As per my previous article focusing on the history of the Altcoin Bubble we identified that we were currently at a critical juncture at the $50B support level. Either we would rally upwards or drop to levels below. The latter happened, as we all know, and it has been a quick dive to the $40B level over night.

At this stage the Altcoin sector IS in a bear market. We don't know for how long, but with double digit percentage drops on a daily basis on a number of key Altcoin, we're definitely looking for some ground beneath us to land on.

Now, if you're Holding it doesn't matter. Just relax and check in every few months to just see how things are going in general.

However, if you're trading in this space and want to make sense of the structure of this Bear Market and the triggers for this movement south, let's try to make sense of it and why it may have happened to improve our ability to spot similar events in the future.

(1) Huge Growth in the Altcoin Sector not entirely Supported by Fundamentals

The Altcoin space grew 29x from February 2017 through June 2017. This wasn't organic growth, or fundamentally driven in its entirety. It was due, in large part, to speculation. Speculation isn't a terrible thing, though, as it drives investment into a space, even during down cycles like this one.

Fundamentally speaking, there were a handful of coins that saw legitimate, fundamental reasons to appreciate in value. Did they deserve the appreciation they received in the marketplace within such a short period of time? Maybe, maybe not. With that said, let's highlight some of the coins that showed fundamental improvements:

Ethereum

- The Enterprise Ethereum Alliance was organized for enterprise MNCs to explore blockchain technology and its benefits through Ethereum.

- The use of Ethereum as a Platform has seen incredible growth across dozens of Altcoins

- Most ICOs accept only Bitcoin and Ether, highlighting its leadership position in the market

Dash

Incorporated into payment methods across multiple vendors online while Bitcoin was facing slow transaction speed due to its scaling issues.

Monero

Used frequently within the Dark Net Marketplaces as a key payment vehicle due to its privacy focus.

ZCash

- Also used on the Dark Net Marketplaces, like Monero, due to privacy features

- Partnership with JP Morgan to integrate its technology into the company's Blockchain platform was a tremendous credibility boost.

Smaller Altcoins Take a Roundtrip to the Moon and Back. Why?

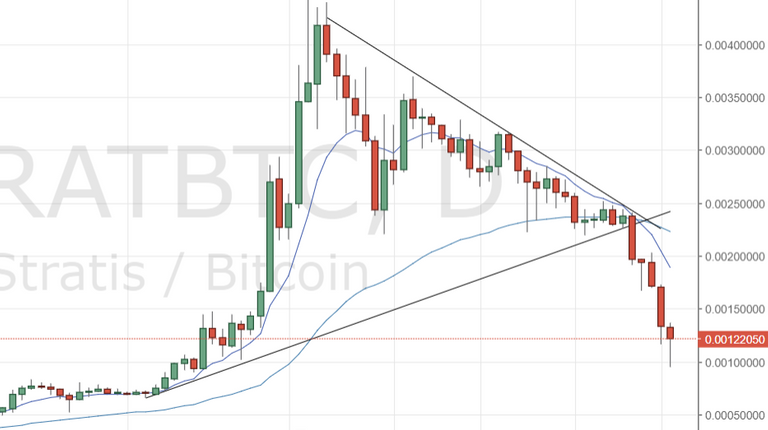

Beyond this small list, can anyone explain why some of the newest coins breached $500M-$1B valuations? Think of favorites like Stratis (example above), Lisk, Golem, Augur, and the like.

Do they have anything to SHOW to prove they deserved to jump 10-80X in price within a matter of weeks?

For each of these projects, their respective teams are "fundamentally" sound BUT there hasn't been any activity to justify the high speculative prices at this stage. None at all.

That isn't to say that these projects aren't worthy of our investment, but we have to do a better job of understanding where they are along their project's life cycle. The names above and many others haven't even launched services yet. They have no real world use yet, and hence, are not driving any value at this stage.

Without fundamental values attached to these coins, their ride to the moon was momentary, and many of them have just come straight back down. Albeit, wherever their resting valuation lies, it will likely be well above where they started from.

(2) No Key Support Levels Built on the Way Up

On the way up, we never paused. We never retraced and corrected for that growth. Without having built support levels, there is very little but a deep dark abyss below us.

It isn't to say we'll fall all the way down to the bottom, but traders look for support levels like they are physical platforms that can be trusted to withstand a beating without caving. I'll go more into detail on how to think about Support levels in a future article.

Remember, the Altcoin space grew 29X from February through June. That's a lot of growth, some of which is and will be given back. And that's OK. We've seen this before in 2014. Everything goes through cycles, and we'll move past this one.

(3) Correlation to Bitcoin

Make no mistake, Bitcoin is King in Cryptoland and it determines the direction of the market.

Aside from having the largest share of the space, it is also the most "stable." When Bitcoin is gradually making its way upwards, the Altcoins follow. When it's working its way down, the Altcoins follow, and at an accelerated rate in either direction.

There is no better proof of the correlation of Bitcoin and the Altcoins than the fact that most Altcoins cannot be purchased without using Bitcoin.

Currently, Bitcoin is struggling to maintain buoyancy so the issues magnify for the other coins. A 10% dip in Bitcoin can result in 20-50% dips in the smaller Altcoins as can be seen above on today's charts taken from Poloniex.

Bitcoin Fork on August 1st

Due to the upcoming fork projected to take place on August 1st, there is a ton of uncertainty in the market. Investors HATE uncertainty so Bitcoin's price has been trading sideways and most recently broke a key support line to the downside.

The tremors of this uncertainty are being felt throughout the cryptospace, causing a double whammy on prices. Until we work our way through August 1st, we'll be seeing Bitcoin's uncertainly impacting the Altcoin market for the foreseeable future.

There is a lot more we'll explore in the coming days/weeks as we figure out where the bottom truly is and when we can begin our climb back up.

Final Words

With the above said, don't panic. Every market goes through cycles. Crypto is no different. Recovery will happen. It may take weeks, months, or a year+ but we'll be back moving towards the stars. The best thing to do is encapsulate the learnings we'll be going through during this period of time and use it as part of your game plan the next time, because there will be a next time, and a time after that, and after that.... you get the picture.

For now get yourself a nice cup of your favorite hot/cold beverage and enjoy some sun. And thank you for the time.

Dang! You hit the sweet spot again. I was just browsing the total coin market cap a few hours ago and was thinking there really wasn't much support as we were on a massive bull run for a couple of months.

I feel it's a temporary correction, or maybe even a month long bear market but I'm still bullish long term.

I'm now a follower bro. Will eagerly wait for your next update.

Thanks for following and I'm glad the post was relevant for you today :) And absolutely it is very hard to look at each coin's TA without also looking at the entire space's as well. Seeking support here and I also hope we aren't going to see the same kind of correction that happened in 2014 (albeit) at a much faster pace but as you stated, we are still in a bull run when we zoom out.

Very well said. It looks to me that it's just the big players shaking up the market.

Don't let your precious coins be scooped up cheap by them, we HODL to the moon again ( maybe not soon but eventually we will ).

Had a great time reading this mate. Please carry on and I'll be on the lookout for your next post.

Super :) You're right. There is a lot of FUD right now. This isn't the end of the world in the crypto space....It really is just another day as we have seen the same kind of crazy downturns thrice in the past one year already. This is a much larger crash for the alt space specifically, but it will come back. And the next boom will dwarf this one as this one dwarfed the one in 2014.

I believe the crypto market is still largely speculative nature. This might change once the demand for crypto is backed by the actual utility of goods and services. The blockchain is here to stay, no doubt about it. It's a matter of finding the right token or currency to invest in. Not every investment will work out however. Time will tell in the next 3 to 4 years.

Very true. Right now we are speculating that any of these coins will start to generate real economic value. For the moment that value is incredibly small. I can only see real value at this stage with countries facing a hyperinflation hell storm where crypto currency comparatively might seem like a cool breeze on a calm sunny day as ironic as that is from where we stand today.

You've put what I was thinking into words better than I ever could. Hopefully we'll find a support level as the new norm soon and it won't wipe out all of the gains from this year.

I agree. Not sure where that support will be exactly but I'll put together a post with a few options that might suggest where things may land. But it seems to be like this every year so, for me, it's really all about looking to next year, rather than looking at how well my new investments are doing this year since calling bottom is almost like guessing the winning lotto ticket number.

Great post ... final words are spot on. No need to panic.

Thanks!

These are corrections hope it will be up again.

As a believer in the space, I have to also believe it will go back up. We all do :)

Great job once again. You have a knack for this!

Appreciate the kind words!

#Secretive Cryptocurrency Hedge Fund Metastable Examined#

“There’s a Handful of, Say Between Five and 10 of These… [Cryptocurrencies]… That Could Be Trillion-Dollar Blockchains” – Joshua Seims, Metastable Co-founder."

Metastable Capital is a cryptocurrency hedge fund that has attracted investment from many top venture capital firms despite largely shunning publicity since its inception in 2014. Metastable was co-founded by Angellist CEO, Naval Ravikant, cryptography expert, Lucas Ryan, and former angel investor, Joshua Seims.

Fortune has reported that Andreessen Horowitz, Sequoia Capital, Union Square Venture, Bessemer Venture Partners, and Founders Fund are among Metastable’s major investors – all of whom participated in Polychain Capital’s fundraiser earlier this year.

Metastable takes a long term perspective when assessing the markets, aiming to invest in projects that it expects will be profitable over the course of at least a decade. “There’s a handful of, say between five and 10 of these major use cases that could be trillion-dollar blockchains,” Seims told Fortune. “It’s all very long-term focused, and we think we’re in super early days right now. It really comes down to which do we think is the strong enough technology, that we think can win.”

Source : - https://news.bitcoin.com/secretive-cryptocurrency-hedge-fund-metastable-examined/

Congratulations @gamerveda! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPPeace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.Congratulations! This post has been upvoted from the communal account, @minnowsupport, by gamerveda from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, and someguy123. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the

If you like what we're doing please upvote this comment so we can continue to build the community account that's supporting all members.

I agree, ups and downs are part of investing.