How to make the most of a pump and dump for yourself and your crypto-community

Introduction

Research shows that the absolute majority of people/investors or around 75% of us buy when the markets are going up or are in the green, and sell when the markets go down, when the markets are blood red. This is of course a surefire recipe to become broke in no time. But reality shows exactly this. But why is this? Because most people take decisions not because of hard facts but because of pure feelings. When we buy in green, it simply feels good. When we sell red, we are often overwhelmed by fear and doubt. Only 25% of the investors are so disciplined that they keep a calm cool head and buy when the charts are blood red, and sell when it's green. A guaranteed recipe to become rich quick.

Market principles

As our readership already knows, markets are -among many things- used to transfer money from weak hands into stronger hands. It means that already rich, strong, disciplined and rational people tend to get richer on the backs of weaker, less rational and disciplined investors. The ongoing and never ending struggle between the 25%-investor vs the 75%-investor.

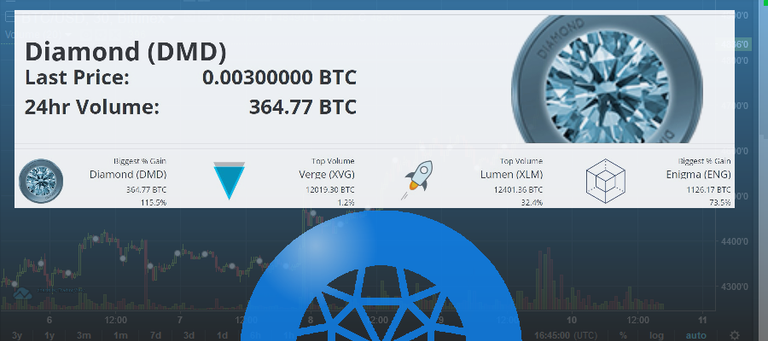

Diamond coins (DMD) hit a new all time high today 2018-jan-02

Typically, once or twice in a 3-4 months period, we get these pump and dumps in any given coin. The DMD coin market isn't sheltered from these. Pump-n-dumps are not desired but since they exist, so let's take advantage of them. As you can see on the chart, once the graph shoots high into the green, it's a sell signal to the 25%-investor. He/she then sends his coins to bittrex.com/livecoin.net or any market that will trade DMD coins in order to sell a portion of his/her investment.

The 25%-investor cushions the price

So a 25%-investor is the preferred investor to have on your side trading any given asset type, in this case Diamond coins (DMD). Why, the 25% investor buying in red will dampen the fall of the price when the price goes down. He or she buys when the price is in freefall. A 75% investor will aggravate price dump because they tend to follow their feelings and decide often to sell in red when the price already is falling. So once the pump and dump event is over, the 25% investor heads over to the market and buys up a portion or more than that he sold off during the pump. We have many DMD investors in our community being of either the fanatically hodler type or the 25%-type.

A DMD investment is a hedge against many mishaps

DMD is a hedge against our fiat currencies, its a hedge against crypto currency drops and against Bitcoin (BTC) value drops. Because of the 25%-investor mentality, an investment into Diamond coins is also a hedge against aggravated price drops.

Bottom line

The 25%-investor is the cool calm investor type that sells when the price is high and buys when the price is low, especially during a pump-and-dump event, earning his/herself money and helps the community when the price goes down. The 25%-investor is more prevalent in the ranks of DMD coin holders as opposed to other cryptocurrencies. Because of DMD scarcity, security and high value, the 25%-investor is yet another factor that propels DMD price upwards together with the compounding effects of: 1) DMD-masternode passive income and 2) passive income from staking DMD.

Would you want to have Diamond coins?

Best regards

Dr DMD

DISCLAIMER: THIS IS IN NO WAY AN INVESTMENT ADVICE AND IS TO BE TREATED AS INFORMATION FOR RESEARCH PURPOSES ONLY

If you're interested in a sneak peak into our community, fill in https://bit.diamonds/contact.php and ask for an invite and you will receive an invitation shortly to our DMD-slack channel. You are warmly welcome!

I've been watching some analytical investing advice on YouTube. Guys name is David and the channel is Trading 212. There's a lot of good stuff there.

Thanks for the heads up, ill check it out right now! Ahh, i remember this guy, he is great and Ive learned alot from him! Thanks again for reminding me of his channel. Best regards DMD

I would say that 10% are "smart" investors not 25%. I came from Forex trading and there is all the same, except much more volume and less volatile. What you are writing is more for day traders who follow their assets few times a day. The holders are passive investors that invest in longterm and do not bother with price movement much.

But the principle is correct :) We need to bank on those pumps and those who want to manipulate will lose in the end.

Hi! Thanks for your quality reply! You might be right, as always. But there is actually research on this, I dont know where i read it or heard it, but it is 25-75% and its across all specters of investors, not just daytrading. I think you're quoting from your empirical observations during your carreer as a daytrader. But you might be right. Its good to have a heavy hitter like you with us oportunis. Best regards Dr DMD