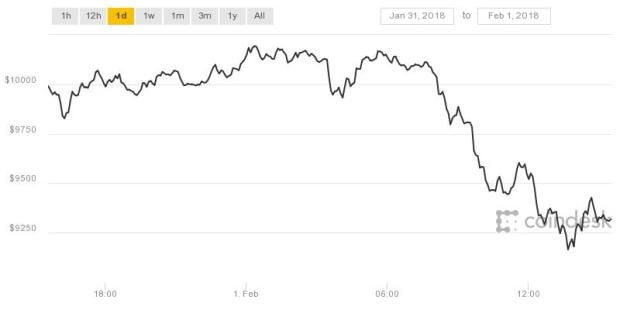

The price of Bitcoin has nosedived by 11 percent today to its lowest point since November 2017 amid a growing backlash against cryptocurrency trading.

This dramatic drop came after India announced a ban on the buying and selling of virtual currences. Since the beginning of 2018, the value of the world’s largest cryptocurrency plunged by almost half in a ‘bloodbath’ which saw £31 billion shaved off the total value of the market.

Bitcoin dropped to a miserable low of $9,022 (£6,343) today, which is a long way from the high of almost $20,000 it hit at the end of last year. It slid more than 26 percent last month in its worst monthly performance since January 2015.

Other cryptocurrencies, including Ripple, the third-largest by market value, and Bitcoin Cash, have also racked up double-digit declines in the last 24 hours, according to Coinmarketcap.com.

Ethereum was up slightly on yesterday, although it has lost value since the beginning of the week.

Last year’s explosive rise in the value of digital coins and the flood of new retail investors drawn to the market have rattled global regulators nervous about a sector used largely for speculation. Officials have also warned that cryptocurrencies can be used by criminals to launder money.

India, which has likened the market to a Ponzi scheme, has just vowed to ban crypto trading. Earlier this week, Facebook said it was banning all advertising that ‘promote financial products and services that are frequently associated with misleading or deceptive promotional practices, such as binary options, initial coin offerings and cryptocurrency’.

It was not clear whether the ban would affect all cryptocurrency adverts on the social media site. Facebook could not immediately be reached for comment.

A $530 million hack of Japanese cryptocurrency exchange Coincheck last week sent shudders through the market, along with the revelation that U.S. regulators are investigating two of the world’s biggest cryptocurrency players, Bitfinex and Tether .

‘Sentiment towards cryptocurrencies is turning sour with negative headlines pouring out from left, right and centre,” said Fawad Razaqzada, an analyst at FOREX.com ‘Concerns that Facebook is banning ads and major crypto exchanges shutting down have really silenced the hype and some people are probably having second thoughts about investing their hard-earned cash into digital currencies.’

In a development welcomed by cryptocurrency investors, the finance minister of South Korea, a major hub for digital coin trading, said on Wednesday there was no plan to outlaw their buying and selling after regulators had earlier pledged to do so.

Please Comment Your Opinion!!