I will go right ahead and admit it: I haven't withdrawn anything from my wallets. Yet. But I do know someone I work with who cashed out when BTC hit the 1200's. Haha, sucker.

How do you withdraw your crypto gains in Canada?

Honestly, I would only go with QuadrigaCX. This is a Canadian exchange, in Richmond, BC. If you've been to Richmond you know every one there is super nice, so your money feels like it in the hands of nice people who wouldn't eff you over, right? That's how I feel. But not only that.

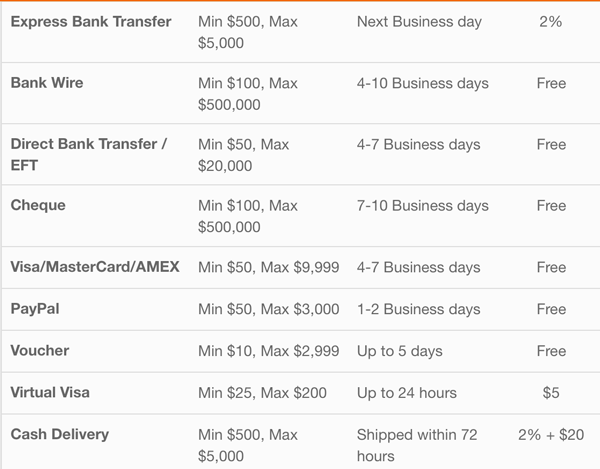

QuadrigaCX actually has MANY withdrawal options

They actually let you withdraw in many different ways. Personally, I think some of these ways are great to be hiding your money from the government, if you're planning on evading taxes and risking a lifetime in white collar jail.

So here's a list of ways you can withdraw with QuadrigaCX:

I personally will most likely use Paypal because I shop online a lot, and I use Paypal for basically everything. But this is for small transactions. I'm super confused by the EFT? Because I am guessing they are talking about an ETF (exchange-traded fund)? But yeah.. not sure how that would work at all.

- But somehow, you can use it to pay for your credit card?!

- You can even get a prepaid credit card

- Get a voucher... really? A voucher for the same site I'm on? Seems a little redundant, but I guess you may want to gift someone up to $3k if you felt real generous?

- Woah woah, Cash Delivery, Money Orders!? I'd sure like to know if QuadrigaCX will be handing a tax receipt over for this or if it's just a mute transaction hint hint

So if it were me, I would most likely go with a Bank Transfer for large withdrawals, maybe even express one if someone was threatening to break my legs or something.

But just remember, our government will tax you capital gains

I'm not really sure how I'm going to enjoy the fruits of my "labor" without paying this pesky tax. Unlike the US and Australia, keeping the profits for more than a year doesn't make it untouchable, just less taxable. In the end, you will most likely incur taxes up to 15%, if you justify your gains as bartering, according to this document.

Except if you keep all your crypto in crypto...

The Government of Canada has ruled the blockchain too valuable a research project to start taxing and hindering the process of adoption. So technically, you won't ever be taxed... if you never withdraw. For now. Canada is actively talking about the blockchain, the banks are getting scared, so there will be more comprehensible laws coming very soon, I am sure of it. No country likes not knowing where her people's money is. But really, when and how are they going to figure out which wallet belong to whom? Ahahhaha, I'm not holding my breath. Canada isn't even letting me deposit my cheque with a phone photo yet, so yeah. Not that scared.

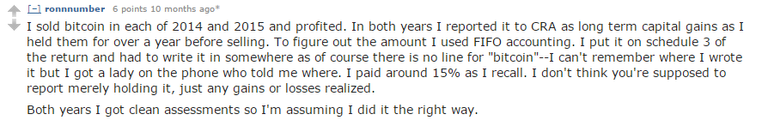

Here's a little bit I found on reddit about crypto and tax in Canada:

Or if you hold it outside of Canada you're not a business

From a reddit comment:

This link states that to be foreign property it must be held outside of Canada and not used for business purposes.

http://www.canadiantaxlitigation.com/wp-content/uploads/2015/07/2014-0561061E5.txt

If it is used for business purposes (such as income from sales), I would use the original guidance from 2013.

Where digital currency is used to pay for goods or services, the rules for barter transactions apply. A barter transaction occurs when any two persons agree to exchange goods or services and carry out that exchange without using legal currency.

Digital currency can also be bought or sold like a commodity. Any resulting gains or losses could be taxable income or capital for the taxpayer. http://www.cra-arc.gc.ca/nwsrm/fctshts/2013/m11/fs131105-eng.html

Have you withdrawn?

Man, I would love to hear recent stories of Canadian withdrawing their crypto as fiat, so please let know in the comments if you have experience doing this!@# And resteem if you're as lost as I am (or am pretending not to be).

A few links for food for thought:

- No cryptocurrency anytime soon, Bank of Canada says: ‘We’re very far off’

- Canadian project shows potential for blockchain-based corporate registries

- How Canada can be a global leader in blockchain technology

- Digital currency in Canada

Hopefully this helps clear up the how and the what next's!

See ya next time :D

Use my Genesis Mining code to get more hashing power: 61Qx0o

Having just recently moved to Vancouver, I was thinking about the tax implications of my crypto activites, nice to see that I can put it off for a while, since I am not planning to withdraw any time soon.

Also, EFT stands for Electronic Funds Transfer, I hope that makes more sense.

Ah!! Thank you! Hm, I will edit my post so that information is there :D

Thanks for the great info. I'm in Canada and was involved in Cryptocurrency for almost a year now.

Glad to help!!!