Hi everyone,

I was trying to work out what relationship MKR has with DAI in regard to how the amount of Dai issued affects the valuation of MKR.

Quick facts: only 1,000,000 MKR, currently valued at $650 per token this is a DAO governance token and fee token combined. Stability fees are paid in MKR and are burned regularly. For more info go to https://makerdao.com/whitepaper/DaiDec17WP.pdf

I realize that the more DAI there is, the more MKR is burned. So there is an amplifying effect on the rate of burn, if MKR doesn't simultaneously grow in value. So if MKR lags behind growing use of CDPs than it will burn faster, causing supply to dimish quicker, causing valuation to rise quicker. This means that MKR Value is correlated well with the rate of CDP's shut per twhatever_time_period_you_want

I suppose the real question is how does the amount of Dai in circulation affect the burn rate of MKR

I'm asking for help, clarity, and feedback on some of my questions and thoughts:

A higher % stability fee, yet higher valuation MKR, creates a balancing effect on the rate of burn

ie:

0.5% fee on a $100,000 dai draw is paid for with 500$, at 600 per MKR that's 0.833 burned

while

0.5% fee on a $100,000 dai draw is paid for with 500$, at $2400 per MKR that's 0.2083 burned

2% fee on a $100,000 dai draw is paid for with $2,000, at $2,400 per MKR that's 0.833 burned

while

2% fee on a $100,000 dai draw is paid for with $2,000, at $9600 per MKR that's 0.2083 burned

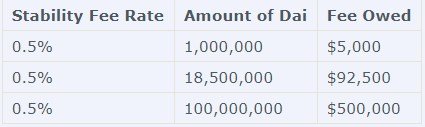

At the moment, for every 1m dai drawn, $5000 worth of Maker is used to close that amount in CDPs. However, since it's denominated in Dai, but paid in MKR this means that the amount of MKR burned fluctuates with the rhythm of the MKR market itself. The cheaper MKR is, the more gets burned as seen in my examples above.

Here are some more example figures:

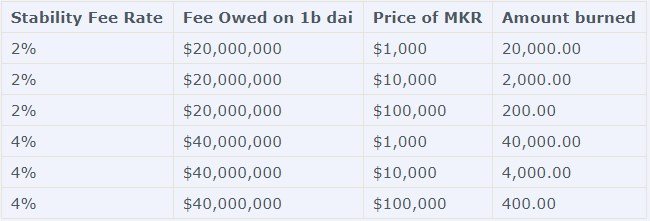

assuming 1billion dai in circulation (which will happen) assuming rates are a little higher for the multi-collateral system:

Do what you wil with those tables, just made them so i don't have to guess figures. So naturally, if the system operates with no failures than over time the burn rate will slow down in terms of MKR (not Dai). So the less MKR there is, the less is burned.

So I've understood that

over time less actual MKR will be burned, as a result of shrinking supply

as MKR becomes more expensive less actual MKR will be burned, regardless of supply

the more Dai in circulation, the larger the rate of shut CDPs

Here are my questions:

How will the stability fee change over time (especially with this coming multi-collateral version of Dai)?

Just because there is a CDP, it doesn't mean it will be closed anytime soon. CDPs can be closed in a day a month, a year, or even a decade. Is the stability fee required to be paid annually? or does it simply accrue with no obligation of payment until the CDP is "shut" (regardless of time frame)?

If one were to try to write an equation to figure out all the variables at play which determine MKR value, what might it look like (calling on our Mathemagicians)?

Anyway, i need to wrap this post up. I would try to think up more stuff if time allowed, but i am curious to see how you all think.

Congratulations @davidutro! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Congratulations @davidutro! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!