Introduction

tutorial series where Steem with all its aspects was explained. Steem knowledge is though insufficient when trading is concerned. The other day we were having a discussion in the @sndbox slack channel about…well…crypto in general. As @sndbox concentrates on on-boarding new members just like established Steem users, we found ourselves in a situation, where new users didn’t really understand our crypto trading discussion and were afraid to commit to trading themselves. @sndbox did (in my opinion) a great job with their

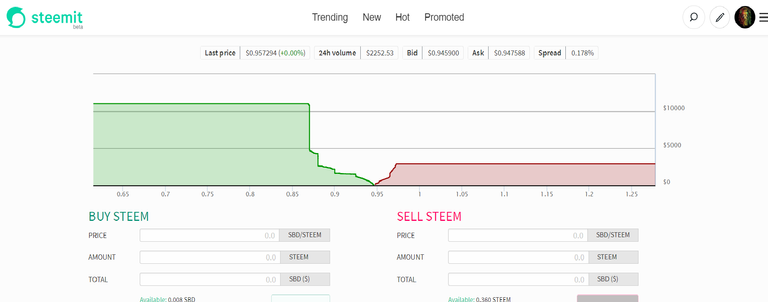

Internal market

Keep in mind that, even though @guyfawkes4-20 called me the crypto guru, I’m no such thing. I’m just an ordinary trader. I’m no professional, I wouldn’t dare to tell you what to do with your funds (for they are your funds, your gains and, your loss after all) if you didn’t explicitly ask and just because my strategy is working so far doesn’t mean it will work forever. Perceive this series as just another strategy that can be used and can come in handy if you have no clue what to do with the generated Steem. Now that the weird disclaimer is finally done, we can move on.

Internal market is the first “trading site” new Steem users usually visit. What to think of it one has to ask. Should I sell my hard earned SBD for 0.95 Steem? Or the other way around? How can I decide when there is no history? Why is there only order book and no graph? So many questions and answers nowhere to be found.

Brief history

I have been a Steem user for almost 2 years. Throughout that history I have assembled some data about the internal market.

The lowest ratio so far has been around 0.18 SBD for 1 Steem.

The highest ratio has been around 1.8 SBD for 1 Steem.

The peaks and lows are of course only “online” for couple of days at best. The ratio usually stays around 0,8 – 1,2.

My strategy

My SBD sell orders are set starting from 0,8 to the 0,18. Even though it is possible to sell SBD for Steem and then buy it back again when the ratio is good I don’t do that. The Steem I buy I usually power up, or send to exchanges right away. The reason why I don’t buy back SBD is that when the ratio is about 1,8 (it would seem to be worth it to buy SBD back) the SBD is over 3 dollars overall. I don’t recommend buying SBD when it’s over 2 dollars… never ever. That is pure speculation and way too risky. One can probably earn more by doing different trades with the acquired wealth.

Trusted exchanges

Since cryptosphere still lacks fully decentralized exchanges (that would be able to compete with the centralized giants), there is one very important thing to understand. As soon as you send your tokens out of your Steem wallet (your profile is basically your wallet) to any given exchange, you immediately lose control over your funds. Thus said, only send your funds to exchanges that you truly do trust. My picks are:

- Bittrex

- Binance

- Cobinhood

- IDEX

Important information in order to make a good decision

Listed tokens

First of all you need to make sure that the exchange you chose does support Steem or SBD and the token you want to trade it for. Binance is known for its massive list of supported tokens. Chances are that if you want to buy a token that is not few months old, or complete scam, Binance will have it listed. Bittrex is mediocre in that regard but supports both Steem and SBD (unlike Binance that only supports Steem). Cobinhood sucks (it only has like 20 listed tokens and Steem nor SBD isn’t one of them) but comes with different strengths (see fees). IDEX is then a very unique DEX (decentralized exchange), where people can trade ERC20 tokens (platforms that were initiated on an Ethereum smart contract).Fees

Bittrex has a very high fixed 0,25% fee on all trades. Binance has lower 0,1 fee on all trades. This can be fruther lowered by acquiring BNB (their native token), which reduces the fees to 0,075% (that is quite cheap imho). Cobinhood is a fee less exchange, which makes it super good for learning purposes and frequent trading. Idex has 0,2% fee for the maker of the trade order and 0,1% for the taker. The taker though also has to pay the GAS fee on the ETH Blockchain.

Withdrawal fees also need to be taken into account. Binance and Bittrex are very comparable in that regard. Some tokens are cheaper on one of them and some are cheaper on the other exchange. Cobinhood has VERY HIGH withdrawal fees so be wary! They somehow have to make up for the (trading) “fee less” system, therefore I advise you to only send funds there that you don’t want to withdraw soon. Withdrawal fee for IDEX is basically the GAS you need to pay in order to transfer your funds elsewhere.

I don’t want to overload you guys with too much information right off the bat. This article should help you to understand internal market and to choose suitable exchange. We shall continue later!

Man, it is great to see you finally writing about this topic. I will be looking forward to the next article.

I am sure you know there are a lot of people calling themselves successful traders on twitter, however, there is this particular user philakonecrypto who seems kind of legit. I have been checking his accounts for days.

Let me know what you think and I will be waiting for more complex trading writings :)

Thanks man. What can I say...so many topics to be written and so little time. I tried to follow twitter traders for a while but gave up cuz i simply didnt have time to check so many social platforms.

Anyway this series wont be too long so expect more "advanced" topics soon:).

I just watched all through hoping I might get to that ignition point At least the sound of that gives me hope This is largely correct when I remember my initial position, it was all about the reward might be a good spring board to start who knows might be worth a trial.I find this very educative, though I still very knew to all of thisHI @fingersik

Thanks! Ill make sure to post yet another article from the series this or next week! Stuff is going to get more complicated:)

...its frightening like lightening......... my knees are knocking

hehehehehe..... @maxiemoses-eu be careful................what you wish forlets have a view to the unknown ...................but no worries bring it on @fingersik

Thanks so much @fingersik, this so much enlightened me. I had no previous knowledge on internal market but this your post or rather explicit lecture has given me a great knowledge. Thanks

Im glad you found the article helpful:)

This is great and so well detailed. I remember you chatting about crypto and such on slack and was hoping you'd make some articles. I'm bookmarking this one!

Awesome! Thanks for your kind words.

Discord server!Hi @fingersik! We are @steem-ua, a new Steem dApp, using UserAuthority for algorithmic post curation! In our last Algorithmic Curation Round, consisting of 107 contributions, your post is ranked at #63. You've shown some user interaction, try more of it! Feel free to join our

Dear bot

I have already spoken with your master about that very issue. Nevertheless i thank you for your effort. And upvote of course :P.

Hopefully the next article wont be too long from now