There is a lot of FUD (Fear, Uncertainty, Doubt) out there and talk of the bubble being popped. I remember in my youth people talking about putting your money in a savings account where a good one might grow by 9% in a year. It was considered smart by the average people.

So in that system if I put $100 in that account a year later I would have $109. I used to talk about hypotheticals of winning the lottery. I dreamed that if I were to win the lottery and put $1,000,000 into the bank I would make $90,000 per year. I could more than live off of that then and now.

That was the status quo. The risky investments that might pay off more were generally in stocks.

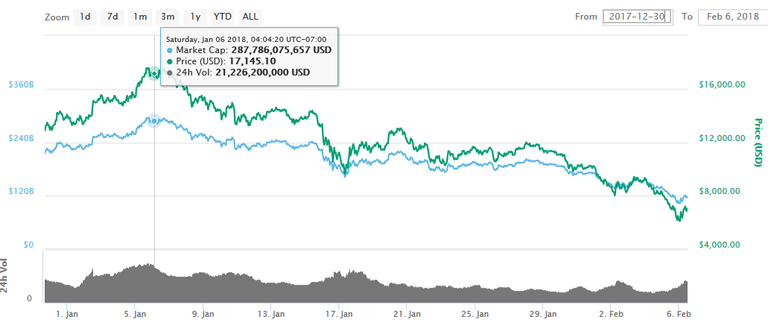

So currently as I write this here are some current prices from coinmarketcap.com on this February 6th, 2018.

- Bitcoin: $7,097.75

- Ethereum: $716.18

- Steem: $3.18

So for this to be a collapsing bubble then the losses should be staggering right?

If you only purchased a few months ago when it was around $10,000 and saw bitcoin soar to $20,000 then you might think it is a crash because you are thinking way too short in terms of time frame on an investment. You would have taken a loss.

However, what were the prices last year at this time.

- Bitcoin: $1043.52 (It is up 680% from last year)

- Ethereum: $11.35 (It is up 6309% from last year)

- Steem: $0.16 (it is up 1987% from last year)

For the record this trend is the same for the stock market as well. Even with the huge recent jobs stocks and cryptocurrency are substantially higher in value than they were this time last year. That isn't a crash, or a bubble popping. For people investing only recently it may seem that way, yet that kind of short term thinking is going to typically lead to doom in any stock or crypto investments. Long term things still look beyond compare when setting it next to a savings account, CD, etc.

What you are seeing here could easily be triggered by powerful people that own a lot of stocks and a lot of crypto. They sell off a lot of it, this causes FUD and other people panic sell off driving the price lower. They wait. They buy in on the low and they force multiply their wealth.

It can also be done by these same people when say they don't like Trump and want to make him look bad. I mean in the U.S. the wealthiest most capitalist people in our nation are actually left leaning people pushing for socialist agendas. Why? Socialist agendas lead to government backed monopolies. Who do you think will control these monopolies?

Cryptos are still a great investment, and things are not nearly as bleak as the media, and some people giving into the FUD are trying to paint it.

Now, it could get bleak, but for it to truly be a crash the prices will need to fall lower than where they were last year. If they don't then it is still a far better investment than an interest bearing savings account.

What we are seeing here actually seems like a combination of things. It seems like a deliberate sell off to provoke these reactions coupled with a trend that seems to have happened for the last four years at this time of year.

The following charts are bitcoin from January 1st through February 6th compared by year:

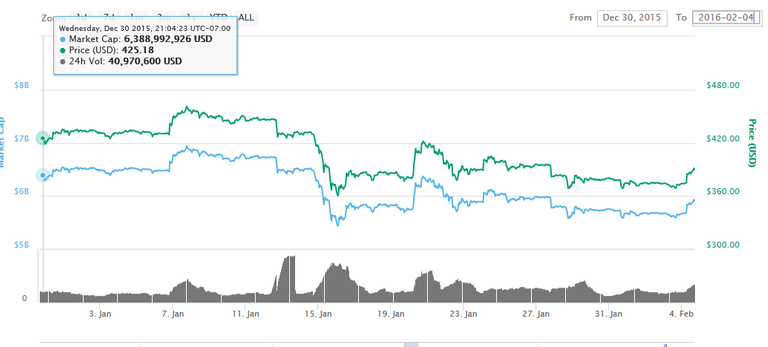

2015

See that big dip on January 14th. There is a similar dip displaced by a few days every year as I will show.

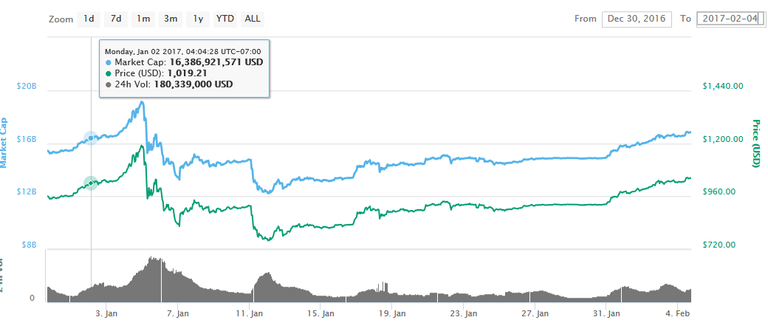

2016

2017

2018

Though there have been coordinated efforts that seem to have impacted prices such as false news reports in India and other places, it typically rebounds quickly.

However, the recent decline has also corresponded with a similar decline in the stock market. This was immediately after Trump received a 75% approval of his State of the Union address. Is that coincidence. I don't think so.

I see all of this in the crypto space as an already annual trend being exacerbated by propaganda, political agenda, and intentionally triggered declines due to large sell offs.

I don't see it stopping crypto. It is just spooking people, but considering how UP we are from last year in both crypto and stocks this is not really a crash. It is just being harnessed as a political weapon to make it seem like it is.

They are intentionally pouring gas onto the fire that is the FUD.

I would have to disagree here with you Dwin. Cryptos experience microbubbles. I mean you are right that overall they are not going anywhere and if you are a long-term investor and believe in blockchain as technology then you shouldn't pay to much attention on the short-term price fluctuations. However, this was a bubble and it did in fact pop. Bitcoin's price even in these levels isn't justified, let alone prices of altcoins that still have no use - they should be worth nothing. Many of the ICOs that hit the market don't even have a working product and their market cap can even be in billions. And that's why the bubble popped. People who don't need these coins are pulling back their money. They were buying them only to make gains, not to use them.

I wrote an article today regarding these things with some technical analysis to back up my views. Check it out if you are interested, cause I think bitcoin is going all the way down to 3000$

https://steemit.com/bitcoin/@drumsta/ta-is-bitcoin-falling-to-3000usd

I find this amusing. Microbubbles? So who get's to set the time periods? IF it is arbitrary then everything experiences 'microbubbles' as everything has ups and downs. So what is the point?

Political agenda? To say "See I told you" when based around some arbitrary short time period?

What's the point? Who cares?

When traditional investments, taxes, everything else are compared on an annual basis then to me that makes sense to use that as the litmus on whether a true crash or bubble has occurred.

Anything else I picked would be arbitrary, and due to not being very standard wouldn't be that useful and I could use it to paint any image I want, I could terrify, or fortify.

Even if bitcoin fell to $3000, so what? That is still a 300% increase since last year.

EDIT: Also I am not invested heavily in bitcoin. I believe its miner fees are its biggest flaw. It is slow, but the slowness is secondary to ridiculous fees for actually trying to use it for something.

On what basis to you proclaim this as fact? I hear this a lot, but never see sound fundamental arguments.

You know me @dwinblood

Buy in thirds...

Sell in thirds...

I'm Good!

#thirdsrulestrategy

Keep STEEM N ON,

Frank

Resteem...

Over all that's the great post ..

I realize it is so valuable post .

Best of luck ..Carry on your own way..

i like your comment

Good blog ..

I am really appreciate to see this post ...

Carry on. best of luck dear 😊

nice blog

thanks for sharing a valuable news

keep it on

this is infirmative...

that's important over all...

thanks for sharing

Thanks for speaking rationally about the current mainstream media driven, market psychology. I try to do the same on my blogs so it's good to see other rational voices on the stream.

I've given you a follow and will be sure to see you around!

good news share

You say right! Every year change this! Great share! Thank you for nice post

After this before year analysis .Now i got trust and feel free and the rate of crypto must increase.

Am i right?

I won't say "must" on anything. I am no expert. I will say that it'd have to drop a lot more before I considered it a crash. Like it would need to be worth LESS than it was last year. It isn't even close to that yet.

EDIT: I am betting on it going up though.

It looks as though institutional investors got into bitcoin and knew something was coming. So they pulled all their investments out of both. What remains are probably the less institutional investors. It's hard t osay if they will pump cryptos again if the stock/dow etc doesn't recover.

Even if they did, so what? Look at how high it is compared to last year. If they pulled then it is where it is at without them.

I really like this post dwinblood! keep it up!

great news... thanks for the news.....

Awesome informative post. I am wondering that why every year early months BTC go deep and regain. It seems like somebody play on it periodically.

wonderful post and a lot of useful information here...☺

keep posting

thanks for sharing with us @upvoted and @resteem done

Yes I got the same conclusion in my article! But I want to add one thing: The common behaviour of the cryptomarket in the last years has a reason. The Cinese New Year is on February 16th and that's the reason why many Chinese are taking their profits out of the market! So just HODL and watch how the market will come back to new ATH's :)

Yeah I had heard of the Chinese New Year. Some people also think it could be tied to the tax season in the U.S.

Yes this could have a big impact as well! Thank you for your information! :) It's great to learn new things every day on Steemit :)

thanks sir for sharing this news......

that is useful to the bitcoin lover I mind carry on

valuable post that is...your activity is really good

i appreciated for this

carry on

gotta love the FUDPushers

(not)

There is nobody on the whole of Steemit who gets more spam comments than you! :)

(Not this one, my comments are awesome)

Nice good specal blog post sir dear I lik your valuble contents

That's probably because I up vote a lot of them when I am not completely certain.

@everittdmickey thanked me for this service. He can look at my post and determine more "bots" that he can then mute. LOL. :)

He muted me as well!

I'm still going on about this because hes the first non-vegan to ever mute me and it cracks me up :)

The bit I like best is that he can't see my comments now so I can mock him right under his nose...

What I like most is the positive way you look at this downtrend period. Down is never Nice, bit I Fully agree that it is not that worse. At least comparing with last year. Next to that; this good be a good moment to invest a bit more by buying the dip.

And remember ; after rain the sun always will shine again.

Actually this DOWN is nice if we remember the trend next year. Sell before the annual downtrend and then buy in.

Thats what I learned..... just started in July 2017.

But at least I did buy last week ... hope it was the dip.

so sad..cryptocurrency is verry bad..lovely information sir..

nice work...

go ahead.

thank you for sharing great post

resteem donegreat news @dwinblood! your post is very nice! keep it up!

Yeah I have nothing in tether. I also don't have much in bitcoin. I am diversified across a lot of crypto, but my current largest investment (if you don't count steem power) is Ethereum.

Yep. I agree. Also the speed in bitcoin has been an issue for me, but I could plan around it. The miner fees though as the value increased were ridiculous. The worst I personally saw was somewhere wanting to charge me $100 to move my currency. At that time $30 was happening everywhere. So if you wanted to use it as a slow currency to purchase something for $5 you'd actually pay $35. If you wanted to but something for $100 you'd end up paying $130.

That is ONE very expensive fee. Couple that with the slowness and I just don't see it as being a long term viable investment. I do think it'll keep doing ups and downs, but I expect things to replace it.

I was mostly in ETH and I'm glad ad Eth declined less % wise than the other currencies I am in.

I have almost nothing in the currencies you said to avoid. What little BTC I have is on coinbase to fuel my SHIFT card. Yet, I don't actually plan to invest a lot there except for short periods if a nice up trend begins again.

Yeah I converted BTC on bittrex to BCH, ETH, and LTC and tested transferring all of them to coinbase. LTC was the fastest of the three. It also charged me a $0.30 fee at the time BITCOIN fee was $30 to transfer.