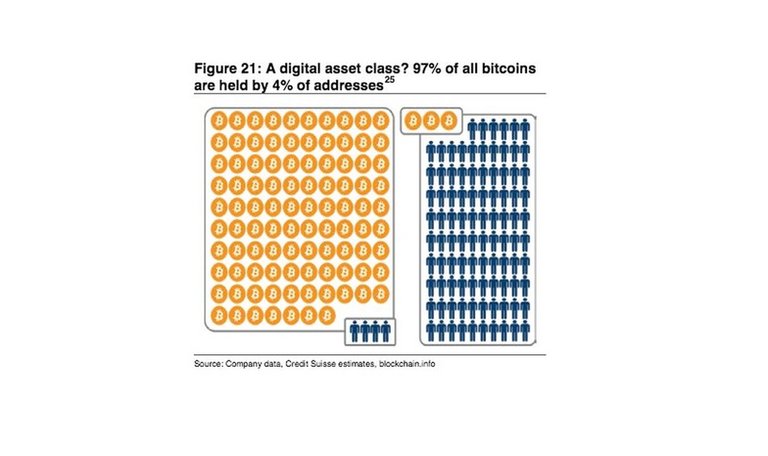

Credit Suisse decided to look at the concentration of bitcoin in the world. According to the Swiss bank, 97 percent the world's most popular cryptocurrency is kept in only 4 percent. all virtual wallets. Is there another toy for 1 percent? the richest people on Earth?

- The concentration of bitcoin on such a small number of addresses proves that only a few key players have an impact on this market - argue Credit Suisse analysts in a note sent to customers on Thursday, 11 January. Players according to the bank keep the cryptocurrency, without selling it, which led to the mentioned concentration.

See also: Goldman Sachs with optimism about cryptocurrencies. "They can be a form of real money"

Bitcoins are very concentrated

For comparison, as in November 2017, the Swiss bank convinced 1%. The richest people in the world have about half of the world's wealth. - Such a bitcoin deployment on players' virtual wallets may indicate that the latter treat it as a way to store capital - something like the 21st century gold or other precious metals - analysts say and add:

The proportions of bitcoin distribution and other cryptocurrencies suggest that they are an investment good that is kept by investors as bullion. And that means limiting the liquidity and availability of "virtual" money.

2017 was a breakthrough for cryptocurrency including bitcoin. It grew by 1.3 thousand from January to December last year. percent. , reaching peaks in December at 20 thousand. dollars. In the pre-Christmas week of the last month of 2017, Bitcoin's market capitalization reached a peak of 322 billion dollars. Currently, it is about $ 236 billion. (data for coinmarketcap.com).

I would disagree: https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html

The worst form of inequality is to try to make unequal things equal.