The "Dogecoin is more used than Bitcoin Cash" narrative is faulty but I don't agree entirely with the logic of your rebuttal.

Exchange trade volume does not mean there is more commerce on Bitcoin Cash. It means there is more money being traded every day for the tokens, but in both cases the vast majority of that money never leaves exchanges. It doesn't represent people getting value from Bitcoin Cash (by facilitating the trade of goods and services) but people assigning value to Bitcoin Cash. However, the increased trade volume at least corroborates that there is more going on in Bitcoin Cash than Dogecoin. Yet still not always. Cardano has $5 Billion market cap and $113 million daily trade volume. Yet it is doing less than 100 transactions per day on its blockchain, so trade volume doesn't necessarily translate into anything more meaningful. Similarly Ripple has very high trade volume but pathetic numbers of transactions per day.

I would instead challenge the legitimacy of the transactions that are being done on Dogecoin. Sure, there are more transactions, but anyone can run a bot that chains transactions together over and over. It would not really be very expensive to do, on either Dogecoin or Bitcoin Cash.

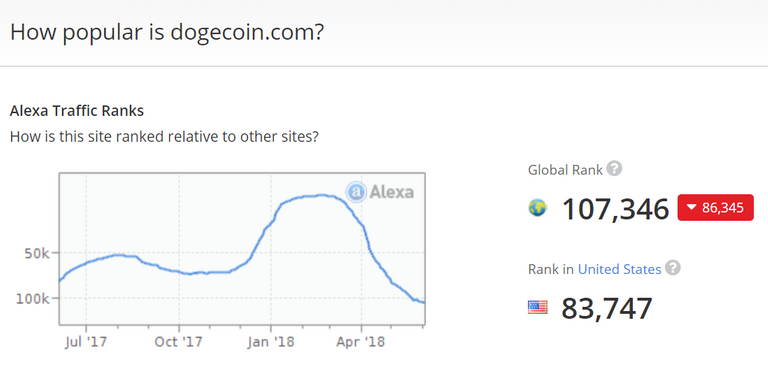

If there is legitimate financial activity going on on a chain you should be able to see it in other ways. For example web traffic to Dogecoin related sites.

Dogecoin.com is dead.

The Dogecoin subreddit is dead, with a new post every few hours:

https://www.reddit.com/r/dogecoin/new/

There is far more activity on https://www.reddit.com/r/btc

Given the lack of evidence of activity within Dogecoin, I would say the burden of proof is on those making the argument that the transactions represent economic activity.

I was about to comment the same, but the market cap is a measure of interest and in the video he also shows these 1, 2, bitinfosharts that clearly show there is much more money moving in the form of Bitcoin Cash.

It is clear there is more interest. It's less strong evidence of commerce (other than speculation), because tokens which clearly have no commerce on their blockchain still have a lot of money sloshing around on exchanges.

Median transaction value is itself something easily manipulated on chain. The cost of creating transactions if you send to yourself is not related to the value of the transaction but the physical size in bytes. Median transaction value would also be expected to decline over time with real commerce, because in real world commerce there are vastly more small-value transactions than large ones. Since the median for Dogecoin is $36, it wouldn't be unexpected for Bitcoin Cash to go below that if it were doing large amounts of real world commercial transactions.

The median and average can't prove commerce use of course, but it also doesn't disprove it. I'm not aware how much commercial use there actually is of Dogecoin, but I know of some businesses that only accept Bitcoin Cash.

Something like BitPay and Coinbase coming out and detailing their merchant trade volume in each of the currencies they facilitate would be the best possible evidence.

Dogecoin used to do loads of transactions via the Reddit tip bot. The first one is now defunct (was running a fractional reserve and lost everyone's money), the second one does barely any transactions these days:

https://www.reddit.com/user/sodogetip

There are other doge tip bots on Twitter and other platforms but they're not doing loads of transactions as far as I'm aware today.

Dogecoin actually used to have pretty good merchant adoption compared to most cryptos, but that was several years ago. If you go through this page now they are largely defunct or inactive:

https://www.dogecoins.com/spend.php

In the absence of evidence of any significant activity, I think it's fair to assume the Dogecoin transactions are mostly self-transfer spam.