Civic could be one of the first cryptocurrencies to hit mass adoption. It provides financial benefit to business and improved security for society. In fact, millions of people could use Civic before they even know what a cryptocurrency is.

This article provides an overview of Civic’s strengths at the moment.

Partnerships

Civic has been very low-key with their marketing, so it stayed off the radar of many investors. Instead, they have chosen to form partnerships and build dominant network effects in its niche. For example, they recently announced a partnership with Progrexion, one of the leading credit repair services in the United States.

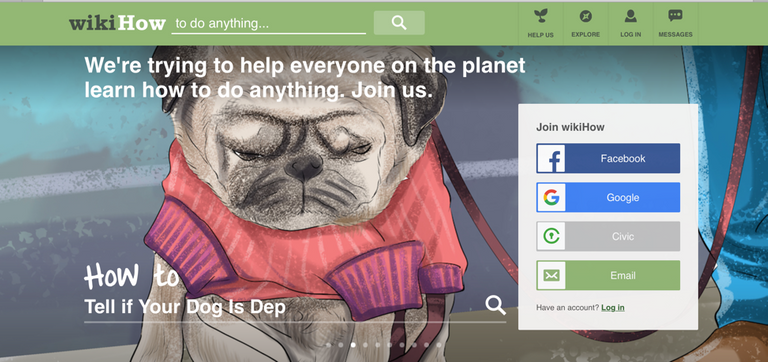

Another major partnership? Look at WikiHow’s homepage…

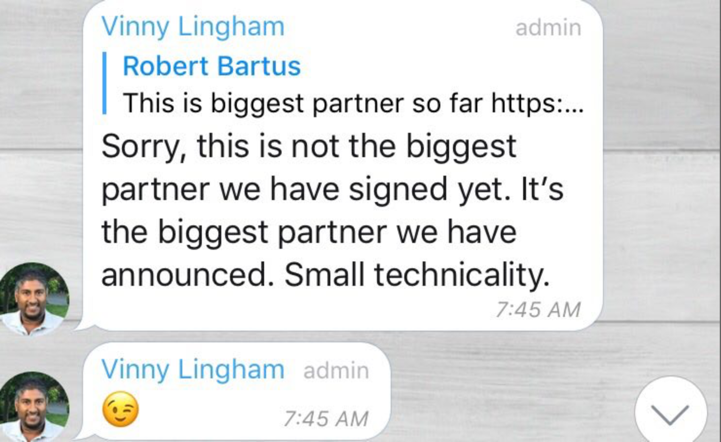

By the time any competitors come along, Civic will have firmly established itself as the go-to solution for identity verification in the crypto space. From what Vinny Lingham says, there is a deep pipeline of major partnerships that have not been announced yet.

In response to a comment about the Progrexion partnership…

Benefit to Business

Civic provides a clear economic incentive to businesses:

It costs 50-70% less to verify identities than traditional methods.

Verification is much faster and simpler, providing less friction to them and their clients.

Clearly, businesses will prefer to use the cheaper, faster option to verify identities. This will drive business to push users to verify their identities with the Civic app over other options.

Businesses who choose to verify identities with Civic will have to purchase Civic tokens to pay for the services, increasing the token’s value. Which leads me to our next point.

No Mainstream Adoption Needed

Businesses buy the tokens, not the users. That means we don’t have to wait for the general public to know what cryptocurrencies are for Civic to achieve mass use.

On the user experience side, all they have to do is download the app, enter their information, and then scan the QR code. They don’t need to buy Civic, or even know cryptocurrencies exist.

That’s great news because cryptocurrencies are confusing to most people. It will likely take several years or decades for the average person to accept cryptocurrencies as “real money”. With Civic, they don’t need to.

Benefit to Society

The major societal benefit of Civic is that the major hacks that we saw in the Equifax hack recently will not be possible.

The Equifax hack was so devastating because Equifax stored all of their data in one “box”. If a hacker gets into the box, everyone’s identities are compromised. Until now, this system has been standard.

Because the Civic protocol is decentralized, systemic hacks aren’t possible. There is no one box for a hacker to get into. You upload your information to the Civic app on your phone. The information stays on your phone. That information is not connected to any other outside source.

Conclusion

These are just a few of the important strengths of the Civic project. The strength of the project is by no means limited to the information above. Although anything could happen, it does seem that Civic is preparing itself to become super dominant in it’s niche. The network of partnerships and uses is expanding rapidly behind the scenes, setting itself up for amazing long term growth and adoption.

Disclaimer: I am not a financial advisor and this is not financial advice. I'm just some random person who is interested in cryptocurrencies, and these are just my opinions. I am biased. Do you own research please!

Nice post, seems to be going under the radar atm, not had to much price action in a while

I have some Civic coin though I still have some doubts about the whole thing. Unfortunately, phones are not very secure at all so I wonder how wise it is to put all your info on them. Any comment on that issue?

If your information can only be accessed with your personal thumbprint, it seems like a pretty secure way to store data. I don't have enough knowledge in that area to comment very well, but I'll look into it. In any case, the Civic network as a whole would be far more secure than our current centralized system. With no single point of failure, a mass hack like we saw with Equifax would be essentially impossible.

Thanks for the question :)