是来自于他们的对自己利益的考虑。

Crypto assets: the invisible hand… of the internet.

数字资产: 互联网的无形之手。

Bitcoin is capitalism, distilled. You should love it!

And since these miners have debts to pay (mostly electricity bills), they will likely sell their newly earned Bitcoins on the open market in exchange for whatever real currency they need to satisfy their liabilities. Anything left is profit. The Bitcoin is now in circulation. People who need it can buy it. And so can people who just want to speculate on it. (More on the people who “need it” vs. those who are speculating later.)

由于这些矿工有账单要支付 (大部分是电费), 他们很可能会在公开市场上出售他们新挖出来的比特币, 以换取真正的货币来满足他们的账单。剩下的都是利润。比特币现在正在流通。需要它的人可以买它,投机的人也可以。

Eureka! We have killed two birds with one stone: the financial reward that substitutes our need for a trusted central party with a marketplace of competing yet honest timestampers is the same asset that ends up in circulation for use as a digital bearer instrument in an electronic payments network that has no central party (it’s circular, I know).

耶! 我们做到了一石二鸟:这种把我们对信任的中央机构的需求替换为算力竞争经济奖励,和最终在流通中被用作电子支付网络中的数字承载工具, 是同一种资产(我知道这有点绕)。

(译者注: 流通的代币和给矿工奖励是同一种)

Now that you understand Bitcoin, let’s generalize this to decentralized applications as a whole.

现在你了解了比特币, 让我们把它扩展到所有的去中心化应用程序。

In general, a decentralized application allows you to do something you can already do today (like payments) but without a trusted central party.

一般来说, 去中心化应用允许你做一些今天已经可以做的事情 (如付款), 但不需要一个受信任的中央机构

Here’s another example: a decentralized application called Filecoin enables users to store files on a peer-to-peer network of computers instead of in centralized file storage services like Dropbox or Amazon S3. Its crypto asset, also called Filecoin, incentivizes entities to share excess hard drive space with the network.

还有一个例子: 一个被称为 Filecoin 的去中心化应用程序使用户能够将文件存储在一个点对点的计算机网络上, 而不是集中在Dropbox或亚马逊 S3 这样的中央文件存储服务中。它的加密资产, 也被称为 Filecoin, 激励节点在网络中共享过剩的硬盘空间。

Digital file storage is not new. Neither is electronic payments. What’s new is that they can be operated without a company. A new form of organization.

数字文件存储不是新事物。电子支付也不是。新的是他们可以在没有公司的情况下运作, 一种新的组织形式。

One more example.

再举一个例子。

Warning: this one is a bit confusing because it’s meta.

注意: 这个例子可能有点混淆, 因为它很大。

There’s a decentralized application called Ethereum that is a decentralized application for launching decentralized applications. I am sure by now you have heard of “initial coin offerings” (ICOs) and “tokens.” Most of these are issued on top of Ethereum. Instead of building a decentralized application from scratch the way Bitcoin was, you can build one on top of Ethereum much more easily because a) the network already exists and b) it’s not designed for a specific application but rather as a platform to build applications that can execute arbitrary code. It is “featureless.”

有一个去中心化的应用叫以太坊, 它是用于启动去中心化应用的去中心化应用。我敢肯定, 现在你已经听说了 "初始代币发行" (ICOs) 和 "代币"。大多数这些都是在以太坊上面发布的。不用像比特币一样从头开始构建一个去中心化应用, 你可以很容易基于以太坊创建一个, 因为以太坊 a) 网络已经存在和 b) 它不是为一个特定的应用程序设计的, 而是作为一个平台来构建可以执行任意代码的应用程序。

Ethereum’s protocol incentivizes entities to contribute computing resources to the network. Doing so earns these entities Ether, the crypto asset of Ethereum. This makes Ethereum a new kind of computing platform for this new class of software (decentralized apps). It’s not cloud computing because Ethereum itself is decentralized (like aether, get it?). That’s why its founder, Vitalik Buterin, refers to Ethereum as a “world computer.”

以太坊的协议鼓励实体为网络贡献计算资源。这样做能赚取Ether, 以太坊的加密数字资产。这使得以太坊成为这一类的软件 (去中心化应用) 的一种新的计算平台。这不是云计算, 因为以太坊本身是去中心化的。 这就是为什么它的创始人, Vitalik Buterin, 说以太坊是"世界计算机"。

To summarize, in just the last few years the world has invented a way to create software services that have no central operator. These services are called decentralized applications and they are enabled with crypto assets that incentivize entities on the internet to contribute resources — processing, storage, computing — necessary for the service to function.

总而言之, 在短短的几年中, 这世界发明了一种构建没有中央机构的软件服务的方法。这些服务被去中心化应用, 它们启用了数字资产, 激励互联网上的节点为服务的功能提供资源-处理、存储和计算。

It’s worth pausing to acknowledge that this is kind of miraculous. With just the internet, an open protocol, and a new kind of asset, we can instantiate networks that dynamically assemble the resources necessary to provide many kinds of services.

值得停下来承认这是一种奇迹。只要有了互联网、开放的协议和一种新的资产, 我们就可以实例化网络, 动态地汇集必要的资源来提供多种服务。

And there are a lot of people who think this model is the future of all software, the thing that will finally challenge the FANG stocks and venture capital to boot.

还有很多人认为这个模型是所有软件的未来, 最终将挑战方股和风险资本启动的东西。

But I’m not one of them. Because there’s a problem.

但我不这么认为,因为还有个问题

It’s not at all clear yet that decentralized applications are actually useful to most people relative to traditional software.

目前还不清楚的是, 去中心化的应用是否在现实中对大部分人来说比传统软件更有用。

Simply put, you cannot argue that for everyone Bitcoin is better than PayPal or Chase. Or that for everyone Filecoin is better than Dropbox or iCloud. Or that for everyone Ethereum is better than Amazon EC2 or Azure.

简单地说, 你不能争辩说对所有人而言,比特币比 PayPal 或 Chase 更好, Filecoin 比 Dropbox 或 iCloud 更好,或者, 以太坊比亚马逊 EC2 或 Azure 更好。

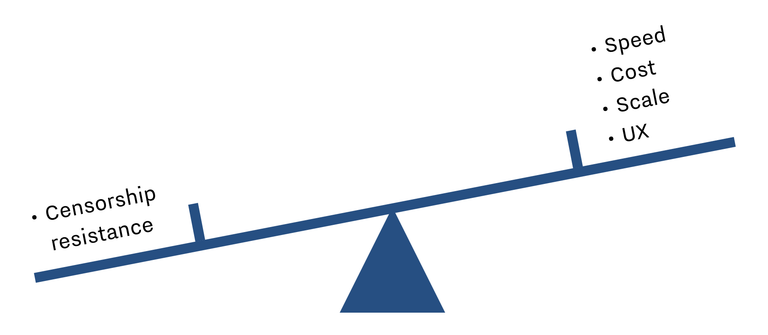

In fact, on almost every dimension, decentralized services are worse than their centralized counterparts:

事实上, 在几乎每一个层面上, 去中心化服务都比其对应的中心化服务要差:

They are slower

它们更慢

They are more expensive

它们代价更高

They are less scalable

它们扩展性更差

They have worse user experiences

它们用户体验更差

They have volatile and uncertain governance

它们有不稳定和不确定的治理

And no, this isn’t just because they are new. This won’t fundamentally change with bigger blocks, lightning networks, sharding, forks, self-amending ledgers, or any other technical solutions.

而且, 这不仅仅是因为它们还是新事物。大区块, 闪电网络, 分区, 分叉, 改进账本, 或任何其他技术方案, 都不会从根本上改变它们。

That’s because there are structural trade-offs that result directly from the primary design goal of these services, beneath which all other goals must be subordinated in order for them to be relevant: decentralization.

这是因为这些服务的主要设计目标直接导致了结构上的权衡, 而在这种情况下, 所有其他目标都必须服从, 以使它们具有相关性: 权力下放。

Remember that “elaborate and expensive competition” I described? Well, it comes at the cost of throughput. Remember how users need to “cryptographically sign” their transaction announcements? Well, those private keys need to be held onto much more securely than a typical password (passwords can be recovered). Remember how “ no single entity operates” these networks? The flip side is that there is no good way to make decisions or govern them.

还记得我说的 "精致和昂贵的竞争" 吗?嗯, 它是以吞吐量为代价的。还记得用户需要 "加密签名" 的交易通知吗?那么, 这些私钥需要比传统密码(可以恢复密码)更安全地保存 。还记得 "没有一个实体经营" 这些网络吗?另一面是, 没有好的方法来决策或管理他们。

Sure, you can make decentralized applications more efficient and user friendly by, for example, centralizing users’ cryptographic signing keys (i.e., control of their coins) with a trusted entity. But then we’re mostly back to square one and would be better off using a service that is centralized.

当然, 您可以使去中心化应用更有效率和对用户友好, 例如, 通过将用户的加密签名密钥 (代币的控制权) 集中到一个受信任的实体。但是, 我们大多又回到了第一种, 使用一个中心化的服务会更好。

Thus, bitcoin, for example, isn’t best described as “Decentralized PayPal.” It’s more honest to say it’s an extremely inefficient electronic payments network, but in exchange we get decentralization.

因此, 比如说比特币, 最好不是描述为 "去中心化的PayPal。更诚实的说, 这是一个非常低效的电子支付网络, 但作为交换, 我们得到了去中心化。

Bottom line: centralized applications beat the pants off decentralized applications on virtually every dimension.

结语: 中心化应用在几乎每一个维度上都能打败去中心化应用。

EXCEPT FOR ONE DIMENSION.

除了一个维度

And not only are decentralized applications better at this one thing, they are the only way we can achieve it.

而这不仅仅是去中心化应用在这一件事情上更好,它们是我们实现它的唯一途径。

What am I referring to?

我在指什么呢?

Censorship resistance.

绕开审查

This is where we come to the elusive signal in the noise.

这就是我们在噪音中遇到难以捉摸的信号的地方。

Censorship resistance means that access to decentralized applications is open and unfettered. Transactions on these services are unstoppable.

绕开审查意味着访问去中心化应用是开放和无限制的, 基于这些服务的交易是不可阻挡的。

More concretely, nothing can stop me from sending Bitcoin to anyone I please. Nothing can stop me from executing code on Ethereum. Nothing can stop me from storing files on Filecoin. As long as I have an internet connection and pay the network’s transaction fee, denominated in its crypto asset, I am free to do what I want.

更具体地说, 没有什么能阻止我把比特币发送给任何我愿意的人。没有什么能阻止我在以太坊上执行代码。没有什么能阻止我在 Filecoin 上存储文件。只要我有连接的网络并且支付交易费, 我就可以自由交易加密数字资产。

(If Bitcoin is capitalism distilled, it’s also a kind of freedom distilled. Which is why libertarians can get a bit obsessed.)

(如果比特币是资本主义蒸馏出来产物, 它也是一种自由主义蒸馏出来产物。这就是为什么自由主义者会有点痴迷。)

And for readers who are crypto enthusiasts and don’t want to take my word for it, will you at least listen to Adam Back and Charlie Lee?

对于那些热衷于加密数字资产的读者, 即使不愿意听我说的, 但你会至少听亚当和查理的吗?

So while we can’t say “for everyone Bitcoin is better than Visa,” it is possible that for some cohort of users Bitcoin truly is the only way to make a payment.

所以虽然我们不能说 "对于每个人来说比特币比Visa好", 但对于某些用户来说, 比特币可能确实是唯一的支付方式

More generally, we can ask:

通常, 我们会问:

For whom is this the right trade-off?

对谁来说这是正确的选择呢?

Who needs censorship resistance so much that they are willing to trade away the speed, cost, scalability, and experience benefits of centralized services?

谁如此需要绕开审查, 以至于愿意舍弃在速度, 成本, 可伸缩性和经验更有优势的中心化服务?

To be clear, I’m not saying you have to make this trade-off in order to buy/speculate on crypto assets. I am saying that in order for decentralized applications themselves to have utility to some cohort, that cohort must be optimizing for censorship resistance.

要清楚,我不是说你必须做出这个权衡才能购买/投机加密资产。 我说的是,为了使去中心化应用对一群人有用,这群人必须优化逃避审查制度的方式。

So, who are these people?

这些人是谁?

While there is not a lot of good data, actual users of decentralized applications seem to fall into two categories:

虽然没有很多好的数据, 但去中心化应用的实际用户似乎分为两类:

People who are off the grid: that is, in countries where access to competently operated traditional services is limited (for any number of reasons) but where internet is not

在有互联网, 但是传统服务受限国家(无论什么原因)的人们

People who want to be off the grid: that is, people who don’t want their transactions censored or known

那些不希望他们的交易被审查或知道的人们

With that framework in mind we can ask:

基于这个框架, 我们可以问:

For whom is Bitcoin the best/only way to make a payment?

对谁来说, 比特币是做好的/唯一的支付方式

For whom is Filecoin the best/only way to store a file?

对谁来说, Filecoin是做好的/唯一的存储方式

For whom is Ethereum the best/only way to compute code?

对谁来说, 以太坊是做好的/唯一的计算方式

These are the questions that get at the heart of the value proposition of the technology.

这些都是技术价值主张的核心问题。

So far, most decentralized applications have very little use relative to traditional services. Bitcoin, for example, has fewer mainstream merchants accepting it as a payment option in the U.S. today than in 2014. And for all the talk of Bitcoin’s value as a payments system in developing countries or emerging markets like China, it is traditional software (i.e., apps) like AliPay and Paytm that are actually driving sweeping change in these places.

到目前为止, 大多数去中心化应用相对于传统的服务几乎没有什么用处。以比特币为例, 如今在美国的主流商家接受的付款方式比2014年要少。即使在大量讨论把比特币作为支付系统的发展中国家或中国等新兴市场的, 也是传统的软件 (即应用), 比如支付宝和 Paytm在这些地方推动着彻底的变革。

At the same time, use of Bitcoin on the dark web and for ransomware is evident, even if it is hard to get good data.

同时, 即使很难获取很好的数据, 我们也能显而易见的看到在黑色交易和比特币勒索的使用 。

But aren’t people using Bitcoin as a “store of value?” Sure, which is just another way of saying people are investing in Bitcoin with a longish time horizon. But remember I’m not talking about investing in the crypto asset yet. I’m talking about whether there are people who find a decentralized application for payments (which is enabled by that asset) useful. Real estate is only a good store of value in the long run if people live and work in the buildings. The same is true of decentralized applications.

但人们不是在使用比特币作为 "价值存储" 吗?当然, 这只是另一种说法, 人们在投资比特币的长线价值。但请记住, 我不是在谈论投资于加密资产。我说的是, 是否人们发现去中心化的支付是有用的。如果人们在建筑物中生活和工作,房地产才是长远的价值存储。去中心化应用也是如此。

What should we make of Ethereum evaluated through the “censorship resistance” lens? After all, it seems to be getting a ton of use by developers. Since Ethereum is a developer platform for decentralized applications, does that mean it is developers who have been censored or blocked somehow? In a way, yes. Developers and start-ups who wish to build financial products do not have open and unfettered access to the world’s financial infrastructure. While Ethereum doesn’t provide access to that infrastructure, it does provide a different infrastructure that can be used to, for example, create and execute a financial contract.

通过“绕开审查”的镜头,我们应该怎样评估以太坊呢? 毕竟, 它似乎得到了大量的开发人员使用。由于以太坊是一个用于去中心化应用的开发平台, 这是否意味着开发人员在被审查或阻止?在某种程度上, 是的。想要构建金融产品的开发人员和初创企业无法开放和不受限制地进入世界金融基础设施。虽然以太坊不提供对该基础结构的访问权限, 但它提供了不同的基础结构, 可用于创建和执行财务合同。

Since Ethereum is a platform, its value is ultimately a function of the value of the applications built on top. In other words, we can ask if Ethereum is useful by simply asking if anything that has been built on Ethereum is useful. For example, do we need censorship resistant prediction markets? Censorship resistant meme playing cards? Censorship resistant versions of YouTube or Twitter?

因为以太坊是一个平台, 所以它的价值和最终是建立在上面的应用程序的价值相关。换句话说, 问以太坊是否有用, 我们可以通过问以太坊上建立的东西是否有用。例如, 我们是否需要防审查的预测市场?防审查的棋牌游戏?防审查的 YouTube 或 Twitter?

While it’s early, if none of the 730+ decentralized apps built on Ethereum so far seem useful, that may be telling. Even in year 1 of the web we had chat rooms, email, cat photos, and sports scores. What are the equivalent killer applications on Ethereum today?

虽然还在早期, 但如果建立在以太坊上的730多个去中心化应用,没有一个有用, 这可能说明了点什么。网络出现的第一年,出现了聊天室,电子邮件,猫照片和体育赛事。 今天以太坊的等效杀手级应用程序是什么?

So where does this leave us?

那我们该怎么办?

Given how different they are from the app models we know and love, will anyone ever really use decentralized applications? Will they become a critical part of the economy? It’s hard to predict because it depends in part on the technology’s evolution but far more on society’s reaction to it.

考虑到它们不同的应用程序模型,是否真的有人在使用去中心化应用呢?他们会成为经济的关键部分吗?这是很难预测的, 因为它部分取决于技术的演变, 但更多的是社会对它的反应。

For example: until relatively recently, encrypted messaging was only used by hackers, spies, and paranoids. That didn’t seem to be changing. Until it did. Post-Snowden and post-Trump, everyone from Silicon Valley to the Acela corridor seems to be on either Signal or Telegram. WhatsApp is end-to-end encrypted. The press solicit tips through SecureDrop. Yes, the technology got a little better and easier to use. But it is mainly changes in society that are driving adoption.

例如: 在最近之前, 加密消息只是被黑客、间谍和偏执狂使用,这似乎没有改变。直到斯诺登和川普之后, 从硅谷到 Acela 走廊的每个人似乎都在使用Signal或Telegram。WhatsApp 是端对端的加密。新闻界通过 SecureDrop 来招揽小费。是的, 这项技术有了一些改进, 更容易使用。但主要是社会的变化推动了接受度。

In other words, we grew up in the rainforest, but sometimes things change and it helps to know how to adapt to other environments.

换句话说, 我们是在雨林中长大的, 但有时事情会改变, 它有助于了解如何适应其他环境。

And this is the basic argument that the smart money is making on crypto assets and decentralized applications: that it’s simply too early to say anything. That it is a profound change. That, should one or more of these decentralized applications actually become an integral part of the world, their underlying crypto assets will be extremely valuable. So might as well start placing bets now and see how it goes. Don’t get to hung up on whether we see the killer apps yet.

这就是智能货币对加密资产和去中心化应用的基本观点: 说什么都为时过早。这是一个深刻的变化。, 如果这些去中心化应用中的一个或多个领域成为世界不可分割的一部分, 它们的底层加密资产将非常有价值。所以不妨现在就开始下注, 看看会怎么样。不要局限于我们是否看到了杀手应用程序。

That’s not a bad argument and I tend to agree.

这不是一个坏的论点, 我倾向于同意。

I would summarize the argument as: in the long-run, a crypto asset’s value is driven by use of the decentralized application it enables. While it’s early, the high valuations are justified because even if the probability of mass adoption is small, the impact would be very large, so might as well go along for the ride and see what happens.

我将把论点概括为: 在长期, 一个加密资产的价值是由它关联的去中心化应用驱动的。在它的早期, 高估值是合理的, 因为即使被大众接受的概率很小, 但一旦接受了影响将是非常大的。 所以不妨去顺着这趟旅程看看会发生什么。

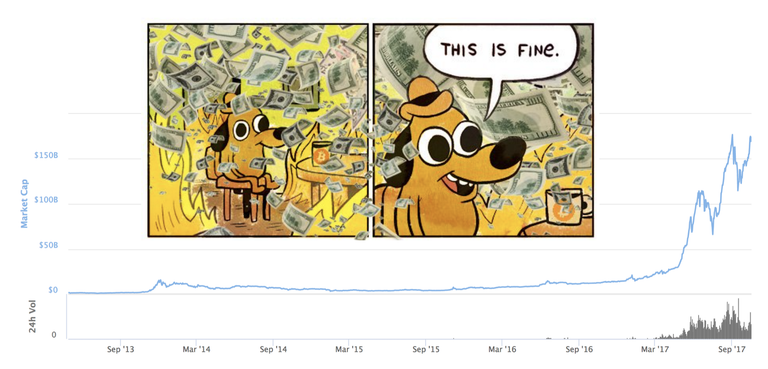

But how do we explain the recent mania?

但我们如果解释最近的疯狂呢?

Bitcoin is up 5x in a year, Ethereum is up 30x. The total market cap of all cryptocurrencies is ~$175B, up from $12B just a year ago. Why?

比特币在一年内上升5倍, 以太坊上升了30倍。整个数字货币的总市值从去年的120亿美元上升到1750亿美元。为什么?

As in every mania in history, it is currently rational to be irrational.

正如在历史上的每一个狂热, 它是目前的非理性是理所当然的。

To understand what’s going on, let’s look at the buyer and seller mentality right now, starting with the buyers.

为了了解目前的状况, 让我们看看买方和卖家的心态, 从买家开始吧。

If you invested early in Bitcoin or Ethereum, you are sitting on a windfall. It feels like you are playing with “house money,” a well-known psychological effect. You feel smart and willing to risk more than you otherwise would if it was “your money.” Might as well diversify a bit and parlay your gains into the next crypto asset, or two, or three.

如果你早期投资于比特币或以太坊, 你就发了一笔横财。 你会觉得自己很聪明, 也会愿意多冒险一点, 把你的收益放到下一个或多个加密资产中。

If you didn’t invest, the fear-of-missing-out continues to build until the “screw it” moment when you buy in. Maybe you read about Bitcoin, didn’t understand it, and followed Warren Buffet’s (good) advice not to invest in things you don’t understand. Some of your friends made money but you still ignored it. Then you read about Ethereum, which you really didn’t understand, also passed on buying, and later found out that your friends are planning to retire because they did. The lesson seems to be anti-Buffet: only invest in things you don’t understand. This is causing people to check their judgement at the door when the latest all-time high finally convinces them to jump into the market.

如果你没有投资,那么在购买之前,你都会担心错过了机会。 也许你留意到比特币,不明白它是什么,并遵循沃伦·巴菲特的(好的)建议 不要投资你不明白的事情。 你的一些朋友赚钱了,但你没有。 然后你留意到以太坊, 还是不明白而没有买,后来发现你的朋友计划退休,因为他们买了。 这个教训似乎是个反例:只投资于你不明白的事情。 这导致人们匆匆下了判断,一波新的进入市场的高潮到来。

And that is not good.

这可不好。

Because there will be sellers to fill the demand, especially the demand coming from people who have decided they will never understand this stuff so will just place bets on things that sound complex and impressive.

因为会有卖家来填补这些永远也搞不懂,只对那些听起来复杂和印象深刻的事情下注的人们的需求。

Let’s think about these sellers. And by sellers, I don’t mean people selling their holdings of existing crypto assets. I mean new issuers. Teams launching new crypto assets.

让我们来谈谈这些卖家。 说到卖家, 我不是指持有现存加密资产的人, 而是新发行数字资产的人和团队。

The basic model is to pre-sell some percentage of the crypto assets the proposed network will generate as a way to fund the development of the decentralized application before it launches. The project founders tend to hold on to some percentage of these assets. Which means that raising money for a project this way is a) non-dilutive as it is not equity and b) not debt, so you never have to pay anyone back. This is basically free money. It’s never been this good for entrepreneurs, even in the 90s dot-com boom. Which makes it incredibly tempting to try and shoe-horn every project that could perhaps justify an “initial coin offering” to go for it, even if they aren’t actually building a decentralized application. After all, an ICO lets you exit before you even launch.

基本的模型是预售这个网络即将产生的一定比例的加密资产, 作为在其启动前为去中心化应用的开发提供资金的一种方式。项目创始人往往持有这些资产的一定比例。这意味着, 以这种方式筹集资金是 a) 免责的,它不是股份和 b) 不是债务, 所以你永远不必向任何人还钱。这基本上是白送的钱。即使对90年代的互联网热潮中的企业家来说, 也没这样的好事。这样就诱使人们尝试和包装每一个项目去ICO, 即使他们实际上并没有建立一个去中心化应用程序。毕竟, 一个 ICO 在你启动前就能让你退出。

And there is a pervasive narrative out there that supports entrepreneurs looking to create new crypto assets. The idea is that by selling assets to users before your network launches, you create “evangelists” who will be early users and promoters you wouldn’t otherwise have if there were no financial incentive to participate in your community.

而且有一个普遍的支持企业家创造新的加密资产的说法。 这个想法是,通过把资产卖给你的网络启动前的用户,你就给早期用户和推广者带来了福音, 否则无法通过经济激励让用户参与到你的社区。

The problem with this line of thinking is that it conflates early investors with early users. The overlap between people who buy your crypto asset and people who actually want to use the service you are building is likely very, very small, especially during market manias like this one. It creates a false sense of “product-market fit.” Yes, people are buying your crypto asset. But that’s because the “market” are people who want to get rich and the “product” you are selling is a “way to get rich.”

这种思路的问题是, 它合并早期投资者与早期用户。购买您的加密资产的人和实际想要使用您正在构建的服务的人之间的重叠可能非常非常小, 尤其是在像这样的市场狂热中。它制造了一种 "产品-市场契合" 的假象。是的, 人们正在购买您的加密资产。但那是因为 "市场" 是那些想要致富的人, 而你所销售的 "产品" 是 "致富之道"。

But “this is fine.”

但这没问题。

Everyone’s making money. For now.

现在每个人都在赚钱。

It’s currently rational to be irrational.

现在理性是不合理的。

As long as that blue line keeps going up.

只要那条蓝线持续上升

Only when the tide goes out do you discover who’s been swimming naked.

只有当潮水褪去, 你才知道谁在裸泳。

At the same time, I wouldn’t bet against crypto assets.

同时, 我也不会对加密资产下注。

He who lives by the crystal ball will eat shattered glass.

靠水晶球生活的人会吃碎玻璃

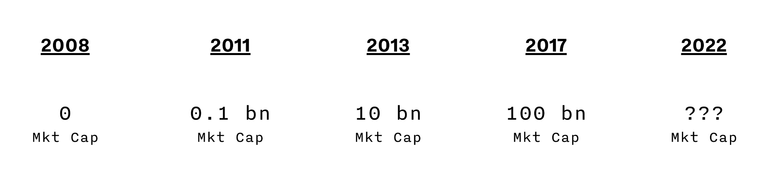

Consider the following. The total market cap of crypto assets has been increasing by an order of magnitude every few years. Where will they be in 2022? It’s certain that many (most?) of the crypto assets launching today won’t make it. But neither did most of the ones that were launched back in the 2013/4 boom (when they were referred to as “alt coins”). Though an important alt coin from 2014 did stick around and drove the most recent boom to new heights by being the platform to power all the others: Ethereum.

考虑以下这点。 数字资产的总市值每隔几年就会增加一个数量级。 到2022年会如何呢?可以肯定的是目前很多(大多数)的加密资产无法活到哪个时候。但是2013,2014年发行的数字资产(被称为山寨币)也没有活到现在。 即便这样,2014年一个重要的山寨币坚持下来了, 并作为平台把最近的热潮推向了新的高度:它就是以太坊

So, Jamie, what’s the bottom line?

所以, Jamie, 结论是什么呢?

Allow me to summarize.

让我来总结一下。

Cryptocurrencies (which I prefer to call crypto assets) are a new asset class that enable decentralized applications

数字货币(我称之为加密数字资产)是一种新的资产类别, 它使得去中心化应用成为可能。

Decentralized applications enable services we already have today, like payments, storage, or computing, but without a central operator of those services

去中心化应用提供我们现在已经有的服务, 像支付, 存储或者计算, 但是不需要中心化组织。

This software model is useful to people who need censorship resistance which tend to be people that are either off the grid or who want to be off the grid

这个软件对想要绕开审查的人群有用

Most everyone else is better off using normal applications because they are 10x better on every other dimension, at least for now

其他所有人最好使用普通的应用程序, 因为它们在每个维度都比去中心化应用快10倍, 起码现在是这样。

Society’s embrace or rejection of new technology is hard to predict (think about encrypted messaging)

社会对新技术的拥抱或拒绝很难预测 (参考加密消息)

In the long-run, the value of a crypto asset will rise and fall in proportion to the use of the decentralized application it enables

长期来看, 加密资产的价值取决于对应的去中心化应用的使用比例

In the short-run, there will be extreme volatility as FOMO competes with FUD, confusion competes with understanding, and greed competes with fear (on both the buyer side and the issuer side)

在短期内, 在疑惑与理解,贪婪与恐惧, 价格将有极端的波动性

Most people buying into crypto assets have checked their judgement at the door

大部分购买加密资产的都没有经过认真思考

Many sellers of new crypto assets aren’t actually building decentralized applications but are instead shoe-horning an ICO into their service because of the market mania; that doesn’t mean decentralized applications are bad, it just means people are capitalizing on the confusion and are probably themselves confused

大部分加密资产的发行方并不是真正的构建去中心化应用,而是在它们的服务中装入ICO, 因为ICO市场太疯狂了。 这并不意味这去中心化应用是糟糕的, 而只是说人们可以利用这种混乱, 或者他们本身也感到疑惑。

Don’t bet against crypto assets in the long-run: as we approach the 10 year anniversary of the Bitcoin paper it is clear that they aren’t going anywhere and that decentralized applications may very well find an important place alongside all the other forms of organization we have come to take for granted.

不要赌加密资产长期会怎么样:当我们已经接近比特币论文发表10周年纪念的今天, 很明显, 他们不会去任何地方。 去中心化应用很可能会在我们习以为常的形式和组织外,找到一个重要的位置。 Best, Adam

p.s. —You may have noticed that I didn’t use the word “blockchain” in this note. The word now tends to confuse more than enlighten.

另外 - 你可能注意到了, 我没有使用“区块链”这个词, 因为它带来的迷惑比启发多。

p.p.s — There is another, related market I didn’t talk about: cryptographic ledgers in the enterprise. More on that soon.

再另外 - 还有一块我没有谈到的市场: 企业中的加密账本。这个我以后会说。

区块链中文字幕组

致力于前沿区块链知识和信息的传播,为中国融入全球区块链世界贡献一份力量。

如果您懂一些技术、懂一些英文,欢迎加入我们,加微信号:w1791520555。

点击查看项目GITHUB,及更多的译文...

本文译者简介

小丹 区块链技术爱好者, 欢迎加微信号 zhuangjun0606� 交流。

本文由币乎社区(bihu.com)内容支持计划赞助。

版权所有,转载需完整注明以上内容。

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://blog.chain.com/a-letter-to-jamie-dimon-de89d417cb80