Hello crypto community... I would like to share with you some tips for better storage of crypto assets...

I hope it will be helpful for all of you !

- Cold Wallets Are an Awesome Idea

Keeping all your currency in a hot wallet is asking for trouble. A hot wallet (one connected to the internet) is great for day-to-day transactions, but they are easier to steal from. A “cold wallet” means storing your crypto offline. Keeping most of your cryptocurrency safe in cold storage is just plain good practice.

Most hardware wallets are tamper resistant. Meaning they will erase themselves if someone tries to break into them, either physically or by attempting many passwords. This is much better than a laptop or other general-purpose device because if the laptop is stolen, any wallets on there can be attacked forever.

The most popular cold storage hardware wallets are Ledger and Trezor.

- Never Use Exchange Wallets for Longer Than You Need To

In other words, don’t keep your bitcoin on Coinbase, Bitpanda, Binance, or any other exchange.

This one doesn’t make sense on the surface. Why wouldn’t you want all your currency ready to trade at a moment’s notice?

First off, online wallets, in general, are dangerous. You are not the only person with access to your funds. In fact, you don’t even have total control over the wallet. Not having full control over your wallet is a pretty glaring security issue, and should be avoided if possible.

Secondly, cryptocurrency exchanges can fail incredibly quickly. There is no fallback for crypto exchanges other than the ones they make. If the exchange fails, you may never get your cryptocurrency back. Your money may have even been used without your knowledge in an attempt to prop up the failing exchange.

And lastly, due to their extremely large turnover, exchanges are a much bigger target for hackers and other malicious people than a single wallet.

BUT if you want to use it:

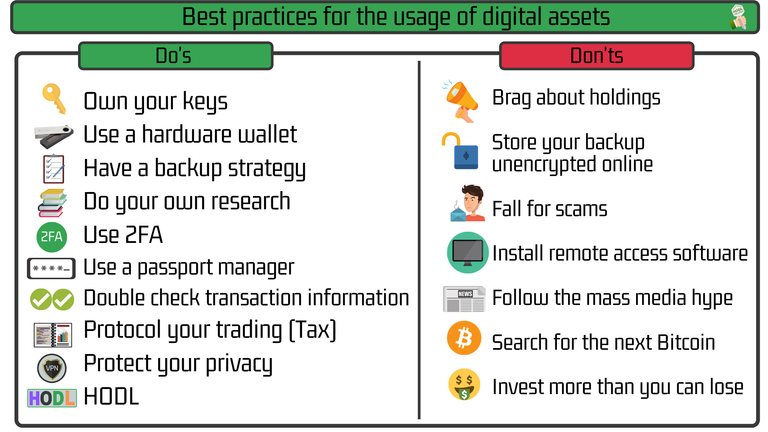

Always Use 2FA

If you choose to use an exchange or centralized cryptocurrency trading platform, always use a platform that offers 2FA security. Simply setting up SMS authentication is not enough — always use a dedicated 2FA application such as Google Authenticator.

- Always Encrypt Your Wallets

Now that your crypto is safely in a private wallet, your next challenge is keeping your wallet secure should the files themselves be stolen by someone across the internet.

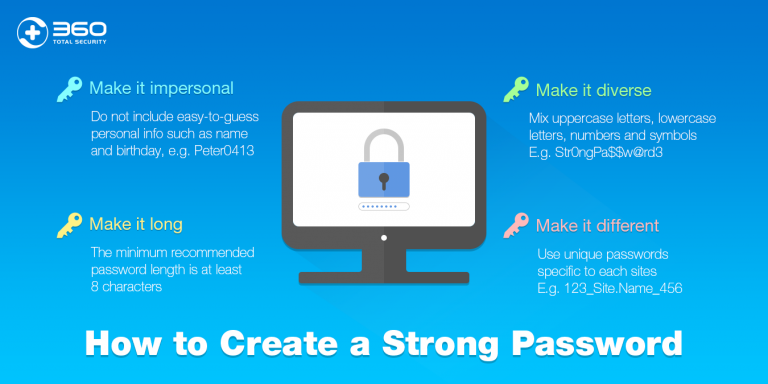

The first line of defense for the wallet is a strong password. As with most passwords, length trumps complexity, and the combination of both is best.

- Use Separate Addresses Where Possible

Staying private in the cryptocurrency world is, in general, a good idea. Bitcoin has a reputation for being anonymous, but that’s not actually true.

When you transact with someone, they can see your “public address.” It looks something like this:

1GsOmhLr0FbBpNco1NDar6sSV8tsHaKF6kd.

It doesn’t tell anyone your name, but if they search for this address (on a block explorer), they’ll see every transaction you’ve ever made using that address.

It means you’re effectively sharing your transaction history with someone else. You’re also showing that person who else you have transacted with and how much was transferred. That last one falls under the first rule we have, as sharing how much cryptocurrency you have makes you a target.

When transacting with non-private cryptocurrencies like bitcoin or litecoin, be sure to use separate addresses for each transaction.

An alternative is using a truly anonymous cryptocurrency like monero.