passive income blog.I got inspired by @lukebrn with his

After reading famous book Rich Dad Poor Dad a long time ago my financial goals became more and more clear to me.

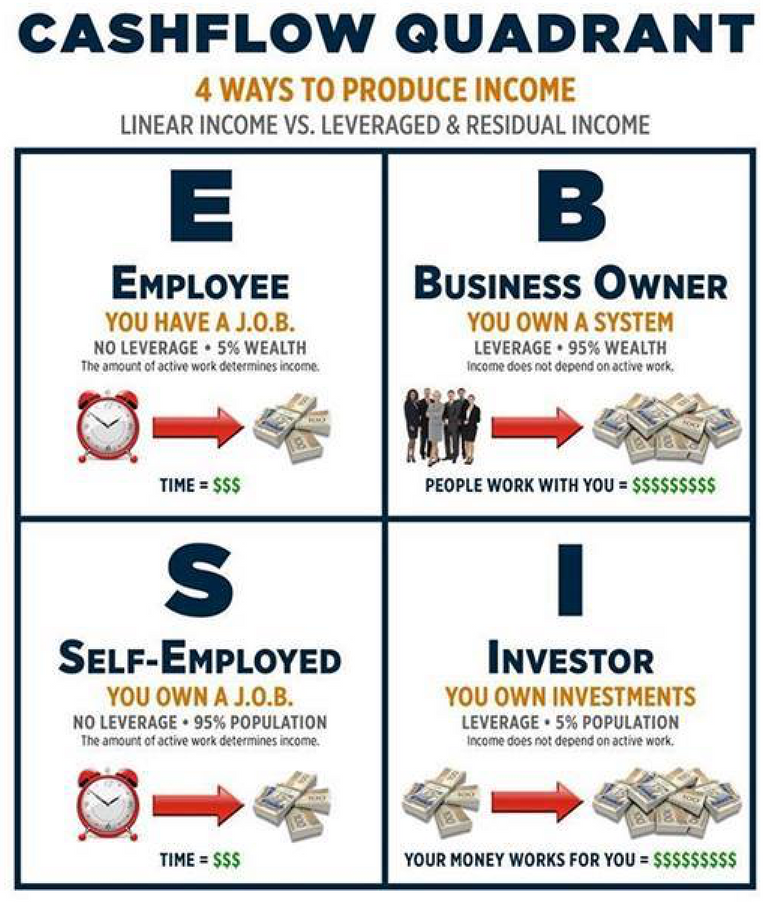

For those of you who haven't had the chance to read the book which I can highly recommend to do so if the headline of this post has got your attention here the key concept in a nutshell.

Basically the book introduces four areas of income

- "E" Income from being an employee

- "S" Income from being Self-employed

- "B" Income from Business you own

- "I" Income from invests you do.

Those areas are called the cashflow quadrant summarized in picture below.

source

Most of those areas are easy to understand. What might get confused sometimes is the difference between "S" and "B". While "B" you are passive - you hired entrepreneurs who are running the Business for you while "S" is you are "the business" and income depends on your work.

While E + S lock up your time - B and I doesn't (so much). So if we are talking about passive income I am talking about how to come from the left side to the right one.

Cryptocurrency therefore brought a lot of opportunities for people with this kind of mind set.

First of all crypto made it possible to be an investor in start up accessible for everyone. In traditional investing you only have the chance to get on board at the time of an IPO. At that time most of the growth and value increase happened already.

And second crypto generates a lot of ways to produce passive income like the examples @lukebrn brought up in his series.

I wanted to look at passive income from a higher, strategic level. When I thought about my financial goals I needed a baseline first.

step 1 - Know your wealth

I am doing sind I am 20 years old a yearly balance, profit/loss and cashflow statement for me. Yes, correct - not for a company but for me. Same concepts though. Of course it is up to you to do so but in my opinion it is necessary to have such a clear baseline to set the right goals. Of course it become more relevant the bigger your wealth is but if you just have one bank account I would do it anyway. It will than take only view minutes every year so why bother?

By that way I learned so much about finance that I became later on an CFO for a mid size company (not vice versa) - so that is a cool side effect isn't it?

step 2 - Know your cost structure

I feel it is also necessary for planning your financials to know about your cost structure. What are all your spendings? What of them are variable (you could choose to not spend it) and which of them are fix (e.g. rent etc.)?

step 3 - Setting goals

With that knowledge I made up my plan. I want to earn in 5 years more with passive income than my cost structure which means I can choose to work or not. Financial freedom.

step 4 - building capital

Old rule of thump: No risk - no reward. So getting to B and I implies that you take risks. Taking risks means you are going to fail a certain amount of times. Just be sure that you go for good risk/reward scenarios than you will succeed in the long term.

Being in the box "E" as most of the people are is not going to help. It won't work to just go on like all the years before and hope for better results to come. It is necessary that you get active and do some B and I to gain experience. I started investing in stocks when I was 22. I learned by doing and in parallel educating myself by reading books (yeah I am so old). What helped a lot - I invested together with a friend and discussed trades with him. The increased the learning curve and is highly recommended.

But to be honest I wasn't very successful in the beginning - I had some lucky shots but also significant losses. Worst one I got devastated in the financial crisis 2009. Fail and stand up - I got back up by reinvesting at the bottom of that crisis into banks which recovered a lot of my losses. Without the experience I made in the 10 years before I certainly wouldn't have done that. And I wouldn't have been investing into crypto in the way I did.

Not to forget the other side of the equation: costs. Verify your cost structure especially the fix costs. Especially when you are young you can do here a lot. It gets harder as soon as you have family - I am father of four kids so I know what I am talking about. Here in Switzerland statistic says one kid costs 1/4 of a million in a life time - I still hope that statistic to be wrong...

But I don't want to go too much into detail about costs as this could be a post on its own.

step 5 - diversify

After you gained experience in step 4 you have hopefully build up a certain amount of capital (there is a lot of truth about the saying "the first million is the hardest" - though it doesn't have to be a million to go here) you should diversify. Don't put all eggs into one basket. Same thing for B/I strategies. So having the right mix of stocks, real estate, crypto, bonds, physical asset reduces your risk. And also defining passive income strategies for crypto you can diversify into several baskets (mining, master nodes, staking, bots). I will give you an insight on how I have setup my passive income in one of my next posts. That might give you some ideas for your own targets.

I hope those basic steps are giving you at least one impulse to improve your financial management - that is all I am hoping for. If you have questions or points to add - feel free to comment. Also it would be interesting to read about your take aways of my article.

All the best for reaching your financial goals!

great post and great advise. The only thing I would argue against is the point of diversification. Diversification is no hedge against any extrem/tail event like a 20 Sigma Event (e.g. Marketcrash -->Blow up). It is the allocation of the total investment volume (but you discribe it above in the right way) Bonds, Cash, Cryptos (stocks are prone to fat-tail events and we dont know how they are correlatet to the Stock market --> another elemente of uncertainty (not the same as risk). *so I just complained about the terminology not about the contend ^^

dass du uns dein Wissen teilst.

für mich ist es ein sehr interessanter beitragt.Danke @famunger,

Thank you very much!

Thanks for the mention @famunger! Very interesting post, with a great, logical explanation to the 5 steps of success for financial freedom - I'm still working on financial freedom to be honest!

I'm glad to announce that I will be releasing a passive income with cryptocurrency course within the next month to 6 weeks. Get back to me if this is something that you're interested in.

Interesting - I will be busy next days but sure we can talk some time. Are you on steem.chat?

Perfect, yes I am! I'll find you on it now.

I have heard many positive reviews about this book. But I thought it was something in the spirit of motivation:" Think positively and believe in yourself". But after reading your very detailed and well done review of this book, I realized that it really is a must-read. It really is efficient and reasonable recommendations for augmentation Finance.

Great article once again @famunger!

I'm not sure how this is possible but similarities with my interest seem to overlap a lot, almost in a scary way :-P

Rich Dad Poor Dad was actually the first book that really opened my eyes about passive income streams. I really liked the biographical part combined with mindset changing stuff in there. Robert also has some great quotes like “Winners are not afraid of losing. But losers are. Failure is part of the process of success. People who avoid failure also avoid success.". Or the “The love of money is the root of all evil." vs. "The lack of money is the root of all evil.” His Cashflow Quadrant book is also interesting, but less good and a bit repetitive when you've already read RDPD.

I like your 5-step process btw, easy and very true. I would suggest to take another look at step 4 though. All 5 are a 'do' thing, except for number 4 (make sure you know your wealth, your costs, set goals, diversify). Is step 4 building capital or learning/familiarising with all options to build capital through just doing it? So is it more about learning about what all options are to gain capital and pick which ones are for you? Maybe it is just a title of step 4 thing, since the description could remain the same :-)

Anyways, just my 2 cents...

Definitely good stuff though!

A cryptocurrency is a digital or virtual currency that uses cryptography for security. A cryptocurrency is difficult to counterfeit because of this security feature.

thanks for sharing dear

A great read and chrystal clear resteemed.

Even if I thought I know everything, this book helped me a lot since I have read it last summer.

Thanks for sharing such important wisdom.

And full recommandition for eveyrbody to read the whole book.

True life advices

Can I be rich if I apply them?

Sure - if you have the right attitude and be consequent. Yes you certainly can.

Though I've read the book recently but man you have summed up the concept really well........Looking forward for your future posts.

wow!it's really helpful for us! thanks for your sharing! support you~~ could you support me as well? :-)

More people need to read this. It is so true.

Think so too - it shows clearly the problems of being a life time in the "E" area as most of us are.

Thank you for your post @famunger. Amazing book indeed. I am actually reading now. For the moment im very much stuck in B but im working hard to get into I. Time is the real variable even though of course saving can be the hardest thing. I alwasy think about what Warren Buffet said:

Then diversify to the max. But risks must be indeed taken I cannot just hope to reach financial independency with some bonds paying 4%. So here we are investing in crypto hoping for a very strong bull run and looking also to build a company in this crypto world, many opportunities are to be taken as you have said

Thanks for your comment. Stuck in "B"? Is that really what you meant as this would be a great thing. In "B" you earn a lot of money with just owning a business which doesn't depend on your work. That is something I feel difficult to relate to "stuck" ;-). I would love to enlarge my "B" area - I have a strong "I" area though.

Different story ahahha

Sorry typoed i wish i was B

With cryptos many opportunities are available though, its a matter of being able to catch the good ones and execute well.

As for you "I", what proportion are you allocating in crypto? I figure that for me its worth having a big allocation given the upside potential is huge vs the upside on fiat.Hi @famunger omg shame on me sorry i meant im stuck in E ...

my initial thoughts were to make regular income with steemit and travel around the world but its easier said than done.

Slowly when you get into calculations you realize there's still a long way to cover.