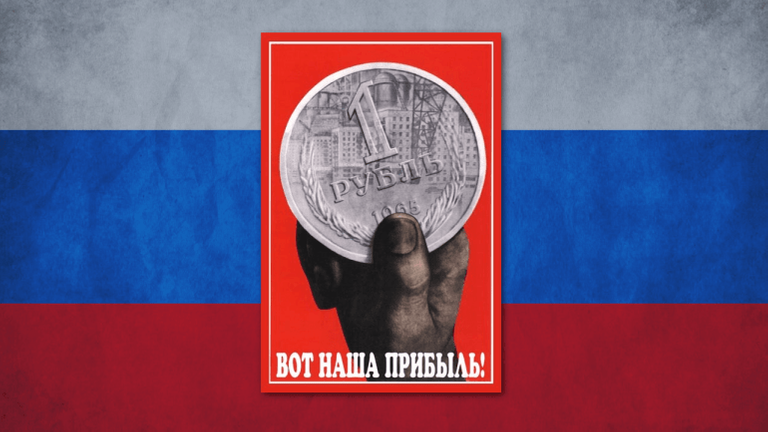

Just days after Russia issues a ban on cryptocurrencies, it has now confirmed that it will issue its own digital currency, the CryptoRuble. In doing so, Russia has confirmed the greatest fear of cryptomongerers: impending regulation.

Just days after Russia issues a ban on cryptocurrencies, it has now confirmed that it will issue its own digital currency, the CryptoRuble. In doing so, Russia has confirmed the greatest fear of cryptomongerers: impending regulation.

Examining CryptoRuble’s Specifications

Russia’s CryptoRuble will be controlled entirely by central authorities, according to Nikolay Nikiforov, Minister of Communications. It will not be mined, and the proof system has not been confirmed. Instead, it will be issued through authorities themselves. The currency will carry a 13% capital gains tax, and all transactions will be taxed at that rate without proof of acquisition.

Sounds pretty terrible.

Russia’s Stance on Crypto

Russia has been consistently critical of cryptocurrencies. In fact, all of this comes just weeks after Russia proposed exchange bans and mining bans, going so far as to slap the ‘money laundering’ label on on crypto miners. Its official stance is that cryptocurrencies pose “serious threats” through fraud and money laundering, according to one of Putin’s recent statements. Finance Minister Anton Siluanov articulated the following:

“We have agreed on the following: the state should regulate the process of issuing cryptocurrencies, the process of mining, the process of circulation.”

Realizing Bitcoin’s Weakness

Bitcoin has only one weakness: regulation. Inevitably, governments will heavily regulate digital currencies or simply issue their own. These new currencies represent direct competition to Bitcoin, privacy coins, and existing digital currencies. While their validity is refuted by central authorities, government issued coins will be backed by the full faith and credit of their respective governments. Although some businesses have begun accepting bitcoin as payment, many refuse to because of its apparent lack of backing and threat of regulation. It is too risky, from their perspective, to engage in commerce with currencies that may draw a disapproving regulatory eye.

Global Reaction

Bitcoin saw a sharp fall immediately following the news before settling around $5,500.

Top altcoins saw similar price action, and the overall market appears to be stalemated at press time. This reaction is surprisingly tepid given the gravity of this announcement. If the excitement surrounding the Bitcoin Gold hard fork were removed from the situation, the market would likely be found without a bottom in sight.

source - www.cryptoanswers.net