If we torture the definition of "Ponzi Scheme" enough, can we call Bitcoin a Ponzi Scheme? The best way to answer this might be to wonder if gold is a Ponzi Scheme also.

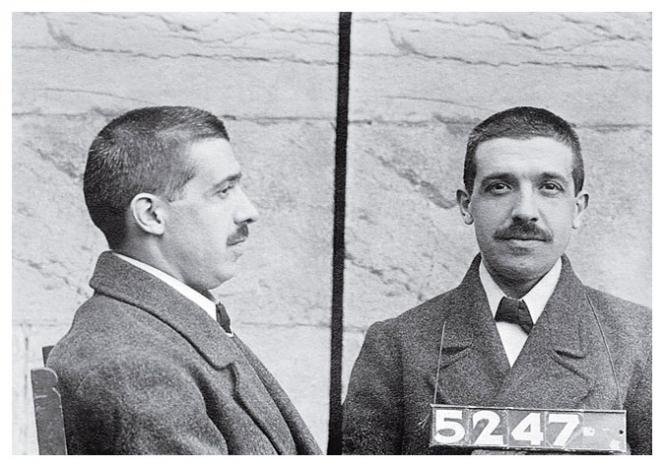

Charles Ponzi

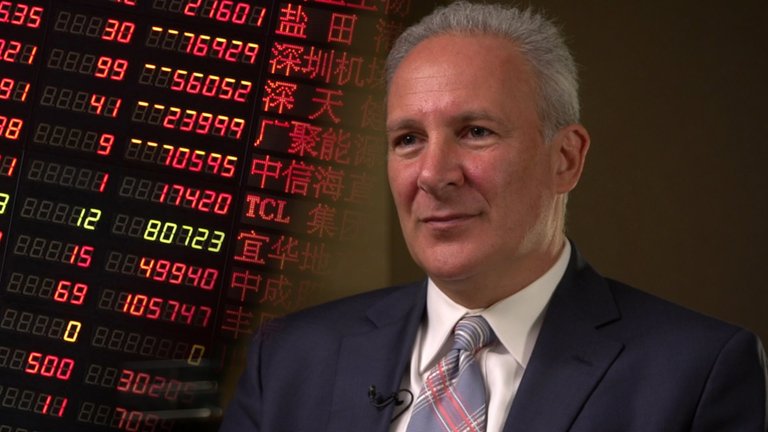

I'm inspired to write this because gold investor and market bear Peter Schiff has not been shy recently about calling Bitcoin a Ponzi Scheme, something which I think is very weakly justified. In economics and finance, terms like "Ponzi Scheme" are quite specific and it does not behoove someone like Peter Schiff to so irresponsibly abuse them. Unfortunately, this is what he is doing and it is muddying the discussion surrounding an emergent new asset class; digital cryptographic currencies.

Peter Schiff

Peter SchiffPeter explains that Bitcoin is a ponzi scheme because its value is speculative and thus new investors are needed to speculate on price so that old buyers can then sell to them to realize profits. Now, this is not strictly the definition of a Ponzi Scheme in which a central operator takes in new investments to pay out old investors. A Ponzi Scheme collapses after some time because eventually the central operator is not able to court enough new investment to satisfy withdrawal demands and the lack of equity in the operator's fund finally causes a halt to payouts. Because there is no central operator managing Bitcoin buying and selling, and because the price of Bitcoin is based entirely on supply and demand from individual buyers and sellers, Bitcoin simply does not meet the definition of a Ponzi Scheme, but for some of us there may be some sympathy lent to this view, so it's not entirely without merit to tease it out somewhat.

Foundational to this view that Bitcoin is a Ponzi Scheme is the argument that Bitcoin has no industrial utility like Gold or other precious metals. Bitcoin for instance is not used in necklaces or the fabrication of computer chips. It is not used in dentistry or to add pigmentation to certain types of glass. This is touted as an advantage of gold over Bitcoin because gold it is argued, will always have utility value to fall back on. This means that as a wealth store, gold has underlying value securing it against significant devaluation all the way to zero. Bitcoin on the other hand has no industrial applications and so there is no simmilar buffer between the current price and zero.

Now suppose we accept this as an observable risk to Bitcoin and not to gold, and that Bitcoin is entirely speculative in value. That it's used as a unit of account for wealth storage on a speculative basis, and that should this speculation ever suffer from a significant market panic, that Bitcoin could go to zero. Again, I stress that this does not meet any accepted definition of a Ponzi Scheme, but for the sake of argument let us accept this is a risk to the value of Bitcoin as a unit of account. The question that arises now in my mind is how much of gold's value is similarly speculative in nature?

Well as it turns out, we can answer that and for Schiff's investors in his gold investment funds, there may be cause for some shaking of the shoes where the safety of their wealth is concerned.

Year over year, roughly 3,100 metric tons of gold are mined which has a small inflationary effect on world gold supplies, but that doesn't really factor very much here. The more interesting part of this is how much of that mined gold is demanded by industry for industrial use applications. Not for jewelry or collectors coins; for real industrial use applications, some of which actually seem somewhat frivolous like the adding of pigmentation to some types of glass. Even dentistry seems a little silly considering silver fills the same role if you really want pricey metal in your teeth. But that aside, industry demand for gold comes out to roughly 650 metric tons per year.

If 3,100 tons are mined and industry demands 650 metric tons of that, this means that industrial use of newly mined gold is just 21% of the global produced supply. Put another way, only 21% of today's spot price is justified by demand from industry which means that gold's utility value (some of which is still arguably superfluous) is roughly $1,333 (Sep' 4th, 2017) times 0.21 which equals a somewhat anemic price of just $279.93 per troy ounce.

For every ounce of gold, there is over $1,050 of value that is not at all justified by real world utility and it's this $1,050 or so of margin in price that people like Peter Schiff operate in. That margin is 100% speculative price movement. Now, is it fair to say that anything above $279.93 per ounce is unjustified and that gold holds not a single bit of value above that industrial use level? Of course not, and that's because we can all recognize that gold in the present day makes for a useful value store. In monetary theory, we can recognize that a unit of account can express market value by being a logical tool for indexing market value. A way for us to index other forms of value and trade said value is not useless to the marketplace, and so gold displays an obvious use case for investors of wealth. Because gold is highly useful for value indexing, only the short sighted among us would insist that gold is overvalued beyond any industrial application.

It is as unfair to say that Bitcoin is a Ponzi Scheme as it is to say that Gold is worth no more than $279.93 per ounce...or that at $1,333 per ounce, gold is just another Ponzi Scheme. It's flat out dishonest to describe Bitcoin in such a fashion in fact, and it's frightfully sad to see Peter Schiff adopt such a brutal kind of dishonesty in his criticism of Bitcoin, particularly because it's so flatly hypocritical.

The bottom line here is that units of account express market value because a society that employs the use of complex markets for trade requires units of account to function. There's no great mystery to that, and seeing Bitcoin's meteoric rise with this mind, it starts to make sense that a free market form of money would adopt a market trajectory that challenges other units of account that we're used to. Even those units of account which have been around for millenia.

Why does Peter want gold to succeed other than he'll make gains where he invested most of his money? Gold has always centralized power. Doesn't seem very freedom oriented. Peter save me $100's of $1000's pointing out the housing bubble but I want to use Cryptocurrencies and not gold.

The bankers got bailed out by the people in 2008. Bitcoin and Cryptocurrencies are my bailout, let the banks fail...

LOL "good post, follow me" Made me laugh a little.

Schiff's bias is just so hopelessly apparent. I used to have an incredible amount of respect for the man, and yes, he's still intelligent in a lot of ways, but the fact he's just insisting on remaining ignorant on this fundamental point is just embarrassing and transparent.

Gold and silver markets have always been manipulated. This is nothing new. I think that the powers that be are a bit miffed because they haven't found a way to manipulate bitcoin so therefore it must be a "Ponzi Scheme". Has anyone looked at governmets lately? Now, there's a Ponzi Scheme if ever I saw one!

good post. follow me @lomidze

upvoted and followed you if you like salaheldeen0 please upvoted and follow me lets help each other :)

Good article and solid points you make here. Thanks for spending the time on this post. This has come back into play in the media lately and the more people that get educated on the specifics of what a Ponzi scheme is the better.

Cool post!