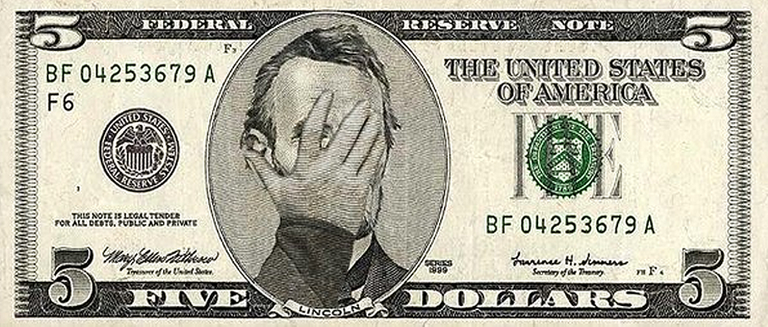

One guy wrote a post on the Internet. He invested in an ICO and did not know what to tell his wife because the money he invested were borrowed from a bank and the ICO failed. Nobody wants those tokens anymore. So, what should this guy do now, in your opinion?

One guy wrote a post on the Internet. He invested in an ICO and did not know what to tell his wife because the money he invested were borrowed from a bank and the ICO failed. Nobody wants those tokens anymore. So, what should this guy do now, in your opinion?

When we were launching an ICO I spoke to almost all of our investors. Not with all of them but with the majority. My message was simple – you should invest the amount of money you are willing to lose. I kept saying this over and over again. I even refused some of the potential investors. Not many, but still I turned two or three of them down. It was not about ethics. It was not about morality. It was not about reputation.

The thing is that one of my businesses is a detective agency. Thus, I saw many malicious fraud cases. People say a project will be a success and then some force majeure happens. This is when infuriated investors hire detectives to find the fraudsters. We conduct a thorough investigation on the case and see that no one actually intended to cheat at first. It just happened.They just did not calculate their own strength. Did not foresee all the possible outcomes. In fact, willful fraud cases are not as common as single cases of stupidity. But the outcome is always the same – court cases initiated by the investors and jail for the stupid entrepreneur.

Some people wrongly assume that it is possible to flee – there were cases when we had been searching for 2 years but managed to find people in the end. Whatever large amount of investments a person gets, they will lose it in a couple of years if they have no experience of managing such sums. Moreover, they will end up in a much worse situation than they were before.

Knowing all this, I have decided to work only with those investors who were ready to lose money. Even though my thoughts are unlikely to be heard, I highly recommend that all ICOs adopt this policy. We all play a very high-risk game: 9 projects out of 10 fail after collecting money. Different people, including ones like the guy I was talking about, invest into projects; they invest money borrowed from banks. These people are stupid. They are not ready to be investors. The ICO team has to explain that investing is out of their league. Maybe they are just not suited for this.

However, ICOs do not do this. As a result, after crying his eyes out, our guy will get angry and file a report to the police to initiate criminal proceedings against the ICO team. The team will have many unpleasant years ahead.

So maybe it is reasonable to prevent such situations? Maybe saying ‘guys, we can fail’ at the beginning makes perfect sense? ‘Investing credit money in an ICO is a bad idea and this is why we refuse you’?

It's probably not about the ICO's themself but about market situations. Most of the ICO's (at least the barely legit ones) stated clearly in their whitepapers that it's an extremely high risk investment. But during the period from december to february, because of the extremely bullish market, a lot of people ignored any kind of warning and overinvested, thinking it will never go down. It's probably unpossible to prevent something like this because with the market in similar conditions to december/january a lot of people will ignore anything written on the websites and just buy, it's like gambling: you can put signs stating that it may cause dependency but some people will became gambling addicted. With large investors like this case it may be possible to do better checks from the ICO companies but there always be some standard investors that may overinvest. In some countries small money in the western world may be big money, that's hard to "prevent" something.