A few weeks ago, I started writing an article about my growing mistrust of ICOs. I chose to leave it on the rocks because meh, maybe I was overreacting.

This is right about when the Status ICO announced they'd be liquidating the 40% of the capital they had raised in ETH during their token sale. This came right when their sale pretty much flash crashed the Ethereum network and everyone lost their proverbial shit on them.

At that point, with all the anger expressed at Status and the oh-so-predictable outcome of nearly every ICO that came out in the last few months, I think every one had something bad to say about these outrageous token sales.

One. After. The. Other, these things were sucking up ETH investments, straining the market and encouraging the worst pumps and dumps I've seen since getting into crypto.

Brace yourselves, regulations are coming

Well, it seems, just like the dreaded Winter, the White Walkers (read: SEC - US Securities and Exchange Commission) are making their presence known and they will be marching down on our lands soon enough. As of yesterday, the SEC has ruled that token sales and ICOs may just be considered securities. Now this isn't surprising considering ICOs were off-limits to US Citizens since day one. But that didn't stop any one from buying into them and the ICOs themselves didn't stop any US citizen from shoveling funds their way either. Because in the end, no one knows you're a US Citizen on the blockchain, anyway. So really, the only liable people are the developers of said ICOs.

But most ICOs don't operate in the US... so what can the SEC do? Well... the sticky problem is pretty much every country complies with similar securities regulations and so they could take a clue from this.

Personally, I think this is a good thing because it can stop the ICO madness, stop fracturing the ETH market and ensure we only have trust-worthy ICOs left: the ones with an actual product. Not just a great idea.

So they made a report? The DAO is fine. So why would ICOs worry?

A lot of people seem to think they would have gone after DAO if they could have. Because the SEC would certainly take them to court if they knew they could win, right? Well, not so. The SEC will never take you to court unless they have a precedent for your case to argue against.

The DAO Report has done just that: this is the precedent. Now any SEC litigation will go like this: "Hm, I don't know what you're selling but this sure looks like the DAO token sale by definition, which has been ruled as an illegal securities sale. Guess this makes your ICO illegal."

But the thing is, they could start considering anything crypto-related "an unregistered security" soon enough.

This Report reiterates these fundamental principles of the U.S. federal securities laws and describes their applicability to a new paradigm—virtual organizations or capital raising entities that use distributed ledger or blockchain technology to facilitate capital raising and/or investment and the related offer and sale of securities. The automation of certain functions through this technology, “smart contracts,” or computer code, does not remove conduct from the purview of the U.S. federal securities laws.

Yikes.

A Brief history of the Blue Sky Law and the SEC

In the last 1800s, joint stock companies started taking over the world. The Dutch were first, this is how they built the first mercantile empire the world has ever seen: Amsterdam managed to become the richest city in Europe, without ever waging war. They did it by opening a joint stock company that guaranteed its investors a return. They amassed tons of money this way and were able to literally buy themselves colonies.

In the US, these were also all the rage. The stock market because so important to the American economy, the government got super concerned. So the Blue Sky law was enacted, in Kansas, in 1911.

These state laws were meant to protect investors from worthless securities issued by unscrupulous companies and pumped by promoters. They are basic disclosure laws that require a company to provide a prospectus in which the promoters (sellers/issuers) state how much interest they are getting and why [...].

Sound familiar? (Ahem, ICO white paper). The Blue Sky law had failed to be enforced and investors were throwing their money at this new craze: the stock market. And so you ended up with a bunch of whales, trading among themselves, driving the prices up, cashing out and boom, Black Tuesday happened. The Blue Sky Law was proven useless, and now President Roosevelt decided the US needed the SEC - with massive wielding powers, to prevent this from ever happening again.

Read more: The SEC: A Brief History Of Regulation

The Crypto Aftermath of the SEC ruling

Much like hearing about the White Walkers, many cowered im their boots, and then went back to life as it was. Twitter was up in arms about ICOs getting dumped out immediately; I expected all the ICOs I keep an eye on (but don't invest in) to effing crash! And low and behold, the sky is still blue and steady above our heads. Turns out the blue sky law does not reign supreme - or at all, in the crypto market.

And now I'm doubting it ever will? After all, as I learned in the last episode of Game of Thrones, "every winter that has ever come, has ended."

Market gives zero f*cks

At first, it was looking like the SEC statement about the DAO was going to hit ETH and ERC20 tokens real hard. ETH's price fell by 10% but no one knows whether it's due to this news. Does this mean ICO-MANIA will chill? Probably. Just not anywhere but the US.

For now, things seem stable. No one seems very surprised by this. People have been predicting this for a while. Some are even super happy about this. After all, we are all pretty tired of the amount of ICOs for product-less tokens being distributed on the Ethereum Network.

Real money trying to scare fake money

The funniest part of all of this is watching more and more fear trying to be sewn into the market. Along with its chilling report, the SEC has also released a statement to caution investors from the crypto market. This morning, the founder of the Oaktree Capital Management says Digital Currencies ‘Aren’t Real’. The Bank of America is also warning against investing in Bitcoin. Not too long ago, the German Bank was warning against investing.

But in the end, it seems nothing is going to stop the most disruptive tech to come into the spotlight in decades.

Crypto is here to stay.

But still, think before investing in ICOs

Initial Coin Offerings operate on the premise that they need exponential amounts of funding to run their offices, pay their developers, keep the lights, etc. It's like a startup, it needs money to keep going. Except the thing with ICOs is they don't even have a product yet, yet they need millions and millions of dollars to get off the ground.

Why?

Do your developers all drive lambos? Are they clad from head to toe in Marc Jacobs clothing, working remotely, in their Bel-Air mansions?? Because if they're not, one has to wonder why they need so much money to get started. Many a coin startup has began without these millions of dollars, so what the shit.

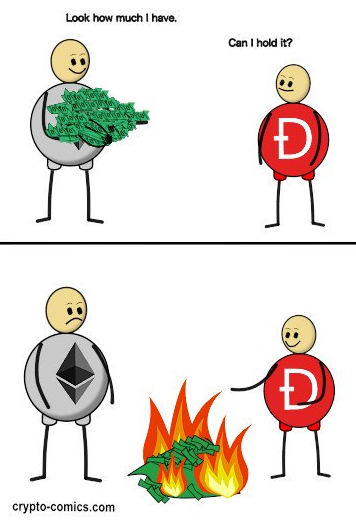

Now, it'd be one thing if these ICOs were taking people's crypto and running their business model on it. But they're not. They're taking your ETH and cashing it out, dumping it out on the market. I'm looking at you, Status, you piece of shit.

</end ico-rant>

Thanks for the reads!@# xoxoxo

Love the White Walkers reference in regards to the SEC--they put the freeze on everything.

Very nice! Thx T

Awesome content as always. Everything up-voted, please up-vote me too <3