I firmly believe in the adage, do not invest in something you do not understand. Cryptocurrency isn't easy to understand to be sure, so I'll try to explain it in my own words and omit some of the technical stuff as much as I can ....

Essentially, in a nutshell, bitcoin (and other cryptocurrencies) is a type of decentralised peer-to-peer database. Peer to peer means you communicate with each other and not to some central server. There is no single point of control, and the system works because transaction validation happens randomly (and several validations are necessary) throughout the world and through the strength of cryptography. There exists thousands of nodes contributing to the network and anyone can participate and get rewarded for their contribution in block rewards. In bitcoin's case, this network purely deals with the storage of the bitcoin currency and transactions. This is its application.

Numerous exchanges exist worldwide that allow you to exchange bitcoin for fiat (fiat means "regular" money like the euro/yens/dollar etc) and that is one way that gives bitcoin direct value. Another way is online stores accepting bitcoin for payment, although uptake here is slower albeit accelerating. As with fiat currency, these days, currency is just an entry in a database. None of it is actually real, people decide to make it real. So why bother with cryptocurrency at all if we have "already solved" the currency problem...

Well, because we have not. At least, in the modern connected world the traditional centralised systems just do not work. They work in their own little bubbles but as soon as integration needs to happen between different systems things start to break down. Mostly, because these centralised financial systems do not trust each other and all have their own agendas (to make money for themselves usually). This is the reason why it takes days to send funds from one bank to another. Sending money overseas is even harder, and more importantly, pretty expensive. It is expensive because of the middle man, the middle man wants a cut, a big cut really. This is the problem that cryptocurrency solves because there IS NO MIDDLE MAN. You do not need to trust each other because you can trust the power of cryptography. So that is kind of a big deal, the ability to send money(or other assets) to anyone in the world and it only takes seconds or minutes (many minutes for bitcoin currently) and you need no bank to do it.

The other reason you may well be aware of is we have no control over our own money. I don't think I need to explain that one, you cannot even really stop someone from debiting your own account...it is tedious to get those entries reversed too. Your basically trusting a centralised institution to protect you. And the reality is most of them have failed so far.

So, this is the future of money I believe - is in some measure to do away with banks and decentralise. Banks will never go away completely but their role will diminish, unless they radically reform themselves technically. Some of these changes will probably happen over the next few years. It will be disruptive to the big corporates, but those corporates that choose to embrace it will have a role to play and those that do not will just wither away.

In a nutshell, what this is all about is about people taking control back of their own money. That is the goal of bitcoin. Cryptocurrency as a whole goes far beyond just money, other currencies aim to solve other applications, although they too have currency behind it all.

So basically besides for being a great thing as a concept and application it is also a fantastic investment right now.... The supply is essentially limited meaning more monetary value entering the system means the earlier you get in the better. As a reference point I will point you to snapshots within the last few years at about this time of the year. What you need to understand is totally supply + number of circulating supply (the number of tokens) for now and the increases are very apparent.

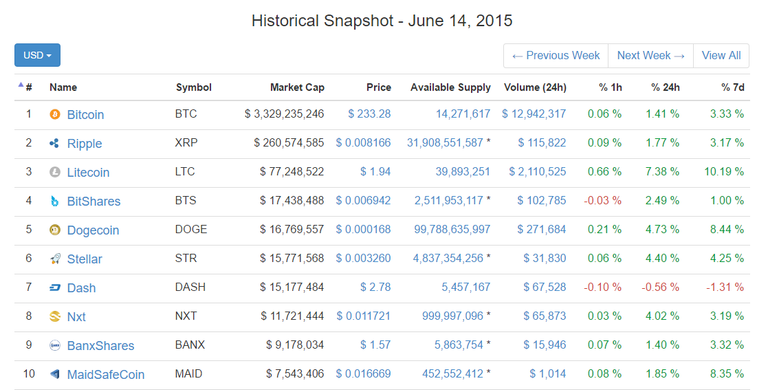

2015:

Note, no Ethereum yet.

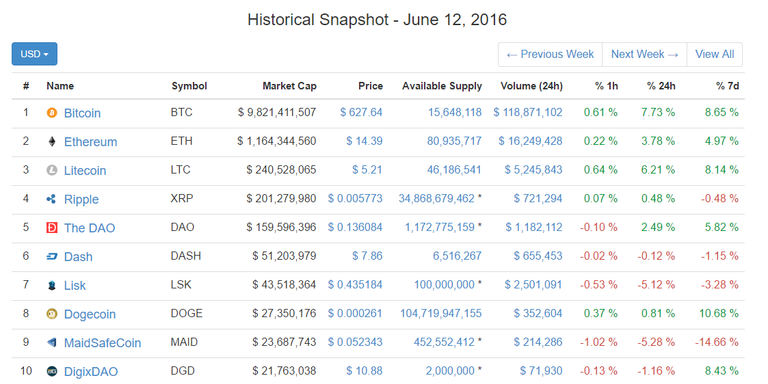

2016 :

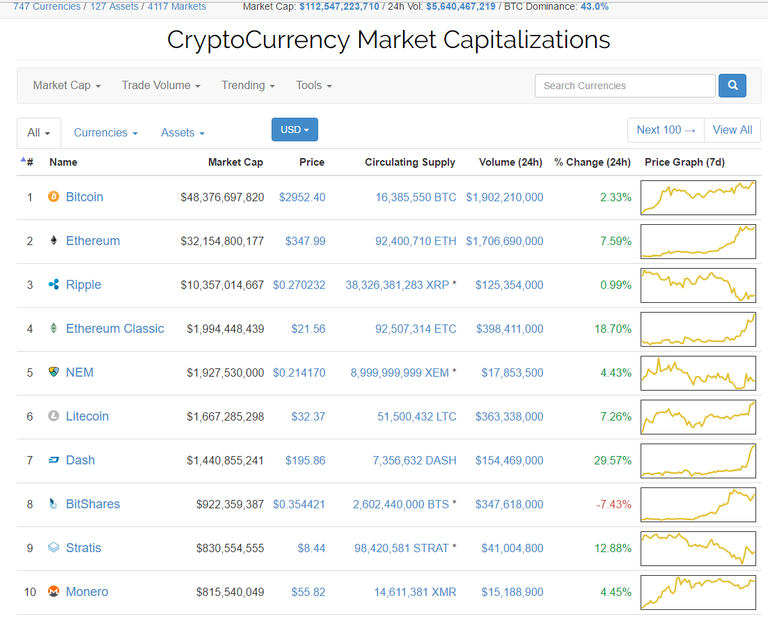

2017 - today :

As you can see it is snowballing, some things of interest happened this year. Japan and Singapore declared cryptocurrency as fully legal tender. So that is a huge new market. In our country, South Africa, it is not considered as tender but also not illegal, there just is no legal recourse - unless you have a really good lawyer that can prove damage was done in the event of any unscrupulous losses. Best advice, do everything yourself as much as possible. But more on wallets and security next time.

Yes it is volatile. Yes there will be a correction at some stage and maybe quite a big one, but I don't think this is any bubble we have just started chewing the gum.

Good article btw buddy,it simplify some complex matter about cryptocurrency too.