Regular daily update on BTC ta analysts opinions.

Own comment:

- Now we have totally mixed sentiment - 1x bull, 1x slightly bullish, 1x slightly bearish, 1x bear, 1x neutral. It shows that the market gives a lot of mixed signals and it is hard to make calls - @hefziba commented on yesterdays overview that fact quite perfectly.

Analysts key statements:

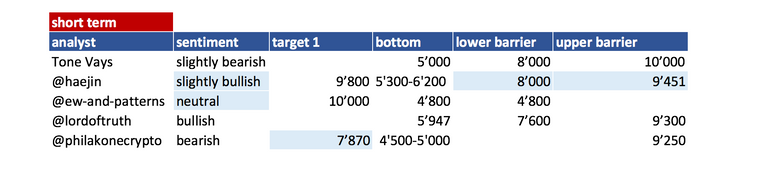

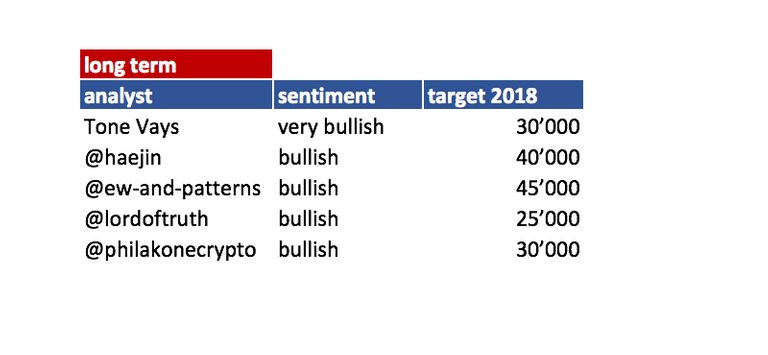

- Tone: Weekly still looking good. This week needs to close above last week (which was at 7'625) and next week needs close with a higher high than this week. Only than we continue with the bullish momentum. Daily start getting a problem. Usually we should recover stronger and go up to 10'000. There is a danger that we have a 1-4 reversal and than continue the bearish trend (that would be tomorrow) kicking off a countdown to 13. 4hourly - we fall below the 50MA - which is bad. We need a close over 9'400.

- @haejin: Breakout of the wedge is still intact. The support of the former resistance of the wedge now needs to hold (which is around 8'000) otherwise alternate comes into play and could lead towards the 5'200. The upper barrier is at 9'451.

- @ew-and-patterns: See strength in bitcoin - bottom might be in. He turns from bearish to neutral. He sees wave b completed - wave C towards 10'000 ongoing (target until Friday).

- @lordoftruth: He needs btc to take the resistance at 9'400 and than the 10'700 level. After that bulls will be dominating the market. Today trading expected between 7'900 and 9'300.

- @philakonecrypto: He has a very short term trading focus presented in his video. He is looking btc to go down to 7'870 short term (bullseye). Might even go down to 7'670. Than new evaluation need to be done.

Overall sentiment: mixed

(last: slightly bearish)

Reference table

| analyst | latest content date | link to content for details |

|---|---|---|

| Tone Vays | 11. Feb | here |

| @haejin | 11. Feb | here |

| @ew-and-patterns | 11. Feb | here |

| @lordoftruth | 11. Feb | here |

| @philakonecrypto | 11. Feb | here |

Definition

- light blue highlighted = all content that changed since last update.

- sentiment = how in general the analysts see the current situation (bearish = lower prices more likely / bullish = higher prices more likely)

- target 1 = the next price target an analysts mentions

- bottom = price target analyst mentions as bottom

Both target are probably short term (so next few days/weeks) - lower/upper barrier = Most significant barriers mentioned by the analysts. If those are breached a significant move to the upside or downside is expected. It does not mean necessary that the sentiment will change due to that (e.g. if upper resistance is breached it does not mean that we automatically turn bullish).

If you like me to add other analysts or add information please let me know in the comments.

Thank you very much

I am glad I found you article

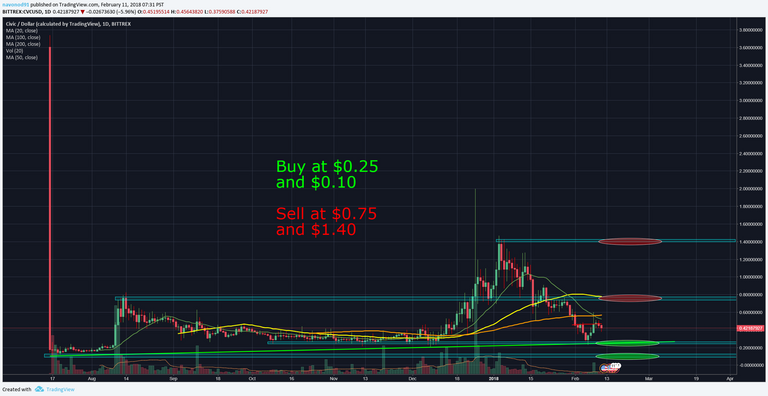

I am interested in the civic coin

I will definitely buy a few and make an exodus wallet too

It seems to be a very good useful coin

Thanks again

Right click then open new tab to zoom in

Thank you for these updates, they are very helpful. It is nice comparing my analysis in my posts to theirs. I also think the market can go anywhere from here.

Hello @famunger thanks for your daily must read summary. You may want to edit adding a comment above as although you’re right philakonecrypto (55) didn’t repeat longer term price correction, he did answer a reply confirming his $4,800 to $5,200 correction target:

nomoneyincrypto (25) · 7 hours ago

Do you still think we gonna reach 5k? Sorry if I couldnt figure that 100% out of your awesome vids

[-]

philakonecrypto (55) · 6 hours ago

yes, my analysis stands

Hi @cryptoprog - yes that is also still my understanding of his view, That is why in the table the bottom is still blow the one we have until know. So that was supposed to reflect that. And through your comment that got even more clarified - thank you for that!

so are your picks just limited to steemit - if so allow me to introduce myself...

I was just going to say you need to get BK; Brandon Kelly aka the Boss (bkcryptotrader) on that list! The Boss method is an unique analysis that all other TA's are missing which clearly demonstrates which way the market is moving. BTC is still under water and I think Philankonecrypto is most accurate we are heading down.

I agree. See my next reply:

I agree I find Phil analysis very well done and often accurate. I very much respect his analysis. And I know it is not as good represented in my overview due to his intraday focus - that is a problem of my overview I guess and I haven't figured out how to change it.

I have to disagree. i used to follow him but it's totally bs. Maybe that's too strong, but it seemed to me he makes totally arbitrary drawings that look catchy but don't have much substance to them. He certainly doesn't seem to keep a record of all his predictions (right and wrong) and share it like others do. He's nowhere near as technical and thorough as some of the others either, in my humble opinion. He also claimed to copyright a simple moving average technique, which is just ridiculous, and ego. He has a big following, of totally novices I presume, like I was. I don't like writing overly bitchy comments, just my opinion and i'm sure he's a good guy

His technique works though which can not be denied. If you go back and look at any chart it will clearly demonstrate entry/exit points. Which means it shows when you can make money and when you are going to lose money. Now is the method perfect for entry/exit as in picking the exact bottom and tops; no it is not. There are pro's and con's for every system.

i toned down my comments a little, but I still stand by them. I did however enjoy most the videos I watched whilst I was following him, but as I learned more I felt there was less value there. just my experience.

Before making any decision you want to gather as much information as possible in order to make an informed decision. The Boss method by BK provides a new perspective utilizing fractal harmonics that other trading systems do not offer. So its not a matter of one or the other but gathering as much data as possible to make the best possible decision for the desired outcome. I realize the strengths and the weaknesses of BK's system. For the average person getting into crypto's if they don't understand the basics, which way the market is moving they are most likely going to get owned. The Boss method allows the average person the advantage of knowing where the market is heading, understanding market cycles, and a very simple way to spot entry/exit spots. If an individual gets into crypto's not knowing this then they are simply gambling. However there are day trading systems and methods that may have a better advantage if one is looking to trade day to day. Right now all the known TA's are struggling to understand where the market is heading whereas the boss method clearly shows we are under water and still in a downtrend. As a result its a matter of using the right tool for the job.

@famunger You have an ERROR referring to last week’s close number. Tone stated was $8200 not $7,625! I don’t know if Tone Vays gave you that summary of his YouTube video or you didn’t watch it all, because that summary is far apart from his statements like: In his week candle view, he used phrases like “this is looking bad” and “this is turning bearish”, indicating this week needs to close tonight above last week’s close of $8,200 as closing above last week’s low of $7.625 is not enough to offset bearish signs. In the daily candle view, he said this candle could get very ugly… In the 4hour, he said “we have a problem” with 50 moving average broken down. Etc. He noted the unconvincingly low volume. He criticized those claiming that BTC hovering around $8,000s was good and stated that signaled going lower because it was happening after having risen higher instead of coming from lower. He said he no longer considers $7,600 a strong resistance and stated that if we drop $500 more (from $8,000 at time of video), the only hope for some support would be at $7,000 because then there would be a 90% probability the $6,000 will not hold this time.

I’m sorry to bring up of negative news but there they were.Now, wouldn’t that bring us towards @philakonecrypto ‘s correction target $4,800 to $5,200. I’ve fallowed these Top 5 BTC analysts in Steemit and this guy, newest addition to your excellent pack, has been incredibly accurate. Then, we see members complaining to @Haejin that he switched his wedge drawing to his current version only a few days ago, IMAGINING a breakout. I don’t know if he switched them or not, but it is a fact there are other complaining and coinciding replies, including textbook bearishness and not making sense with his own charts.

Hi @cryptodog - thank you for being so active and trying to help that we have most accurate numbers in this overview. That is highly appreciated.

I do have all my information from analyzing the posts / videos of the analysts. I watch videos with focus of the essential jumping the introduction and other non btc related infos. That is necessary as creating this post daily consumes already a lot of time - that said it might lead to me missing some information.

But coming back to Tone - I just rechecked. He said that we get a problem if we close below last weeks low and that is 7'625. In his video at 5:45. I did not mention that he meant above last weeks low so I am going to add that.

I am not saying he is bullish yet (see also table) but he was yesterday very happy with weeks candle (looked like a hammer) and turned today to a doji which is stated is still ok as long as the two prerequisites are met.

Your other comments I think we are just coming from different angles. Yes he mentioned several "dark clouds" but to me he is in the mode of looking for confirmation if the bottom is in or not. And I thought I stated several of the things you commented mentioning daily is becoming a problem and that we should recover faster and need a close over 9'400.

That is always a problem of an overview - it loses in comparison to the original.

What would you like to see so that things are more precise?

Regarding analysts precision I am trying to evaluate if they are right or wrong. So far I have no great metric to be honest. Only so far: i have tried to monitor their targets they are mentioning and which I add into my table. And the hit rate is very similar with all analysts so far. But that said - phil made much more calls which were intraday - those calls not fitting my daily overview well as they are already history when I do my post )so never become a target in my table). And also some analyst make more long term calls which seem to me more difficult (at least they are something completely different). So at the end it is very difficult to judge.

But as I said due to my tables and the blue marking of changes you see how often an analyst is changing his targets. It is up to you how you judge that.

Great effort in keeping abreast of all the respected analysts here on Steemit!

Not all - you are not on (yet) ;-)

:-) Quite kind of you to say!

Just for the record, as of today, I'm short-term bullish, medium-term bearish, and long-term bullish. :-)

Nice post! Anyway i can contact you? I live in switzerland and got some questions regarding steem :)